-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Yield

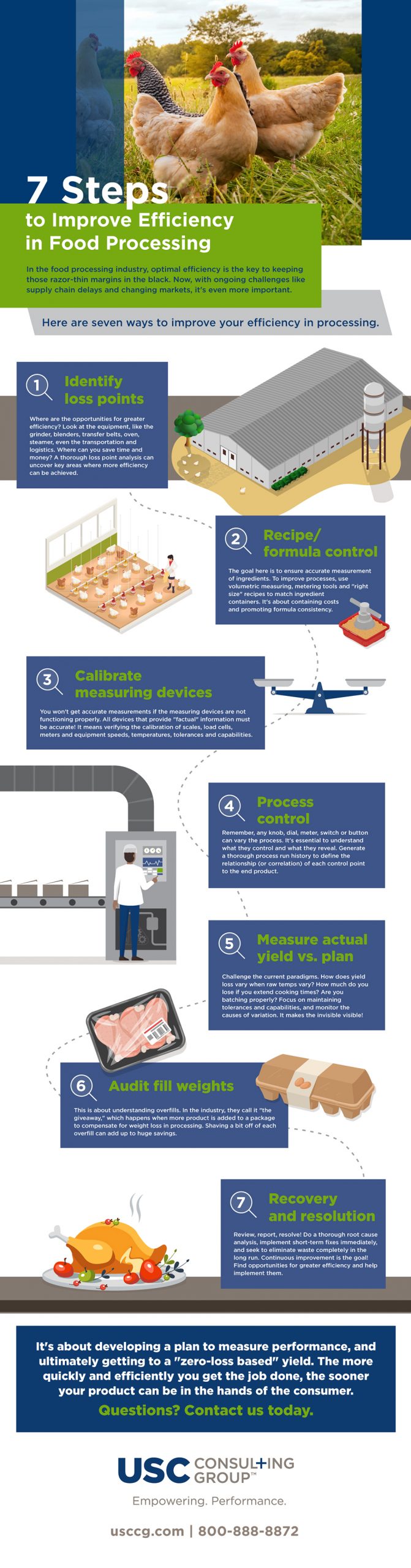

In the food processing industry, optimal efficiency is the key to keeping those razor-thin margins in the black. Now, with ongoing challenges like supply chain delays and changing markets, it’s even more important.

Efficient processes lead to reduced operating costs, improved yield and throughput, and more control over your management systems.

The following graphic provides seven ways to improve your efficiency in food processing:

1. Identify loss points

Where are the opportunities for greater efficiency? Look at the equipment, like the grinder, blenders, transfer belts, oven, steamer, even the transportation and logistics. Where can you save time and money? A thorough loss point analysis can uncover key areas where more efficiency can be achieved.

2. Recipe/formula control

The goal here is to ensure accurate measurement of ingredients. To improve processes, use volumetric measuring, metering tools and “right size” recipes to match ingredient containers. It’s about containing costs and promoting formula consistency.

3. Calibrate measuring devices

You won’t get accurate measurements if the measuring devices are not functioning properly. All devices that provide “factual” information must be accurate! It means verifying the calibration of scales, load cells, meters and equipment speeds, temperatures, tolerances and capabilities.

4. Process control

Remember, any knob, dial, meter, switch or button can vary the process. It’s essential to understand what they control and what they reveal. Generate a thorough process run history to define the relationship (or correlation) of each control point to the end product.

5. Measure actual yield vs. plan

Challenge the current paradigms. How does yield loss vary when raw temps vary? How much do you lose if you extend cooking times? Are you batching properly? Focus on maintaining tolerances and capabilities, and monitor the causes of variation. It makes the invisible visible!

6. Audit fill weights

This is about understanding overfills. In the industry, they call it “the giveaway,” which happens when more product is added to a package to compensate for weight loss in processing. Shaving a bit off of each overfill can add up to huge savings.

7. Recovery and resolution

Review, report, resolve! Do a thorough root cause analysis, implement short-term fixes immediately, and seek to eliminate waste completely in the long run. Continuous improvement is the goal! Find opportunities for greater efficiency and help implement them.

