-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Reliability

Mining and metals companies are implementing a range of strategies to enhance asset management and equipment reliability.

In today’s market, many senior executives leading natural resource companies hesitate in making additional capital investment and instead focus on what can be done to squeeze higher performance out of current assets. Consequently, companies are increasingly looking for ways to improve performance and returns with existing infrastructure.

The key approach to this challenge lies in upgrading and improving asset management capabilities. Many organizations have failed to deploy optimal asset management practices. This is surprising given that asset spend frequently represents 30% to 50% of the overall operating expenses. Shifting to a best-in-class asset management program will consistently deliver improved plant or equipment performance, lower operating costs, extend asset life, and generate a higher return on capital. Most recently, companies have sought to implement a range of strategies such as:

- Implementing Asset Management Systems: Utilizing robust asset management systems to track equipment performance, maintenance history, and lifecycle costs, allowing for better decision-making regarding repairs, replacements, and upgrades. Digital technologies like IoT sensors, AI-driven analytics, and automation further optimize asset management.

- Enhancing Maintenance Practices: Implementing proactive maintenance strategies like conditioned-based monitoring and reliability-centered maintenance to address issues before they cause failures. Utilizing data-driven insights, mining companies can optimize “time on tools” by identifying patterns and trends in equipment usage, maintenance needs, and performance. This allows for more precise scheduling of maintenance tasks, reducing downtime and maximizing the time equipment is operational.

- Investing in Training: Providing comprehensive training programs for front-line management, maintenance and operations personnel to ensure equipment is used and serviced properly, reducing the likelihood of breakdowns due to human error and that access to equipment is available. Training personnel to utilize data-driven insights enables management to make informed decisions impacting “time on tools” and leading to improved equipment utilization and overall operational performance.

- Improving Supply Chain Management: Ensuring timely access to quality spare parts and materials to minimize downtime caused by equipment breakdowns and repairs. Some are adopting blockchain for transparent supply chain management and better tracking of assets throughout their lifecycle.

The level of performance improvement companies can realize by implementing key strategies such as enhancing proactive maintenance practices, investing in training to improve skills and capabilities, improving supply chain management, and leveraging digital technologies and data-driven insights varies depending upon factors like current operational efficiency, the scale of implementation, and industry conditions. However, many can expect significant improvements in:

- Safety: Proper training programs and proactive maintenance strategies contribute to a safe work environment by reducing risk of accidents and equipment failures.

- Productivity: Proactive maintenance and digital technologies can reduce downtime, increase equipment availability, and optimize process execution, leading to higher productivity levels.

- Cost Reduction: Efficient equipment usage and maintenance practices can lower operational costs by minimizing unplanned downtime, reducing repair and replacement expenses, and optimizing resource utilization.

- Quality: Improving the essential management skills and work place practices result improve the quality of maintenance execution.

Overall, these strategies can result in substantial performance improvements, enhancing competitiveness and profitability for mining and metals companies.

USC Consulting Group partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Asset Management and Reliability Excellence.

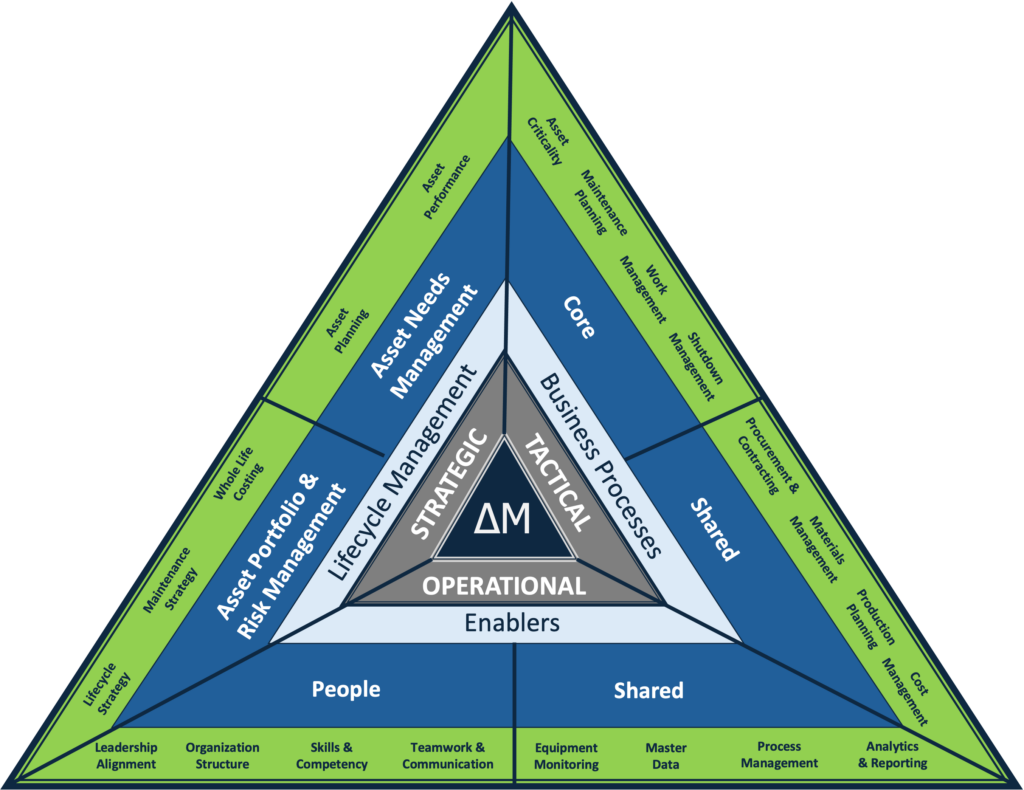

USC’s experience helping clients to shift asset performance by transforming and optimizing asset management capabilities and processes has repeatedly demonstrated the need to focus on the key levers and enablers to asset management and reliability excellence. Our asset management framework is designed to be pragmatic rather than conceptual, thereby leading to accurate, practical decisions about a client’s assets and aspirational outcomes.

