-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Mining

Mining companies are embracing operational excellence to remain competitive, profitable, and sustainable in a challenging and rapidly evolving industry.

Operational Excellence is the cultural and process foundation that enables mining companies to unlock real value. Companies that operate without a strong Operational Excellence mindset often struggle with performance improvement, change adoption and sustainability.

Largely driven by efforts to improve safety, increase operational efficiency, reduce downtime, improve cost performance, meet sustainability goals, and manage operational risks, many companies already have or are deploying an Operational Excellence framework of practices, tools, and behaviors. It combines process discipline with people engagement and data-driven decision-making.

The benefits of Operational Excellence

Mining companies that embrace Operational Excellence are realizing a range of measurable, quantifiable benefits across safety, cost, productivity, and ESG metrics. These gains often begin within months and scale significantly with sustained execution and digital integration.

There are many real-world examples of how mining companies are applying Operational Excellence in their operations and linking with the use of today’s developing technologies:

- When addressing equipment reliability issues, BHP deployed predictive analytics across its mobile equipment fleet, and reduced unplanned maintenance by up to 25%, thus improving asset availability, and saving millions in downtime.

- Rio Tinto leveraged bottle-neck analysis, short interval controls and Lean Six Sigma practices to address process optimization issues and used digital twins at its processing plants to optimize throughput and reduce energy use, while boosting recovery rates by 2–5%.

- After analyzing fleet performance and dispatch efficiency issues with continuous improvement kaizens and visual management/KPI dashboards, Newmont leveraged an integrated Operational Excellence dispatch system using AI that improved truck utilization and increased daily production by 7–10% at certain sites.

- An asset of Teck Resources used Operations Excellence processes and tools to better understand energy use through waste identification, energy audits and cross-functional teams to deploy AI-driven energy optimization, cut energy consumption by 9%, which contributed to both cost savings and ESG targets.

As with any performance change, organizations will vary focus as they mature. Early-stage Operations Excellence organizations focus on fixing the basics — stabilizing performance and embedding a management rhythm; while mature Operations Excellence organizations deliver strategic advantage — agile, data-driven, low-cost, and high-performing operations.

The bottom-line, Operational Excellence is the cultural and process foundation that enables mining companies to unlock real value. Companies that digitize without a strong Operational Excellence mindset often struggle with adoption and sustainability.

How to accelerate Operational Excellence maturity

USC Consulting Group is an operations management consulting firm that partners with organizations and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence maturity.

USC brings a tailored, structured, and disciplined methodology, along with a range of tools and techniques we apply collaboratively with our client’s personnel. We work with our clients to find full operating potential and unlock the hidden value through Operational Excellence.

We identify waste, redundancies, and ineffective processes, and then rapidly recover the prioritized opportunities, and convert them to improvements in performance and operating profit. Further, our people embed with client teams to develop, enhance, prototype, validate and implement operational excellence strategies to drive, sustain and perpetuate improvements in mining operations, while changing how plans, schedules, and work is executed.

In short, USC implements measurable, sustainable changes that drive operational performance and financial improvements.

USC clients experience measurable operational and financial results that significantly improve both the efficiency and profitability of their operations such as:

- Enhanced Safety Performance (10–40% reduction in injury rates)

- Increased Production Throughput (5–15% increase in ore mined or tonnes processed per day, reductions in production losses, downtime, delays, and rework)

- Higher Recovery and Yield (2–5% increase in mineral recovery through process optimization)

- Improved Equipment Reliability & Availability (10–25% reduction in unplanned downtime; 5–15% increase in OEE)

- Lower Operating Costs (8–20% reduction in cost per tonne; reductions in overtime, fuel usage, maintenance, and material waste)

- Reduced Variability (Up to 50% reduction in cycle time variance in drilling, hauling, and milling)

.

USC Helps You Tackle Key Challenges

- Optimize production strategies and increase mine throughput and mill recovery

- Predict asset integrity and reliability needs and improve time on tools and equipment availability

- Improve integrated mine planning across all time horizons to strategically & tactically impact performance

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcome cultural and organizational communication issues, while ensuring quality expectations

Do you want to understand how prepared your company is to build a performance focused culture that drives sustainable results based on an Operational Excellence foundation?

Want to find out more about how USC can help you unlock the hidden value lurking in your mining operations? Contact us today.

Over the next five years, mining and metals companies are expected to spend between $25 billion to $30 billion annually to maintain their assets.

Largely driven by efforts to improve operational efficiency, reduce downtime, immediately reduce costs, meet sustainability goals, and manage operational risks in an increasingly volatile market, mining and metals executives are motivated to start their asset management transformation now. Delaying this transformation could result in lost competitive advantages, higher operational costs, and increased regulatory or market pressures.

Over the next five years, the mining and metals industry is projected to invest heavily in the maintenance of fixed and mobile assets. Various reports indicate that the industry is expected to allocate a significant portion of its CAPEX to maintaining and upgrading its assets. A substantial part of this investment will be directed toward maintaining critical assets required to meet global demand for minerals essential for the energy transition. In a recent survey conducted by Global Data, 48% of the companies surveyed indicated they plan to increase investments in technologies like AI and IoT sensors for equipment upkeep over the next two years.

Investment in predictive maintenance is becoming a top priority for many mining operations. Companies are leveraging their EAM’s with advancing technologies like Digital Twins, AI and IoT, along with other reliability and planning applications, and significantly transforming asset management and the asset lifecycle. These advancements in technology are expected to reduce maintenance costs by 20-30%.

Mining and metals companies integrating Enterprise Asset Management (EAM), Computerized Maintenance Management Systems (CMMS), AI, and IoT are experiencing several quantifiable benefits, including:

- Improved Asset Reliability and Uptime: Utilizing a combination of AI, IoT sensors and Digital Twins provides continuous real-time monitoring of equipment health allowing companies to predict potential failures before they occur while reducing the reliance on reactive and scheduled maintenance – reducing unplanned downtime and fewer equipment breakdowns, increasing equipment availability and extending asset lifecycles.

- Cost Reduction: A predictive maintenance capability helps avoid costly emergency repairs and reduces unnecessary scheduled maintenance, saving on labor and spare parts. It also ensures that the right parts are available when needed, minimizing overstock and understock issues, which helps reduce capital expenditure tied to inventory. It optimizes the energy usage of equipment by adjusting operational parameters in real-time, leading to lower energy consumption.

