-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Labor Planning

Demand is back. After many industries saw customer demand dry up during the pandemic, it is surging like it hasn’t in a long time. Consumers are spending money again. That’s the good news. The bad news? Companies across many industries, especially manufacturing, are struggling to meet that demand.

The reasons for this are as varied and unique as every company out there, but we are seeing a one-two punch creating capacity limits among our clients: the tight hiring market coupled with supply chain disruptions. So, how can businesses overcome these restraints and get ahead in the current landscape? First, let’s understand the issues at hand.

The hiring problem

We haven’t seen this tight of a hiring market in two decades or more. Businesses in many industries were forced to lay off or furlough workers during the pandemic, and now that demand is back up, they’re finding it next to impossible to fill those shoes, or in many workplaces, steel-toed boots. Why? The pandemic caused employees of all stripes to rethink their life choices. Maybe they don’t want to work in a manufacturing facility, or retail shop, or in a cubicle anymore. The result of that is what economists are calling “The Great Resignation.” According to the U.S. Department of Labor, 4 million people up and quit their jobs in April 2021. In May, that number dipped “all the way down” to 3.6 million, but by the time June rolled around, it was back up to 3.9. We haven’t seen this kind of mass exodus in generations, if ever. Make no mistake, the jobs are out there. Companies in all industries are scrambling, even desperate, to fill them. But this is not a matter of “if you post it, they will come.” They’re not coming.

The supply chain problem

Yes, many restrictions have been lifted, but supply chain snags, roadblocks, disruptions and downright stoppages continue to bedevil many industries. So even if you have enough people to get the job done, the supplies may or may not be there when you need them.

The hiring crunch and supply chain double whammy, combined with skyrocketing demand, is creating a difficult situation out there for many industries.

How USC Consulting Group can help

When it comes right down to it, meeting increased demand with fewer workers and a disrupted supply chain means one thing: Getting the job done requires increasing your operational efficiency. At USC Consulting Group, that’s our specialty. We’ve been doing it for 50-plus years. But it’s not easy. Sure, everyone wants to do more with less. But how, exactly? Here are some ways we find work well to ferret hidden opportunities for greater efficiency.

Engage the line. This means getting up close and personal with anyone who has anything to do with the production line, mining their expertise about what’s working and what’s not, and looking closely at the job on an hour-by-hour basis. Looking at the operation through that lens, you’ll be surprised what you can find.

Get a firm handle on capacity. How much is actually possible to produce? How much time will it take?

Rethink your staffing. How many people will it really take to get the job done? Looking at the operation with an eye toward people power, you may find you can get the job done with fewer employees. Which is good news for companies scrambling during this hiring crunch.

Scrutinize the management operating system. This is about how you plan your work, assign it and follow up to ensure the job is getting done. Make this part of your business a well-oiled machine.

Get real about throughput. What is the ideal “drumbeat” of your production line? Are things moving at the right speed? But, this isn’t just about speed. It’s about producing good product faster.

In the end, we use these and other strategies to uncover opportunities for efficiency and help companies meet rising demand even with the constraints they’re facing today. If you’d like to read about this topic in more depth, download our whitepaper, “Strategies for Meeting Customer Demand” or give us a call today. We’re ready to help.

Once one of America’s most respected professions, truck driving now generally struggles to be seen in a positive light. Instead of being seen as a traditional, hard-working segment of the workforce, unpleasant notoriety now exists around truck drivers. In 2018, Wisconsin-based trucking company manager Boris Strbac told The Washington Post that “people don’t respect truck drivers. We are treated as the bad guys on the road by other drivers and the police.”

That perceived lack of respect from other motorists, law enforcement, and the general public is just one reason why the U.S. is in the midst of a truck driver shortage. The job is also difficult and isolating, resulting in a high turnover rate.

Employment trends within the trucking industry have wide-reaching implications. For starters, trucking is essentially the lifeblood of manufacturing logistics. Without trucking, the whole supply chain could crumble. In fact, about 71% of American freight is moved via truck, equating hundreds of millions of dollars in revenue on an annual basis. Due to the national truck driver shortage, freight prices have jumped considerably in recent years. And the trend is expected to continue, to the detriment of food suppliers and restaurants alike.

How Trucking Impacts Food Manufacturing Supply Chains

Rising freight costs within the food industry due to truck driver shortages are nothing new. The same year that Strbac vented his work-based frustrations to the Washington Post, food manufacturers began to see freight costs severely impact their bottom line. Representatives for Tyson Foods, one of the country’s largest producers of meat products, reported a freight cost increase of $250 million in a single year.

