-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Inventory

Strikes have been in the headlines lately, with the writers’ strike bringing Hollywood to a standstill and President Biden making history as the first sitting president to ever walk a picket line (he did it in Michigan in support of the United Auto Workers strike), and most recently healthcare workers are threatening to walk out as well. The average Joe is certainly impacted by these disputes between management and workers. The writers’ strike, which was recently resolved, means no new scripted programming this fall season (say it ain’t so, Law & Order!). The auto workers’ strike means new car prices are expected to rise… as if inflation and interest rates hadn’t handled that already. And a nurses’ strike will certainly impact the care people receive.

So, it’s easy to see how everyday people are affected by strikes. How do labor strikes impact the business side of the manufacturing industry? They can wreak havoc in many facets of operations, obviously bringing production to a screeching halt during the strike itself.

But those effects, and others, can linger when employees exchange the picket line for the production line, impacting operations long after the strike is resolved. Here’s how.

Decreased output. Obviously, production is brought to a stand-still during the strike itself. So, when employees get back on the job, the entire operation is behind. It affects everything from hitting forecasted numbers to earning revenue.

Inventory snags. Other parts of the industry, like the supply chain, can be unaffected by a strike, so inventory can accumulate. Getting inventory just right is a core principle for efficiency, and it’s a delicate balancing act between too much and not enough. Strikes can throw that balance off in a big way.

Delivery delays. Product isn’t being produced during a strike, period, so obviously it’s not going to be delivered on time. But even after the strike is over, delays can continue as companies play catchup. Those delays and shortages have a ripple effect, first hitting your partners and clients, but then rippling out to their partners and clients.

Damaged relationships. Employee morale is like gold in any industry, but after a strike, especially if it’s a prolonged one, relations between employees and management can sink to an all-time low. Distrust of higher-ups can seep onto the production line, disputes may not be completely resolved to both parties’ satisfaction, collaboration can suffer. With the battle for qualified, experienced workers in manufacturing, this is a tough setback.

Bottom-line woes. All of those production delays can result in fewer orders, distrust among your clients and vendors, stock prices could even take a tumble. All of it will eat away at your profits.

How manufacturing can bounce back after strikes

When the negotiation is done and the workers are back on the job, management’s next steps can mean the difference between bouncing back quickly from a strike or feeling those nagging, lingering effects. At USC Consulting Group, we’re the experts in helping management streamline operations, become more efficient, create effective training and more — all crucial elements in the next steps after a strike.

Careful scheduling to increase production. This doesn’t mean piling on the work to make up for the shortfall. But it might mean adding additional shifts, giving people extra hours or even hiring temporary help to close that gap.

A laser focus on employee relations. Now is the time for the C-suite to get out on the production line, if they haven’t already been walking that floor. Employee relations can be at an all-time low after a strike, so it’s vital to focus on employee retention efforts, additional training and other methods to make your employees feel valued and needed.

Involve employees in the fix. Items may have been hammered out at the negotiation table, but it doesn’t mean all employees will be on board with what the union agrees to. The old adage, if it ain’t broke, don’t fix it, applies here, only in reverse. It was “broke.” Involving the people on the front lines in the “fix” in terms of streamlining operations can go a long way.

Strive for operational excellence. This means efficiency and ease all the way down the line. When your shop is running on all cylinders, it’s not just good for your company’s bottom line. Employees like their jobs better when snags, delays and other frustrations aren’t happening.

Have labor strikes affected your manufacturing operations? Need some help improving your processes to please your employees and bottom line? Contact us today and we will walk you through the steps.

When looking into the trends for the automotive industry, there’s really only one headline. Electric vehicles. EVs are no longer “the future” of the industry. The future is now. It means many changes for the automotive industry, including changing demand, supply chain and inventory (which are all connected) and workforce challenges, in addition to the specter of new facilities to handle new assembly lines. For auto manufacturers, it means a heightened focus on efficiency, which we at USC Consulting Group are all about.

Electric vehicles (EVs) aren’t dominating the market. Yet. But they’re on the road there. According to research by the International Energy Association, the demand for electric vehicles is surging and is expected to rise 35% by the end of 2023 after a record-breaking 2022.

