-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Process Optimization

There’s a popular phenomenon being shared online at the moment: “Instagram vs. Reality.” It’s two photos, side by side. One is doctored and photoshopped and filtered to look perfect. The other is what it looks like in reality. More often than not, there’s a big difference. Perfection is a far cry from reality, and not just on Instagram.

It got us thinking about operational excellence. Some operational excellence consulting firms might tell you their goal is to deliver optimal perfection in which your organization is running on all cylinders 24/7. But in our experience, reality is a lot more complicated than that. We find that operational excellence is a process. And sometimes it’s a moving target. It can change and morph, affected by myriad factors that may be out of your control, like the economy, supply chain issues, hiring problems and snafus, your best leader on the line quitting with a moment’s notice. The list goes on.

As an operational excellence consulting firm, we contend that operational excellence is a process of continuous improvement, not something static and perfect that stays that way in perpetuity. Does it exist? Absolutely. But it doesn’t stay the same.

What is operational excellence consulting?

The textbooks will tell you operational excellence is a process for improving a company’s effectiveness and efficiency — two things we happen to specialize in. The goals of operational excellence consulting read like a playbook of our typical projects: Improving productivity and throughput, reducing waste, focusing on quality and reducing defects, optimizing shifts, updating processes.

Often an end goal of Lean Six Sigma (LSS), operational excellence is a moving target. Striving for operational excellence means continuously improving, rolling with unforeseen circumstances, adapting to ever-changing tides. Here are some effective strategies we’ve honed in the pursuit of operational excellence that you can apply in your operations today.

Strive for process optimization

The cornerstone of LSS, process optimization means finding opportunities to ramp up efficiency, eliminating bottlenecks and waste, enhancing productivity, reducing defects and glitches in both the product and the process, and the whole nine yards of LSS. To read a deep dive into LSS and what it can do for your organization, download our eBook, “Lean Six Sigma: Do You Really Know These Methodologies?”

Get the right people in the right jobs…

Is everyone from the front lines to the corner office in the right jobs? Assess skills, provide training if necessary and listen to feedback so your team is ready to tackle their roles with a great work ethic and enthusiasm.

…and then empower them to do the job right

Many times, the people who work on the shop floor know a lot more about the job than the people in the C-suite. Give them the power to do their jobs and to act quickly when unforeseen situations arise.

Develop KPIs

If you’re not already establishing and monitoring key performance indicators and metrics, get on that. It helps your people know what’s expected of them, and helps you evaluate the quality of the work they’re doing. They also show opportunities for improvement.

Develop standards

Hand in hand with KPIs, standardized operating practices and procedures can ensure you’re getting the consistent results you need.

Manage by the numbers

It’s an oft-used phrase here at USC. Decisions need to be driven by data and hard numbers, not what’s “always worked in the past.” The data can tell you where to improve, what’s working and what needs to change.

Keep the customer in focus

Sometimes, companies can get so caught up in process improvements they lose sight of the end customer. By keeping their needs, expectations and wants in the forefront, you can be assured you’re hitting the mark.

Encourage a culture of continuous improvement

Culture change is easier said than done, but it’s a necessary component to operational excellence. Encourage innovation and ideas for improvement, and reward employees for finding ways to do their jobs better.

Above all, remember it’s a process, not a single achievement. Yes, you may have achieved operational excellence… today. What about tomorrow?

Enjoy the article? Subscribe to our blog to receive the latest news and content.

The times they are a-changin.

If there was one song that could best describe the current state of the mining and metals industry, the 1964 classic sung by Bob Dylan sums it up. In just about every way you can imagine — consumer interests, technological innovation, regulatory scrutiny, automotive production, political developments — a variety of forces largely beyond producers’ control are causing businesses to re-examine how they operate.

In some respects, these influences have fueled the sector’s prosperity. For example, metals and mining remains a major contributor to the nation’s economy, adding an impressive $2.5 trillion per year, according to the most recent statistics from the National Mining Association. Additionally, it’s also one of the more high-paying professions, directly employing 419,000 Americans directly and 1.2 million indirectly.

Yet at the same time, many of the successes experienced by producers are raising the stakes for other companies so that they too can remain profitable and avoid being left behind. After all, metals and mining is a competitive, performance-based industry, where only those who truly thrive can survive. The best way of going about this comes from reading the tea leaves and making the proper investments to improve the ongoing supply chain and reduce cycle time.

