-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Transportation

Long-haul trucking has become more expensive and less logistically viable, making intermodal transportation an increasingly attractive alternative. Its market growth will directly affect industrial production and commerce, impacting manufacturers and business owners. Which trends should they prepare for in 2025?

Why Intermodal Transportation Is Becoming More Common

Intermodal transportation involves moving freight by multiple modes of transportation — rail, air, road and ship. Lately, its growth has been exponential. Experts project its upward trajectory will continue. According to a Research and Markets report, the intermodal freight transportation market will reach an estimated $103.78 billion in 2028, up from $58.85 billion in 2024, achieving a compound annual growth rate of 15.2%.

The cost of long-haul trucking is among the foremost driving factors. Geopolitical issues and inescapable inflation have driven fuel prices up. The ongoing labor shortage is also compounding this problem. According to the International Road Transport Union, more than 50% of trucking companies had difficulty filling driver positions due to the shortage in 2023.

Since far fewer younger people are entering the trucking industry, the supply of skilled drivers is diminishing. Many of those who remain are demanding higher wages. Employers can either comply or lose their staff to competitors, further driving up operational expenses.

Other factors besides the high cost of long-haul trucking are driving intermodal transportation growth. For one, the e-commerce market is booming. Urbanization and an increased demand for expedited delivery support heightened manufacturing output, which drives the need for intermodal transportation. Ultimately, while these factors are core growth drivers, other burgeoning trends have moved into position to cause dramatic, abrupt changes in 2025.

Trends Pushing Intermodal Transportation Growth in 2025

Three significant trends should support positive growth for the intermodal transportation market in 2025.

Emissions Regulations Are Tightening

Various countries worldwide are getting serious about greenhouse gases. For instance, the European Union set a carbon dioxide standard for heavy-duty vehicles, targeting a 15% reduction by 2025 and a 45% reduction by 2030. These emerging environmental regulations will likely drive firms away from long-haul trucking and toward other modes of transportation.

Interest Rates May Soon Ease

The Federal Reserve may soon reduce interest rates. Experts project it could carry out two rate reductions in 2025. This forecast is not as optimistic as the previous one, which projected up to four cuts. This change may be the culprit of an abundance of caution — officials are waiting to see the impacts of President Trump’s policy changes. His handling of trade and immigration could influence their decision-making process.

The freight market will see growth if interest rates ease. In addition to rebounding from the yearslong recession, industry professionals would experience heightened borrowing capabilities. These factors could increase their resiliency to disruption and give them a unique opportunity to explore intermodal transportation.

Logistics Technologies Are Advancing

Advanced logistics and management technologies can increase supply chain visibility, making managing multiple modes of transport more accessible. With real-time tracking, edge computing, telematics and global positioning systems, intermodal transportation is not as risky as it otherwise would be. Since these solutions are becoming more powerful and affordable every year, even small business owners can leverage them.

Trends Slowing Intermodal Transportation Growth in 2025

While industry leaders hope for a meaningful upturn in 2025, these concerning trends may hold back the intermodal transportation market.

Cargo Theft Is on the Rise

The more stops and handoffs there are, the easier it is for bad actors and malicious insiders to infiltrate supply networks unnoticed. Cargo theft already increased by nearly 50% from 2023 to 2024. Would a multimodal strategy introduce carriers to a heightened risk of stolen freight? This question does not inspire confidence.

Geopolitical Instability May Worsen

Geopolitical instability often follows elections. Roughly 50% of the global population lived in countries that held a national election in 2024 — the largest election year in history. Naturally, inevitable policy and party changes lead to trade tensions and restrictions, potentially disrupting supply chains. In other words, the entire world will likely feel the effects in 2025.

The Government Might Introduce New Tariffs

A shift toward higher tariffs often results in a reduction in import and export volume. Trade restrictions are another common by-product. These obstacles could complicate the Federal Reserve’s efforts to ease interest rates, potentially slowing the growth of the multimodal transportation market.

The Far-Reaching Impacts of Intermodal Transportation

One year may not seem like a long time, but it is. By the end of 2025, interest rates, labor market logistics technologies and the geopolitical landscape could look completely different. Whether supply chains experience a recession or congestion, multimodal shipping will likely remain a rising market. However, companies and manufacturers should remain observant — the trends that influence growth may indirectly impact their profits and business opportunities.