“Surge” is a good term for it, but “tsunami” might be even better. The EV market share in the worldwide automotive industry was hovering at around 4% in 2020, jumped to 14% in 2022 and will hit 18% by the end of 2023. It shows no signs of slowing down. By 2030, the EV market share is projected to rise to 60% in the U.S. and the EU.

It feels like we’re on the cusp of a great societal change with the surging EV market, the likes of which we’ve seen during the first and second industrial revolutions, the dawn of the internet and the day, back in 2007, when Steve Jobs stood on a stage in front of the world and introduced Apple’s new invention, the iPhone.

Yes, society will be impacted, but perhaps no sector more than auto manufacturers. It means great changes in demand, new challenges with supply chain and inventory, the urgent need for increased employee education, expertise and training, and changes on the line. It’s a whole new world out there for auto manufacturers, from the C-suite to inventory management to the production line, even extending to the dealerships.

How EVs are impacting automotive manufacturers

Here’s a look at the ways EVs are impacting the auto industry today, and how USC can help.

Changing demand

A good analogy for what’s happening in auto manufacturing right now in regard to changing demand is what we saw in the food processing industry during the pandemic. If a company was mainly supplying produce to restaurants, its entire market dried up when the restaurant industry was shuttered. Many processors shifted and began supplying grocery stores — two very different markets. Companies that were agile, lean and light on their feet (so to speak) were able to shift quickly in response to the shifting demand. So, too, with automotive today. Demand for traditional cars is lessening as demand for EVs is rising. It requires auto manufacturers to do a delicate “just in time” dance, which also involves supply chain and inventory.

For more info on how to roll with changing demand, read our eBook, Strategies for Meeting Increasing Customer Demand.

Supply chain

To state the obvious, EVs require different components, technologies and parts than traditional cars. Batteries, electric motors and other types of electronics, to name a few. On a higher level for auto manufacturers, it means developing new relationships that may be outside of the current supply chain, including battery manufacturers, those who deal with raw materials and microchips, and more. Supply chain woes that began during the pandemic are still bedeviling manufacturing operations in many industries, including automotive. New and unforeseen snags in the supply chain are sure to pop up as well. Solidifying while also diversifying your supply chain, with an eye toward reshoring, is critical.

![]()

Inventory

With shifting demand and supply chain challenges, this is an especially tricky time for the auto industry, inventory managers especially. It’s important to focus on inventory and output, ensuring a balance between too much and too little. To wrangle all of these issues, demand, supply and inventory, savvy auto manufacturers are employing a methodology we call SIOP: sales, inventory and operations planning.

S&OP is a time-tested business management process that involves sales forecast reports, planning for demand and supply, and other factors. The goal is to help companies get a better, more clear look at their operations and create better-informed strategy decisions, allowing them to deliver what clients need in the most profitable way. We’ve found a lot of our clients do not include inventory as a strategic tool in their S&OP process. Therefore, they leave the “I” out of SIOP. That’s a mistake, especially now for auto manufacturers. The key to SIOP is to emphasize inventory as a strategic tool to help offset variation in demand or production issues.

To find out more about SIOP, download our free eBook: “Sales, Inventory & Operations Planning: It’s About Time.”

Workforce

Ramping up EV production or even transitioning to EVs is going to require a lot from your workforce. In some cases, your best people who have been on the production lines for their entire careers will start to feel obsolete. It means reskilling and retraining of your current people, and hiring workers with expertise in EV technology.

Infrastructure

As the demand for EVs grows, the production line will need to grow with it, shifting from traditional engine vehicles (combustion) to the kind of specialized production that EVs require. It may mean new facilities and new technology.

All of these changes for the automotive industry require a sharp focus on efficiency to meet current demand and planning to gear up for future demand. If there was ever a time for Lean Six Sigma (a methodology involving less waste, greater efficiency and consistent quality) it’s now. Lean was developed back in the day for the auto industry, and it couldn’t be more pertinent today. At USC Consulting Group, we have decades of experience helping our clients navigate changing tides in their industries. To learn more about how we can help, contact us today.

Effective inventory management is often a challenging task for businesses to undertake. While some factors may be similar across organizations, predicting inventory demand can vary significantly depending on the industry or business model. One of the most common problems affecting various industries is a lack of inventory visibility.

Inventory visibility issues have become increasingly prevalent with the rise of online shopping. The additional steps and expediency demands of this now preferred process can make tracking an item even more complicated. This often results in invisible inventory, where materials or products are unaccounted for in the system.