Here are four forces catalyzing change in the mining and metals industry. Recognizing these influences and making the appropriate adjustments may be the difference between prosperity and insolvency:

1. Automation

For years, economists have described artificial intelligence as the wave of the future. In reality, it’s the here and now. Americans have a love-hate relationship with AI, as a recent poll from Gallup found 77% of adults believe the process improvements endemic to AI as mostly positive. Yet at the same time, close to 60% of respondents in a separate survey viewed it as a threat to people’s jobs.

Metals and mining is certainly no exception to AI’s influence. This industry is steeped in tradition, being one that traces back thousands of years. However, economic realities, employment conditions, and the supply and demand of mineral deposits have impelled producers to embrace AI to improve work processes and output. Many of the activities involved in extraction, for instance, are labor intensive and entail repetitive actions. Thanks to automation, however, some of the grueling work that used to be done by people is handled by robotics.

As referenced in a recent Reuters article, AI adoption has dramatically improved output, rising between 15% and 20% among some companies. If trends continue, the automation market is poised to reach a valuation of nearly $3.3 billion by 2023, according to estimates from Markets and Markets.

2. Natural resource depletion

The Earth is rich with minerals and thanks to enhanced technological capabilities, they’re more easily extractable and locatable. The U.S. is heavily invested in exploration, responsible for around 7% of such spending in 2016, based on estimates from the National Mining Association.

The problem? Other parts of the world are spending much more, including Canada, Australia and Latin America (accounting for the largest percentage at 28%). In fact, were it not for imports, the U.S. mining industry would be unable to contribute many of the metals used for fabrication purposes, such as in fighter jets or catalytic converters.

One of the leading natural resources that isn’t nearly as plentiful as it once was is gold. According to data compiled by Bloomberg, gold discoveries slipped 85% in the 10 years leading up to 2016, and gold reserves are down by double digits tracing back to 2011.

Reversing this trend won’t come easily, but by more fully embracing innovative extraction activities and more targeted utilization of public funds, producers may be able to more assiduously plumb uncharted tracts of land and compete with other countries upping the metals exploration ante.

High demand for gold and depleted resources is forcing producers to strategize.

High demand for gold and depleted resources is forcing producers to strategize.

3. Ubiquity of mobile technology

If there is one thing that has taken the world by storm in recent years, smartphones may top them all. Everywhere you look, people are looking at their phones. Indeed, in the U.S., 81% of the public owns a smartphone, according to figures from the Pew Research Center. In other parts of the globe, ownership is substantially higher, including South Korea (95%), Israel (88%), and Sweden (86%).

The multifunctional element of smartphones wouldn’t be possible without actual elements. As the U.S. Geological Survey so aptly puts it, ordinary minerals give smartphones extraordinarily capabilities, utilizing a sweeping array of deposits that include bauxite, sphalerite and arsenopyrite.

It’s safe to assume that smart device ownership will continue to surge as technologies and consumer interest further develops. But since natural resources are inherently finite, producers must be constantly thinking a few steps ahead to make the most of the minerals available. For example, computer chips at one time were fabricated from primarily 12 minerals. Today, the number is closer to 60, according to the National Mining Association.

Producers must continue their research to further extract the potential available in mineral resources.

4. Resource capacity planning

In a global marketplace, where countries and companies vie for a smaller pie of natural resources available, miners must make capacity planning a central focus of their operations.

The decisions made in this regard are often determined by the realities on the ground. Take steel as an example, which is an alloy of primarily carbon and iron. According to S&P Global Ratings, worldwide steel capacity in terms of utilization is fairly low by today’s standards compared to previous years, operating at approximately 78%, based on the most recent figures available. However, the worldwide steel landscape could be fundamentally altered with the ArcelorMittal acquisition of Ilva, an Italy-based steel developer, which became official in November 2018. Combined, the companies represent a combined 50% market share in flat production for the whole of Europe.

Whether it’s the manufacturing of steel or obtaining the minerals needed to fabricate it, resource capacity planning in the current trade environment is a core component of day-to-day workflow that mining organizations must prioritize.

Change, by its very nature is difficult. Yet it’s life’s only constant and one that mining and metals must embrace to improve output and remain competitive in a global marketplace. USC Consulting Group can help you control the variables by assessing your work processes and charting out a plan for what’s next. We have a 98.2% satisfaction rating from our clients and are confident you’ll be pleased with what we have to offer. Please contact us today.

