-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2024 (4)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Building materials

Like most industries today, the building products industry is faced with a host of challenges. These uncertain economic times aren’t helping matters any. Here are some of the top challenges we’ve identified, and tactics to combat them.

Challenge #1: Post-COVID demand

As the tumultuous start to the decade began to ease back into normalcy, the industry saw an increase in consumer spending and a boom for the construction and building products industries. What was behind it? Potential customers had time to sit and think. A year or more of being involuntarily secluded in their homes put their current infrastructure to the test. Who thought that kitchen countertop was a good idea? Wouldn’t it be nice to open the wall up and put in a breakfast bar? And… while we’re at it, let’s install that screened-in porch to go with it. The projects consumers had been thinking about for months were finally able to be realized and construction started up again with a vengeance.

Great! But building products manufacturers have been struggling to meet this ever-growing demand.

Strategy: Don’t turn down work — extend your lead time

Many of our clients have more work than they can handle right now. While it may seem unrealistic to take on every project in sight, it’s important to shore up your bottom line that took such a hit during the pandemic. Extending your lead time by a few weeks will allow you to accept more jobs and keep business flowing.

Challenge #2: Supply chain bottlenecks

A post-COVID boom is great for business — until you can’t get the materials you need at a price that makes sense. Supply chain disruptions have been commonplace for a few years now and that disruption is touching nearly every industry imaginable.

The pandemic showed just how vulnerable the current state of the supply chain is across the globe. From shipping and transportation delays to factory disruptions and material shortages, it has never been more important to keep a close eye on where and how you are sourcing your materials.

Strategy: Implement SIOP to keep a careful watch on your inventory

Being mindful and proactive about your inventory is the best way to make sure you have the materials you need, when you need them. We are helping many of our clients implement Sales, Inventory and Operations Planning (SIOP) to do just that.

SIOP is a process that facilitates having the right inventory conversations at the right time by integrating customer-focused demand plans with production, sourcing and inventory. Using this method, companies can get a clearer look at their operations and create better-informed strategy decisions.

Read more about SIOP in our eBook, Sales, Inventory & Operations Planning: It’s about Time.

Challenge #3: Rising Costs

We get it. This problem is everyone’s problem these days. Despite the already razor-thin profit margins in the building and construction industry, material prices continue to rise across the board. Your business isn’t operating for free, and finding ways to complete projects under budget and stay profitable is proving to be a harder challenge with each passing quarter.

Strategy: Include an escalation clause in your contracts

There are a few strategies you can employ to combat rising costs, but each has its pros and cons. Should you finance material purchases? Raise your prices? Will these strategies help your bottom line, or will it cause customers to look elsewhere?

Ultimately, the wisest strategy seems to be including an escalation clause in your contracts, stating that if prices increase by a certain percentage or more during the duration of the project, you have the right to adjust your costs accordingly. This provides the most flexibility for your business without risking losing customers to cheaper alternatives.

At USC Consulting Group, we’re here to help you through these uncertain economic times. And the good times, too! If you’d like to learn more about these common industry disruptors and our solutions, download our free eBook, “Constructing the Building Products Industry: An Outlook of Challenges and Solutions.”

It’s a double-edged sword for the building products industry today.

The production and demand slump during the pandemic has turned into a boom. Residential and commercial building is on a high.

Yet, challenges still exist for the building products industry as it navigates these uncertain economic times.

While each company has its unique issues, our team of subject matter experts have compiled the most common challenges we’re seeing for the building products industry today, and share productive solutions we’re recommending to our clients to tackle them.

Download our free eBook “Constructing the Building Products Industry: An Outlook of Challenges and Solutions” as we advise on tactics to deal with the boom and optimize your operations.

In this eBook you will learn how to overcome the following:

- Rising costs

- Supply chain bottlenecks

- Understaffing & skills gap

- Post-COVID boom

These strategies will help you get started on combating industry challenges and carry you through these uncertain economic times. If you need more in-depth help or would like to discuss specific issues you are experiencing, give us a call today. We listen first and then advise on how we can make your operations more efficient.

COVID-19 has been a take-no-prisoners virus. In mere months, thousands of businesses have folded in a variety of industries or are on the verge of closing. Some sectors have proven to be more resilient than others though. For instance, while a number of economists anticipated real estate would likely be hard-hit, the combination of solid economic fundamentals as well as record-low interest rates have kept the industry humming. Indeed, the Pending Home Sales Index reached nearly 9% in August and the existing-home sales topped a seasonally adjusted annual rate of 6 million during the same period, according to the latest estimates from the National Association of Realtors. Engaged buyers and highly limited inventory have kept builders hard at work nationwide.