To address these issues, many companies are turning to supply chain visibility (SCV) technologies to remain competitive. These advanced systems provide real-time tracking, monitoring, and notification of each item in the supply chain. By utilizing responsive supply chains, a company can increase transparency within its inbound/outbound processes and other daily activities.

Another innovative solution is cloud-based POS systems and e-commerce management software. This technology integrates every aspect of a business for greater efficiency and offers a range of benefits. Companies can use it to track sales and customers, exercise better point of sale control, automate inventory replenishment, and generate reports with detailed analysis of gross margin ROI.

By utilizing modern technology to improve inventory visibility, businesses can stay ahead of the competition and provide better customer satisfaction. To discover strategies for staying ahead in inventory management, we encourage you to explore the resource provided below. It offers valuable insights to help you tackle this crucial aspect of your business operations.

Invisible Inventory from Celerant, a bike shop pos system company

If you need assistance with your inventory management, contact USC Consulting Group today.

Remember the familiar line from an old TV cop show: “There are 8 million stories in the Naked City”? As USC Consulting Group’s Vice President and Senior Operations Manager Paul Harker likes to point out, the same could be said about your inventory.

Like most dramas, the story of your inventory management can take unexpected turns. It’s very easy to get lost in the din of safety stock levels vs. Lean principles, order quantities, reorder triggers and the lead time to replenish the stock. Supply chain disruptions and shortages haven’t helped matters over the past few years. The plot unravels when these stories don’t add up to a single coherent tale.

Major characters in this inventory management drama:

Operations, which sees inventory as a buffer against fluctuating demand. But how much is too much? They don’t want an excess of stock, which would fly in the face of the popular “just in time” or Lean operating method, which, admittedly took a bit of a hit during the pandemic when people panicked about shortages and bolstered their safety stock.

Sales wants product at the ready at a moment’s notice, not “just in time,” but “all the time.” They’re not overly concerned with storage space, inventory investment or production efficiency.

Finance looks at inventory as a double-edged sword. They want to reduce inventory in order to free up cash and minimize carrying costs. But inventory is also collateral. High levels of production, whether the goods are sold or not, can absorb overhead and drive better month-end results, which are Finance’s Holy Grail.

Executives are focused on achieving quarterly corporate objectives and view inventory in terms of dollars.

At a fundamental level, all of these decision-makers speak different languages, have different perspectives and conflicting messages. Of course, everyone has the same goals: efficiency and profitability. But they may be at cross purposes getting there.

The Hero: SIOP

You might be thinking: “Is that a typo? Don’t they mean S&OP?” Yes and no. No, it’s not a typo. And yes, S&OP, the business management process that involves sales forecast reports, planning for demand and supply, and other factors, is the foundation of all of this. We just think S&OP is missing something: Inventory.

When you’re focusing on inventory, it elevates the entire planning process up a notch. When your inventory is optimized, things tend to fall into place. But it is not an easy mark to hit in these days of supply chain disruption and the sometimes conflicting goals of key decision-makers. With SIOP, you can circumvent these challenges and make your inventory work for you.

“A key to SIOP is to emphasize inventory as a strategic tool to help offset variation in either demand or production issues,” explains David Shouldice, Senior Vice President and Managing Director at USC Consulting Group. “One lever of control in the SIOP process is to make inventory harder working as a strategic tool.”

As Shouldice notes, it’s about having the right conversations about the right topics at the right time.

This isn’t a one-and-done process. The SIOP planning horizon should be at least a rolling 14-month period. We recommend that our clients update their plans monthly. Some do it more often than that. The point is covering a sufficient span of time to make sure the necessary resources will be available when you need them. The plans take into account projections made by the sales and marketing departments and the resources available from manufacturing, engineering, purchasing and finance. All of that together works toward hitting the company’s goals and objectives.

Using SIOP for inventory management

Sales, Inventory and Operations Planning helps your company get departments in sync, ensures that everyone is on the same page and realistic about the process, helps you manage and roll with changes, and measures performance.

One powerful component of SIOP is that the process involves all of the key players in your inventory drama.