The primary goal of USC’s asset management framework is to help our clients to implement and execute of a robust set of integrated processes and tools to manage and maintain their operational assets at the targeted service levels while optimizing life-cycle costs and asset life. This is accomplished by recognizing the needs to:

- Improve safe execution of work

- Increase asset life and reliability

- Improve productivity and cost performance

- Improve operational predictability

- Control material asset risks

- Develop competitive advantage

Our asset management and reliability framework helps clients identify an organization’s asset management maturity level and the areas and gaps that need to be addressed, by evaluating their strategic, tactical and operational levers and the enablers that comprise each.

Strategic (Lifecycle Management): A tailored maintenance program for each piece of equipment translates overall strategic objectives into executable plans for equipment upkeep. Our framework helps to structure and prioritize critical assets while defining a baseline operational ‘plan of action’ by determining strategies for maintaining equipment based on analysis of equipment capabilities, required performance levels, failure frequencies, and cost objectives. Optimal maintenance strategies are frequently a blend of preventative, predictive, operator-maintained, and run-to-fail options.

Tactical (Business Processes): Business processes bridge the gaps between the initial, ideal plan and the reality of ‘day-to-day’ operations, so the maintenance and reliability organization can make adjustments. Historically, many maintenance organizations have been poor utilizers of labor resources that result in low “time on tools” and excessive delays in repairing down or poor performing equipment.

Operational (Enablers): Enablers help to identify needed support to manage assets throughout their lifecycle in alignment with organizational aspirations. Leading asset management teams have also made changes in their organization structures and management practices to foster more action-oriented leadership that focuses on operational excellence, which usually requires a culture shift that must be relentlessly supported by the leadership team over the long-term. A heavy emphasis on management behaviors and company culture can help organizations make this difficult transition.

USC Helps You Tackle Key Challenges

- Optimize maintenance strategies and increase equipment availability operational output

- Predict asset integrity and reliability needs and improve time on tools

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcoming cultural and communication issues with contractors, while ensuring quality expectations

Do you want to understand how prepared your company is to drive needed asset performance and reliability improvements and what the key focus areas that will contribute to lower operating costs?

Want to find out more about how USC can help you uncover the hidden value lurking in asset portfolio?

For more information, let’s talk it through with a no obligation video conference call or a meeting with one of our executive team. Email info@usccg.com to arrange a call.

The energy and utilities industry is in the midst of change.

Businesses are facing pressure from the government and consumers alike for more renewable energy while also balancing that with grid reliability and traditional energy sources. Meanwhile, electricity demands are expected to skyrocket. Other wild cards are supply chain disruption, labor shortages and more.

But within those challenges, we always see opportunities. Let’s take a closer look into the outlook for energy.

Continued focus on renewables. The demand for clean energy will continue to rise. Governmental regulations are mandating the focus on clean energy and decarbonization, including enacting green-friendly legislation and incentives for companies to transition to cleaner sources like solar and wind. The industry made great strides in solar power and the energy storage it necessitates in 2023, but more is needed and the focus will continue in 2024 and beyond. Consumers are demanding it as well, with climate change among people’s top concerns. All of it has led many companies to push the timeline to cut carbon emissions by 80% from 2050 up to 2030.

Energy storage. The push for solar requires an enormous amount of battery storage capacity to, in very simple terms, store all of that energy for times when the sun’s not shining. It means innovation in battery technology, and 2023 saw much of that, with storage capability doubling in 2023 and set to nearly double again in 2024.

Electricity surge. According to industry sources, the demand for electricity is expected to triple by 2050. It means planning now for this increased load on what is likely aging infrastructure, resulting in costs to shore up that infrastructure to ensure grid reliability. It’s also necessary to consider expanding the grid to meet that demand.

Aging grids + extreme climate. We all saw the worst-case scenario play out in Texas when their grid failed when the state experienced a rare deep freeze. But weather extremes are becoming the norm, with heat, wildfires and drought on the one hand, floods and record snowfall on the other. The industry is modernizing the grid, and made progress in that area in 2023, but reliability is still a large concern.

Supply chain uncertainty. The recent geopolitical unrest in Ukraine and the Middle East has underscored the need to reshore this nation’s oil supply.

Labor shortages. Like many industries today, energy is battling a labor shortage and facing the double whammy of their most experienced workers retiring and taking institutional knowledge with them, and having too few younger people in the pipeline to pick up where they left off.

It’s a full plate for the energy sector in the coming years, that’s clear. But within these challenges, we see opportunities to bolster processes, making operations more efficient and guard against supply chain snafus. Reducing operating costs, improving productivity and increasing efficiency will help the industry navigate these challenging times.

This is where USC can help

Management Operating Systems. A solid Management Operating System is a must for efficiency, time savings, employee productivity and so much more. For a real-world example on how USC helped an energy producer save time and money by implementing an MOS, read “Energy Producer Generates Savings with Smarter Labor Practices.”