*This article is written by Jack Shaw. Jack is a seasoned automotive industry writer with over six years of experience. As the senior writer for Modded, he combines his passion for vehicles, manufacturing and technology with his expertise to deliver engaging content that resonates with enthusiasts worldwide.

The nature of supply chains has evolved over the years, with new technologies and many players in the middle making logistics highly complicated and expensive. A report by PwC indicates that logistics and supply chain costs account for approximately 10% of the organization’s total expenses. This is the most costly issue businesses struggle to minimize in their supply chain operations.

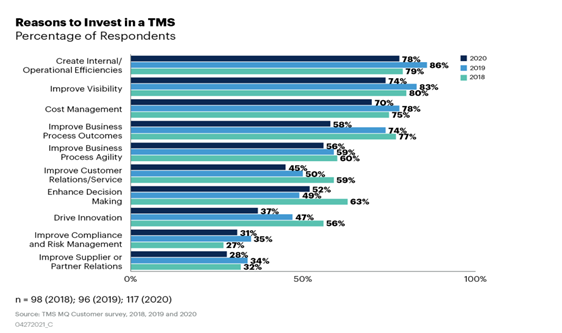

Managed transportation systems (MTS) address this problem, providing an organized way of consolidating logistics and eliminating waste. According to Gartner, the transportation management systems (TMS) market is expected to grow by 60%. This boom exemplifies the role of MTS in adapting to the prevailing dynamics of supply chain management.

This article will define MTS within the supply chain, reveal its operational and financial advantages, and explain how companies can embed them within their current structures and processes without disruption.

Benefits of Using Managed Transportation Systems

Managed transportation systems (MTS) go beyond optimizing shipping routing and data analysis management. They help manage logistics, allowing companies to concentrate on their primary business operations. Outsourcing the transportation management systems promotes professional development within the organization. It also enhances efficiency by eliminating wastefulness and saves costs in the long run.

The following are key benefits of using MTS in your supply chain processes:

Risk Management

Risk management has become more crucial now than ever because disruptions are bound to impact a company’s performance in its logistics industry. A managed transportation system can reduce risk by controlling carrier relationships and fine-tuning supply chain networks while using data-driven predictive tools to prevent delays or inefficiencies.

Cost Savings

Managed transportation systems assist organizations in selecting appropriate carriers and routes. This helps marketers cut transportation costs. In fact, companies that use data-driven insights can make well-organized decisions geared toward saving and managing costs effectively in the long run.

Simplified Day-to-Day Operations

If your company outsources logistics management, it can concentrate on its core business activities, such as developing new products and servicing customers. MTS providers manage logistics complexities, from booking shipments to addressing issues that may arise, so internal resources can be focused on core operations, increasing operational efficiency.

Enhanced Data and Insights

MTS analytics helps businesses monitor where logistics failed in real time. These insights allow businesses to make timely decisions, reduce delivery time, and optimize supply chain operations. Research indicates that data analytics helps cut costs and improve service levels.

Achieving Cost Efficiency with Managed Transportation Solutions

To stay competitive in the logistics market, your business must focus on reducing the cost of operations. But how do we achieve this? It’s pretty simple: Integrate managed transportation systems into your business.

Here are some vital hands-on ways to guarantee cost-effectiveness with MTS.

Carrier Optimization

Cost efficiency starts with choosing the appropriate carrier. MTS providers are not always out to settle on the cheapest rates but instead aim to optimize carrier selection by balancing cost and service performance. This guarantees timely deliveries and reduces transport costs.

Route and Mode Optimization

MTS helps companies find an optimum route and transport mode, resulting in huge cost savings. Increased route planning and mode selection for faster transit times help save on fuel consumption.

Data-Driven Decision Making

Data analytics are essential tools in minimizing a company’s costs. MTS vendors gather information from multiple systems and provide organizations with intelligence regarding logistics activities. Predictive and prescriptive analytics help forecast demand, anticipate disruptions, and make informed decisions that drive long-term cost savings.