- Scalability and Flexibility: Leveraging these technologies together, allows companies to scale their asset management strategies as they grow, adapting to changes in operational needs without significant disruptions. Maintenance scheduling based on asset condition rather than time-based intervals, ensures that resources are used effectively, reducing downtime and improving workflow efficiency. They provide a holistic view of all assets, enabling better coordination between teams while improving “wrench-time” productivity and the execution of maintenance and operational tasks. It delivers a single platform to access real-time data across the entire asset portfolio, improving visibility and control over operations for optimizing performance and recommendations for future operations.

USC partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence

USC brings a tailored, structured, and disciplined methodology, along with a range of tools and techniques we apply collaboratively with client’s personnel. Whatever your challenge, we are the people who work with our clients to find full potential and unlock the hidden value.

USC help to identify waste, redundancies, and ineffective processes, and then rapidly recover the prioritized opportunities, and convert them to improvements in performance and operating profit. Further, our people embed with client teams to develop, enhance, prototype, validate and implement asset management strategies to drive, sustain and perpetuate improvements in asset lifecycles and equipment reliability, while changing how plans, schedules, and work is executed. In short, USC implements measurable, sustainable changes that drive asset performance and financial improvements.

- Increased Wrench Time (up to 25% improvement) – Reducing non-productive time through improved work-order generation and prioritization, maintenance teams spend less time searching for work-orders, tracking down parts or waiting for approvals.

- Reduction in Travel & Downtime (up to 20% time savings) – Optimizing the routing and scheduling of maintenance tasks and reducing travel time between jobs to maximize “time on tools”.

- Faster Work-order Completion (up to 30% efficiency gains) – Reducing delays in task assignment, approval and completion tracking, technicians can move quickly from one job to the next by ensuring all the necessary tools and parts are available at the work site, eliminating delays caused by missing resources.

- Optimized Spare Parts Management (up to 15% time reduction) – Faster access to parts and accurate spare part forecasting reduce time on sourcing, stocking and searching while ensuring tools & parts are available for tasks.

- Better Data-Driven Decision Making (up to 20% longer asset life spans) – Collecting and analyzing needed information provides actionable insights that support planning and allow for more informed and pro-active decision making, often delaying the need for capital-intensive replacements.

USC clients experience measurable operational and financial results that significantly improve both the efficiency and profitability of their operations. Benefits delivered may include a 10-20% increase in overall equipment availability due to reduced unplanned downtime and optimized maintenance schedules and a 10-15% improvement in equipment utilization as predictive maintenance reduces the time equipment is out of service.

USC Helps You Tackle Key Challenges

- Optimize maintenance strategies and increase equipment availability operational output

- Predict asset integrity and reliability needs and improve time on tools

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcoming cultural and communication issues with contractors, while ensuring quality expectations

Do you want to understand how prepared your company is to drive needed asset management performance and reliability improvements and what the key focus areas that will contribute to lower operating costs? Contact us today.

It is commonly believed that the project stakeholders have delivered their project commitments once the asset had been successfully commissioned.

Given the fact that recent studies show that 65-80% of large capital projects in the mining and metals industry frequently experience performance issues and fail to meet their budgets and/or schedules, it’s no wonder why executives and owner teams are distracted from envisaging the outcomes beyond the commissioning phase. The stark reality is that a project can only be regarded as a success once the asset sustainably reaches name plate production within the projected timeframe.

Senior leadership needs to focus more on the strategic business case and outcomes of the project and enable the acceleration of operational and organizational maturity growth beyond ramp-up. By focusing on “culture and systems of work by design” earlier in the project development cycle, prior to or during the detailed engineering phase, companies can experience a positive impact on Net Present Value (NPV) while positioning the future operational organization to enhance organizational capabilities and drive maturity growth.

Establishing the needed operational foundation that enables data-driven decision making, operational excellence and continuous improvement during capital project execution and post operational ramp-up, creates a culture that fosters long-term growth, resilience and scalability across the asset. Furthermore, the early investment in designing the “systems of working” with the supporting management operating systems, while integrating with today’s advancements in AI, automation, Digital Twins, EAM, ERP, IoT, robotics and other technologies positions the asset to emerge from the capital project at a much higher maturity stage and set of organizational capabilities. By leveraging the insights and efficiencies these systems and tools provide, mining and metals companies can not only optimize their immediate operations but also position themselves for sustained success in a rapidly evolving industry.

Yes, integrating management operating systems with AI, IoT and other enterprise platforms during capital project execution can have a positive impact on NPV and cash flow. “Systems of Working” help streamline project execution, reduce delays, and improve project scheduling, allowing the company to start generating revenue earlier than expected. Additionally, avoiding project delays reduces the discounting effect on future cash flows. These same systems can help identify and mitigate risks such as supply chain disruptions, equipment failures, and market fluctuations. By reducing these risks, companies can avoid unforeseen costs and improve project reliability.

Systems of working provide the project and operating teams the ability to improve operational efficiency by optimizing resource allocation, reducing downtime, and minimizing waste. Additionally, predictive maintenance supported by enabling technologies, process automation, and enhanced supply chain management can lower equipment failure rates, energy consumption, and labor costs, while helping owners to significantly reduce both capital and operational expenditures. Creating a “Culture by Design” with the supporting “Systems of Work” early in your capital project will directly impact the key drivers of NPV by improving operational efficiency, reducing costs, accelerating revenue generation, and lowering risks.

USC partners with your organization to accelerate Operational Maturity by helping your team create a Culture by Design supported by the needed Systems of Working

Since 1968, USC Consulting Group has been working with clients to address the challenges and avoid the pitfalls when creating cultural change and developing systems of working. While the integration of AI, IoT, MOS, EAM and ERP offers tremendous potential in capital project execution in the mining and metals industry, companies must carefully navigate the challenges. Addressing high costs, technical complexity, workforce readiness, and data management are key to overcoming hurdles. Strategic planning, phased implementation, and ongoing system monitoring are critical to successful integration and maximizing financial and operational benefits.

Mining and metals projects often vary in size, complexity, and location, which means the systems of working need to be scalable and adaptable to different environments. Inflexible systems may struggle to scale up or adapt to specific project needs, leading to inefficiencies and higher costs. Our seasoned consultants help the owner team to ensure compatibility with the project environment and to overcome scalability challenges.