Here’s who we typically see take part in the SIOP process:

- President

- Vice President, Sales and Marketing

- Vice President, Operations

- Director of Logistics

- Vice President, Engineering

- Vice President, Finance

- Vice President, Information Systems

- Vice President, Human Resources

Different languages? You bet. But getting them all working together cuts down on the noise of those different languages. One reason SIOP is such a critical management tool is that key players from many departments are working from the same plan, and able to compare actual results to plan, evaluate their performance, and prepare updated plans going forward. SIOP: The universal translator, or C-3PO, for your business.

It is a powerful tool to help you wrangle your inventory management, achieve the optimal balance between not enough and too much, and settle back into Lean (or just in time) manufacturing principles that can eliminate waste and help ramp up your efficiency.

If you’d like to learn more about SIOP, download our (free) eBook, “Sales, Inventory & Operations Planning: It’s About Time.”

In life, bottlenecks crop up from time to time; moments where we’re stuck and can’t push through a problem. Patience may be the only remedy. In the manufacturing sector, however, bottlenecks can be a serious drain on productivity, revenue, efficiency, and asset utilization.

What does a bottleneck mean in manufacturing terms?

When people think casually of “bottlenecks,” they might think of forced congestion, like traffic on a multi-lane highway pinched down to a single lane for construction or emergency reasons. Traffic would be an apt metaphor, as bottlenecks on the road and those in a manufacturing plant are both concerned with throughput and achieving continuous flow.

However, in manufacturing, bottlenecks have their own clear-cut definition as well. According to the Institute of Industrial and Systems Engineers, bottlenecks occur when:

- A process step exceeds 100 percent utilization

- Capacity drops below or equals takt time

- Capacity drops below or equals demand

To identify bottlenecks, plant managers ought to utilize operational data and tighten their focus on steps in assembly that meet these specifications or come close. However, seasoned plant employees and equipment operators may be able to sense and point out potential bottlenecks without crunching the numbers.

What do bottlenecks look like on the plant floor?

For some manufacturing processes, bottlenecks are easy to spot. For instance, if asset operators in a bottling facility – to continue with today’s theme – notice visible accumulation of goods clogging a labeler, chances are the labeler is the issue, so long as all other operations appear to be functioning to capacity.

“One common indicator of a bottleneck is inventory overabundance.”

Other times, bottlenecks are not as readily apparent, but misbehaving processes ancillary to production may clue plant managers into trouble elsewhere. One common indicator of a bottleneck is inventory overabundance. When manufactures have aligned inventory needs against demand properly, inventories should remain relatively lean. Materials overflow in that context, therefore, would signal capacity issues somewhere in production. All that’s left to do is hunt them down and sort them out.

How can manufacturers overcome bottlenecks?

Once plant managers locate their bottleneck, they must perform three basic functions to formulate a solution. First, they must temporarily reduce the capacity of the entire process, carefully watching how a bottleneck functions for any observable performance problems.

Second, upon gathering a few notions as to what may be creating a bottleneck, plant managers must then conduct root cause analysis on each. Root cause analysis involves tracing the conspicuous bottleneck issue back to its true catalyst. Perhaps it’s as simple as a mechanical failure, or maybe as comprehensive as accidental overproduction.

Finally, after arriving at the bottleneck’s root cause, plant managers should assess whether it is a long- or short-term concern. Long-term concerns may require organizational change to correct the issue once and for all, but may require scheduled maintenance or production downtime to finalize the fix.

Short-term concerns generally correct themselves with little to no intervention. However, in the meantime, plant managers may feel more secure in their operations by decentralizing capacity over multiple employees or machinery. That way, should an out-and-out failure occur, manufacturers minimize the effect of downtime on productivity.

Trade advisory consultants at Vigilant Global Trade Services, a turn-key solutions provider for every aspect of global trade management, configured a detailed infographic illustrating how to avoid bottlenecks in your supply chain:

Contact us today to learn more about how you can avoid manufacturing bottlenecks and optimize your operations.

In the blog Every Part Has a Purpose: Building Materials Manufacturing, we learned about a few of the challenges that the American housing market and its producers will be facing here in 2019. The number of wildfires occurring annually is increasing at alarming rates and the building materials manufacturers are feeling the repercussions from these natural disasters. The softwood and hardwood resources being burned down are causing the lumber suppliers to struggle to meet the demands of the home construction market. Furthermore, the housing market being on fire lately (pun intended) has led to intense bidding wars among buyers while developers work hard to increase inventories. To top it all off, material costs have increased significantly due to the global trade showdown linked to the recently introduced tariffs.