Reskilling employees. All of this innovation and growth in renewables, not to mention AI entering the mix, requires more workers with new skills. This can be very good news for your current employees, who can move up the food chain with new training, and the ability to attract highly qualified workers.

Resource planning. If you know anything about our company, you know we are great proponents of SIOP – Supply, Inventory and Operations Planning. It gives companies a roadmap to the future, so they’re not reacting to events, they’re anticipating them. With the exponential growth of the energy and utilities sector in the coming years, solid planning for the resources needed for that growth, like increased storage capacity and grid strength, is a must.

Bottom line, delivering reliable, affordable and sustainable energy is the goal for the energy and utility industry. It takes efficient operations, a handle on resources, and a clear eye toward the future. Contact us today to find out more about how USC Consulting Group can help.

Have you heard of a High Reliability Organization? The concept has been out there for several decades but it’s taking center stage again now. Let’s delve into what a High Reliability Organization is, why this concept is coming to the forefront again, and whether you should explore implementing the principles in your own organization.

Simply put, a High Reliability Organization (HRO) is a company that has a solid operating system of execution in place that emphasizes safety and strives to minimize risk across the business.

We’re talking about complex or hazardous industries like nuclear power, the Navy and other branches of the military, air traffic controllers and the mining industry.

The idea behind HRO is a basic one. Expect the unexpected. An HRO creates a number of operational systems and ways of working that promote consistency and keep the focus on achieving company goals while avoiding major errors. These systems not only make the HRO more nimble, responsive and functional than a non-HRO competitor, but they also deliver more efficiency and most importantly, safety.

Why being an HRO is vital today

The concept of HROs has long been a method of ensuring safety in hazardous industries, but it’s becoming more relevant today in mining and other industries because of a perfect storm of circumstances. The marketplace is changing dynamically. Shifting sands don’t exactly make for solid foundations. A few things happening now:

Natural disasters. We seem to be in a period of increased earthquakes, “storms of the century,” droughts, volcanic eruptions and more. It makes facilities vulnerable to disruption.

Cyber attacks. Another vulnerability. As the industry gets more dependent on technology, the vulnerability to hacking of control systems ratchets up.

Boomer retirements. The impact of this can’t be overstated. Baby Boomers make up nearly a third of the entire U.S. workforce. The U.S. Census Bureau projects that 4.4 million people will turn 65 (retirement age) every year from now through 2027. During the period from 2022 to 2030, 75 million Americans are expected to retire. Called the Silver Tsunami or the Great Retirement, it is the largest surge of retirement age Americans in history.

Loss of institutional knowledge. Those retiring Boomers represent your most experienced, knowledgeable workers. These are the people who have gotten the job done, and done safely, for decades. All of that know-how will walk out the door with them.

Lack of skilled workers. It’s a real problem for many industries, including mining. Talent acquisition and training is on the top of the list of concerns for mining CEOs, because when those Boomers retire, the mining industry needs skilled, experienced people to keep the operation moving.

Doing more with less. In this economy, it is incumbent on companies to do more with less, cut costs, trim staff and extend the lifecycle of equipment while also investing in AI.

All of these things are coalescing into a situation in which the mining industry is experiencing a great potential for increased risk. It’s easy to see why. Experienced people retiring en masse, less experienced people taking up the mantle but not having that deep institutional knowledge you just can’t get in a training course, and the need for constant cost cutting – it all adds up to risk.

And when you’re talking about operations in a mine, risk doesn’t just mean business disruption. It means people’s lives.

HRO core principles

It’s about more than just focusing more on safety. The core principles of HROs, specifically in the mining industry, include:

Preoccupation with failure. It’s vital to anticipate the potential for failure and put measures in place to stop a problem before it starts. Emergency response training, regular equipment inspections and maintenance, failsafe protocols. The goal here is to be ready to spring into action, to have that training kick in, when a potentially disastrous situation arises.

Sensitivity to operations. Everyone’s eyes need to be open, all the time. Much like the “see something, say something” campaign at airports, it means developing a culture of awareness among workers on the front lines and in the front office. Identifying processes and ways of working that can be optimized; or potential issues or risks that could lead to disruption in the future.

Resilience. The ability to roll with the punches. Redundancies need to be built in. Clear protocols for disruptions or sudden change responses need to be automatic.

Shared understandings. Everyone in the organization needs a shared understanding of HRO principles, the role they themselves play, and are operating with the same road map.

Respect hard-earned expertise. Those Boomers who are retiring? They know how to get the job done. They’re carrying your organization’s institutional knowledge – the part of the job that can’t be taught in a training class. This knowledge needs to be respected, especially when decisions get made.

Why being an HRO matters

Why should mines focus on high reliability? Here are a few of the benefits.

Safety. Since the first canary went down a coal mine, this industry has been implementing safety protocols. It can be dangerous for people working in a mine, period. Anticipating risks and putting safety protocols in place will save lives and reduce accidents and injuries.

Efficiency. The focus on asset management minimizes unscheduled downtime and process disruptions, while getting everyone on the same page streamlines operations. It all works together to increase efficiency.

Equipment lifespan. One of the challenges today is doing more with less, and that means keeping aging equipment on the job. The regular maintenance and inspection of equipment adds to its lifespan.

Hiring and retention. That lack of skilled workers? It’s causing stiff competition for the skilled workers who are out there. Being a High Reliability Organization shows new recruits that you’re committed to safety, value their contributions and knowledge. In short, it’s a powerful recruiting tool.

