-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2024 (4)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Food Manufacturing

The rise in food prices is all over the news these days. The USDA and the Consumer Price Index tell us that, in 2023, grocery store purchases were up 5% from the previous year, while eating out cost an average of 7.1% more. This year, those costs are set to bump up another 1.3%. But, if you work in food manufacturing, (or buy groceries for your household) you don’t need the government to tell you those prices are rising.

It’s the trickle-down effect. Challenges facing food manufacturers mean higher production costs, which are ultimately influencing everyone’s grocery bills.

Here’s why, and what food manufacturers can do to save money on the front end to stop that trickle down.

Challenges affecting food prices

Some of the issues food manufacturers are navigating through that can ultimately show up in prices at the grocery store include:

Supply chain disruptions. Whether it’s geopolitical tensions, droughts, wildfires, strikes, or other events, it can disrupt the supply of raw materials food manufacturers use to get the job done. This can and does create delays, backlogs and other costly challenges.

Price inflation. Before price increases hit the grocery store shelves, the rising cost of things like grain, meat and dairy affects manufacturers who use those raw materials to make their goods.

Shipping costs. Rising fuel prices affect how much it costs to get those raw materials to food manufacturers, whether it’s coming from across town or across the world.

Labor shortages. The continuing battle to hire and train good people, and retain the ones you have, contributes to labor costs at the plant, which contributes to rising costs for the end user.

Evolving demand. Consumers are ever changing in their preferences and expectations. People are increasingly demanding sustainability, ethical sourcing, friendly practices like free-ranging and more. And dietary trends shift too, with plant-based alternatives growing in popularity on the one hand and minimally-processed meals on the other. This makes it difficult for manufacturers to forecast to accommodate the demand.

Regulations. Compliance with FDA regulations can be complex at best and lead to inefficiency and higher costs for manufacturers at worst. It’s especially prevalent in yield, when manufacturers are trying to hit the “wiggle room” the government allows between what the package label says and how much product is actually in the package. Not wanting to be out of compliance, manufacturers often overfill packaging to reach that sweet spot, but it means they’re actually giving away product… and profits.

All of these challenges can have a direct impact on manufacturing costs and will inevitably trickle down to their customers. It boils down to:

Higher production costs. This is by no means unique to the food manufacturing industry. Higher production costs on things like raw materials, labor, transportation and more mean higher costs to the customer – that’s a fact of life for most every business.

Supply and demand uncertainty. Supply chain disruption leads to shortages, which cause prices to rise.

How food manufacturers can tackle these challenges

In the short term, agility is key. But strategic planning, process improvements, and a focus on efficiency can shore up food manufacturers for the long run.

Sales, Inventory & Operations Planning which we call SIOP, takes the sales and operations planning (S&OP) process that most manufacturers use and adds inventory to the mix. At USCCG, we find inventory is often left out of the planning process, but it can be as important of a variable and a strategic tool. Following this methodology helps manufacturers eliminate waste, increase efficiencies and achieve an optimal level between not enough and too much.

It’s also an unparalleled tool for inventory management, which is a tricky business today given all of the challenges this industry is facing.

If you would like to learn more about SIOP, download our (free) eBook, “Sales, Inventory & Operations Planning: It’s About Time.”

Process improvements. One way streamlining and refocusing your processes can help manufacturers now is in the area of yield. Getting a handle on yield — improving processes so you’re not giving away product — can save millions of dollars. To learn more about how one food distributor saved $2.3 million per year by improving their yield, read “Food Distributor Masters Management by the Numbers to Improve Yield.” And speaking of management by the numbers…

Implement a Solid Management Operations System. Many manufacturers, whether food or other industries, tend to manage on the basis of what has worked in the past, a gut feeling by seasoned managers, and other methods. At USCCG, we like hard numbers, streamlined processes and everyone doing the same job the same way. And about that…

Focus on training. It’s crucial to have all shifts, all facilities and all employees working in tandem, doing the same job the same way. It’s how you create the proverbial well-oiled machine.

None of these tactics will stop challenges from happening, but they can and do make your operations more efficient, and in turn, save you money. Not only will it improve your bottom line, but you might just be able to trickle the savings down to your customers, too.