Backbone of the American housing market

Building materials manufacturers are poised to overcome the various obstacles thrown their way and accelerate operations in this demanding economy. Thus, continuing to power the U.S. housing market. But, just how pivotal are these building materials producers to the consumers who are scouring Zillow and Realtor.com in search of their dream home?

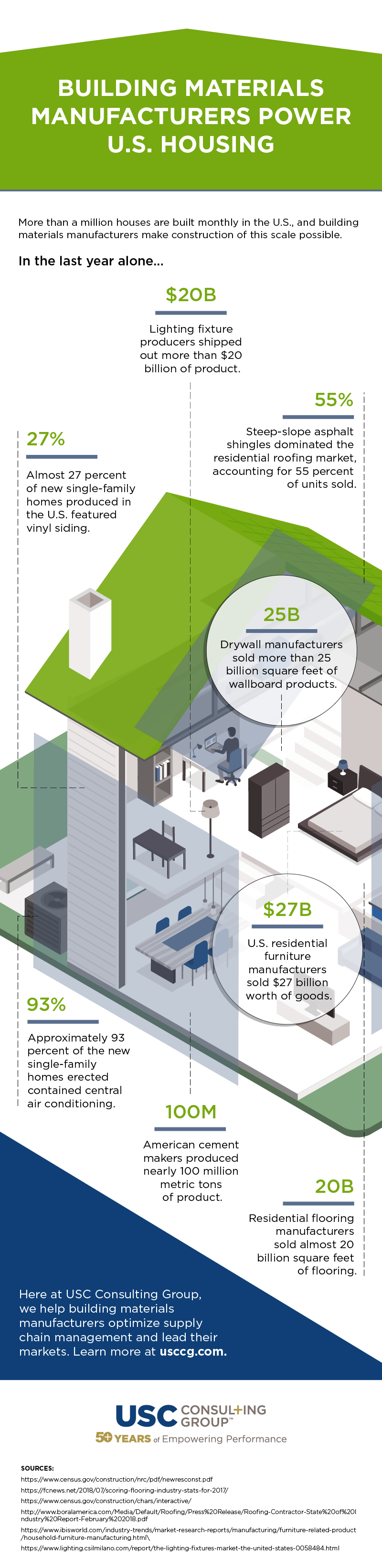

Here at USC, we love to analyze data and processes as much as Joey Tribbiani loves to eat sandwiches. So, we took a deeper dive into just how important these building materials manufacturers truly are to the industry. We put our results into a cool infographic for easy digestion. You will see that every part, or every manufacturer, has a significant purpose in powering the whole.

“More than a million houses are built monthly in the U.S.” That stat in itself is incredible. What’s even more mind-blowing is when you start considering “how” this is all made possible and realize how crucial building materials manufacturers really are to the industry.

Providing more power

It is essential that these behind-the-scenes producers improve their processes to keep pace with the housing market demands. However, with such a strain to keep up, building materials manufacturers may not have time to analyze and optimize their operations and could use some extra horsepower. USC Consulting Group is here to help. By working with your shop-floor personnel and leadership teams, we not only help to achieve greater throughput and yield, but can also enhance your supply chain management to improve in areas such as strategic sourcing, maintenance practices, and logistics.

Contact us today to discuss how together we can help you sustain as well as thrive in the current opportunistic landscape.

From foundation concrete to tile adhesive, the average house contains many different components. Building materials manufacturers are, of course, responsible for producing these essential supplies. Collectively, they are the backbone of the American housing market. These businesses are poised to continue their successes into the new year, a comforting sign for U.S. home builders, especially those who intend to accelerate operations in 2019 to bridge the inventory gap, according to research from the National Association of Realtors.

That said, building materials manufacturers will also face significant obstacles throughout the coming year. Here are a few of those challenges and how they might affect the organizations that form the foundation of the domestic housing market:

Wildfires

More than 52,300 separate wildfires burned through approximately 8.5 million acres in 2018, according to analysts for the National Interagency Fire Center. While neither of these figures surpassed historic highs, together they still paint a disturbing picture. Between 2008 and 2017, roughly 60,300 wildfires occurred annually, each one burning around 105 acres of land, but in 2018 the average wildfire claimed 163 acres. Suffice it to say, wildfires are getting worse, so their repercussions on related industries, such as building materials manufacturers, will continue to escalate.