How USC can help: Anticipate the Unexpected

One of the most vital components of transforming into an HRO is the integration of a solid Management Operating System that breaks down siloes between areas of the organization like engineering, maintenance, procurement and operations.

The end goal: Constantly anticipating the unexpected and executing in a consistent manner.

When USC begins the process, we start with an assessment of current operations. Then we do a deep dive. Some, but by no means all, of the areas we focus on:

Identify operational disconnects. Is everyone on the same page to execute the plan? Are priorities between departments aligned? Has production prepared access to equipment to be maintained? Are shift managers setting work expectations in the same way? How are variances to the plan addressed?

Close the gaps. This is about breaking down silos and getting everyone looking in the same direction, working in the same way, and managing departmental operations with a common vision.

Build in buy in. Like many projects that require change at all levels of the organization, this requires buy in from the corner office to the depths of the mine. In many instances, this requires a culture change, with people being used to doing the job one way now asked to shift their operations.

Make it transparent. Change can’t be foisted on people in a vacuum. The new initiative on transforming into an HRO should be a full team effort, with full transparency from the top.

Implement measures and metrics. It’s also important to implement accurate measurements and targets. Still, one assessment rises above all others: addressing overall organizational health. Organizational health is the softer side of the business that is frequently dismissed because it is often viewed as both difficult to revamp and even more difficult to measure.

HRO Checklist

Do you need to focus on High Reliability Organization? Here’s a quick checklist to help you decide.

- Do you have an organization-wide sense of susceptibility to the unexpected?

- Does everyone feel accountable for organizational reliability?

- Are your leaders paying as much attention to managing unexpected events as they are to achieving formal organization goals?

- Do people at all levels of your organization value quality?

- Have you identified how your activities could potentially harm your organization, employees, other stakeholders and the environment at large?

- Do you pay attention to when and why your employees or other stakeholders might feel angry or disenfranchised?

- Do you have widespread agreement among the organization’s members on what shouldn’t go wrong?

Transforming into a High Reliability Organization doesn’t happen overnight, and many challenges exist in the process. It requires a cultural shift, training for both workers and management, investing in protocols, and commitment from the top.

But, in today’s volatile world, it’s a solid framework the mining industry can use to ramp up safety, increase efficiency, minimize risks and anticipate the unexpected. For help setting up your HRO, contact USC Consulting Group today.

Are you performing preventive maintenance on a regular basis? If you’re not, you may want to consider adding it to your schedule. Why? In a word, it’s about efficiency. In a few words (as its name suggests), it prevents problems before they start. Preventive maintenance is becoming the manufacturing industry standard. Roughly 80% of asset and facilities stakeholders are embracing the process as a way to cut costs, increase efficiency, and keep assets running like clockwork.

By performing regular preventive maintenance (or its cousin, data-based predictive maintenance) you are heading off problems, snafus and breakdowns at the pass. It’s about identifying and handling any potential issues that may be lurking down the road. The point is to find potential problems before they become real problems that could lead to delays and costly headaches.

The irony of preventive maintenance is that it can sometimes seem like it causes more problems than it solves. It requires regular downtime, which in itself is a problem. There’s also the tricky matter of timing. Finding the optimal time to perform the maintenance can be a delicate balance between shutting down for maintenance too soon and waiting too long.

But, the challenges are worth the rewards. Ensuring you have the proverbial well-oiled machine will make your operation more efficient and productive now and in the future.

Let’s take a look at preventive maintenance benefits and challenges and how it can help boost your operations.

Preventive maintenance benefits

The idea behind doing regular maintenance on the lifeblood of your manufacturing operations — your machinery — is to keep it humming along at optimal efficiency and prevent any problems that might occur. Benefits to making it a regular part of your business process include:

You control the downtime schedule. It’s true that performing maintenance requires downtime. You’ll experience a work stoppage because of it. However, the good news is, when that downtime happens is up to you. You can schedule it for slow periods and avoid your high-volume times. Build maintenance into your schedule as a regular part of your routine.

Fewer surprises. A snafu happens, something breaks, and you have to stop production to figure out what it is and fix it. That can happen at any time, and trust us, it will happen when you least want it to. Performing preventive, not reactive, maintenance will lessen those unwelcomed surprises that erode your productivity and profitability. A general rule is that planned work will cost two-thirds less than unplanned work in time and other resources.

Increased efficiency. At USC Consulting Group, we’re all about efficiency, and one of the surest ways to find “hidden efficiencies” that you didn’t even know were possible is to perform regular preventive maintenance on your machines.

Increased longevity of your machinery and assets. This is key. Just like your car needs regular oil changes and tune-ups to keep it running at its best, so do your assets.

Preventive maintenance challenges

There are some challenges with doing regular preventive maintenance. However, in our view, these don’t outweigh the benefits.

Finding the optimal time to do it is tricky. A regular schedule is the key to finding the best time to shut down for maintenance. And the downtime is typically where we see the most pushback from executives and managers who aren’t thrilled with this process.

It will cause shutdowns. There’s no way around it. To perform maintenance on your equipment, the line must stop.

If it ain’t broke, don’t fix it. This is an old adage for a reason. You may be shutting down for your scheduled maintenance when no problems actually exist. The shutdown does come at a productivity cost, so… is it worth it? Some manufacturers solve this issue by performing predictive maintenance instead. It’s a more complex process that is data driven, and analyzes how your assets are performing in real time. All’s well? No shutdown. But if you find problems, that’s when you act. It reduces downtime, and you’re not replacing any parts while they’re still good to go. The downside of this approach is complexity and connectivity. If you don’t have state-of-the-art machinery, you won’t get the data analytics that this process requires. That’s why the majority of manufacturers today are using the preventive approach.