The integration of AI, IoT, MOS, EAM and ERP introduces additional layers of complexity in project management, as these systems require continuous monitoring, optimization, and alignment with project objectives. Mismanagement of complex systems may lead to delays, cost overruns, and reduced system effectiveness. USC Consulting Group understands how your project and operating teams can best utilize the needed information while addressing the unique challenges of the mining and metals sector to ensure smoother execution and in-shift adjustments.

Employees and management may resist the changes required to implement these new systems of working, especially if they fear job displacement or lack understanding of the new ways of working. Cultural resistance can slow down or even derail the integration process, leading to project delays and inefficiencies. Our people bring effective change management strategies, including clear communication, training, and involving employees in the transition, that ease resistance.

Misalignment between project stakeholders can cause challenges. Lack of collaboration between the various teams can result in inefficiencies, process failures, or unmet project and/or operational goals. Ensuring early and continuous collaboration between project stakeholders and operational teams helps bridge the gap while ensuring a successful project completion and production ramp-up.

While the long-term benefits of integrating and implementing systems of working are substantial, measuring these benefits and calculating NPV and ROI can be complex, especially when the results are not immediately visible. Stakeholders may become skeptical if they don’t see immediate financial returns, leading to reduced support for continued investments. USC works with the owner’s team to establish clear KPIs and benchmarks for performance improvements, measure progress and demonstrate long-term value.

USC Helps You Tackle Key Challenges

- Align project and operational stakeholders on the strategic business case and operational outcomes

- Develop a high reliability culture focused on breaking down silos and executing work in a safe manner

- Ensure the right resources are at the right place to minimize lost time – enabling safe and disciplined execution

- Control quality of work at the point of execution by identifying off specification and enabling in-shift correction

- Identify potential roadblocks proactively during mine planning and solve complexity during the planning process

Do you want to understand how creating a Culture by Design can accelerate the future asset to achieve the strategic business case and nameplate performance targets safely?

Want to find out more about how USC can help you uncover the hidden value loitering in your capital projects? Contact us today.

By integrating their Management Operating Systems (MOS) with AI and IoT, mining and metals companies can significantly enhance their operational capabilities, leading to better asset management, increased productivity, and ultimately, improved financial performance.

Utilizing IoT devices, such as sensors and connected equipment, to continuously collect data on various aspects of their operations, including equipment performance, environmental conditions, and production metrics, this real-time data is fed into the MOS, providing a comprehensive and up-to-date view of operations. The collected data is then analyzed by AI algorithms within the MOS to generate insights, identify patterns, and predict outcomes, allowing for proactive management of assets and operations, such as predicting equipment failures or optimizing production schedules.

A key aspect of any MOS is to assist management in decision making. Integrating AI with MOS enables real-time decision support, where AI provides recommendations or automates decision-making processes based on the analysis of IoT data. This helps managers make more informed decisions quickly, improving responsiveness to changing conditions. Additionally, AI allows the MOS to simulate different operational scenarios and predict their outcomes. This capability helps managers evaluate the potential impact of different decisions before implementing them, reducing risks and optimizing outcomes.

By focusing on operational efficiency, AI models integrated into the MOS can optimize processes in real-time by adjusting operational parameters based on current conditions and historical data, leading to improvements in ore and metal recovery, energy efficiency, and overall productivity. AI can also be used to analyze data on resource usage and availability, helping the MOS to optimize the allocation of resources such as labor, equipment, and materials, leading to cost savings and improved operational efficiency.

When approaching enterprise asset management and predictive maintenance models, integrating AI and IoT with the MOS, companies can enhance their predictive maintenance capabilities. AI algorithms analyze sensor data from IoT devices to predict when maintenance is needed, helping to prevent unexpected equipment failures and reduce downtime. This assists the MOS to automatically schedule maintenance activities based on AI predictions, ensuring that maintenance is performed only when necessary and that it is coordinated with other operational activities.

The use IoT and AI integration helps the MOS to optimize inventory levels by predicting demand for spare parts and materials based on operational data, thus reducing inventory costs and ensuring that critical components are available when needed. By having AI analyze data across the supply chain, assisting the MOS to optimize logistics, reduce lead times, and minimize costs associated with the procurement and transportation of materials.

Integrating Management Operating Systems with AI and IoT in the mining and metals industry offers substantial benefits, but it also comes with several challenges and potential pitfalls.

USC partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence

For more than 55 years, USC has been working with clients to address the challenges and avoid the pitfalls when developing, enhancing and deploying their management operating systems.

As technology enablers, like AI and IoT, are deployed, we help clients to address the challenges through careful planning and a strong focus on change management, including employee involvement. By proactively identifying and mitigating the pitfalls, mining and metal companies can successfully integrate AI and IoT with their MOS, unlocking the full potential of these technologies for improved asset management and operational efficiency.

Integrating AI and IoT into MOS often requires close coordination across different departments, such as IT, operations, and maintenance. Misalignment or lack of communication between these departments can lead to project delays and failures. The complexity of integrating AI and IoT, projects can often experience timeline and budget overruns. Effective project management is critical to keep the implementation on track and within budget.

Mining and metal operations often have data scattered across different systems and departments. Integrating this data into a unified MOS that can effectively leverage AI and IoT is challenging, particularly if the data is stored in incompatible formats or is not standardized. AI systems require high-quality, accurate data to function effectively. Inconsistent, incomplete, or inaccurate data can lead to poor AI performance, resulting in unreliable predictions or insights. Ensuring that data from IoT devices is processed in real-time is crucial for effective AI-driven decision-making. However, high latency in data transmission or processing can lead to delays, reducing the effectiveness of AI in making timely decisions.

Many companies often face a skills gap when it comes to AI, IoT, and data analytics. There may be a shortage of in-house expertise required to manage and maintain these advanced technologies effectively, so having a partner can assist in compressing the time it normally takes cleanse data and align MOS processes. Employees accustomed to traditional methods may resist adopting new technologies, especially if they perceive AI and IoT as threatening their jobs or making their roles redundant. Effective change management and training programs are essential to address this issue.

Companies that have integrated their Management Operating Systems with AI and IoT are experiencing several quantifiable benefits across various aspects of their operations. These benefits are often measurable in terms of improved safety (30-50% reduction in safety incidents), cost savings (10-40% reduction in maintenance costs), and an increased productivity (5-15% increase in productivity and 10-20% improvement in operating efficiency), just to name a few. By leveraging these technologies effectively, mining and metal companies can achieve substantial improvements across their entire value chain.