Harnessing Data-Driven Insights for Superior Supply Chain Management

As supply chains grow more complex, data and analytics have become more than an optional add-on; they have become enablers of efficiency and resiliency. With the situation becoming even more complicated due to global disruptions, regulatory demands, and changing market conditions, data-driven approaches can bring a paradigm shift in supply chain management.

Here’s how businesses can capitalize on data-driven capabilities to improve the efficiency of their supply chain.

Supply Chain Data Management

Effective data management is the backbone of survival in the modern supply chain. There is an increasing reliance on advanced analytic tools for managing large volumes of data, which warrants quick insights and quicker actions.

According to KPMG’s Future of Supply Chain report, 39% of global supply chain professionals say they will invest in digital technologies to strengthen their data analysis capabilities. The readily available data enables an organization to anticipate interruptions, enhance visibility, and support efficient actions that maximize costs and service.

AI-Enabled Supply Chain Planning

Traditionally, demand planning is frequently carried out across departments using antiquated methods. This always leads to slow and less accurate forecasts. Fortunately, using AI-powered supply chain planning, the gaps between internal and external data can now be eliminated by leveraging unique machine learning models that link disparate types of information into a much more accurate forecast.

Generative AI in Supply Chain

Generative AI (GenAI) can transform supply chain management by making automation and decision-making easy. Examples of Gen AI use cases are translating complex data, summarizing legal documents, and analyzing customer feedback in real time.

Gen AI helps supply chain leaders more easily spot early warning signs, such as disruptions in supplier countries. It also supports faster response due to its capacity for handling huge amounts of information.

Best Practices for Leveraging Managed Transportation Systems in Your Business

A managed transportation system is a significant step and must be planned accordingly. Some best practices can help guide the process and ensure business gain from these systems.

1. Evaluate the Specific Needs of Your Business

Each company has different logistics requirements, and there may not always be a one-size-fits-all answer. When choosing a managed transportation provider or system, map your specific needs and see if they align with what they have—this is key. Shipment volume, frequency, and where you operate your business are some things to reflect on.

2. Monitor Key Performance Indicators (KPIs)

Measuring success for managed transportation system metrics begins with setting KPIs as they provide the capability to formulate results and track ongoing progress. Some metrics to monitor in your LSP are on-time delivery rates, transportation cost per shipment, and how fuel-efficient they run. Frequent monitoring of these KPIs will help determine the probable areas where the system could be improved to deliver desired outcomes.

3. Focus on Continuous Improvement

The logistics industry is ever-changing, and what works today may not work tomorrow. Businesses should be proactive agents, constantly assessing their managed transportation system and making informed course corrections based on data intelligence and performance metrics.

While this explanation can be more in-depth, businesses that embrace these best practices will have a smoother deployment of their managed transportation system and the operational as well as cost-saving results they expect.

Conclusion

There are many benefits of using managed transportation systems for businesses trying to improve supply chain efficiency and cost savings. MTS gives companies the tools needed to modernize logistics by delivering real-time visibility, route optimization, and data-driven decision support so that carriers can gain a competitive advantage in an increasingly complex supply chain. By deploying these systems, businesses can reduce costs and improve compliance and overall customer satisfaction.

*This article is written by Sheer Logistics. Sheer Logistics provides technology-driven supply chain solutions that empower businesses with visibility, efficiency, and agility across their logistics operations. With a focus on transparency and strategic partnership, Sheer Logistics helps clients optimize their supply chains and drive sustainable growth.

When cargo theft occurs, the entire supply chain suffers. Manufacturers must be aware of these recent trends occurring and act accordingly to protect their assets. With smart planning, businesses can adequately thwart thieves and safeguard their employees. Here are considerations for manufacturers to move in the right direction.

1. Understanding the Most Significant Risks

First, companies should understand the specific threats to which they are most vulnerable. The most immediate danger could be trucks in unsecured areas where thieves can quickly access them. In other instances, manufacturers may see organized crime targeting highly valued goods. Regardless, business owners need to acknowledge their weaknesses.