This disturbing development is especially concerning to businesses in the forestry industry, which supplies the softwood and hardwood used in home construction. While reports from the Department of Agriculture show that forest inventories have steadily increased over the last seven decades, the recent intensification of wildfires threatens American woodlands and, by extension, the lumber suppliers that depend on them. Unfortunately, the NIFC believes that significant fire activity is likely to unfold over the course of 2019, meaning timber manufacturers will have to grapple with the threat of wildfire over the coming months and look for ways to mitigate the associated production risks.

America’s global trade showdown

When the Trump administration announced that it would increase duties on aluminum and steel imports back in March 2018, leaders in the home building space immediately criticized the decision. Randy Noel, chairman of the National Association of Home Builders, said the then-proposed tariffs would “translate into higher costs for U.S. consumers and businesses.” American Institute of Architects CEO Robert Ivy offered a similar sentiment, concluding that “inflating the cost of materials will limit the range of options [that architects] can use while adhering to budgetary constraints for a building.”

However, these voices failed to persuade the Department of Commerce, which enacted the tariffs in May. In the months since, material costs have indeed increased significantly, according to data analysis from the Associated General Contractors of America. Over the same span, the White House has issued additional import duty increases, further weighing down building materials manufacturers, their clients, and American homebuyers.

While America’s global trade conflicts have cooled as of late, President Trump has reiterated his desire to move forward with similar trade policies, NBC News reported. Enterprises in the building materials space could encounter new challenges linked to tariffs in 2019. Again, businesses in the industry will likely have to engage in some operational reorganization to reduce the bottom-line impact of any new duties.

A hot housing market

American home builders have struggled to meet demand in recent years, forcing buyers to participate in intense bidding wars, but developers are working hard to increase inventories, according to research from the U.S. Census Bureau. Residential permits, starts, and completions rose in 2018, signaling the arrival of a building construction boom. This activity is expected to continue into 2019, during which time single-family housing starts are forecasted to increase, analysts for the NAR found. Building materials manufacturers may find themselves fielding higher order volumes, even as sourcing gets more complicated and supplies dwindle.

Together, these developments pose serious challenges to organizations navigating the building materials manufacturing arena and may necessitate the implementation of new shop-floor techniques and tools. Here at USC Consulting Group, we have been helping businesses of all kinds adjust to new marketplace conditions, implementing on-the-ground strategies that lay the groundwork for success.

Connect with USCCG today to learn more about our work and how we can help your company prepare for the challenging year ahead.

Marketplace pressures have forced procurement professionals to abandon traditional sourcing practices and implement more responsive strategies designed to promote organizational efficiency, agility and flexibility for growth, not to mention cost reductions. For businesses on the outside looking in, it might be difficult to understand how strategic sourcing differs from other long-established procurement practices. Here’s what differentiates truly strategic sourcing strategies from their predecessors:

Data dominates strategic decision-making

In the past, procurement professionals focused on building and maintaining relationships with suppliers. This makes sense on the surface. After all, vendors are more likely to provide price reductions and special services to loyal customers than they are fickle patrons. However, these connections can become problematic. Service agreements might fade over time as casual collaboration usurps formal partnership. This can lay the groundwork for cost increases and significant breakdowns in service delivery.

Conversely, strategic sourcing strategies place more focus on data analysis rather than relationship-building, according to Insight Sourcing Group. Instead of measuring vendor performance via the quality and frequency of personal interactions, procurement teams utilizing this methodology base their decisions on actionable KPIs and regularly review active contracts to ensure adherence. While impersonal, this approach often generates optimal return on investment as it allows procurement teams to partner with high-quality suppliers and therefore strategically source materials based on real-time marketplace conditions. This operational strategy is essential today because of fluctuating raw material prices, according to analysis from analysts at Knoema.