When freight costs rise, those costs are typically passed along to the consumer. According to the U.S. Department of Agriculture (USDA), national food prices in January 2020 were 1.8% higher than the previous year. What’s more, the cost of foods consumed away from home, such as in restaurants, increased by more than 3%, with fruits and vegetables seeing the largest relative price increase of all food categories.

Produce often must travel long distances to reach the nation’s restaurants, grocery stores, and cafes, and their transport is typically done via truck. And even food and beverage industry trends, such as increased demand for plant-based meat substitutes, can’t curb the damage caused by increased freight costs.

Data indicates that the truck driver shortage is a primary culprit of rising freight costs nationwide. In order to help curb those rising costs, the trucking industry may need to make changes to help bring more workers to the crippled industry.

Methods for Improving Truck Driver Health

Trucking can take a major toll on a driver’s physical and mental health. Thus, many job seekers overlook truck driving opportunities as they find the pay to be negligible compared to the work performed. Long-distance truck drivers, for example, spend a large chunk of their time on the road, and may only see their families a few times per month.

That social isolation, coupled with health difficulties such as lack of physical exercise and sleep deprivation, directly contributes to the national truck driver shortage. Reducing hours spent on the road while increasing pay may be key factors in job recruitment within the trucking industry.

Exercise is also an important consideration for prospective truckers, who need to counteract their sedentary lifestyle in order to improve their overall health. Sitting for more than six hours per day can be detrimental to one’s health, even contributing to premature death. Trucking companies should thus consider including a gym membership as part of their sign-on bonus, or provide incentives for positive health changes among employees, such as weight loss or smoking cessation.

Manufacturing Logistics, Supply, and Demand

Unfortunately, health-related measures may not be enough to spawn a renewed interest in truck driving as a career. The sad truth is that the “U.S. trucker shortage is expected to more than double over the next decade,” reports Bloomberg. Trucking companies are looking to fill in the employment gaps by recruiting more young people and women, typically underrepresented in the workforce.

But it may not be enough, leaving the U.S. manufacturing industry in a limbo. In fact, Washington State University reports that the manufacturing industry is adding jobs faster than the rest of the economy, especially within the fabricated metals, machinery, and food manufacturing industries. And as the manufacturing sector continues to rake in steady revenue, the demand for freight and trucking naturally increases.

If the truck driver shortage isn’t mitigated in the near future, manufacturers from all industries will have to look elsewhere for their freight needs. Inevitably, costs will then rise at both the business and consumer levels. Steadily rising freight costs lead to gaps in the supply chain, a fact that seems counterintuitive in a nation where product manufacturing is in high demand. It’s time for trucking industry leaders to make appropriate, forward-thinking policy changes in order to help mitigate the truck driver shortage and perhaps stop the snowballing costs of freight across the country.

For over 50 years USC Consulting Group has been guiding logistics and manufacturing companies with optimizing their supply chains and improving their bottom lines. Contact us today and we will help drive up efficiency in your operations.

This article is written by guest author Beau Peters. View more of Beau’s articles here.

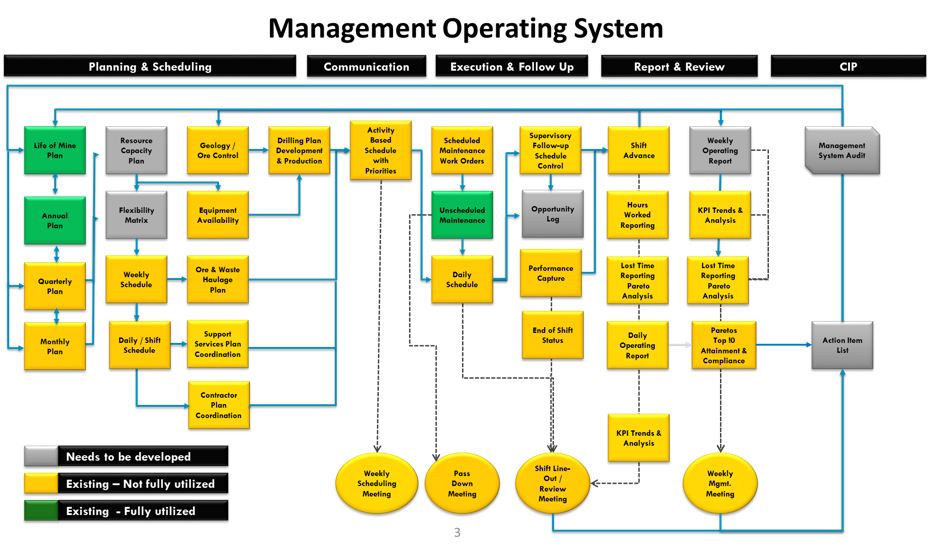

As organizations today have become ever more reliant on networks and other systems that run using 21st century data-driven technology, one way in which they can maximize their potential is through the implementation of a management operating system.