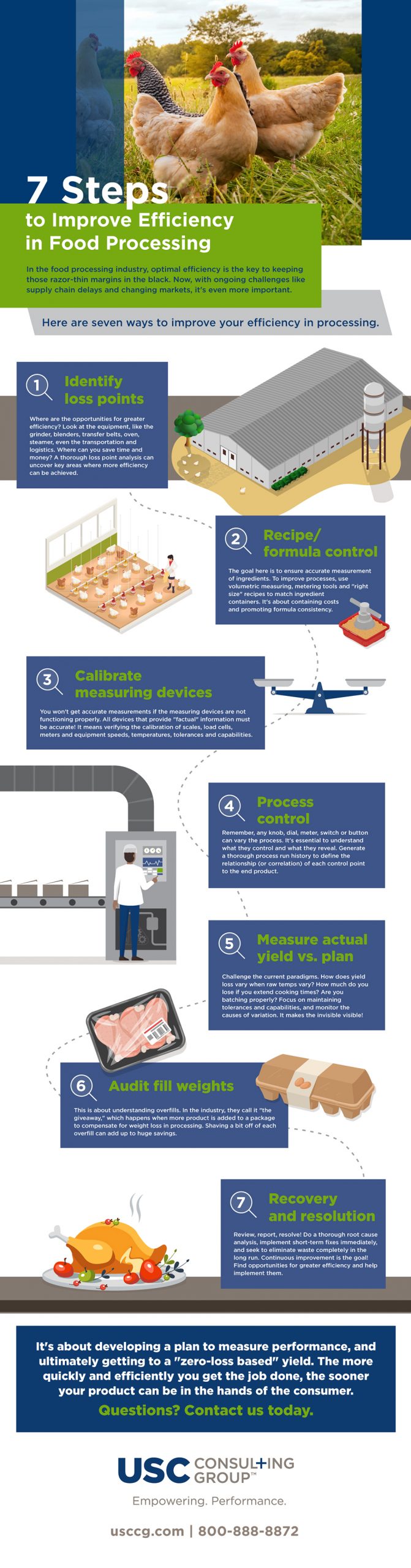

In the food processing industry, optimal efficiency is the key to keeping those razor-thin margins in the black. Now, with ongoing challenges like supply chain delays and changing markets, it’s even more important.

Efficient processes lead to reduced operating costs, improved yield and throughput, and more control over your management systems.

The following graphic provides seven ways to improve your efficiency in food processing:

1. Identify loss points

Where are the opportunities for greater efficiency? Look at the equipment, like the grinder, blenders, transfer belts, oven, steamer, even the transportation and logistics. Where can you save time and money? A thorough loss point analysis can uncover key areas where more efficiency can be achieved.

2. Recipe/formula control

The goal here is to ensure accurate measurement of ingredients. To improve processes, use volumetric measuring, metering tools and “right size” recipes to match ingredient containers. It’s about containing costs and promoting formula consistency.

3. Calibrate measuring devices

You won’t get accurate measurements if the measuring devices are not functioning properly. All devices that provide “factual” information must be accurate! It means verifying the calibration of scales, load cells, meters and equipment speeds, temperatures, tolerances and capabilities.

4. Process control

Remember, any knob, dial, meter, switch or button can vary the process. It’s essential to understand what they control and what they reveal. Generate a thorough process run history to define the relationship (or correlation) of each control point to the end product.

5. Measure actual yield vs. plan

Challenge the current paradigms. How does yield loss vary when raw temps vary? How much do you lose if you extend cooking times? Are you batching properly? Focus on maintaining tolerances and capabilities, and monitor the causes of variation. It makes the invisible visible!

6. Audit fill weights

This is about understanding overfills. In the industry, they call it “the giveaway,” which happens when more product is added to a package to compensate for weight loss in processing. Shaving a bit off of each overfill can add up to huge savings.

7. Recovery and resolution

Review, report, resolve! Do a thorough root cause analysis, implement short-term fixes immediately, and seek to eliminate waste completely in the long run. Continuous improvement is the goal! Find opportunities for greater efficiency and help implement them.

It’s about developing a plan to measure performance, and ultimately getting to a “zero-loss based” yield. The more quickly and efficiently you get the job done, the sooner your product can be in the hands of the consumer. Questions? Contact us today.