At USC Consulting, we’ve been helping manufacturing businesses increase their efficiency, production, throughput and profits for more than half a century. Get in touch today if you’d like to learn more about how preventive maintenance benefits can boost your bottom line.

They happen every year in California and throughout much of the Pacific Northwest: wildfires. According to the Interagency Fire Center, 8.2 million acres burned in 2018 in the U.S. overall. In the Golden State so far in 2019, land scorched nears 8,000 acres.

But wildfire season is slightly different this time around, in addition to displacing thousands of residents and businesses, the effects have also led to widespread power outages. Some of these have been scheduled by the state’s largest utility provider, Pacific Gas & Electric Corp., in order to ensure the safety of firefighters and emergency personnel battling the blazes.

However, patience has ceased to become a virtue for many of the state’s residents impacted, and the length of the outages is peeling back the curtain on what many people view as one of the country’s most pressing problems as it relates to infrastructure: the aging electrical grid. Because the vast majority of small-business owners and major corporations require power to provide, manufacture, or deliver products and services, the grid’s failings are forcing companies to evaluate their current processes and develop workarounds so service interruptions are minimized.

As veteran business owners can attest, it’s not if they’ll be affected by outages, but when and for how long.

Are blackouts happening more frequently?

If it seems like outages are occurring with greater regularity, it’s not your imagination. In 2017, the most recent year in which complete data is available, outages totaled 3,526 nationally, according to estimates from Eaton. These affected close to 37 million people — many of them business owners — and lasted close to an hour and a half per outage. They also occurred in all 50 states.

“For the ninth consecutive year, California experienced the highest number of power failures.”

For the ninth consecutive year, California experienced the highest number of power failures. And between 2008 and 2017, the total was close to 4,300, more than doubling the amount in Texas, which saw the second highest number at 1,603, Eaton reported. Furthermore, how much time passed before the lights came back on in the Golden State was considerably longer than the national average at 133 minutes.

Of course, outages are hardly isolated to the nation’s most-populated state. Several other states experience a greater number of them and for lengthier time periods than in years’ gone by. These included Alaska (138 minutes), the state with the lowest population density, Arizona (138 minutes), Wyoming (153 minutes), Vermont (172 minutes), and Montana (212 minutes).

Why are they occurring on a more regular basis?

Because so many variables play into the power supply and its reliability (e.g. weather-related events, source of electricity, car accidents that damage utility poles, etc.), it’s difficult to isolate their frequency to one issue. In general, however, the uptick is largely due to a lack of investment in fixing the grid as it presently exists and the growth in the country’s population. In other words, more properties are tapping into an already tapped out energy infrastructure.

As chronicled by the American Society of Civil Engineers, the U.S. at present has approximately 640,000 miles worth of high-voltage transmission lines. Most of these distribution lines were installed in the 1950s and 1960s. At that time, they weren’t expected to last more than 50 years. With it now being 2019, do the math. What’s more, in the contiguous U.S., power grids are operating at full capacity.

In short, wear and tear, accompanied by utility lines being stretched thin, has taken a toll.

“The government lacks an adequate federal energy policy.”

Additionally, investments in shoring up the grid have been insufficient. Some lines are owned by the federal government, which the ASCE notes lacks an adequate federal energy policy, while others are managed by investor-owned utilities. Specifically, they’re responsible for only 6% of electrical providers, yet serve close to 70% of customers.

Add in the surge in wildfire activity as well as other weather-related catastrophes — 17 of the last 25 Atlantic hurricane seasons have been above average in terms of activity, according to the National Oceanic Atmospheric Administration — something’s got to give. That something is the electricity.

These are among the reasons why major utility providers such as PG&E don’t expect blackouts to diminish anytime soon. At an October meeting held by the California Public Utilities Commission, PG&E CEO Bill Johnson noted it could be 10 years or more before they’re “really ratcheted down significantly,” NPR reported.

Although many households in California are still in the dark a month removed from the shutoff events, at least 2 million Californians were without power when the outages peaked in October.

What is the solution?

While there are many potential answers to the power problem, something everyone agrees on is there’s no quick fix. Some communities and municipalities, such as those in Wyoming, have decided to bury electrical lines so they’re underground, thus avoiding impact-related events that cause outages. This may help explain why Wyoming has averaged the fewest power outages between 2008 and 2017 (only 94). However, the problem with these is cost: three times more than traditional overhead, as noted by the Casper Star Tribune.

ASCE has a few suggestions, noting that any meaningful action must start at the top:

- Federal government must comprehensively assess where grid requires reinforcements and strategically invest in alternative energy sources such as biomass, hydroelectric, geothermal, and solar.

- Utilize remote sensing and inspection technologies to improve maintenance and real-time detection.

- Rebuild distribution lines so they’re more resistant to seasonal forces (wind, heavy snow, ice, etc.).

- Make it easier for utility providers to obtain permits they need to begin construction.

- Enact a national “storm hardening” plan that is guided by the recommendations of electrical engineers.

Restoring the nation’s power grid — as well as your own — will cost money, but doing nothing about it may cost more if outages continue to proliferate as expected. From 2003 to 2012, outages resulted in losses that averaged between $18 billion and $33 billion for the U.S. economy when adjusted for inflation, according to ASCE’s calculations. Even one lengthy outage can be devastating on productivity, never mind several.