What is a management operating system (MOS), and what can one do for my business?

According to CEO Magazine, an MOS allows for an organization to “better control the flow of work and production, driving higher outcomes in customer service, quality and cost.” At a minimum, these systems make use of tools that allow organizations to create plans for future work in certain operations, carry out that work, and then measure the work performance data to suggest future improvements that could be needed.

In short, an MOS is a set of tools, processes, and frameworks by which an organization’s employees operate. It is responsible for gathering data and then using the garnered information to inform decision making that fosters continuous improvement to address issues as they occur. These issues can range from production shortfalls to those related to worker safety; as such, companies that use production lines or have other types of hazardous workplace environments commonly employ management operating systems.

A MOS is a set of processes and resources by which businesses operate that drive the decision making of important organizational figures.

One way that an MOS can be described is that it is a set of processes and resources by which businesses operate each day that in turn drive the decision making of important organizational figures.

An effective MOS should be able to identify and quantify inefficiencies in an operating system and shift any reactive data-gathering methods towards those based in data analysis. This ensures that any adjustments can be made so operations are not adversely affected. An MOS should also use real-time feedback so an organization can safely direct operations, funding and other resources to maximize return on investment.

Organizations can observe some notable benefits after they implement an MOS, including cost savings, waste reduction, and increased product quality. Among other benefits, an MOS can help organizations identify and close workflow gaps, find ways to improve efficiency, or monitor operations to see if they are in compliance with company or government regulations and policies.

After an organization has implemented a management operating system, it may see the following benefits:

- Increases production cycle efficiency through the elimination of any bane to an organization’s workflows, such as unnecessary overtime or any operational and/or financial surprises.

- Ensures that key products such as raw materials are readily available at all times to meet any production requirements or needs

- Maximizes the potential of available workspace, equipment, inventory, and human resources

- Reduces excessive inventory and can help avoid any defective or outdated products from getting to customers

Human-run MOS still important in the impending age of automation

Some have argued that the MOS has become obsolete with the rise of automated data-driven decision making and the ongoing replacement of human beings in certain occupations with robots and artificial intelligence, according to CEO Magazine. That being said, the article’s author David Hand also argues that this view does not consider reasons that management operating systems were required in the first place, citing a few major points. In particular, Hand predicts that management operating systems will continue to be used wherever there are human beings employed instead of robots. Sectors reliant on human resources that have grown the fastest are the healthcare and professional services such as information technology and engineering, notably among others.

While organizations are able to reduce costs by making use of technology rather than humans, the article notes that cost is only one of two aspects that a customer requires to make a purchase, the other two being service delivery and quality. As a result, organizations that place too much of an emphasis on cost reduction amid a “new wave of innovation” related to technology use have been found to get away with poor customer service and product delivery. To avoid this dilemma, MOS principals such as short interval control and management of variance are important for any enterprise, no matter how big or small.

“Organizations must not be complacent. The struggle to remain competitive and to improve service delivery is unrelenting and a willingness to confront process shortfalls that drive customers away is vital,” Hand writes.

Adherence to an MOS and related principals can also have a positive impact on employees such as knowledge workers with regard to delivering better outcomes. Deadline commitment is the single most effective MOS principal that a knowledge worker can follow, Hand argues, and despite the stress of meeting deadlines, the practice can often result in large dividends.

How can my business best use an MOS, and what are the benefits?

In particular, owners of business operations can employ business management systems not only to bolster their bottom lines, but also to prepare themselves for planned growth or unexpected downturn. Forest Admin’s Thomas Didier concludes that while most businesses it has observed use different methods in their management operating systems, they center around four main components: processes, systems, roles, and structures.

When designing processes, businesses must be sure that they are safe, secure and clear for employees to understand and tools are used to support operations — never are they to be used in ways not dictated by the overall structure. This means that users should not use tools in inappropriate ways, especially those that could simply automate their inefficient methods. An effective MOS uses well-designed systems upon which their employees and processes are reliant to achieve goals, which means they should run smoothly and do not reduce established efficiency. Roles within a MOS should adhere to clearly defined job descriptions that require certain skill sets, and when combined with a business’s processes and systems can best utilize talents. Finally, the best-run management operating systems always establish a business-wide structure upon which the different roles within the company interact. This is usually done last because it ensures that the processes do not dictate the entire established structure and cause further issues.