It’s about developing a plan to measure performance, and ultimately getting to a “zero-loss based” yield. The more quickly and efficiently you get the job done, the sooner your product can be in the hands of the consumer. Questions? Contact us today.

For more information about how Food & Beverage consultants can significantly reduce your operating costs and improve productivity, read this eBook:

In the food processing industry, the name of the game isn’t necessarily doing more with less, although that’s a powerful goal. For many companies, it comes down to getting the most out of their raw materials. To do that, it’s all about yield.

It can be a slightly confusing term to those outside the industry, but yield is generally defined as “the amount of usable product AFTER processing raw materials.” There’s a popular meme on the internet right now with the theme of: “How it started. How it ended.” Essentially, it’s “before and after” photos. When you’re talking about yield, the “before” photos might be a side of beef hanging in a cooler, while the “after” photos would be a pound of hamburger packaged and ready to ship to the grocery store. In that case, how it started isn’t necessarily going to be how it ended. In other words, a pound of beef isn’t always going to end up being a pound of burger. The difference is your yield.

Yield is affected by a wide range of variables, and low yield numbers can mean trouble for a company’s bottom line. It’s a common problem, one USC Consulting Group helps our clients with regularly. Let’s look a little deeper at yield, how and why it can bedevil companies, and what they can do about it.

The challenge with yield

Improving yield is the end goal. But let’s start at the beginning. Staying with the beef industry as an example, when companies start with a pound of beef and end up with .8 pounds of burger, that’s an 80% yield. The reasons for that gap become the problem.

Loss of moisture or weight. In processing beef, moisture is lost. It’s just the nature of the beast. That’s why, when you start out with one pound of raw materials you don’t always get one pound of finished product.

MAV. Government regulations give the food industry a little wiggle room between the expected quantity of any given item and the actual quantity. That’s the Maximum Allowance Variance (MAV). No product should weigh less than the MAV, nor should it weigh more than 100% of the MAV. That’s the gray area, or wiggle room. However…

Label weight. Due to government regulations (and good sense) the actual weight of a product — say, that pound of packaged ground beef in a grocery store — should not be lower than the label weight. End users, in this case, grocery store customers, can’t be told they’re buying a pound of burger when they’re really getting .8 pounds or less. Nor should grocery store owners be told by their suppliers they’re buying 100 pounds of ground beef when they’re getting 80. So to hit that MAV sweet spot and comply with label weights, food processing companies commonly…

Compensate. In the case of the beef industry, it means adding a little more ground beef into each unit. To not take the risk of going below the MAV, companies often prefer to run the process at a higher weight than the label. It’s what the industry calls “the giveaway.” They are essentially giving away beef to compensate for the loss of moisture.

Just a little more? How big a problem is this? If a company is processing, say, 30,000 pounds of ground beef into burger every day, adding a smidge into each package can be a very big problem. One recent client of USC came to us when they realized they were giving away over 1.5 million pounds of beef yearly.

Maximizing yield

This isn’t unique to the beef processing industry. Produce companies can overbag. Companies that process shelf-stable foods can use too much water. The list goes on. But no matter the type of food industry, maximizing yield is about achieving the right balance, hitting the right numbers. Not too little, not too much. Here are a few ways we help our clients do that. Hint: It’s all about efficiency and managing by the numbers.

Operations. Efficiency is the key in any operation, and at USC, we are always looking for opportunities for our clients to improve their processes. Scheduling, the sequence of how the job gets done, and even shift changes can play into efficiency. Creating a solid management operating system that allows you to “manage by the numbers” is vital in evaluating these processes for maximum efficiency.

Equipment. We don’t always recommend the latest and greatest technology. In many cases, it’s not necessary to upgrade. Maintenance? That’s another issue. Machines used to process raw materials into batches need to be at their optimal best. Regular maintenance and monitoring are key. Something as simple as build-up on a machine can lead to overfilling. A processing arm that slows down just a bit can hamper production.