At USC Consulting Group, we can power your processes so you can keep your business up and running so the lights don’t go out. We do this by analyzing how your company functions at present, set up asset maintenance best practices, and offer step-by-step solutions for where to fill gaps. The productivity improvements and supply chain optimization we recommend can help you work proactively so you’re always expecting the unexpected. Please contact us today.

The U.S. chemicals manufacturing space is poised for growth following years of middling performance. Worldwide economic development, improvements in the domestic manufacturing and oil and gas industries, and the completion of improved chemical production infrastructure are likely to drive historic gains over the next two years, researchers from the American Chemistry Council found. Production volumes are expected to increase 3.7 percent in 2018 and 3.9 percent in 2019, laying the groundwork for an industrial valuation of more than $1 trillion by 2022. How has the sector managed to regain ground in the marketplace? Increased production capacity linked to digitization.

Advanced hardware and software are transforming chemicals producers of all sizes, facilitating efficiency gains across virtually all operational areas, from the back office to the shop floor, according to the World Economic Forum. By 2025, digital technology will have generated a cumulative economic value of between $310 billion and $550 billion within the worldwide chemicals space. There are, of course, countless solutions and deployment methods specially designed for use within the chemicals manufacturing arena. However, innovations centered on asset management stand above the rest in terms of demonstrable operational impact.

Unpacking the asset management equation

Chemical companies live and die by the mission-critical machinery they use to craft their product. In the event of unexpected downtime, the entire operation grinds to a halt, customers orders go unfilled, and revenue drops. Losses can increase at an accelerated rate when this occurs. For example, the average automotive manufacturer loses an estimated $22,000 per minute of unplanned production stoppage, according to research from Advanced Technology Services and Nielsen. Only the largest companies can weather such losses. Small or midsize organizations might falter entirely under the weight of such astronomical downtime costs.

Chemicals manufacturers are at great risk for suffering such events due to the very nature of their work. These firms supply the market with more than 100,000 different chemical compounds, according to the WEF. The vast majority of these substances are extremely caustic and therefore wreak havoc on production assets, requiring major investments in maintenance. In the U.S., chemicals producers are expected to spend more than $1.26 billion on planned maintenance activities in 2018, constituting a year-over-year rise of more than 38 percent, analysts for the ACC found. Of course, this figure does not take into account unplanned work, which usually costs 2 to 5 times more than scheduled activities, according to the Marshall Institute.

Implementing an innovative solution

Rising costs and the continual existence of massive maintenance-related risk has forced businesses in the chemicals manufacturing arena to embrace bleeding-edge technology in hopes of streamlining asset management workflows and ultimately improving reliability. Many are turning toward predictive maintenance processes powered by connected equipment sensors and robust backend platforms, Schneider Electric reported. These all-encompassing solutions allow chemical companies of all sizes to closely monitor their production assets and catch small mechanical issues before they devolve into full-on catastrophes with the potential to cause downtime. Such products also give producers the power to continually fine-tune their machinery, embrace continuous improvement, and boost productivity.

Early adopters have seen serious results, promoting wider investment in the technologies that underpin such proactive asset management approaches. For instance, businesses across all sectors are expected to spend more than $239 billion on industrial sensor technology alone in 2018, researchers for the International Data Corporation have predicted. Firms in the chemicals manufacturing space are likely to contribute to this spend as they retrofit their production workflows to more effectively compete in an expanding marketplace. However, such technology is unlikely to remain optional for long. Almost 90 percent of chemical company executives believe businesses in the industry that fail to embrace digitization will end up falling behind, the WEF found.

Chemicals manufacturing firms standing on the outside looking in on this trend must act quickly to implement next-generation asset management processes and technology. USC Consulting Group can help. Here at USCCG, we’ve been working with businesses across numerous industries for 50 years, helping them adjust to marketplace transformations of all kinds. Connect with us today to learn more about our work and how our chemicals manufacturing consultants can help your enterprise embrace and benefit from digitization.

Let’s keep in touch – subscribe to our blog in the top right of this page or follow us on LinkedIn and Facebook.

Energy companies across the globe have been forced to change their operational approaches in response to an evolving energy marketplace. Crude oversaturation, along with the emergence of cost-effective alternative sources such as natural gas, has pushed per-gallon prices for gasoline and oil down considerably, according to research from the Energy Information Administration. Consequently, firms have found themselves engineering massive restructuring initiatives over the past two years, transforming their business verticals and on-the-ground workflows via mergers and acquisitions, all in an effort to remain prosperous in the low-price era, CNBC reported.

With this work completed, analysts expect more transactions to occur within the global energy space. However, this M&A activity will constitute the heart of portfolio consolidation programs aimed at catalyzing growth and bolstering production. How might this unfold?

Understanding the M&A environment

Many large oil and gas producers with balanced budgets are looking to increase efficiency at scale through tactical moves that allow them to net more acreage in high-yielding territory. At the same time, smaller organizations with considerable experience and drilling inventory seek to scale up through acquisition. This environment gives oil and gas giants such as Exxon Mobil the opportunity to acquire valuable assets located in prime drilling territory that requires little to no investment. RSP Permian, an independent driller based in Dallas, Texas, is an exemplary target for bigger producers hoping to consolidate through targeted M&A activity, according to Forbes contributor and energy journalist Claire Poole. The firm controls more than 500,000 acres of territory in the oil-rich Permian Basin, making the small yet well-established company an ideal acquisition for large organizations focused on solidifying their core operations.