“Many factors…can have an impact on the definition of your structure. As a result, it is unlikely that two companies with the same processes, systems, and roles will end up with the same structure,” Didier explains.

How to realize benefits when after implementing or improving an existing MOS

Businesses that do not make full use of a management operating system can undoubtedly improve the efficiency and overall profitability of their operations if they are able to create ones that effectively suit their needs. Regardless of whether an organization has an insufficient MOS already in place or does not use one at all, the development of a new one is a process that requires a great deal of investment and commitment from different organizational figures and departments. For example, some older production plants may have become reliant on relatively outdated production line methods and need to reduce observed downtime and inefficient processes in order to cut costs.

Regardless of whether an organization has a poorly planned MOS already in place or doesn’t use one at all, the development of a new one requires a great deal of investment and commitment from different key figures and departments.

Without an MOS in place, those responsible for the plant’s operations should first find a way in which to quantify key performance indicators related to products, assets and even everyday routines; there are different tools and methods that can be used to find out which information needs to be quantified, including those used by consulting services. As a result, conclusions drawn from the former can allow employees to operate more efficiently. This translates into a better understanding of the causes of production downtime, which can drive proactive and accurate decision making. Departmental training should be required with any future changes to a MOS to ensure that it still remains effective.

Rather than come up with the most basic of KPIs as a solution, organizations that use an MOS and aren’t seeing desired results need to reevaluate their methods of quantifying the information upon which they rely. For instance, one scenario might be that a major operation has become reliant on data collection methods that overlook key information explaining the causes of operational delays or unrealistic production deadlines and expectations. With the ability to see how workload expectations relate to overall productivity, a well-run management operating system can help an organization hit its numbers without worry each quarter.

When it comes to important areas in business operations such as the success and cost of a project or the safety and productivity of employees, knowing how to garner the right information and put it to good use is essential.

USC Consulting Group can help enhance your existing MOS or implement an entirely new one using its Client Technology Solutions like LINCS Lean Information Control System. Contact USC Consulting Group today to see how we can help your organization achieve desired outcomes.

With approximately 765 million acres of woodland, America ranks among the most forested nations, according to research from the U.S. Forest Service. Consequently, the country boasts a healthy forestry sector. After evaluating raw data from the USFS and the Institute for Supply Management, analysts from Forest2Market found that total production is up across the industry, as lumber, paper, pulp, and wood manufacturers rush to fill increasing order volumes. However, the industry faces multiple large-scale challenges that threaten to erode recent gains. Here are some of those obstructions and how they might affect the American forestry industry:

Wildfires

Massive blazes have dominated the news in recent months. The Woolsey and Camp Fires together devastated more than 250,000 acres and killed 91 people throughout Southern California in October and November 2018. Unfortunately, California and other western states have grown accustomed to such disasters over the last decade or so. The total amount of acreage burned has steadily increased since 2003, according to data from the National Interagency Fire Center, compiled and published by the Insurance Information Institute.

In addition to creating a serious public safety risk, wildfires especially problematic for businesses in the American forestry industry. Wildfires are among the most serious threats to forest resource supply, according to research from the U.S. Endowment for Forestry and Communities. As these blazes increase in volume and intensity, the total inventory of usable trees drops. In fact, American forestry companies on the West Coast are already grappling with operational issues linked to the recent California wildfires. Unfortunately, these disasters are likely to increase in frequency over the coming years, which means organizations in the U.S. forestry sector must take action to protect their supply chains. Increased investment in the fuel management activities is an ideal course of action, as is the introduction of supply fail-safes that kick in should a blaze destroy linchpin wood supplies.

Sustainability

Many companies made changes to their forest management practices in 1992 as a result of the UN introducing the Forest Principles during its conference on Environment and Development in Rio de Janeiro. This document called on member nations to promote forestry practices that “meet the social, economic, ecological, cultural and spiritual needs of present and future generations.” In the years since, the concepts laid out in the Forest Principles have gained serious traction in the industry because of the emergence of various supply risks, including insect infestation and wildfire. By ensuring forest biodiversity, facilitating healthy ecosystems, and maintaining and conserving clean soil and water resources, businesses in the forestry sector can address such hazards and cultivate long-lasting supplies, according to the USFS.