For more information about how Food & Beverage consultants can significantly reduce your operating costs and improve productivity, read this eBook:

The food and beverage manufacturing industry is facing labor shortages. While labor challenges aren’t new to the industry, the reasons for this current situation are. The pandemic brought about a seismic shift and disruption for nearly every industry, F&B included. Many companies, like Smithfield Foods and Tyson Foods, saw closures of multiple facilities. Others stayed the course but laid off employees, and as the country begins emerging into a post-pandemic new reality, some of those employees simply aren’t returning to their jobs.

There’s also the matter of older workers retiring and not enough young workers entering the industry, leaving a skills gap as those veterans take their institutional knowledge out the door with them.

Together, they add up to a two-pronged labor shortage problem. You not only don’t have enough people to get the job done, the people you do have aren’t as skilled as the ones you lost.

Let’s look at both of those prongs in more detail.

Labor shortage challenges and questions

Like many industries, F&B is getting a handle on whether changes brought about by the pandemic will be permanent. Some challenges like supply chain disruptions can go away forever, please, but other aspects, like the adaptation of workflows, processes and procedures have proven to be positive changes.

Some questions F&B processors are grappling with now:

- Our staffing levels are down. Do we really need to staff up to pre-pandemic levels?

- Our demand is increasing. Can we meet rising demand with less staff?

- Will new configurations on the shop floor to accommodate social distancing continue if and when the entire workforce is vaccinated?

- How will companies deal with potential work stoppages in the future?

- Will we adapt to more regional, less centralized facilities?

- Should we change our forecasting model from yearly to quarterly or even monthly to be more agile?

Solution: Process improvements

The answer to all of these questions is: It depends on efficiency. Some companies, when aiming to do more with current assets and employees or, especially when they’re seeking to do more with fewer employees because of a labor shortage like the one we’re in now, turn immediately to automation, machinery upgrades, even artificial intelligence. The aim is to take the human element out of the equation or reduce it dramatically, with the goal of streamlining and speeding up operations.

But is all of that upfront expense worth it?

Time and time again, clients have come to us after trying to “buy their way to profitability” through large capital investments in technology and automation, only to see that profitability disappear because of high overhead costs of those upgrades.

A better solution to dealing with this labor shortage, keeping up with rising demand, and doing it all with fewer people is to optimize your processes first.

At USC Consulting Group, we’ve helped hundreds of businesses navigate operational challenges so they can get the job done efficiently and better meet the needs of their customers. The key to doing more with less, or even doing more with your current assets, is taking a deep dive into your operations to discover ways to be more efficient. That’s one of our specialties, and we’ve been doing it for more than 50 years.

In one example, we worked with a poultry processor that experienced just this situation, making huge capital investments only to see any gains eaten up by high overhead costs.

We created cross-functional teams to evaluate the operation, highlighted the non-value-added activities and conducted analysis. Based on those findings, the teams identified waste and process variations that were causing lower yields, created improvements in workstation layouts and material flow, and conducted training sessions designed to impact yield performance. All told, we identified 300 loss points within their operation. Results?

By the end of our six-month engagement, the company saw a financial gain of $100 million, all realized without capital investments. That’s not chicken feed! Read more about it in our case study, “Poultry Processor Gobbles up Savings From Process Automation.”

Skills gap challenges

The other prong to today’s labor shortages in food and beverage manufacturing has to do with older, veteran workers leaving their jobs and taking their knowledge with them.

If you’ve got a team filled with long-tenured employees, you know what this is like. It’s one thing to train someone new on the basics of the job. It’s something else to lose your best worker who spent a career doing that job. It’s the experiences, processes, deep understanding and “this comes naturally” abilities of your people to get the job done in an intuitive way. The hard-won, trial-and-error-gleaned instincts that your senior people have absorbed from years on your front lines. That’s your company’s institutional knowledge.

When older workers retire or are laid off, that’s what you’re losing.

Skills gap solutions

There are a few tactics you can use to help close the skills gap.

Mentorship. Do you have a mentorship program in place? It can be an invaluable (and very low cost) way to transfer knowledge from your seasoned pros to your newbies.

Recorded interviews. Talk to your older employees about lessons learned on the job, hard-won experience and mistakes that taught them the right way to do things. Record those interviews for new hires to watch as part of their onboarding process.