Researchers have investigated risk influential factors (RIFs) to determine the most damaging aspects. A 2022 study published in Reliability Engineering and System Safety developed a data-driven Bayesian network model to predict and diagnose cargo theft. The experts said product category, year, region, location type and modus operandi are the most significant RIFs. Therefore, manufacturers should be aware of these guidelines.

2. Leveraging Advanced Algorithms

Improving cargo security has become more challenging due to increased attack surfaces and opportunities for outside threats. In response, manufacturers must leverage advanced technologies like artificial intelligence (AI) and machine learning (ML) to protect their assets. Algorithms are excellent tools for business owners because they reduce the theft risk when transporting goods on the road.

A 2024 study published in Computers and Industrial Engineering used a physical internet-based analytic model to combat rising cargo theft. The researchers used real-world scenarios in their experiments to understand the benefits and drawbacks. Their model determined the risk of different product types based on their specific routes, allowing them to better understand the threshold where shipments become vulnerable to criminal organizations.

3. Using the Internet of Things (IoT)

IoT devices are critical for management operating systems (MOS) because they enhance software and hardware capabilities. With these gadgets, manufacturers can improve productivity and financial performance. IoT research is also critical for securing cargo through each step of transit. For instance, GPS technology provides real-time knowledge of each shipment.

Manufacturers should take advantage of IoT because it can be present with the device and around the facility. Smart cameras are an excellent example because business owners can remotely monitor the feeds and promptly take action. Advanced technology also lets manufacturers take extra steps to protect their cargo. Smart locks with biometric recognition are a vital safeguard against thieves.

4. Improving Cybersecurity Practices

Cargo theft increased by 46% in the first quarter of 2024 compared to the same time in 2023. CargoNet reported 925 incidents in the quarter, emphasizing the need for heightened security tactics. While physical barriers are necessary, manufacturers should also improve their cybersecurity practices. Internet crime is equally damaging to companies and could be more challenging to predict.

Ransomware attacks are among the most pivotal for manufacturers, considering their frequency. A 2022 IBM report found that 23% of these incidents affected manufacturing, making it the most targeted industry. Preventing ransomware attacks entails basic to advanced cybersecurity tactics, such as multifactor authentication, anti-malware software and software updates.

5. Selective Supplier Partnerships

Some manufacturers outsource specific tasks to reduce overhead and strengthen their bottom line. In addition to these partners, companies must watch other links in the supply chain. Businesses should monitor supplier relationships to ensure security — otherwise, they risk lost revenue and downtime while fixing errors.

Supplier relationships start with background checks and regular audits. Manufacturers must ensure these partners do their best to detect and address vulnerabilities. Business owners should find companies with pertinent industry certifications like C-TPAT if applicable. Monitoring should continue throughout the relationship with consistent communication and key performance indicators (KPIs).

6. Properly Training Employees

While suppliers can be security liabilities, it’s equally essential for manufacturers to monitor their employees. Workers may willingly or unknowingly contribute to cargo theft through their actions, so businesses should protect them from themselves. First, company leadership should train employees on best security practices, such as reporting procedures and proper loading.

Then, the company should focus on internal theft from its workers. Experts say over 75% of employees have stolen from their employer at least once. Therefore, robust internal measures should be in place to prevent theft. Mitigating employee stealing includes restricting access control and using biometric scanners. Business owners could also encourage workers to be vigilant of suspicious activity.

7. Controlling Supply Chain Aspects

Ultimately, it’s up to manufacturers and business owners to control as many supply chain aspects as possible. Internal audits are a valuable tool because they reveal gaps in shipments and where theft has potentially occurred. Once a company understands its insufficiency, leadership teams can act accordingly. Businesses should audit their inventory, security and other critical business features.

Supply chain professionals should also regain control in areas they may consider less secure, such as transit. Highways and oceans provide plenty of unknowns, so businesses must protect their cargo before, during and after the route. Besides GPS devices, forward-thinking companies wield electronic seals, telematics devices, light sensors and other tech.

Tackling Theft and Protecting Assets

The rise in cargo theft should alarm manufacturing professionals and business owners. Outside threats have become more sophisticated through physical and cybersecurity risks. While crimes have increased, manufacturers should proactively combat thieves. Leadership teams should scrutinize suppliers, employees and other aspects of the supply chain to ensure safety.