Of course, RSP Permian is not the only viable asset on the market. A handful of other hardy entities are available for purchase. As a result, a significant number of transactions are likely to occur over the next seven months. By year end, the upstream transaction total may eclipse the $64 billion recorded in 2017, according to analysts at the oil and gas research firm 1Derrick.

Grasping the production impact

How will increased M&A activity affect production? Last year’s figures suggest improvement. Even as oil and gas companies swapped assets in 2017, crude production moved upward, especially in the U.S. market where companies exported record amounts of crude oil and petroleum products, the EIA reported. In short, a repeat performance is to be expected during this year of consolidation through M&A.

Oil and gas enterprises navigating this transaction-heavy territory should consider connecting with the industry experts at USC Consulting Group. With 50 years of experience, our consultants can help energy producers on both sides of the M&A equation achieve ideal outcomes. Not only will USC help streamline the M&A process, but they can help improve overall production and process efficiency focusing on areas such as asset performance management, predictive and preventative maintenance, throughput, reliability and sustainability, and inventory control. Contact us today to learn more.

The American manufacturing space has experienced considerable improvement in recent years. Producers have embraced data-driven processes and procedures designed to boost productivity and keep overhead costs down. The industry contributed approximately $2.2 trillion to the U.S. gross domestic product in 2016, capping off four consecutive years of annual value-added figures above the $2 trillion mark, according to the Bureau of Economic Analysis. But this success is not a symptom of scale. More than 98 percent of U.S. manufacturing firms have fewer than 500 workers, according to the National Association of Manufacturers. More astonishingly, 3 out of 4 firms employ fewer than 20 workers.

How do American manufacturers account for more than 10 percent of the national GDP with such small staff rosters at their disposal? Operational optimization through continuous improvement. Almost 70 percent of domestic producers utilize lean manufacturing strategies to facilitate such an approach, Reliable Plant reported. These methodologies center on the collection and evaluation of key performance indicators, critical quality metrics that lend operational leaders insight into mission-critical workflows, giving them the power to spot deficiencies and make changes as quickly as possible. Only with this data can firms successfully navigate the modern marketplace where responsiveness reigns supreme.

There are numerous shop floor functions suitable for performance measurement programs. However, industry innovators and researchers have pinpointed several operational avenues that can provide data capable of driving continuous change and bolstering the bottom line. Here are some of the KPIs associated with these shop floor hotspots:

1. Total downtime

Downtime is a manufacturer’s greatest enemy. When mission-critical assets stop functioning because of mechanical issues, producers often lose hundreds of thousands of dollars. For example, automakers lose an average of $22,000 per minute of downtime, according to research from Advanced Technology Services. A large number of modern manufacturers can’t survive such losses as most are already operating on razor-thin profit margins. This state of affairs makes the total downtime KPI an essential metric of quality. Gathering this data is relatively easy, but tracking it and exploring the operational variables behind it can have an immense impact.

Most producers pair this macro measurement with finer KPIs, such as overall equipment effectiveness (OEE) or changeover time, to form a more robust downtime picture.

2. Takt time

This versatile KPI – the amount of time it takes to complete a given task – works in numerous operational contexts. According to Food Manufacturing, plant supervisors can leverage takt time to track the entire product creation process and monitor the smaller functions that make up this total workflow. This allows for increased visibility and gives producers the power to institute minor tweaks in piecemeal to get the most out of their shop floors. Takt time is also one of the few KPIs that relates directly to the customer. These readings can show businesses where they stand in relation to customer demands centered on timeliness, even reveal upgrades that could quicken production processes and more effectively meet the needs of modern buyers.

On the surface this KPI may seem basic, but its versatility and connection to the customer experience make it an essential metric for even the most advanced manufacturers. Again, there are other KPIs that work well with takt time, including estimated time to completion and piece variance. These measurements relate directly to customer satisfaction and can therefore yield useable insights with transformative power.

3. First pass yield

The days of the single-use production line are over. To compete in today’s marketplace, manufacturers must be prepared to reconfigure their operations to meet changing volume demands or roll out new products altogether. This state of affairs makes first pass yield an essential KPI for modern producers. This metric measures the effectiveness of a given workflow during its initial run. Quality assurance personnel calculate the first pass yield by dividing the number of completed units requiring no rework by the number of total products produced. Using this figure, shop floor stakeholders can assess the overall efficacy of a new process and make changes to improve its productivity.

In the past, this KPI may have been something manufacturing leaders used only occasionally. But times have changed. With customer demands shifting so frequently, manufacturers must be ready to reorganize their processes and measure their effectiveness after reorganization. The first pass yield KPI makes this possible.

4. Mean time between failures

Manufacturers are only as reliable as the production equipment they have on the shop floor. This is why many organizations adopt preventive maintenance strategies with cutting-edge technology at their centers. More than 40 percent of manufacturers currently subscribe to this approach, while another 30 percent have gone one step further and embraced predictive maintenance, according to recent research from Plant Services. A majority of these maintenance-minded firms rely on the KPI mean time between failures (MTBF), which is the length of time a repairable asset will function properly after experiencing a major mechanical problem and before doing so again. This KPI gives maintenance teams a base line off of which they can schedule preventive activities.

Mean time between failures and related metrics, such as mean time to failure (MTTF) and mean time to repair (MTTR), help manufacturers evaluate overall asset reliability. With this information in hand, operational stakeholders can make incremental improvements to plant efficiency and productivity.