However, this is difficult and expensive work. Companies pursuing the Sustainable Forestry Initiative’s certification standard often incur extra costs during the process, researchers for the North Carolina State University found. While many have the budget required to hire extra forest management staffers and implement strong sustainability programs, a similarly large number do not. Recent developments have revealed sustainable forest management to be essential today. This puts lumber producers in a tough position.

Staffing shortages

Despite recent success in the marketplace, organizations in the American forestry industry are suffering operational dysfunction linked to staffing shortages. The logging workforce is declining at an accelerated rate, according to the Bureau of Labor Statistics, which estimates that the industry will be short of some 7,000 loggers by 2026.

Logging is an incredibly dangerous job and takes an immense physical toll on workers, two factors that dissuade younger U.S. residents from entering this vital profession, NPR reported. It also applies to tradesmen and engineers in the mills. Young engineers do not want to join this industry because the mills tend to be located in smaller towns and there is a belief that forestry is not “high tech.”

Additionally, training in this area is hard to come by, according to the Forest Resource Association. People who might be interested in working in the forestry industry struggle to get the education and practical instruction they need to find success out in the field. Therefore, many companies are having difficulty replacing tradesmen as they retire and, in turn, are losing all that knowledge and expertise. Businesses in the industry must address this ongoing issue to ensure they can meet customer demand and remain competitive in the marketplace. USC Consulting Group helps by providing a framework to define the skills required and “downloads” the knowledge of retiring tradesmen into solid job instructions for future maintenance work.

Together, these challenges appear daunting to even the most capable American lumber, paper, pulp, and wood manufacturers. However, these organizations have no choice but to pursue internal improvements that mitigate the impact of wildfires, promote sustainability, and address staffing shortages. Of course, companies in the sector don’t have to embark on such efforts alone. Here at USC Consulting Group, we have been assisting enterprises in the forestry industry for decades, lending them external perspective and operational expertise they need to reshape their operations in response to significant challenges.

Contact us today to learn more about our work in the forestry industry.

This holiday season, American consumers are expected to spend more than $720 billion, an increase of nearly 5 percent over sales figures from 2017, according to the National Retail Federation. But as buyers bolt to malls to take advantage of last-minute deals and purchase gifts online, manufacturers here and abroad are navigating a holiday rush all their own.

During peak season, businesses in the manufacturing space – especially those that serve brick-and-mortar and online retailers – pour all available resources into ambitious shop-floor initiatives centered on facilitating optimal output and service delivery.

Finding success during peak season is, of course, no easy task. As competition increases, more production roadblocks materialize. This is why manufacturing organizations must develop and deploy specific operational strategies designed to achieve favorable results during peak season. When they do, their clients can keep their shelves stocked, customers get the products they want and company coffers grow. What exactly are these peak season manufacturing best practices?

Keep an eye on manpower

Worker absenteeism is an acute year-round problem that only grows worse during peak season. According to research from the Society for Human Resource Management, an estimated 72 percent of American businesses said that workers take unplanned time off around the holidays, reducing staff levels and making it harder for businesses to hit production targets.

Manufacturers can fight back against these operational roadblocks by planning ahead and introducing innovative solutions such flexible shifts, which can bolster employee engagement and retention. Moving forward with ambitious hiring initiatives is another proven option, as this allows firms to cultivate corps of willing workers prepared to work to embrace the holiday rush.

Address the supply chain

As customer demand reaches its zenith, supply chain operations become even more critical. Manufacturers that plan for this eventuality set themselves up for success. According to The Wall Street Journal, in autumn 2017, Nintendo began ramping up supply chain processes for its new Switch video console, which had suffered from logistical issues, making it harder to acquire after its release date earlier that summer. Pre-holiday planning allowed the company to meet customer demand during peak season and laid the groundwork for historic sales, according to Polygon. Manufacturers can find similar peak season success by anticipating the effects of heightened demand, safeguarding against issues and ensuring supply chain efficiency ahead of the holiday shopping season.

Prepare for marketplace changes

With every peak season comes unique economic challenges. Manufacturing businesses must take steps to mitigate shop-floor issues stemming from recent marketplace developments. Many companies looking for success in the final weeks of 2018 have begun putting into place processes designed to address the trade war unfolding between the U.S. and China, a conflict that has complicated raw material procurement practices, Logistics Management reported. Some have decided to secure materials and components from China as early as possible, thus beating the implementation of the tariffs. Others are biding their time, developing backup plans and hoping the countries come to an agreement that doesn’t include tariffs.