Throughput. One reason for loss of moisture in beef processing is speed, so you need fast, efficient processing. But not too fast, or you can risk issues like bottlenecks in packaging, errors and ultimately waste. The Lean Six Sigma methodology helps companies maximize throughput and eliminate waste while preserving quality.

Yield is a key element to a company’s bottom line. The more efficient, streamlined and effective the operation, the more it allows companies to wrangle yield so it adds to, not drags down, profits.

If there’s one certain thing about the food and beverage industry, it’s the fact that nothing is certain – not when it comes to trends, anyway. Take nutrition as a classic example. At one time, low fat was all the rage; now it’s high fat, combined with low carbs. In the late 1990s and early 2000s, the all-protein diet from lean meat sources was popular. Today, plant-based protein is on more and more dinner menus.

But there is one constant in the food and beverage business: consumers’ demand for top quality, originality and convenience. Thus, the heat is always on for manufacturers to deliver on Americans’ high expectations.

The best way to come through is to understand what’s on the menu, in terms of food manufacturing challenges facing producers and developing strategies for how to overcome them. Our ebook “Understanding the Challenges Facing Modern Food and Beverage Producers” details some of the potential obstacles producers face and offers suggestions that can help turn sour situations into sweet solutions.

Download our ebook today to learn more about current food manufacturing challenges and discover solutions to key areas including:

- Product quality

- Leveraging technology

- Product variation

- Formalized workflows

- Throughput rates

- Takt time

Contact us today for help fine-tuning your workflows or improving yield and productivity.

Available financing and an abundance of dry powder in the Private Equity sector has recently increased the volume of deals and generated the highest amount of buyouts ever. This environment has not only sustained high average EV/EBITDA multiples in the mid 11s, but the related yield pressure has caused GPs to look at creative approaches to winning asset competitions as well as value creation.

Business management consultancies are being leveraged as an important tool in the PE value creation toolkit due to their vast industry experience. Yet even within a particular PE firm, financial dynamics are constantly in flux. With deal competition driving firms to shake up their strategy and models, management consulting represents a critical stopgap for PE firms looking to navigate the private equity life cycle and implement sustainable operational improvements.

Rising above the competition

To really find great value in this tight market, you need to know what to look for in a consultant. Ask yourself: Is your consulting firm simply providing philosophical and strategic guidance while leaving you to execute change unsupported? Do your consultants have the operational expertise needed to deliver results?

This is where we can help. USC Consulting Group is a top-tier organization with over 50 years of experience implementing sustainable operational improvement and leveraging that functional experience to help PEs get the most out of their investments.

Download our eBook: “Private Equity Value Creation: Increase Yield and EBITDA through Leveraging Consultants” to learn more, like:

- Deal competition forcing creative approaches

- Opportunities within the private equity life cycle

- Consulting and PEs: understanding the financial dynamics

- Strategy versus execution

- Potential areas of improvement

- Tools of the trade

- Facilitating acquisition ROI

Interested in learning more? Contact USCCG today to discuss your portfolio companies and how to generate the greatest value creation.

From the ground up, USC Consulting Group helps building material manufacturers solve their sourcing problems, fine-tune their operations and improve their bottom lines.

It all begins with a blueprint for success, developed and perfected by our experts and your in-house teams.

By starting with an optimization strategy, we set a strong foundation on which you can build a better-performing business.

We examine opportunities along the supply chain, from sourcing to scheduling, that can put you on sturdier footing.

We also use our knowledge of the industry to open processes in order to achieve greater throughput, yield, and OEE.

Our operational management specialists pay attention to every detail, no matter how small, and our clients take comfort knowing that we will implement the right strategies for continued improvement.

Every manufacturer is a special part of the whole to the Building Materials industry and we have worked with each to help reduce costs and improve productivity.

List of Building Materials Industry Manufacturers:

- Cement

- Flooring

- Fixtures

- HVAC

- Windows and doors

- Furniture

- Plumbing and pipes

- Electrical

- Drywall

- Bricks and siding

- Roofing and shingles

Want to put 50-plus years of consulting experience to work for you? Contact USC Consulting Group today.