USC helps you tackle key challenges

- Ensure the right resources are at the right place to minimize lost time – enabling safe and disciplined execution

- Optimize mine planning and scheduling across all planning horizons – delivering detailed and accurate plans

- Identify potential roadblocks proactively during mine planning and solve complexity during the planning process

- Control quality of work at the point of execution by identifying off specification and enabling in-shift correction

- Enhance your ability to cluster & centralize scarce human expertise, allowing all sites to benefit from their expertise

Do you want to understand how a MOS can integrate your mine and operational planning, while helping you to safely increase performance site wide? Contact us today.

A robust MOS is vital for mining and metal companies to navigate the challenges of today’s market.

Management operating systems (MOS) are making significant impacts to performance goals and outcomes for mining and metals companies by providing a structured and systematic approach to managing the business across the value chain. Companies have a strong need for robust MOS in today’s market to ensure safety and compliance, improve efficiency, and achieve sustainable growth, given the safety of workers is a top priority across the mining industry; the global demand for minerals and resources is rising, leading to increased competition; mining operations are inherently complex; the industry is facing significant cost pressures from fluctuating commodity prices and rising operational costs; and the adoption of new technologies requires an integrated approach to managing operations.

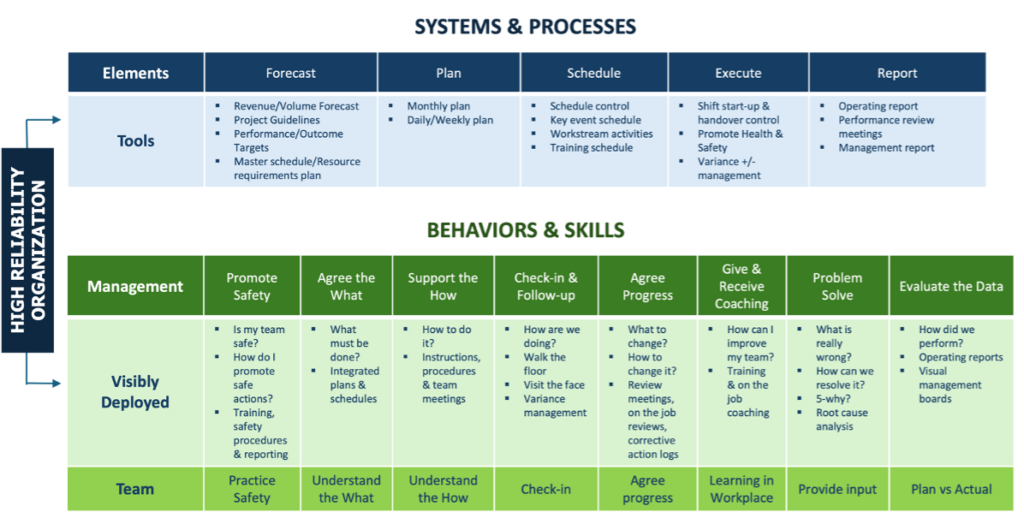

Performance is improved by providing a structured framework for planning, monitoring, and controlling operations. MOS can help through:

- Safety and Compliance – ensuring that safety protocols and regulatory compliance are integrated into daily operations, while minimizing the risk of accidents and legal issues, promoting a safer working environment.

- Enhanced Planning and Scheduling – creating detailed and realistic operational plans and schedules, ensuring that resources are allocated efficiently and that production targets are met without unnecessary delays. Potential bottlenecks can be identified and addressed during the planning process – “Planned work is safer and more productive than unplanned work.”

- Real-Time Monitoring and Control – tracking operations in real time, allowing for quick in identification and in-shift resolution of issues, while reducing downtime and safeguarding that operations run smoothly.

- Improved Communication and Coordination – standardizing processes and providing clear protocols, MOS enhances communication and coordination among different departments and teams, leading to more cohesive and efficient operations.

- Data-Driven Decision Making – providing and analyzing comprehensive data on various aspects of the operations to identify trends, inefficiencies, and opportunities for improvement and leading to more informed decision-making.

- Cost Control and Efficiency – optimizing resource use and reducing waste, while aiding in cost control and improving operational efficiency.

Supporting mining and metal companies to stay competitive and adapt to changing market conditions, MOS fosters a culture of continuous improvement by regularly reviewing processes, identifying areas for improvement, and implementing changes.

MOS in mining and metal operations are significantly enhanced by today’s technological advancements. By leveraging these advancements, MOS becomes more robust, responsive, and efficient. This not only enhances operational performance but also ensures better safety, sustainability, and profitability.

USC partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence

USC brings a tailored, structured, and disciplined methodology, along with a range of tools and techniques we apply collaboratively with client’s personnel. Whatever your challenge, we are the people who work with our clients to find full potential and unlock the hidden value.

USC identifies waste, redundancies, and ineffective processes, and then rapidly recover the prioritized opportunities, and convert them to improvements in performance and operating profit. Our consultants achieve this by improving the skills sets of all levels of the client’s management and employees.

Our people embed with client internal teams to develop, enhance, prototype, validate and implement management operating system (MOS) element improvements to drive, sustain and perpetuate change in how the business budgets, plans, schedules, assigns work, executes, follow-up, reports, analyzes and improves. In short, USC implements measurable, sustainable changes that drive operational and financial improvements.

Our Management Operating System (MOS) Essentials Framework is designed to be pragmatic rather than conceptual – thereby leading to accurate, practical decisions about your operations and outcome aspirations. The key, that many miss, is the linkage process execution with management behaviors. MOS is about “managing differently” using visibly deployed management and supervisory behaviors. Consistent execution of the right behaviors at the right time creates certainty in the workplace, driving performance improvement and sustainable new ways of working.

Client performance goals and outcomes are realized through:

- Integrated safety protocols and compliance requirements into daily operations., leading to a safer work environment and fewer accidents.

- Reduced operational costs, including minimized waste, optimized equipment usage, and reduced energy consumption.

- Optimized workflows and resource allocation, leading to increased efficiency and higher production rates.

- Effective maintenance planning and real-time equipment monitoring, MOS reduces unexpected breakdowns and downtime.

- Alignment of daily operations with strategic objectives, ensuring that all activities contribute to the company’s long-term goals.