Manufacturers that implement these and other peak season best practices can end the year strong and make out like so many of the bargain hunters out shopping for holiday sales. That said, implementing these strategies alone might prove difficult for some teams. USC Consulting Group is here to help, leveraging decades of consulting experience to assist manufacturers intent on optimizing their operations and boosting the bottom lines. Contact us today to learn more about our work in the manufacturing space.

No organization operates in a vacuum. Economic developments and technological advancement have prompted businesses across all industries to cultivate new kinds of partnerships. In fact, most high-functioning enterprises, including massive consumer brands, outsource many mission-critical functions to third-parties, including engineering, product design and manufacturing operations, according to analysts for EY. But these same companies must carefully consider the details of their outsourcing strategies and determine whether farming out key production activities makes financial sense and aligns with their broader long-term goals.

By using outsourcing rationalization, businesses can effectively assess their outsourcing infrastructure and build partnerships that benefit their bottom lines without laying the seed for dysfunction. Here are a few steps that organizations usually take when they want to start down the path of true outsourcing rationalization:

Assessing internal motivations

First, businesses must analyze why they chose to outsource in the first place. For instance, 51 percent of manufacturers that outsource an element of their supply chain, production or maintenance did so in an effort to reduce the cost of goods sold and take advantage of external expertise, according to survey data from Peerless Research Group and the Supply Chain Management Review. Other common drivers for outsourcing include rapid growth, a need for greater agility and asset reduction.

The outsourcing rationalization process normally begins with an in-depth evaluation of factors that first prompted business leaders to consider third-party partnerships. Rationalization is all about leaving emotion at the door and looking at the logic behind an action – outsourcing in this case. Businesses must pore over each of its partnerships and ask whether they’re logical, which begins by investigating initial expectations and developing criteria for measurement. Has the relationship met these expectations? If so, do you have the figures to back it up? If not, why not? Did your organization set its sights too high, or did the partner fail to prove its value?

Pinpointing ideal partners

If a business is in the market for any strategic partnership, its likely seeking, in part, competitive pricing and proven reliability. But beyond these two pillars of every attractive partnership, businesses must consider how prospective collaborators will function in long-term strategic partnerships.

Again, this refers back to reassessing initial goals, but it extends further. Companies have to create a standard procedure for vetting partnerships as they pertain to the specific parts of their business in direct contact with partners. For example, if a manufacturer outsources its maintenance and parts of its production, it should not hold these discrete partnerships to the same standard. There should be separate standards for each that align with its specific maintenance goals, such as decreased cost or unplanned downtime, and specific production goals, such as higher quality or better throughput.

Furthermore, the standard or standards by which a business assesses its partnership should include cross-functional factors. Asset maintenance, for example, does not solely affect the production line, so equipment operators shouldn’t be the only people who weigh in on what makes a partnership like this valuable.

Grappling with internal demands

Outsourcing requires considerable internal commitment, as stakeholders must oversee relationships with third-party partners and ensure they generate optimal return on investment. Governance can make or break outsourcing programs. In fact, faulty relationship management is the most-cited reason for strategic partnership failure. Businesses that continue forward despite poor third-party governance see value leakage rates of between 17 and 40 percent, according to EY.

With this in mind, companies with strategic partnerships must devote the final stage of the outsourcing rationalization process to determining whether they have the internal expertise and resources needed to properly oversee relationships fully.

Organizations that properly work through these steps can gain a full understanding of how outsourcing might affect their operations and pursue or avoid external collaboration with full confidence. Here at USC Consulting Group, we’ve been helping companies navigate these and other key operational issues for 50 years. Connect with us today to learn more about our experience and how we can help your business get more out of its partnerships.

Raw material costs continue to increase as a result of recent economic developments – most notably, the new tariffs on aluminum, steel and Canadian lumber. Firms in the building materials manufacturing space are, of course, among the numerous industrial businesses dealing with the repercussions of these duties. Lumber companies looking to tap suppliers in the Canadian market must grapple with historically high prices, according to The New York Times. Sawmills in the Great White North are now charging $655 per thousand feet of product to offset tariffs as high as 21 percent. For comparison, the average price per thousand feet of Canadian fir, pine or spruce wood hovered near the $500 mark for most of 2017.

This situation has put building materials manufacturers in a tough position. Few of these firms are capable of absorbing higher costs and must make operational changes to keep their bottom lines intact. What exactly can companies in building material manufacturing do to mitigate the impact of increasing raw material expenses?

1. Operational optimization

Like most modern businesses, building materials manufacturers rely upon complex supply chains that contain numerous components and third-party stakeholders. Forward-thinking enterprises in this sector are scouring these intricate workflows in the hopes of uncovering hidden cost savings.