*This article is written by Jack Shaw. Jack is a seasoned automotive industry writer with over six years of experience. As the senior writer for Modded, he combines his passion for vehicles, manufacturing and technology with his expertise to deliver engaging content that resonates with enthusiasts worldwide.

Once one of America’s most respected professions, truck driving now generally struggles to be seen in a positive light. Instead of being seen as a traditional, hard-working segment of the workforce, unpleasant notoriety now exists around truck drivers. In 2018, Wisconsin-based trucking company manager Boris Strbac told The Washington Post that “people don’t respect truck drivers. We are treated as the bad guys on the road by other drivers and the police.”

That perceived lack of respect from other motorists, law enforcement, and the general public is just one reason why the U.S. is in the midst of a truck driver shortage. The job is also difficult and isolating, resulting in a high turnover rate.

Employment trends within the trucking industry have wide-reaching implications. For starters, trucking is essentially the lifeblood of manufacturing logistics. Without trucking, the whole supply chain could crumble. In fact, about 71% of American freight is moved via truck, equating hundreds of millions of dollars in revenue on an annual basis. Due to the national truck driver shortage, freight prices have jumped considerably in recent years. And the trend is expected to continue, to the detriment of food suppliers and restaurants alike.

How Trucking Impacts Food Manufacturing Supply Chains

Rising freight costs within the food industry due to truck driver shortages are nothing new. The same year that Strbac vented his work-based frustrations to the Washington Post, food manufacturers began to see freight costs severely impact their bottom line. Representatives for Tyson Foods, one of the country’s largest producers of meat products, reported a freight cost increase of $250 million in a single year.

When freight costs rise, those costs are typically passed along to the consumer. According to the U.S. Department of Agriculture (USDA), national food prices in January 2020 were 1.8% higher than the previous year. What’s more, the cost of foods consumed away from home, such as in restaurants, increased by more than 3%, with fruits and vegetables seeing the largest relative price increase of all food categories.

Produce often must travel long distances to reach the nation’s restaurants, grocery stores, and cafes, and their transport is typically done via truck. And even food and beverage industry trends, such as increased demand for plant-based meat substitutes, can’t curb the damage caused by increased freight costs.

Data indicates that the truck driver shortage is a primary culprit of rising freight costs nationwide. In order to help curb those rising costs, the trucking industry may need to make changes to help bring more workers to the crippled industry.

Methods for Improving Truck Driver Health

Trucking can take a major toll on a driver’s physical and mental health. Thus, many job seekers overlook truck driving opportunities as they find the pay to be negligible compared to the work performed. Long-distance truck drivers, for example, spend a large chunk of their time on the road, and may only see their families a few times per month.

That social isolation, coupled with health difficulties such as lack of physical exercise and sleep deprivation, directly contributes to the national truck driver shortage. Reducing hours spent on the road while increasing pay may be key factors in job recruitment within the trucking industry.

Exercise is also an important consideration for prospective truckers, who need to counteract their sedentary lifestyle in order to improve their overall health. Sitting for more than six hours per day can be detrimental to one’s health, even contributing to premature death. Trucking companies should thus consider including a gym membership as part of their sign-on bonus, or provide incentives for positive health changes among employees, such as weight loss or smoking cessation.

Manufacturing Logistics, Supply, and Demand

Unfortunately, health-related measures may not be enough to spawn a renewed interest in truck driving as a career. The sad truth is that the “U.S. trucker shortage is expected to more than double over the next decade,” reports Bloomberg. Trucking companies are looking to fill in the employment gaps by recruiting more young people and women, typically underrepresented in the workforce.

But it may not be enough, leaving the U.S. manufacturing industry in a limbo. In fact, Washington State University reports that the manufacturing industry is adding jobs faster than the rest of the economy, especially within the fabricated metals, machinery, and food manufacturing industries. And as the manufacturing sector continues to rake in steady revenue, the demand for freight and trucking naturally increases.

If the truck driver shortage isn’t mitigated in the near future, manufacturers from all industries will have to look elsewhere for their freight needs. Inevitably, costs will then rise at both the business and consumer levels. Steadily rising freight costs lead to gaps in the supply chain, a fact that seems counterintuitive in a nation where product manufacturing is in high demand. It’s time for trucking industry leaders to make appropriate, forward-thinking policy changes in order to help mitigate the truck driver shortage and perhaps stop the snowballing costs of freight across the country.