Growth outpaces gain

Stakeholders in most departments normally gravitate toward operational strategies that net quick wins. Procurement professionals are no different – and for good reason. More than 80 percent manage activities that directly affect the bottom line and contribute to company success, analysts for PricewaterhouseCoopers found. As a result, most are under pressure to appease executives who answer to shareholders looking for immediate, demonstrable progress. Unfortunately, quick wins do not translate to sustainable success. Deals made in the interest of immediate budgetary or operational improvement often lose their luster over time and can become budgetary burdens, the organization discovered. Additionally, some vendors draw up contracts in anticipation of this strategy, front-loading potential agreements with discounts or credits that disappear following the first year or so.

On the other hand, supplier agreements developed as a part of strategic sourcing best practices center on short-term and long-term company needs, allowing vendors to provide services that change or scale with the organization. The benefits that come with these contracts tend to unfold slowly, making them considerably less flashy than deals designed to generate quick wins. However, they undoubtedly have a more lasting affect on operations by facilitating extended growth.

Strategic thinking begets bargains

In the past, vendors had the upper hand when negotiating with businesses due, in part, to the fact that few procurement teams spent time looking into alternative sourcing options, Insight Sourcing Group reported. In fact, best practices dictated that procurement professionals solicit a handful of proposals and choose the cheapest out of the bunch. This was, of course, an immensely problematic strategy that not only increased the likelihood of budgetary overrun but also promoted operational decline. The emergence of strategic sourcing has changed the procurement paradigm, allowing organizations to take back bargaining power via strategic thinking.

Today, businesses confronted with unfavorable supplier agreements are likely to look for other arrangements by mining their supply chains for sourcing functionalities that might negate the need for external partners. Sometimes, enterprises decide to keep things in-house and avoid third parties altogether. In other cases, this practice prompts vendors to reassess their original proposed agreements and draft new contracts with more favorable terms. No matter the strategic method of choice, organizations that pursue methodologies centered on strategic thinking can save money and ensure they can bring in the raw materials needed for production.

These are just a handful of the variables that separate traditional sourcing models and strategic approaches, which continue to increase in popularity due to their effectiveness. Indeed, businesses that embrace strategic sourcing can develop sustainable workflows that facilitate long-term growth and keep costs low – truly the best of both worlds.

Here at USC Consulting Group, we’ve been working with organizations in almost every industry for 50 years, helping them transform their operations and adapt to marketplace shifts of all kinds. Connect with us today to learn more about our experience and how we can help your company bolster its bottom line by embracing strategic sourcing.

With approximately 765 million acres of woodland, America ranks among the most forested nations, according to research from the U.S. Forest Service. Consequently, the country boasts a healthy forestry sector. After evaluating raw data from the USFS and the Institute for Supply Management, analysts from Forest2Market found that total production is up across the industry, as lumber, paper, pulp, and wood manufacturers rush to fill increasing order volumes. However, the industry faces multiple large-scale challenges that threaten to erode recent gains. Here are some of those obstructions and how they might affect the American forestry industry:

Wildfires

Massive blazes have dominated the news in recent months. The Woolsey and Camp Fires together devastated more than 250,000 acres and killed 91 people throughout Southern California in October and November 2018. Unfortunately, California and other western states have grown accustomed to such disasters over the last decade or so. The total amount of acreage burned has steadily increased since 2003, according to data from the National Interagency Fire Center, compiled and published by the Insurance Information Institute.

In addition to creating a serious public safety risk, wildfires especially problematic for businesses in the American forestry industry. Wildfires are among the most serious threats to forest resource supply, according to research from the U.S. Endowment for Forestry and Communities. As these blazes increase in volume and intensity, the total inventory of usable trees drops. In fact, American forestry companies on the West Coast are already grappling with operational issues linked to the recent California wildfires. Unfortunately, these disasters are likely to increase in frequency over the coming years, which means organizations in the U.S. forestry sector must take action to protect their supply chains. Increased investment in the fuel management activities is an ideal course of action, as is the introduction of supply fail-safes that kick in should a blaze destroy linchpin wood supplies.

Sustainability

Many companies made changes to their forest management practices in 1992 as a result of the UN introducing the Forest Principles during its conference on Environment and Development in Rio de Janeiro. This document called on member nations to promote forestry practices that “meet the social, economic, ecological, cultural and spiritual needs of present and future generations.” In the years since, the concepts laid out in the Forest Principles have gained serious traction in the industry because of the emergence of various supply risks, including insect infestation and wildfire. By ensuring forest biodiversity, facilitating healthy ecosystems, and maintaining and conserving clean soil and water resources, businesses in the forestry sector can address such hazards and cultivate long-lasting supplies, according to the USFS.