Transportation is often at the center of these supply chain optimization efforts, as it normally eats up the largest part of the logistics budget. Freight expenses went up significantly last year, according to the U.S. Bureau of Transportation Statistics. In 2017 alone, American businesses devoted more than $1.1 billion to transportation initiatives, an increase of 6.6 percent over figures recorded in 2016. This number is not likely to decrease any time soon, making transportation a good area of focus for building material providers looking to cut costs in light of rising raw material expenditures.

But what exactly can they do? Contracting steady lane volume and shipping on off-peak days are strong strategies, according to Mark Johnson, senior vice president of transportation and solutions for Kane Is Able, a third-party warehousing and transportation services provider. Investing in relationships is another good methodology. Building material manufacturers that make the effort to form sustainable connections with third-party shippers are more likely to see savings than those that continually chase discounted services.

2. Smarter staffing management

U.S. manufacturers have embraced outsourcing over the last dozen or so years, researchers for the Bureau of Labor Statistics found. For instance, in 2015, the last year for which BLS data was available, temporary workers accounted for almost 10 percent of the American manufacturing workforce. Companies in the building materials manufacturing industry have most certainly embraced this model in an effort to reduce staffing costs and facilitate operational scalability.

Even so, such arrangements can weigh on the bottom line, as businesses with hastily managed outsourcing programs find out. Building material manufacturers cannot afford to suffer such inefficiencies, especially as raw material expenses rise. With this in mind, organizations in this space should maintain relationships with multiple outsourcing partners to drive competition and bolster service quality.

Additionally, human resources personnel and operational leaders must deploy temporary workers wisely – right-sizing contingent staff orders, for example – to generate a return on investment and reduce waste.

3. Passing on the cost

With the average cost of building a home in 2022 rising to $1,393.55 per sqm, here is one cost-cutting method a significant number of building materials manufacturers have implemented for absorbing higher material prices: passing the costs to customers. This is, of course, not ideal for many reasons. Few building materials manufacturers want to charge higher fees, as such increases may not only trickle down to individual consumers but also put them at risk for getting priced out of the market. However, some businesses in the industry find themselves with no other choice.

Building materials manufacturing companies that embrace these methodologies can sustain their bottom lines, even as various external forces push material prices higher and higher. Businesses that require additional assistance in the face of rising costs should consider connecting with USC Consulting Group. With 50 years of experience, we can help building materials manufacturers of all sizes retrofit their operations in response to recent economic pressures.

Contact USC Consulting Group today to learn more about our services.

Businesses seeking to improve internally often focus considerable energy on trying to transform shop-floor operations through the introduction of new equipment, production processes or software. While such additions can surely lay the groundwork for change, these modifications alone cannot catalyze true operational transformation. The employees responsible for managing mission-critical production workflows must change as well. Tools are only as effective as the professionals who wield them.

To bolster worker performance and thereby meet internal improvement goals, organizations must drive behavioral change by promoting innovative workplace practices that pair well with new and improved processes and production assets. Here are the five secrets to driving such change:

1. Start from the top

Executives shape company culture through their actions, providing the behavioral blueprint for employees in every department. Enterprises embarking on internal improvement efforts should utilize this top-down approach to behavioral osmosis by leveraging influential leaders within the initiatives accompanying significant change on the shop floor. In fact, studies show that this is necessary for sustainable, organization-wide behavioral change. According to a study from Harvard Business Review, 70 percent of enterprise transformation efforts fail. And a lack of senior leadership is often why these businesses cannot bring about the cultural changes necessary to innovate their practices well. How can businesses avoid this unwanted outcome?

Leaders must examine their own behaviors and pinpoint conduct that undermines organizational flexibility and innovation. For instance, many executives are guilty of transferring inapplicable experiences from their past to make decisions about the future. Others prevent growth by engaging in personal perfectionism, attempting to cultivate unimpeachable executive narratives by avoiding situations that might result in failure. When business leaders identify and root on these behaviors, they open themselves up to change, setting the stage for behavioral transformation across the business and facilitating true internal improvement. Learn more about personal behavioral change in INPLCenter’s article on why simple behaviors seem impossible to change.

2. Embrace technology

Enterprise technology is often framed as a product of behavioral change. This, of course, is an accurate perception. A significant number of companies launch internal initiatives aimed at reconditioning staff and providing them with the knowledge they need to embrace newer processes centered on the latest hardware and software.