- A culture of transparency by providing clear performance metrics and regular reporting while driving better performance and tracking progress towards goals.

USC Helps You Tackle Key Challenges

- Optimize mine planning and scheduling across all planning horizons – delivering detailed and accurate plans

- Identify potential roadblocks proactively during mine planning and solve complexity during the planning process

- Ensure the right resources are at the right place to minimize lost time – enabling safe and disciplined execution

- Control quality of work at the point of execution by identifying off specification and enabling in-shift correction

- Evaluate performance and identify opportunities for improvement, enabling continuous improvement mindset

Do you want to understand how a MOS can integrate you mine and operational planning, while helping you to safely increase performance site wide?

Want to find out more about how USC can help you uncover the hidden value loitering in your operations?

For more information, let’s talk it through with a no obligation meeting with one of our executive team members. Email info@usccg.com to arrange a call.

Effective risk management, strategic planning, and operational excellence are crucial for minimizing NPV losses and maximizing project value.

Recent studies and industry reports suggest that a significant portion of mining projects may face challenges that impact net present value (NPV) negatively. Estimates range from 20% to 60% or more, highlighting the inherent risks and complexities involved in the mining industry. These challenges may include cost overruns, schedule delays, geological uncertainties, regulatory changes, and market fluctuations, among others.

In fact, in other reports, McKinsey says as many as 4 out of 5 mining projects come in late and over budget by an average of 43%. EY found that 64% ran over budget or schedule with the average cost overrun sitting at 39%, after studying 192 global mining and metals projects worth more than $1 billion.

How can mining projects improve project execution when it comes to budgets and timelines? Mining companies must grapple with many pain points – cost overruns, schedule delays, operational risks, supply chain disruptions, and geopolitical uncertainty.

One of the most critical areas involves owner-contractor relationships and creating a “culture by design” right from the beginning. Many owners outsource their projects to EPCMs that have historically operated in mining and are typically very engineering focused on getting the design as accurate as possible to maximize outcomes and benefits. While important, it only represents 35% or 40% of the total cost of a typical project and that’s not where we tend to see issues. The other 60%-65% of the scope is construction.

Organizational culture can significantly impact projects in several ways:

- Risk Management: prioritizing safety, compliance, and responsible resource management can lead to better risk identification and mitigation strategies, reducing the likelihood of costly incidents and delays.

- Employee Engagement: creating a positive and supportive culture to foster employee engagement, morale, and retention, leading to higher productivity, better teamwork, and lower turnover rates, which are critical for project success.

- Decision-Making Processes: promoting transparency, collaboration, and innovation can lead to more efficient decision-making processes, enabling quicker responses to project challenges and opportunities – maintaining “single source of the truth”.

- Adaptability: encouraging flexibility, learning, and continuous improvement enables organizations to navigate changing market conditions, regulatory requirements, and technological advancements more effectively.

- Stakeholder Relations: valuing relationships with stakeholders, including local communities, governments, and investors, can enhance trust, collaboration, and support for mining projects, reducing the risk of opposition or regulatory challenges.

In summary, positive mining capital project performance, characterized by effective organizational culture, cost management, revenue generation, risk mitigation, and optimal capital expenditure allocation, can enhance NPV by increasing cash flows and reducing project risk.

USC partners with your organization and coaches your people to significantly impact performance outcomes and get your capital projects over the line on-time and within budget.

USC works with Owner Teams to execute capital projects and prepare for operational readiness during the early stages of the capital project development process, typically prior to the start of the construction phase. Operational readiness activities should be integrated into project planning and execution to ensure early adoption of the desired project culture while building buy-in from the various project stakeholders. There are three key elements to successful projects and capturing NPV.

Culture: Corporate culture is the shared values, attitudes, and practices that define the owner’s project, operation and interactions with its employees and various stakeholders. Culture clashes often occur when people from different backgrounds are assembled.

In capital projects, this often occurs when stakeholders are not aligned around a common set of goals and priorities, potentially resulting in the creation of an unsafe environment and/or low productivity and poor-quality execution. The imperative in this situation is to align stakeholders and define a “culture by design” at the top and instill the culture from the bottom up – deliberately starting at the work activity level.

USC works with successful owner teams to begin this journey from the outset of the project, and usually with a high sense of urgency.

Governance: While most recognize the need for establishing a robust governance framework, with a measurable set of metrics, many fail to execute. Typically, governance frameworks include everything from policies, regulations, functions, processes, procedures, and responsibilities, as well as how project progress and execution performance are tracked and reported.

It is not uncommon for EPCs and sub-contractors to use their own processes and systems to track performance – leading to various versions of the truth on the project. Inconsistent and inaccurate information results in inaccurate project execution planning, ineffective execution, and inaccurate status reporting which in turn results in schedule slippage and costly overruns.

USC works with project stakeholders to ensure governance goes beyond the decision-making of a single project, by developing a “Truth Center” where priorities are set, planning is done, performance is integrated, measured and communicated. By creating a single source of the truth and defining detailed work activities, including who is responsible for what and when, stakeholders can avoid the typical project execution pitfalls. By providing consistency, certainty and coordination, owner teams add to the stability of the project.

Readiness: How many projects are delayed due to poorly defined feasibility studies, engineering delays, late recruitment of key personnel and/or procurement delays? These early delays are difficult to overcome during the project and have a severe impact on NPV.

Many organizations are unclear when to start working on operational readiness – long ramp up times and slow operational start-ups are NPV killers, even for well executed capital projects. Key operations personnel should join the project early in the engineering phase to ensure the operability and maintainability of engineering designs. Additionally, they should play a role in defining and designing the culture for the project. Initiating the design of the operational processes and defining operational system requirements no later than the beginning of the construction phase and completed before starting the commissioning phase.

USC brings 55+ years of experience in shaping organizations and designing and implementing management operating systems and processes to assist owner teams in mitigating start-up risks and unlocking hidden-value to accelerate ramp-up success.

USC Helps You Tackle Key Challenges

- Aligning key stakeholders to a common goal and set of project priorities while defining a common culture

- Ingrain a safety-first approach into a planning and execution excellence culture

- Improving your NPV by developing management process and systems that enable in-shift execution optimization

- Ensuring project execution readiness prior to project startup and operational readiness prior to operational ramp-up

Do you want to understand how prepared your company is to manage project risks while accelerating work execution and operational ramp-up and what the key focus areas that will contribute to improved net present value?