Manufacturing businesses looking to carve out space in today’s marketplace must focus on continually improving their workflows, as processes, not manpower, lay the groundwork for success. These KPIs give such enterprises the power to dive deeply into their operations and pinpoint deficiencies big and small that could be holding them back. Here at USC Consulting Group, we have been working with manufacturers for decades, connecting them with experts who can craft customized operational improvement plans designed to stimulate growth. Contact us today to learn more about our work in the space and how our in-house consultants can help your firm reach new heights.

The Trump administration recently published its 2019 budget proposal, which includes deep spending cuts totaling hundreds of billions of dollars. The budget request also calls for the elimination of several federal oversight bodies, including the U.S. Chemical Safety Board, according to Bloomberg. Created in 1990 as part of the Clean Air Act, the independent watchdog leverages $11 million in annual funding to investigate industrial incidents stemming from the mismanagement of caustic chemicals. While the elimination of the CSB seems, on the surface, an ideal development for industrial organizations, some industry leaders and workplace safety experts have expressed skepticism.

Modern manufacturers are deeply invested in protecting their employees, and support the work of bodies such as the CSB as they establish new workplace safety paradigms centered on innovative strategies and technology. Current CSB Chairperson Vanessa Allen Sutherland has received praise from industry leaders for streamlining the agency’s investigation workflows and collaborating more effectively with businesses. Despite these positive developments, however, the agency has been put on the chopping block as part of a wider push for government deregulation.

How would the abolition of the CSB impact firms developing new safety and reliability programs?

Addressing chemicals in the workplace

Chemical compounds are among the most serious safety hazards found within industrial work environments, according to the National Safety Council. Manufacturers and other businesses leverage hundreds of different substances in everyday workflows and produce significant amounts of equally dangerous chemical residue. Workers who encounter these materials can suffer serious or sometimes fatal injuries. In fact, approximately 268 American employees died in 2016 because of such exposure events, according to research from the Occupational Safety and Health Administration. Firms in the industrial space are well aware of the dangers that their workers face, which drives them to develop safety and reliability programs that prevent injuries.

Oversight bodies like OSHA and the CSB are heavily involved in these efforts, working with industry stakeholders to create enforceable policies that keep employees safe, even as they encounter risk while performing everyday duties. In 2016, the CSB conducted seven major investigations, including an inquiry into the 2013 explosion at the West Fertilizer Company plant in West, Texas, that killed 15 workers and injured more than 260 others. Through these investigations, the CSB developed best practice recommendations so industrial businesses do not repeat the errors of their less fortunate peers. OSHA adds another dimension by approaching the subject of chemical management from the position of the worker and formulating safety standards that keep employees safe. While businesses in the industrial space have traditionally butted heads with OSHA, they have had a productive relationship with the CSB, which many leaders credit for revolutionizing chemical handling practices here and abroad. Its investigations have resulted in the creation of new guidelines that not only keep workers safe but also reduce costs associated with employee injury.

Considering operations after CSB

If Congress embraces the Trump administration’s budget and authorizes the elimination of the CSB, then industrial organizations would have to seek out new external partners and refocus their efforts in order to ensure vigilance in an environment with little federal oversight. The critical insight the agency once provided would be gone, increasing the likelihood of catastrophic events caused by small operational lapses. The West fertilizer plant resulted in more than $230 million in damages to the local community. Without the CSB, another similar situation may develop.

USC Consulting Group can help chemical manufacturers with operating efficiency by developing effective safety and reliability programs for addressing chemical usage in the workplace. Furthermore, our consultants can establish asset performance management programs to ensure facilities are properly maintained with scheduled maintenance and well-planned outages, resulting in their employees staying safe from avoidable mishaps.

Is your organization considering how it might operate in a world without the U.S. Chemical Safety Board? Connect with USC Consulting Group today to learn more on how to improve safety in the workplace.

Truly innovative asset management covers all aspects of monitoring, analyzing, and maintaining capital equipment. Does your business have all its bases covered?

Now recovering from economic instability over the last decade, companies in asset-intensive industries have begun to invest in new and recommissioned equipment. In turn, these decisions ignite a fervent interest in improving uptime quality through optimized workflows, reliability-centered maintenance, and proactive decision-making.

Download our latest e-book “Asset Management: The Rise of Reliability” to discover asset management best practices from our team of experienced operational experts. Here are the seven points examined and discussed therein.

1. Work management

A work order is more than just a slip of paper. Its life cycle extends further than most businesses realize and should include information valuable to future successes in asset management.

2. Downtime tracking

If you fail to understand the nuance of downtime tracking, you will fail to sustainably decrease it.

3. Preventive and predictive maintenance

Reward awaits those facilities that understand what these two cutting-edge maintenance methodologies entail and how to execute on them properly to achieve new heights.

4. Asset criticality review

Are you allocating your resources to the machinery that matters most to your business? Align your goals with your actual asset management processes with a comprehensive ACR.

5. Equipment history capture and analysis

Those who ignore history are doomed to repeat it. Do you know what sorts of data you should capture about your assets today in order to make informed decisions tomorrow?

6. Root cause failure analysis

Assets fail for any number of reasons, but they boil down to three basic types of failure. Learn these as well as tips for digging below the surface when failures strike.

7. Operator equipment care

Line operators can work wonders for an innovative asset management program – if only their leaders know how best to utilize them.