Involve employees in process improvements. We’ve found that one of the most critical parts of enacting process improvements to create greater efficiency in our clients’ operations is getting buy-in from the front lines. Without it, we can find all the hidden opportunities for efficiency in the world but putting them into practice will be a challenge without your team on board. Getting your employees invested in process improvements from the get-go also has the added benefit of creating institutional knowledge. The younger workers were there when the process was changed, they contributed to it and they’ll carry that knowledge with them as long as they work for you.

Like many of the challenges we’ve experienced over the past couple years, silver linings can emerge from food manufacturing labor shortages and skills gaps. You can find better, more efficient operations without making huge capital improvements, and through that process, you can create institutional knowledge in your employees and close that skills gap for good.

At USC Consulting Group, we’re subject matter experts in helping companies find more efficiency out of their current assets. Learn more about doing more with the same or less resources in our white paper “Strategies for Meeting Increasing Customer Demand.”

As America dusts off and gets back to business as usual, what can the food and beverage industry expect to find on the road ahead for the latter half of 2021? While some 60% of manufacturers and processors, including F&B, report being impacted by the pandemic (we’d put that figure a lot higher, frankly), demand for products in many, if not all, sectors is beginning to surge. Roaring ’20s, here we come.

So, what does that mean for F&B? According to the 2021 Manufacturing Outlook Survey by Food Processing magazine, the industry is cautiously optimistic. Here are some quick takeaways from that survey:

- 58% of food manufacturers were very or somewhat optimistic about 2021.

- 41% plan to staff up while 44% will maintain current staffing levels.

- 41% plan to increase production and add lines or plants, while 35% will maintain current production levels.

All of that points to good news. Here at USC Consulting, we don’t exactly have a crystal ball, but we are seeing some other trends emerging for F&B as well. Let’s take a closer look.

Were supply chain disruptions a good thing?

OK, hear us out. Nobody is a fan of supply chain disruptions. The unprecedented level of disruption of the pandemic caused inordinate headaches, work stoppages and all kinds of other problems. But it also forced manufacturers of all stripes to focus on efficiency and agility, create new processes and procedures, find alternate routes on their supply chains and a host of other things. The key was finding ways to pivot quickly. Carrying forward some of those lessons learned can make your operations more efficient and leaner than before. Another way disruption might ultimately impact F&B is the trend toward more localized production. On the consumer side of the F&B industry, it’s been about farm-to-table for a while. It may slide into the manufacturing and processing side as well, with good reason. Global supply chains may remain unreliable for the near future.

Automation is here to stay.

Many F&B manufacturers and processors relied on automation on the line to get the job done with fewer people, due to layoffs and social distancing restrictions. All signs point to this trend being permanent. This is not replacing people with machines. It’s using technology to help people do their jobs on the line faster, more efficiently and with less repetitive injuries than before. Automation also creates new work and new ways to work. All of this is an acceleration of the Industry 4.0 revolution that started a few years back with the Internet of Things (IoT), and it’s about interconnectivity. A new term is coming into play: smart manufacturing.

Increases in process efficiency.

Making operations more efficient with the goal of increasing throughput for the long term is the core of our business. Every company out there wants to be more efficient, do more with the assets they have or do the same with less. Competing in the post-pandemic marketplace, when hiring is tight, low-end jobs remain unfilled, and demand is rising, means that being as lean and efficient as possible isn’t a nice-to-have anymore. It’s a vital necessity.

A heightened focus on forecasting and demand planning.

We recommend a process we call SIOP to get the clearest look at your operations now and down the road. It helps companies make better strategic decisions. The common version of this process is sales and operations planning. We think it misses a critical piece of the puzzle: inventory. Adding inventory into the mix is just one additional step, but we find it can be the key to the whole thing. When you’re focusing on inventory, it requires more careful planning and elevates the entire planning process up a notch. We like to tell our clients that the purpose of SIOP is making sure you’re having the right conversations about the right things at the right time. And getting what you need when you need it.

According to the survey, other issues on the minds of F&B manufacturers in 2021 include food safety, worker safety and cost control. Ultimately, it boils down to better, more efficient processes, and a leaner, more agile operation that increases throughput and cuts expenses.

At USC Consulting Group, we’ve been helping companies do just that for half a century. If you’re interested in talking with us about how to position your F&B operation for the future, contact us today.