It is no secret that Americans have embraced healthier eating habits. Last year, analysts for the International Food Information Council Foundation surveyed more than 1,000 U.S. residents and found that 65 percent were making an effort to bolster their fitness by drinking more water, consuming increased amounts of fruits and vegetables, and cutting back on salty food and full-fat dairy products.

But some are going further than simply paying more attention to nutritional labels. Many have come to recognize the healing power of food.

The recontextualization of the meal as medicine has major implications for all parties involved in the production and consumption of food. Processors are, of course, among those that must grapple with this change. Americans used to maintain relatively easy-to-meet standards. As long as products were clean, well made and tasty, consumers would literally eat them up. However, this paradigm shift has put pressure on food processors to produce items that not only meet basic quality metrics but also include ingredients capable of healing.

From organic to therapeutic

Food producers encountered a similar change in the early 2000s when consumers began to demand organic products. While organic farmers and other producers had been around for a number of years, demand remained relatively low, relegating these organizations to a profitable but small culinary niche. This began to change after the millennium as Americans began rethinking their diets. An industry that generated a revenue of just $3 billion in 1997 grew into a $20 billion space within a decade, according to the Organic Trade Association. In 2015, the sector generated more than $43 billion in sales and continues to expand today. Of course, food and beverage processors adjusted to this demand, rolling out new production methods meant to satiate shoppers yearning for organic products.

It seems these enterprises must orchestrate a similar move as the food-as-medicine craze ratchets up in intensity. This trend quietly gathered steam over the last few years, as physicians began advising their patients to supplement clinical treatments with holistic diets designed to promote general wellness, the Chicago Tribune reported. Cardiologists were among the first to embrace these strategies, as many treat patients with good blood pressure and cholesterol levels who still feel physically rundown as a result of poor eating habits. This sort of holistic approach to treatment led to the development of a new branch of formalized clinical practice called lifestyle medicine.

What started in the ward soon grew popular among everyday consumers who watched friends and family members receive care from medical professionals. Now, even the seemingly healthy discuss their diets with their doctors in an effort to pinpoint the foods and ingredients that may bolster their well-being. This involves following a certain dietary regimen, something 14 percent of the people who participated in the aforementioned FICF survey attested to doing. These diets often require food items made with the freshest ingredients, which puts pressure food and beverage processors and prompts them to adjust their production workflows to accommodate such requirements.

Demand for new ingredients and processes

The eating plans at the center of the food-as-medicine movement often emphasize simplicity. For example, a doctor might advise his or her patient to avoid food or beverage items that contain numerous synthetic ingredients. This advice influences the purchasing behavior of the patient, leading him or her to immediately reject products with longer ingredient lists. The same theory applies to the actual processes behind the creation and packaging of food or beverage items. Products subject to antiquated, nontransparent preparation methods are not likely to end up being prescribed by physicians in the lifestyle medicine space.

With this in mind, food and beverage processors must make drastic changes. Product reformulation is one option. This involves cutting back on ingredients or swapping synthetic additives for natural alternatives. Some processors are even adding super ingredients to boost the health benefits of their products. Process innovation is another strong strategy. Eschewing processes of the past for in-demand methodologies such as air drying, cold pressing or raw delivery, as suggested in a Euromonitor International study on the reformulation of packaged foods, can attract health-conscious consumers who want to know how their food or beverages were made.

The reframing of food as medicine is no fad. Consumers are driving immense demand, and supermarkets and innovators in the food and beverage processing space are meeting it, The Guardian reported. Those on the outside looking in on this trend would be wise to reassess their operations and embrace this new reality.

USC Consulting Group understands the many ways in which F&B businesses struggle to align consumer expectations with operational efficiency, but there are solutions available. With 50 years of experience helping food and beverage processors navigate the marketplace, we can help your organization make the changes required to achieve continued growth, even as customer demands increase in complexity.

Connect with us today to learn more about our work in the food and beverage space, and how we can enhance your processes, lower operating costs, and improve overall productivity.