For over 50 years USC Consulting Group has been guiding logistics and manufacturing companies with optimizing their supply chains and improving their bottom lines. Contact us today and we will help drive up efficiency in your operations.

This article is written by guest author Beau Peters. View more of Beau’s articles here.

Transportation and logistics organizations quite literally propel the modern marketplace, underpinning product and service delivery workflows worldwide. Unfortunately, the businesses that populate this key industry have come up against numerous challenges, including a number of environmental obstacles that impede the progress of the shippers and truckers navigating waterways and highways everywhere. Here are some of those roadblocks and ways that transportation and logistics firms might address them over the coming months and years:

Extreme weather patterns

In late 2018, the container ships navigating the Rhine River, Europe’s busiest commercial waterway, encountered a unique problem: The storied tributary was remarkably desiccated and unable to support large shipping vessels, Bloomberg reported. A drought had brought water levels in the Rhine basin to historic lows, forcing carriers operating in Western Europe to find alternative routes – or cancel shipments altogether. Although the Rhine’s water levels returned to normal in December 2018, according to Reuters, this is just one of the many instances in which extreme weather has threatened transportation and logistics operations in recent years. These occurrences, which scientists link to climate change, pose a significant threat to transportation and logistics organizations. In fact, extreme weather events, natural disasters, and “failure of climate-change mitigation and adaption,” rank among the World Economic Forum’s top five biggest business risks in terms of likelihood and impact.

Transportation and logistics enterprises have no choice but to adjust to this environmental risk, but how? Leveraging forward logistics, proactive notification and direct-store delivery strategies are among the most often recommended courses of action, Inbound Logistics reported.

Crumbling infrastructure

Infrastructure is a significant issue for transportation and logistics businesses operating in the U.S., where an investment gap of more than $4.5 trillion exists, according to researchers from the American Society of Civil Engineers. This problem affects virtually all transportation channels. Many U.S. ports cannot effectively handle modern container ships, leading to long-term delays and other serious problems, the trade association found. American roads are in a similarly sorry state, and in need of $836 billion worth of improvements and repairs, per the ASCE. Domestic railroads are also in disarray, as operators struggle with outdated cars, tracks, and stations that cannot meet the demands of commercial shippers, according to the group.

Industry organizations associated with each of these modes have called on local, state, and federal governments to invest in transportation infrastructure. This includes the Association of American Railroads and the American Trucking Association, both of which support large-scale institutional spending strategies. Unfortunately, the trillions needed to improve the country’s ports, roads, and rails are unlikely to materialize. This means carriers must take matters into their own hands by building flexibility into their supply chains to compensate for any infrastructure-related shipping slowdowns.

Increased government regulation

New pieces of government regulation are weighing heavily on organizations in the transportation and logistics space, according to research from Capgemini published in Logistics Management. While firms in the sector generally understand that carefully crafted statutes carry some benefit, many are concerned that the expenses associated with compliance outweigh potential advantages. For instance, the Federal Motor Carrier Safety Administration’s Electronic Logging rule, which took effect in December 2017, generated significant upheaval in the trucking arena as drivers cut down their hauling times to meet strictly enforced ELD regulations, the Chicago Tribune reported. This resulted in higher shipping costs, which ultimately trickled down to the customer.

Many transportation and logistics organizations struggle to comply with rules like the ELD regulation while maintaining healthy profit margins. While lobbying to stop the passage of additional rules can make a difference, companies in the space would be better off adjusting their internal processes in a manner that streamlines compliance and therefore mitigates its functional and financial impact on the operation.

Taken together, these challenges may seem insurmountable to carriers just looking to survive. This is not the case. By making some of the operational improvements mentioned above and embarking on more robust optimization efforts, transportation and logistics businesses can strengthen their position in the marketplace and find sustainable success. Of course, making such changes alone can be hard. This is where USC Consulting Group comes into play. We can tap into decades of consulting experience to help transportation and logistics companies of all sizes bolster their operations to account for new sector-specific challenges.