But technology is sometimes employed to support change management activities prior to the unveiling of any large-scale organizational shifts, according to CIO. Many platforms facilitate behavior change by providing leaders valuable information about how employees function during day-to-day operations, lending these decision-makers the baseline data they need to implement changes that help workers get the most out of new operations. Some solutions leverage neuroscience to help professionals grapple with amended production best practices. Employees using these advanced tools can access training modules that break down complex operational subjects into digestible instructional exercises that promote behavioral change.

Cutting-edge information technology offerings of this kind can do a lot for organizations searching for actionable tools that can support behavior change across the businesses and prepare workers for new shop-floor workflows.

3. Market innovation internally

Marketing teams often launch and oversee internal initiatives aimed at promoting behavioral change. A majority of these campaigns are designed to promote regulatory compliance or raise morale, but businesses can leverage similar promotional programs to encourage behavior change, which, in the context of operational improvement, means embracing new processes and tools.

Incubation campaigns take this approach a step further, calling workers to get involved in organizational transformation by providing professional insights and offering up potential solutions to pressing problems. Inward-facing marketing initiatives of this kind can spark behavior change among professionals in all departments, showing them that their superiors are interested in growing the business through their talent and experience.

4. Search for operational issues

Sometimes, employees are unable to adopt more innovative behaviors because of systematic roadblocks. No matter how forward-thinking the professionals trapped within these workflows may be, the surrounding workplace structures make it impossible for these individuals to act on their innovative urges. This is why businesses looking to prompt behavioral change and unlock improvements that improve their bottom lines must work to streamline operational frameworks that might prevent employees from contributing meaningfully to wider cultural change.

5. Work with external collaborators

While businesses can achieve behavioral change on their own, many may encounter stumbling blocks that require outside expertise and a fresh perspective. Here at USC Consulting Group, we’ve been working with organizations across numerous industries for more than 50 years, helping them transform their operations and adapt to marketplace shifts of all kinds. Connect with us today to learn more about our experience in process improvement and change management.

No industrial business that hopes to turn a profit in the era of Industry 4.0 can do so without selecting the right key performance indicators (KPIs). These metrics afford operations managers and senior-level decision-makers critical snapshots of how their plants operate and, more importantly, how they ought to operate in order to compete.

When it comes to Oil and Gas, the KPIs that processing facilities choose and utilize depend on their unique objectives. Even businesses within the same industry may seek vastly different insights from their data. But given the state of O&G in America today, which KPIs often make the cut?

1. Capital project efficiency

Between 2006 and 2013, budgets for capital expenditures into exploration and upstream oil production grew at many E&P firms, but have since failed to deliver on the allocation, according to a report from PricewaterhouseCoopers. Capex concerns have been no doubt exacerbated by steep decreases in per-barrel oil prices then and now.

As the Oil and Gas industry as a whole moves into more challenging drilling and extraction environs, it should consider how to visibly articulate capex project efficiency, a multifaceted measurement that combines adherence to stricter budgetary allowance, maintenance spend, and project overrun as well as creep.

2. Attendance and completion of safety training

Safety is notoriously difficult to track. This particular KPI can give on-site safety managers a peek at potential dangers to come. Oil and Gas needs this now more than ever – according to E&E News analysis of data from the Occupational Safety and Health Administration, severe work-related injuries pertaining to “support activities for oil and gas operations” occurred at a rate of nearly 149 per every 100,000 workers. Severe injury includes amputation, in-patient hospitalization, or loss of an eye.

It stands to reason that those who undergo safety training courses will act safely and avoid injury. Safety managers must therefore address any barriers suppressing attendance or completion, and KPIs tracking both will alert them to such issues, especially if they monitor the rate at which completion occurs over time. Advocacy for training will ensure investment into these programs pays off as soon as possible, a crucial factor as many O&G companies face tight margins.

3. Leaks per X customers

Midstream oil and gas firms oversee an incredibly long and intricate distribution network, which requires an understanding of its environmental impact. U.S. Oil and Gas companies manage 2.4 million miles of energy-related pipe and 72,000 miles of crude-oil pipe, according to Pipeline101.org, a website maintained by the Association of Oil Pipe Lines and the American Petroleum Institute.

Aligning maintenance spend with environmental regulations requires a deeper look into how often leaks occur, in relation to customer revenue, and which assets incur the highest repair costs.

Although these KPIs have driven success for others, their real value lies in how facilities implement them through continuous improvement initiatives. To speak to organizational management consultants on how to turn KPI insights into actions, contact USC Consulting Group today.