The American manufacturing space has experienced considerable improvement in recent years. Producers have embraced data-driven processes and procedures designed to boost productivity and keep overhead costs down. The industry contributed approximately $2.2 trillion to the U.S. gross domestic product in 2016, capping off four consecutive years of annual value-added figures above the $2 trillion mark, according to the Bureau of Economic Analysis. But this success is not a symptom of scale. More than 98 percent of U.S. manufacturing firms have fewer than 500 workers, according to the National Association of Manufacturers. More astonishingly, 3 out of 4 firms employ fewer than 20 workers.

How do American manufacturers account for more than 10 percent of the national GDP with such small staff rosters at their disposal? Operational optimization through continuous improvement. Almost 70 percent of domestic producers utilize lean manufacturing strategies to facilitate such an approach, Reliable Plant reported. These methodologies center on the collection and evaluation of key performance indicators, critical quality metrics that lend operational leaders insight into mission-critical workflows, giving them the power to spot deficiencies and make changes as quickly as possible. Only with this data can firms successfully navigate the modern marketplace where responsiveness reigns supreme.

There are numerous shop floor functions suitable for performance measurement programs. However, industry innovators and researchers have pinpointed several operational avenues that can provide data capable of driving continuous change and bolstering the bottom line. Here are some of the KPIs associated with these shop floor hotspots:

1. Total downtime

Downtime is a manufacturer’s greatest enemy. When mission-critical assets stop functioning because of mechanical issues, producers often lose hundreds of thousands of dollars. For example, automakers lose an average of $22,000 per minute of downtime, according to research from Advanced Technology Services. A large number of modern manufacturers can’t survive such losses as most are already operating on razor-thin profit margins. This state of affairs makes the total downtime KPI an essential metric of quality. Gathering this data is relatively easy, but tracking it and exploring the operational variables behind it can have an immense impact.

Most producers pair this macro measurement with finer KPIs, such as overall equipment effectiveness (OEE) or changeover time, to form a more robust downtime picture.

2. Takt time

This versatile KPI – the amount of time it takes to complete a given task – works in numerous operational contexts. According to Food Manufacturing, plant supervisors can leverage takt time to track the entire product creation process and monitor the smaller functions that make up this total workflow. This allows for increased visibility and gives producers the power to institute minor tweaks in piecemeal to get the most out of their shop floors. Takt time is also one of the few KPIs that relates directly to the customer. These readings can show businesses where they stand in relation to customer demands centered on timeliness, even reveal upgrades that could quicken production processes and more effectively meet the needs of modern buyers.

On the surface this KPI may seem basic, but its versatility and connection to the customer experience make it an essential metric for even the most advanced manufacturers. Again, there are other KPIs that work well with takt time, including estimated time to completion and piece variance. These measurements relate directly to customer satisfaction and can therefore yield useable insights with transformative power.

3. First pass yield

The days of the single-use production line are over. To compete in today’s marketplace, manufacturers must be prepared to reconfigure their operations to meet changing volume demands or roll out new products altogether. This state of affairs makes first pass yield an essential KPI for modern producers. This metric measures the effectiveness of a given workflow during its initial run. Quality assurance personnel calculate the first pass yield by dividing the number of completed units requiring no rework by the number of total products produced. Using this figure, shop floor stakeholders can assess the overall efficacy of a new process and make changes to improve its productivity.

In the past, this KPI may have been something manufacturing leaders used only occasionally. But times have changed. With customer demands shifting so frequently, manufacturers must be ready to reorganize their processes and measure their effectiveness after reorganization. The first pass yield KPI makes this possible.

4. Mean time between failures

Manufacturers are only as reliable as the production equipment they have on the shop floor. This is why many organizations adopt preventive maintenance strategies with cutting-edge technology at their centers. More than 40 percent of manufacturers currently subscribe to this approach, while another 30 percent have gone one step further and embraced predictive maintenance, according to recent research from Plant Services. A majority of these maintenance-minded firms rely on the KPI mean time between failures (MTBF), which is the length of time a repairable asset will function properly after experiencing a major mechanical problem and before doing so again. This KPI gives maintenance teams a base line off of which they can schedule preventive activities.