Contact USCCG today to learn more about our work in the transportation and logistics industry.

In April the Chinese Ministry of Commerce announced tariffs on 128 American goods, including almost eight dozen food and beverage products. The country instituted the duties, which range from 15 to 25 percent, in response to the American roll out of protective tariffs on aluminum and steel a month earlier. China is the leading producer and exporter of both materials, and therefore took exception to the move.

Unfortunately, as the two nations face off in this tariff war, American businesses may suffer, especially those in the food and beverage industry. The retaliatory Chinese tariffs have had an impact on a significant number of food and beverage enterprises, including fruit and nut growers, pork producers and winemakers.

Fruit and nut growers bear the brunt

Of the more than 90 American-made food and beverage products China targeted, approximately 78 are grown and harvested by fruit and nut growers, most of whom are based in California. In 2016, the sunshine state’s agricultural sector generated more than $46 billion, according to the California Department of Food and Agriculture. Fruit and nut products account for seven of the state’s top 10 agricultural exports. Almond sales alone totaled more than $5 billion in 2016, eclipsed only by grapes and dairy products.

Many of these items find their way to China, which, according to the California Legislature’s Nonpartisan Fiscal and Policy Advisor, consumes 35 percent of California’s pistachios and 15 percent of its oranges. Shipments have certainly slowed because of the new duties, a development that has put additional financial pressure on West Coast growers. NPR reported that pistachio prices in China increased from $3.50 per pound wholesale to $4.00 per pound following the implementation of the tariffs. The 15 percent hike has forced pistachio growers to completely reassess active logistics and sales strategies, many of which hinge on vendor service agreements. To put things into perspective, the pistachio duty of 15 percent, or $0.50 per pound, increases the shipping cost of each 44,000-pound container by $22,000.

To offset this expense and ship product to China, growers must eat the cost and renegotiate their contracts with logistics providers. Those that decide to divert their shipments to importers without duties often pay between $2,000 and $4,000 per rerouted container. Pistachio producers that simply recall their product back to port can expect to incur costs as high as $10,000 per shipment navigating U.S. customs. None of these options is favorable.

Winemakers face international competition

Wine producers in California and beyond are experiencing similar problems. The U.S. wine industry, which hinges on vineyards in California, shipped $197 million worth of product to China in 2017, capping off a decade that brought export increases of 450 percent, according to analysts at the Wine Institute.

But these gains did not come without struggle. Prior to the April tariffs, China had been collecting duties of 14 percent on American wine imports, disadvantaging U.S. vintners warring with ascendant competitors in Chile, Georgia and New Zealand, which are permitted to ship to Chinese ports duty free. With the new tariffs, total duties increased to 29 percent.

In the short term, this tariff hike will do little to damage the American wine industry. China has a relatively small wine market. Tariffs, however, could have long-term implications if they prevent winemakers from selling to the growing number of Chinese middle-class buyers set to gain purchasing power over the next decade.

Pork producers grapple with difficulties

An estimated 60,000 pork producers operate in the U.S., generating more than $20 billion per year, according to analysts from the National Pork Producers Council. Many of these businesses are based in the Midwest and South East, with Iowa and North Carolina boasting the highest production figures, according to the U.S. Department of Agriculture.

China is the fifth largest consumer of U.S. pork, which will now be subject to tariffs of 25 percent. Many American pork producers are not pleased with this development, despite China’s relatively low consumption levels. Some believe the tariffs will result in depressed profits which will ultimately undermine the local economies that pork producers support.

Pinpointing the ideal strategy

Earlier this month, The Wall Street Journal reported that China offered to purchase $70 billion in U.S. farm and manufacturing products in exchange for immunity from the aluminum and steel tariffs. This development has led some experts within the food and beverage industry to believe that China may soon lift its duties.

For the time being, however, food and beverage producers have no choice but to adjust to this new reality. How? By optimizing production workflows to reduce overhead. When enterprises embrace internal improvement efforts, production costs decrease, leaving room for additional expenses, including those associated with higher transportation costs due to tariff increases. For food and beverage makers navigating the Chinese market, this may be the most viable strategy for short-term success.