Want to find out more about how USC can help you uncover the hidden-value lurking in your capital project?

For more information, let’s talk it through with a no obligation meeting with one of our executive team members. Email info@usccg.com to arrange a call.

Mining and metals companies are implementing a range of strategies to enhance asset management and equipment reliability.

In today’s market, many senior executives leading natural resource companies hesitate in making additional capital investment and instead focus on what can be done to squeeze higher performance out of current assets. Consequently, companies are increasingly looking for ways to improve performance and returns with existing infrastructure.

The key approach to this challenge lies in upgrading and improving asset management capabilities. Many organizations have failed to deploy optimal asset management practices. This is surprising given that asset spend frequently represents 30% to 50% of the overall operating expenses. Shifting to a best-in-class asset management program will consistently deliver improved plant or equipment performance, lower operating costs, extend asset life, and generate a higher return on capital. Most recently, companies have sought to implement a range of strategies such as:

- Implementing Asset Management Systems: Utilizing robust asset management systems to track equipment performance, maintenance history, and lifecycle costs, allowing for better decision-making regarding repairs, replacements, and upgrades. Digital technologies like IoT sensors, AI-driven analytics, and automation further optimize asset management.

- Enhancing Maintenance Practices: Implementing proactive maintenance strategies like conditioned-based monitoring and reliability-centered maintenance to address issues before they cause failures. Utilizing data-driven insights, mining companies can optimize “time on tools” by identifying patterns and trends in equipment usage, maintenance needs, and performance. This allows for more precise scheduling of maintenance tasks, reducing downtime and maximizing the time equipment is operational.

- Investing in Training: Providing comprehensive training programs for front-line management, maintenance and operations personnel to ensure equipment is used and serviced properly, reducing the likelihood of breakdowns due to human error and that access to equipment is available. Training personnel to utilize data-driven insights enables management to make informed decisions impacting “time on tools” and leading to improved equipment utilization and overall operational performance.

- Improving Supply Chain Management: Ensuring timely access to quality spare parts and materials to minimize downtime caused by equipment breakdowns and repairs. Some are adopting blockchain for transparent supply chain management and better tracking of assets throughout their lifecycle.

The level of performance improvement companies can realize by implementing key strategies such as enhancing proactive maintenance practices, investing in training to improve skills and capabilities, improving supply chain management, and leveraging digital technologies and data-driven insights varies depending upon factors like current operational efficiency, the scale of implementation, and industry conditions. However, many can expect significant improvements in:

- Safety: Proper training programs and proactive maintenance strategies contribute to a safe work environment by reducing risk of accidents and equipment failures.

- Productivity: Proactive maintenance and digital technologies can reduce downtime, increase equipment availability, and optimize process execution, leading to higher productivity levels.

- Cost Reduction: Efficient equipment usage and maintenance practices can lower operational costs by minimizing unplanned downtime, reducing repair and replacement expenses, and optimizing resource utilization.

- Quality: Improving the essential management skills and work place practices result improve the quality of maintenance execution.

Overall, these strategies can result in substantial performance improvements, enhancing competitiveness and profitability for mining and metals companies.

USC Consulting Group partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Asset Management and Reliability Excellence.

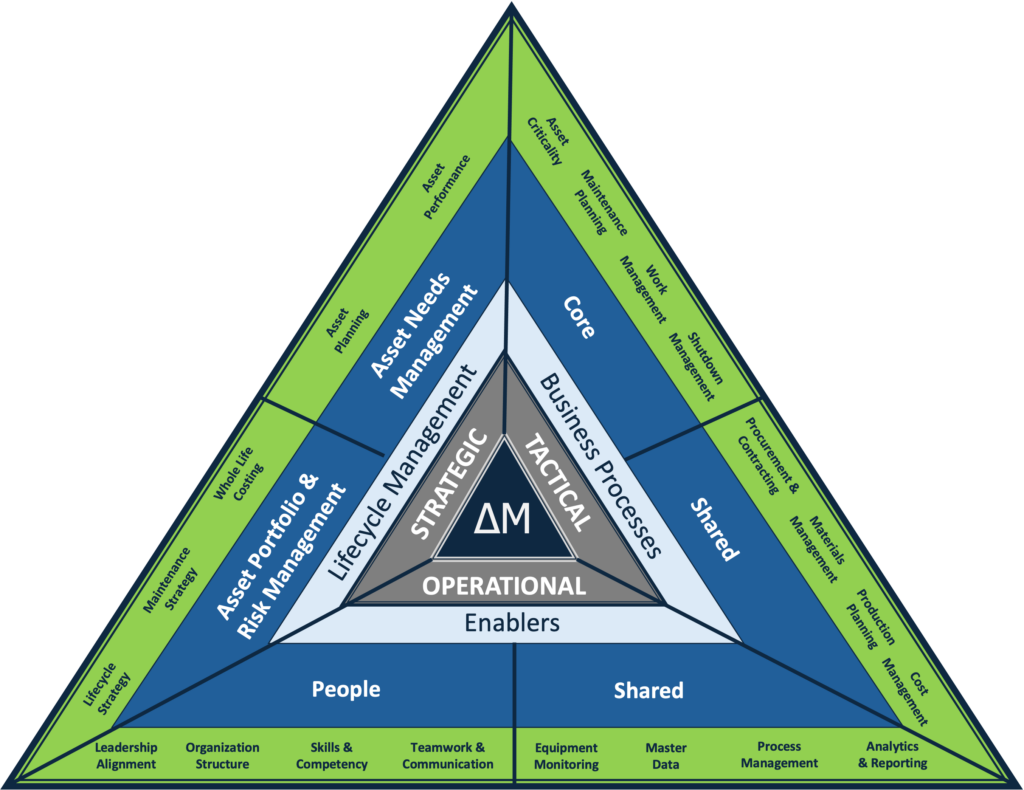

USC’s experience helping clients to shift asset performance by transforming and optimizing asset management capabilities and processes has repeatedly demonstrated the need to focus on the key levers and enablers to asset management and reliability excellence. Our asset management framework is designed to be pragmatic rather than conceptual, thereby leading to accurate, practical decisions about a client’s assets and aspirational outcomes.