However, this is difficult and expensive work. Companies pursuing the Sustainable Forestry Initiative’s certification standard often incur extra costs during the process, researchers for the North Carolina State University found. While many have the budget required to hire extra forest management staffers and implement strong sustainability programs, a similarly large number do not. Recent developments have revealed sustainable forest management to be essential today. This puts lumber producers in a tough position.

Staffing shortages

Despite recent success in the marketplace, organizations in the American forestry industry are suffering operational dysfunction linked to staffing shortages. The logging workforce is declining at an accelerated rate, according to the Bureau of Labor Statistics, which estimates that the industry will be short of some 7,000 loggers by 2026.

Logging is an incredibly dangerous job and takes an immense physical toll on workers, two factors that dissuade younger U.S. residents from entering this vital profession, NPR reported. It also applies to tradesmen and engineers in the mills. Young engineers do not want to join this industry because the mills tend to be located in smaller towns and there is a belief that forestry is not “high tech.”

Additionally, training in this area is hard to come by, according to the Forest Resource Association. People who might be interested in working in the forestry industry struggle to get the education and practical instruction they need to find success out in the field. Therefore, many companies are having difficulty replacing tradesmen as they retire and, in turn, are losing all that knowledge and expertise. Businesses in the industry must address this ongoing issue to ensure they can meet customer demand and remain competitive in the marketplace. USC Consulting Group helps by providing a framework to define the skills required and “downloads” the knowledge of retiring tradesmen into solid job instructions for future maintenance work.

Together, these challenges appear daunting to even the most capable American lumber, paper, pulp, and wood manufacturers. However, these organizations have no choice but to pursue internal improvements that mitigate the impact of wildfires, promote sustainability, and address staffing shortages. Of course, companies in the sector don’t have to embark on such efforts alone. Here at USC Consulting Group, we have been assisting enterprises in the forestry industry for decades, lending them external perspective and operational expertise they need to reshape their operations in response to significant challenges.

Contact us today to learn more about our work in the forestry industry.

Modern retail organizations stock many different items to attract the widest audience of customers. But did you know that, according to the National Association of Convenience Stores and Inbound Logistics, the average corner convenience store may have as many as 2,500 SKUs, while the big-box grocer down the street might store more than 40,000?

Keeping this many products on hand might seem like the ideal strategy for facing ever-changing consumer demands. But this stock-heavy approach often does more damage than good. Simply storing in-demand products is expensive, and keeping items that fail to move costs even more. For this reason, many sellers are embracing SKU rationalization, which involves evaluating available products and stocking only the most sought-after items.

Intent on reducing its annual gross margin by 125 basis points, Hershey recently embraced this methodology, Food Business News reported. Retailers that believe they’re spending too much on warehousing undesirable items would be wise to follow in the footsteps of the confectionery giant. Here are three strategies for jump-starting SKU rationalization:

1. Establish workable sales benchmarks

Businesses pursuing SKU rationalization must establish sales benchmarks to determine which SKUs to cut. These thresholds will vary depending on the financial state of the organization and its fiscal goals. Scale is another critical differentiating factor. Larger retailers might use established benchmarks involving cases sold. Smaller sellers might use just units, according to Retail Wire.

2. Embrace the ABC inventory rule

With workable benchmarks in place, organizations can move on to cutting down stock. The ABC inventory reduction strategy is perhaps the best option for retailers embarking on such efforts, Inbound Logistics reported. This involves separating items into three categories: Products in the A category are bestsellers. Those in the B category generally perform well. Items in the C-category rarely sell and drive up costs simply by sitting in the warehouse. These are offerings removed as part of SKU rationalization.

3. Address disposal

After identifying products ripe for removal, organizations must figure out methods for disposal. This is often easier said than done, but many businesses find success through write-offs or low-priced distribution networks perfect for off-loading superfluous product.

Retailers that implement these three strategies can effectively manage SKU rationalization efforts and generate savings. Those still unsure of how to pursue this methodology should consider working with USC Consulting Group. For more than five decades, our experts have been helping sellers streamline their operations through cutting-edge optimization efforts.

Contact us today or subscribe to our blog to continue receiving insight from our subject matter experts.