The worldwide metal marketplace is changing. Numerous economic forces — most notably, dwindling economic stimulus packages, expiring automotive manufacturing subsidies, and tightening monetary policies — are hamstringing the once-booming space, according to research from PNC Financial Services Group. Virtually all parties within the sector are therefore bracing for sluggish growth over the next year, particularly American metals producers. Metal service centers are among those likely to experience a stalemate stemming from this hesitant outlook. While small and medium manufacturers managed to stay strong during the first quarter of 2019 — 87 percent of U.S. firms in these categories reported positive outlooks, per data from the National Association of Manufacturers — the worrying developments mentioned above make process optimization essential for metal service centers intent on not only meeting their margins but also thriving.

These unique entities can take numerous pathways to operational improvement. However, some select methodologies stand out among the crowd. Here are three of those strategies, along with additional insight into how metal service centers can use them to catalyze shop floor optimization and organizational success.

Cycle time reduction

Highly functioning metal service centers often maintain diverse inventories. This is an effective approach, laying the groundwork for multiple revenue streams and reducing financial risk to the business. That said, operational diversification can create problems, especially where cycle time is concerned. With so many different materials to work through, some metal service centers attempt to tackle workloads as quickly as possible without much preparation or baseline metrics for how long certain tasks should take. This causes production ambiguity, mucks up operations, and drags down service quality. Fortunately, there is a relatively simple solution to this common shop floor faux pas — it all comes down to process tracking and improvement.

Metal service centers must monitor their workflows and develop minimum job completion thresholds. Coil slitting and coil cutting require different time expenditures. By assigning specific values to these and other mission-critical activities and developing fleshed-out process frameworks, metal service centers can then figure out production capacity across multiple units of time — shifts, weeks, months, quarters, and years — identify and address wastage and cut cycle times. Even the smallest reductions can create a ripple affect across the shop floor, generate real return on investment, and better position the business for success now and in the future.

Conversion cost reduction

The material that comes through the doors of most metal service centers is not ready for consumption. Production teams must convert the raw metal into transportable and useable formats — most roll the material into industry-standard coils. Reformatting rigid metal necessitates considerable manufacturing power and prowess, which is why the expenses associated with this activity, called conversion costs, eat up significant portions of metal service centers’ budgets. The typical roll forming setup, an essential part of the conversion process for most of these firms, costs anywhere from $200,000 to $2 million up front, according to Dahlstrom Roll Forming. This amount, combined with ancillary fees related to machine maintenance, can weigh heavy on the bottom line.

Reducing and containing these expenses is critical to operational optimization, but how can metal service centers achieve this goal? Generating as much ROI on roll forming equipment as possible is among the most effective methods. Most forward-thinking companies in the niche do this by running high volumes and offsetting the cost of installation and maintenance. Tactical equipment deployment is another effective methodology for cutting conversion costs. Metal service centers do not necessarily need multiple roll forming lines to process diverse arrays of material, as most alloys have similar physical profiles and can therefore run through a single machine with slight adjustments. Together, these tweaks can build the foundation for major conversion cost reduction and catalyze shop floor optimization.

Effective inventory management

Metal service centers typically serve small or medium manufacturers that cannot forge productive and cost-effective relationships with massive materials providers due to various variables. These more compact manufacturing firms navigate mercurial terrain, weathering alternating production booms and slumps. They need operational partners that can support them in these situations and every scenario in between. Metal service centers typically fit the bill because they offer holistic services — most notably, easy-to-access inventories, per Manufacturing.net. For this reason, inventory management ranks among the most critical functionalities for modern metal service centers, as those that cannot keep essential supplies in stock are unable to effectively meet customers’ needs. That said, there is another side to this particular issue. Overstocking products can be similarly damaging to the budget, for unclaimed products take up valuable space and eventually become obsolete if unused. Striking a balance here is critical and should be the centerpiece in any process optimization program.

What exactly can metal service centers do to facilitate an effective and balanced inventory management? Sussing out baseline inventory conditions is the ideal first step. This might involve finding answers to key operational questions, such as, “How much inventory do I have?” Or, “How often does my inventory turn over?” By exploring these and other issues, the businesses in this niche can figure out their actual inventory needs and pare down their stores to ensure that there are enough products for contracted customers but not so many that widespread wastage will occur.