The primary goal of USC’s asset management framework is to help our clients to implement and execute of a robust set of integrated processes and tools to manage and maintain their operational assets at the targeted service levels while optimizing life-cycle costs and asset life. This is accomplished by recognizing the needs to:

- Improve safe execution of work

- Increase asset life and reliability

- Improve productivity and cost performance

- Improve operational predictability

- Control material asset risks

- Develop competitive advantage

Our asset management and reliability framework helps clients identify an organization’s asset management maturity level and the areas and gaps that need to be addressed, by evaluating their strategic, tactical and operational levers and the enablers that comprise each.

Strategic (Lifecycle Management): A tailored maintenance program for each piece of equipment translates overall strategic objectives into executable plans for equipment upkeep. Our framework helps to structure and prioritize critical assets while defining a baseline operational ‘plan of action’ by determining strategies for maintaining equipment based on analysis of equipment capabilities, required performance levels, failure frequencies, and cost objectives. Optimal maintenance strategies are frequently a blend of preventative, predictive, operator-maintained, and run-to-fail options.

Tactical (Business Processes): Business processes bridge the gaps between the initial, ideal plan and the reality of ‘day-to-day’ operations, so the maintenance and reliability organization can make adjustments. Historically, many maintenance organizations have been poor utilizers of labor resources that result in low “time on tools” and excessive delays in repairing down or poor performing equipment.

Operational (Enablers): Enablers help to identify needed support to manage assets throughout their lifecycle in alignment with organizational aspirations. Leading asset management teams have also made changes in their organization structures and management practices to foster more action-oriented leadership that focuses on operational excellence, which usually requires a culture shift that must be relentlessly supported by the leadership team over the long-term. A heavy emphasis on management behaviors and company culture can help organizations make this difficult transition.

USC Helps You Tackle Key Challenges

- Optimize maintenance strategies and increase equipment availability operational output

- Predict asset integrity and reliability needs and improve time on tools

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcoming cultural and communication issues with contractors, while ensuring quality expectations

Do you want to understand how prepared your company is to drive needed asset performance and reliability improvements and what the key focus areas that will contribute to lower operating costs?

Want to find out more about how USC can help you uncover the hidden value lurking in asset portfolio?

For more information, let’s talk it through with a no obligation video conference call or a meeting with one of our executive team. Email info@usccg.com to arrange a call.

Mining companies know all too well how expensive and dangerous the industry can be, and the demand for safer and more efficient training and procedures is increasing year on year.

The good news is that technology is keeping up with this demand and mining companies are starting to welcome and integrate innovative tech into their procedures.

From virtual reality training sessions to 3D mapping and printing, mining technology is helping streamline complex processes and tasks while reducing safety risks and costs.

In this article, we’re going to look at 7 mining technology innovations that are driving the mining industry forward and the benefits they bring.

1. Mining Drones

Drones have been around for the best part of a decade now and have become popular pieces of mining technology to access hard-to-reach areas and sites.

Drones are transforming the way operators map and survey mining sites. Surveying and mapping sites on foot are often expensive and time-consuming, but drones can relay geophysical imagery and data to surveyors quickly and efficiently without putting anyone’s safety at risk.

Another obvious benefit of drones is the time saved surveying sites and carrying out inspections. Operators are able to use drones to conduct visual inspections of sites and equipment as well as provide surveying and mapping data.

Companies like Exyn Technologies use drones to map out a 3-dimensional landscape of underground mines without compromising employee safety. These drones deliver hyper-accurate, survey-grade 3D maps in real-time. Plus, they’re able to navigate mines with little to no light with ease.

To learn more about Exyn technology and how it compares to more traditional methods, check out our study of Mining’s Top Innovations.

2. Virtual Reality

One of the best implementations of VR in the mining industry is how it’s being used to train employees. Mining companies can now use VR to provide immersive and realistic training simulations to allow employees to practice and navigate complex tasks in a safe and controlled environment.

VR also allows miners to virtually explore mining sites without needing to physically be there. Again, this negates the safety issues concerning visiting dangerous mining sites, but also saves money on travel expenses and transporting cumbersome equipment around the world.

Employees can practice using hyper-realistic machinery through VR, allowing them to experience operating heavy and often complex machinery off-site. This means trainees can learn and make mistakes on the job without severe consequences.

3. 3D Printing

3D printing looks to have a bright future in the mining industry. The ability to print and replicate complex and often expensive mining equipment can save companies a small fortune.

For example, if a piece of equipment becomes damaged during use, companies can use 3D printing to replace this equipment quickly and with incredible accuracy. Sourcing mining equipment is often costly and can take time to deliver specific equipment to mining sites. With 3D printing, both of these issues are negated.

While 3D printing is seeing a steady introduction to the mining industry, the potential it brings could be game-changing. Being able to instantly find, print and install specific tools or parts onsite to damaged machinery can reduce lead times and negate the need to transport expensive equipment to remote sites.

Plus, you don’t need a warehouse to store these parts – as every part can be stored digitally!

4. 3D Mapping

3D mapping is a form of mining technology that provides extremely accurate and detailed digital representations of mining sites.

For example, 3D mapping tools can highlight and pinpoint important areas for excavation, without wasting time and valuable resources. Additionally, it isn’t limited to just mining sites – 3D mapping can also be used to map quarries, waste deposits and transportation routes.

According to the statistics, the global 3D market is expected to grow from $3.8 billion in 2020 to $7.6 billion by 2025.

5. Artificial Intelligence

It would be an understatement to say that AI dominated the technology headlines of 2023. The introduction of ChatGPT, Midjourney and BingChat had (and continues to have) a massive impact on operational processes in almost every industry.

In the mining industry, AI is leveraging smart data and machine learning. Not only does this mean safer training and better mining processes, but it cuts the time to perform these tasks in half. This enables onsite engineers to make decisions faster and with more accuracy.

For example, AI is helping mining companies locate and extract valuable minerals with precision. Additionally, through advanced algorithms and data analysis, AI systems can identify optimal mining sites, predict potential resource deposits, and even guide exploration efforts with exceptional efficiency.

We’re already seeing how AI mining technology is aiding autonomous equipment like self-driving vehicles for tunneling excursions and optimizing drilling systems, and we’ll likely see more processes utilizing AI going into the future.

6. Automation

Automation is becoming increasingly popular in the mining world. Truckless conveyor-belt ore transport systems, subterranean electric vehicles and drones are some of the core automation shifts we’re seeing.