At USCCG, we’ve been working with businesses across numerous industries for 50 years, including the food and beverage industry, helping them adapt to marketplace transformations of all kinds. Connect with us today to learn more about our work.

What areas should transportation divisions look to that could both hide wasteful processes and, if maintained properly, significantly optimize processes?

Transporting goods, as a subdivision of a company’s logistics department, has transformed from an ancillary service to one of the most valuable resources in modern commerce.

Though the value of transportation logistics varies across different supply chains and might be difficult to ascertain cumulatively, a William Blair & Company study found third-party logistics companies constitute a more than $500 billion global venture with only 10 percent of the logistics market share. As evidenced, the power of an intelligently managed fleet can yield exciting revenue growth and truly define a business at its core.

That said, operational deficiencies can also turn the best logistics providers on their proverbial ears. Supply chain networks subsist on the fast execution or pertinent tasks and abhor waste in all forms. Depending on where it occurs along the supply chain, even the smallest inconsistency can offset processes down the line and cause subsequent harm, costing several companies considerable revenue all at once.

Best practices always encourage logistics providers to implement verifiable methods of improving operations when it comes to transportation management. In many ways, this is easier said than done. However, what areas should transportation divisions look to that could both hide wasteful processes and, if maintained properly, significantly optimize processes?

Reliance on technology necessitates repair management

As more and more advanced equipment make their way into all levels of the supply chain, manufacturers expand their potential for accelerated growth and enhanced productivity in granular increments to complement positive scalability. However, once any process becomes heavily dependent on technology, it can just as easily fall victim to its limitations. Machinery doesn’t last forever, and eventually businesses utilizing advanced equipment will need to dip into their repair and maintenance allocations. That is, after all, total cost of ownership.

Big trucks cost big bucks to maintain.

Unfortunately, these R&M costs are not fixed and will require foresight to avoid exorbitant fees. According to a study conducted by the American Transportation Research Institute, the average R&M costs per mile for a single truck grew by 7 percent between 2012 and 2013. When multiplied over an entire fleet and compounded by overall industry growth with expanded services, these operational costs truly stack up. Moreover, the ATRI study also stated fluctuating petroleum prices can impact the cost of tires, an integral and unavoidable resource for ground travel.

On top of all that, these costs don’t even consider the most important ones of all: downtime-related revenue losses. This multifaceted issue affects all aspects of business performance and can ruin profitability across all. Downtime loses companies customers, stifles on-site and off-site productivity, leads to expensive overtime pay for workers, hurts a brand’s image and could possibly even lead to expensive litigation. Though trying to assign a set number value to downtime casts a wide net, Gartner places the figure around $5,600 per minute – or more than $300,000 an hour – on average.

Companies who take their R&M schedule into their own hands can undermine these risks. Logistics providers should be sure to develop strategies that log relevant data pertaining to things like vehicle wear and tear. This can allow logistics managers to address necessary maintenance before the equipment breaks down and the serious costs start piling up. Moreover, this regiment creates an operational framework that accounts for repairs rather than responds to them as best it can.

Closing the skills gap

To maintain a competitive edge, the transportation industry requires a competent workforce knowledgeable about on-site operations, as well as overarching trends in the field. However, many problems stand in opposition of this, ultimately stemming from negative public opinion about the transportation industry and those who are needed to assume its mantle in the coming years.

For example, a study by the Economic Modeling Specialists International found more than half of all truck drivers in Houston, Texas, are 45 years old or older. This is not an isolated issue. Given the size of the baby-boom generation, as these workers retire, others will need to fill the void. Not anyone will do – as stated earlier, transportation has undergone a digital age makeover as of late. With Big Data and the Internet of Things redefining logistics operations, new hires must possess ever-increasing technological knowledge. Ironically, many young people in search of their first careers have been and will continue to be swayed by the incorrect notion that logistics and manufacturing are strictly about manual labor.

To ensure any enhancements to long-term productivity, transportation and logistics providers should never underestimate the value of public relations. Additionally, these organizations should develop new training tools that facilitate an accelerated process that doesn’t glance over the necessities, but provide job candidates with resources that complement their tech-savvy lives and minimize downtime between incoming and outgoing employees.