There is no denying that metal service centers must do all they can to comport with marketplace conditions, and that could entail pursuing some of the process optimizations mentioned above.

Is your metal service center interested in staving off external marketplace forces through process optimization? Consider connecting with USC Consulting Group today. We have been collaborating with organizations across all industries for more than five decades, deploying our seasoned operational experts who offer actionable shop floor solutions that boost efficiency and productivity and bolster the bottom line. Contact us now to learn more about our experience and how we can help your company find success in the metals industry, no matter the conditions.

In the blog Every Part Has a Purpose: Building Materials Manufacturing, we learned about a few of the challenges that the American housing market and its producers will be facing here in 2019. The number of wildfires occurring annually is increasing at alarming rates and the building materials manufacturers are feeling the repercussions from these natural disasters. The softwood and hardwood resources being burned down are causing the lumber suppliers to struggle to meet the demands of the home construction market. Furthermore, the housing market being on fire lately (pun intended) has led to intense bidding wars among buyers while developers work hard to increase inventories. To top it all off, material costs have increased significantly due to the global trade showdown linked to the recently introduced tariffs.

Backbone of the American housing market

Building materials manufacturers are poised to overcome the various obstacles thrown their way and accelerate operations in this demanding economy. Thus, continuing to power the U.S. housing market. But, just how pivotal are these building materials producers to the consumers who are scouring Zillow and Realtor.com in search of their dream home?

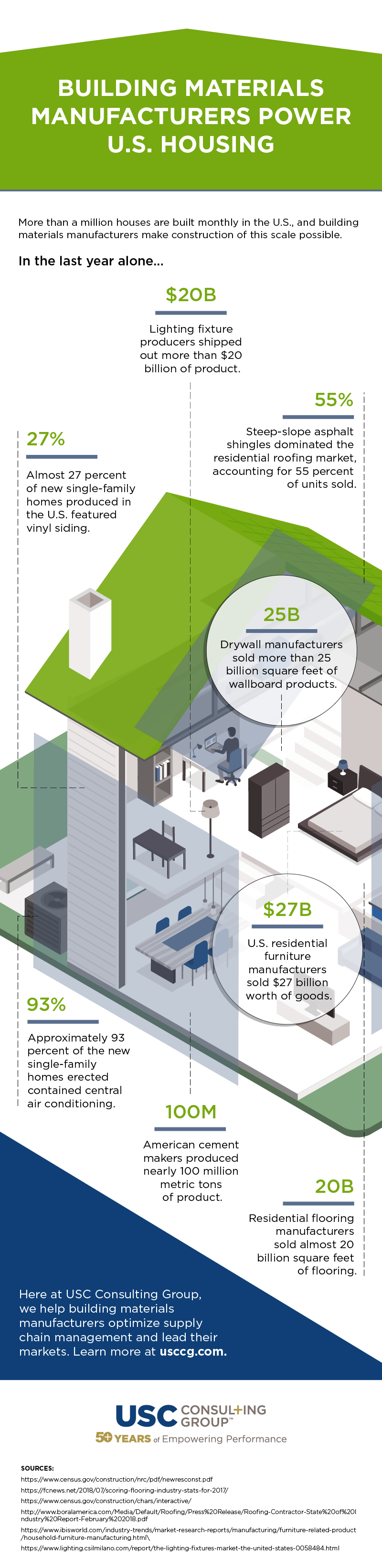

Here at USC, we love to analyze data and processes as much as Joey Tribbiani loves to eat sandwiches. So, we took a deeper dive into just how important these building materials manufacturers truly are to the industry. We put our results into a cool infographic for easy digestion. You will see that every part, or every manufacturer, has a significant purpose in powering the whole.

“More than a million houses are built monthly in the U.S.” That stat in itself is incredible. What’s even more mind-blowing is when you start considering “how” this is all made possible and realize how crucial building materials manufacturers really are to the industry.

Providing more power

It is essential that these behind-the-scenes producers improve their processes to keep pace with the housing market demands. However, with such a strain to keep up, building materials manufacturers may not have time to analyze and optimize their operations and could use some extra horsepower. USC Consulting Group is here to help. By working with your shop-floor personnel and leadership teams, we not only help to achieve greater throughput and yield, but can also enhance your supply chain management to improve in areas such as strategic sourcing, maintenance practices, and logistics.

Contact us today to discuss how together we can help you sustain as well as thrive in the current opportunistic landscape.