One of the biggest benefits of automation is that it allows mining companies to work around the clock without having to be physically present. By automating processes like ore delivery and transport, site monitoring and drilling and ventilation systems, miners do not have to jeopardize their health and safety by venturing into mines and handling hazardous materials and minerals.

Instead, miners can be trained on how to operate heavy machinery remotely from a control center above ground, providing a safer and more comfortable working environment.

Yes, time and resources will need to be invested in training miners on how to use this mining technology. However, the benefits far outweigh the cons. Miners face fewer health and safety risks, speed and efficiency will likely increase and in the long term the industry will experience significant cost savings.

7. Digital Twinning

Digital twinning allows mining companies to create a digital replica of their entire mining ecosystem. This includes mining equipment, geological formations and other relevant objects or assets.

By integrating data from sensors, IoT devices, and other sources, digital twinning provides a dynamic and detailed simulation that mirrors the physical reality of the mining site.

The main aim of digital twinning in the mining industry is to improve decision-making and operational efficiency. Digital twinning also allows miners to simulate various conditions and assess the impact of different variables on operations. This approach means fewer safety risks for employees.

Digital twinning is changing how mining companies do things. It lets them make a digital copy of their entire mining setup, including their equipment, geology, and processes, in an instance.

In essence, digital twinning is making mining operations more efficient, sustainable, and competitive.

Conclusion

The mining industry has been calling out for more innovative and efficient ways to streamline their processes and improve the safety conditions of their employees.

The mining technology at their disposal today is revolutionizing traditional mining processes and more companies will inevitably invest in this new technology.

Improved productivity, enhanced safety and substantial cost savings are just a few of the benefits technology brings to the mining industry. In the next few years, mining companies will need to adopt this technology into their processes to stay competitive and meet the growing demands for sustainability and efficiency.

Embracing these technological advancements is not just a choice; it’s a necessity for the mining industry to thrive in the evolving landscape.

*This article is written by Sophie Bishop. Sophie is an experienced freelance writer with a passion for sharing insights and her experience within the health and safety sector. Sophie aims to spread awareness through her writing around issues to do with healthcare, wellbeing and sustainability within the industry and is looking to connect with an engaged audience. Contact Sophie via her website: https://sophiebishop.uk/.

Challenges are not new to the mining industry and 2024 is shaping up to hold several, from ESG pressure to labor shortages. But by focusing on challenges as opportunities to optimize, this resilient industry will no doubt weather these headwinds.

Here are the top issues, challenges and trends we’re seeing on the road ahead.

ESG (Environmental, Social, Governance)

According to 2024 research at EY, mining executives are looking at ESG as the biggest risk to their business — the third consecutive year ESG has received that dubious ranking. Why? It’s because of increasing scrutiny from investors and other stakeholders, and the likelihood of more strict regulations in the area of environmental protection and governance practices. All of which could lead to higher capital costs for mining companies that have to play catch-up in terms of ESG measures and compliance, like investment in new technologies and efforts toward carbon capture and storage. However, there’s a silver lining here for companies that take the lead in these efforts. It can put them on top in terms of attracting the best talent and capital investments, both of which are poised to be problematic this coming year.

Another thing about the environment …

In addition to mounting governmental pressure and stricter regulations in terms of ESG, there are other factors (and fallout) related to the environment as well. Shifting demand could mean changes in operations and production. For some companies, it may mean less demand for the materials they’re mining. For others, especially those that are focusing on nickel and lithium used in EV batteries, it means a boom.

Capital investments

That EY survey of mining executives cites capital as the second most pressing issue for the industry, behind (and hand-in-hand with) ESG. It’s shaping up to be a race for investments to facilitate the exploration for and extraction of minerals like nickel, copper and lithium, all crucial to the energy and environmental initiatives coming down the pike.

Delivering on growth projects

Linking to capital investments is the ability to develop new assets. Bringing new assets on-line faster, more responsibly and safer is more important than ever, especially in stable regions. Excelling in development projects is no longer a competitive advantage, it is an expectation from all stakeholders. Local communities and authorities expect a faster and larger return while shareholders expect a faster return on their investments. Executing growth projects on time, within budget and responsibly will define the exceptional from the pack.

Geopolitical instability

Ukraine, Israel, Gaza, and that’s just what’s making the headlines. Barring a holiday miracle, geopolitical instability isn’t going away anytime soon. In addition to the human toll, it means continued supply chain disruption, price volatility and more for the mining industry. It might mean trade tensions, embargoes, tariffs and other measures that impact the mineral trade, including “resource nationalism.”

Labor shortage

It seems like every year, we’re talking about a labor shortage in terms of recruitment and retention, and this year is no different for the mining industry. It’s particularly pressing because it’s a problem on two fronts. The labor shortage is impacting productivity today when you don’t have enough people to get the job done now. But it’s also the lack of a skilled workforce pipeline, people coming up and getting the skills they need to replace older, experienced workers who are retiring or leaving the workforce for other reasons. Workforce training, like we provide at USC Consulting, is the key to getting everyone on the same page, doing the same job the same way. It boosts productivity, which is an absolute necessity when you are feeling a labor crunch.

Technology

Technology and innovation will be big in 2024 for mining, as it will for most industries on the planet. Investments in automation will improve efficiency and safety, and it might help with the labor shortage as well. But technology advancements in mining aren’t really about the bots taking over people’s jobs. They can create new jobs and new opportunities for skilled workers which, in turn, will ratchet up productivity and process improvements mine-wide. Investments in new technologies will also help in areas of exploration, discovery and mineral extraction, again boosting productivity.

Cybersecurity

As data becomes king in all industries, not just mining, increasing digitalization heightens the risk of cyberattacks. Mining companies are considered high-value targets and are vulnerable to disruption, financial losses and more. Employee training, having a response plan in place and digital security measures are all important areas of focus for the coming year.

Remaining competitive through economic cycles or shocks

Many natural resource companies struggle to remain competitive through economic cycles or market and commodity shocks. The best possible operating efficiencies, productivity and lowest possible unit costs are the best insurance against these cyclical and adverse events. Companies design and develop good systems, but it is at the point of execution or operator level where the best distinguish itself from the others.

At USC Consulting Group, we understand what it takes to weather the headwinds for the Mining industry in 2024. We focus on optimizing processes and procedures, creating operational excellence and improving production to ultimately boost your bottom line and shore you up against whatever the coming year can dish out. Call us today to find out more.