Mean time between failures and related metrics, such as mean time to failure (MTTF) and mean time to repair (MTTR), help manufacturers evaluate overall asset reliability. With this information in hand, operational stakeholders can make incremental improvements to plant efficiency and productivity.

Manufacturing businesses looking to carve out space in today’s marketplace must focus on continually improving their workflows, as processes, not manpower, lay the groundwork for success. These KPIs give such enterprises the power to dive deeply into their operations and pinpoint deficiencies big and small that could be holding them back. Here at USC Consulting Group, we have been working with manufacturers for decades, connecting them with experts who can craft customized operational improvement plans designed to stimulate growth. Contact us today to learn more about our work in the space and how our in-house consultants can help your firm reach new heights.

Recently, I reached out to one of our most charismatic team members, Charlie Payne, and got him to tell me a little bit about his approach to new projects and, more specifically, his work in the food and beverage industry. Charlie is a Senior Operations Manager at USCCG, and has played an integral role in the development of our strategies and training programs since he came on board in 1990. He has years of experience in various industries including Food & Beverage, Mining, Oil & Gas, Life Sciences, and Manufacturing. Charlie’s innovative solutions and ability to build strong client relationships are the foundation for his long record of successfully completed projects. Here’s what he had to say:

When I start a new project, I certainly like to get face to face as soon as possible so we can get a sense of each other, understand the issues, and decide if we might be a fit. Usually, a half-day on site is enough to see if we want to do a more detailed two-week analysis where we’ll come in with a team and put together a business case and answer three questions:

- Is USCCG the right group to help drive results with this client – do we hit their team right?

- Are the issues we see addressable by USCCG in a timeline that makes sense? Is their management team open to change?

- Is there a viable business case? Usually we strive for a 2 to 4 return on the project costs, depending on the scope of the project. Generally, a bigger scope means a bigger return.

If the business case makes sense, then I like to go in to project mode quickly – the consistency of the team we use is important to us and a lot easier than having an extended decision process that means I need to acquaint a new team to the client.

As a Senior Operations Manager, I am responsible for delivering the results of the project and managing the partnership we have with our client. Working with the bench strength we have in our consultants – full time USCCG employees, many of whom I have worked with for years – can often make the projects successful and fun. To have fun with the client and my team is a key success factor for me.

I have worked with all types of clients, and I enjoy working in the food & beverage industry because it’s unlike other business sectors due to of the variability. In food processing, the input can often be so variable – size, quality, quantity – it can often make us wonder why we try to manage the process at all, when we are out of control right from the start! If you can’t affect the input, then in my opinion, it makes it even more important to control what you can – usually the process within the plant walls.

We’re certainly not making widgets and it’s not as precise as manufacturing. When dealing with nature we can be affected by harvest size, variations in bird or hog size, droughts, so you never know what you’re going to get. Combine that with a work force made up of a multitude of cultures, languages, and literacy skills and you have challenges getting consistency into the process. After 24 years and many businesses, the hardest position I have ever seen is to be a supervisor in further processing in a cold plant.

My work in the food & beverage industry has certainly been across the spectrum from large privately held to co-op, slaughter facilities to further processing. Lately, I’ve seen an increase in organic clients, as well as those expanding heavily overseas and wanting to right size their facilities.

The fierce competition and amalgamation from emerging markets are part of why our food and beverage clients look to us for opportunities to improve their processes to stay ahead of their competitors.

When we engage clients in this industry, we work across a number of fronts – from production plants with a focus on yield, throughput, and productivity – OEE type metrics, installing a Management Operating System (MOS) in the plant to bring consistency between shifts, lines, and plants.

Bringing in our LINCS Business Intelligence solution to allow for the key metrics to be known in a timely manner helps us focus management on the items they need to address in getting the performance they need. More recently, we’ve worked on reducing cost with a focus on the purchasing department and the spend on packaging materials, bringing great benefits to our food & beverage clients.

I believe good management practices are applicable across all industries and our solutions for our food & beverage clients can and have proven to be successful for various other clients.