Despite the residential housing sector’s strength, 2020 will likely be remembered as a down year for developers.

When 2020 officially concludes, the construction industry in the U.S. is anticipated to be 6.5% smaller than it was when the year began. That’s according to a recent report from ResearchandMarkets.com. If conditions continue at their present pace, the sector is poised to contract an additional 2% come 2021.

Coronavirus disruption in construction

The coronavirus is largely responsible. With over 7 million Americans infected by the strain and a variety of social distancing measures installed by states as well as employers, numerous projects that were slated to take place have been delayed, rescheduled, or started but with far fewer workers than initially anticipated. In some instances, this has been due to laborers who were sick; in others, developers were limited to having only so many people on job sites at once.

“In September, wood used for framing reached $950 per thousand board feet.”

Complicating matters further is the price of home-building materials, especially lumber. Forestry and logging companies have encountered their own struggles with the exploration and extraction of trees due to COVID. This, in turn, has led to higher purchase prices for developers. For example, in September, wood used for framing reached $950 per thousand board feet, according to the National Association of Builders. Tracing back to April, lumber prices in the U.S. are up 120%, on average. As a result of this, the cost of buying for would-be homeowners has risen roughly $16,000, NAHB estimates, stretching the finances of many budget-minded families too thinly.

What can building product manufacturers do to bounce back in 2021? Here are a few suggestions:

Embrace the new business as usual

Perhaps the biggest frustration of the COVID-19 crisis is the uncertainty of it all, as no one seems to know when advanced safety measures to slow the spread will end. While most parts of the country now allow laborers to be on the job — whereas before they were off-limits — roughly three-quarters of building product manufacturers believe COVID-19 restrictions will continue for another year, according to polling done by Construction Dive. More specifically, 88% expect social distancing and personal protective gear will be the norm for the long term.

As a result of this, businesses should try to acclimate themselves to the reality of having fewer hands. Whether it’s done by leveraging automation technology to tackle repeatable processes, or streamlining production through smarter asset utilization, building product manufacturers will need to ramp up their process efficiencies so workers can execute more effectively.

Prepare and source even further in advance

In addition to lumber being more expensive to purchase, it’s also harder to come by. As Newsweek reported earlier this summer, COVID-19 restrictions forced numerous lumber mills across the U.S. to cut back on their production, both for softwood lumber and treated lumber.

When the time comes to obtain material for a scheduled project, manufacturers may want to stock up. This is something that Jeffrey Luter of Fulcrum Associates has done and plans on continuing. Speaking to New Hampshire Business Review, Luter noted his company has extended its purchasing window rather considerably.

“Items that we would source three to four weeks before they are needed on the job site are being ordered 10-12 weeks in advance,” Luter explained.

Adopting a more forward-looking strategy can enable building product manufacturers to better prepare for fluctuations in the supply chain, which are forecast to continue in 2021.

Building product manufacturers look to keep employees safe and well.

Keep crew safe and well

With many building product manufacturers operating with skeleton crews, the ongoing productivity of each individual becomes that much more important. However, with construction routinely being among the top industries for on-the-job industries, developers must prioritize the protection of all involved. This includes keeping laborers protected from infection. Tom Sullivan of Sullivan Construction told NHBR this has been an ongoing process throughout the pandemic.

“We take the temperature every day of everybody who comes on-site,” Sullivan said. “We apply social distancing to our projects. We have a mask requirement for all people on our job sites — including people from our group and myself. We want to make sure nobody gets sick. Our objective is to keep everybody healthy and use the latest and greatest protocols out there to protect everyone.”

Prioritize supply chain management

In addition to fully operational work crews, builders also require the materials to build. But as previously noted, key materials and equipment to development are either in short supply, virtually impossible to find or expensive to purchase. As a result, building products manufacturers should aim to optimize their supply chains as proactively as they can. This includes diversifying where they get their materials from so firms have more options and places to go when suppliers are out of stock. Strategic sourcing can help in this regard.

Building product manufacturers may also want to perform their own research to see where it’s possible to use one material in place of another. Former NAHB Chairman Randy Noel said certain alternative materials — such as steel — may serve as a sufficient option as a substitute for lumber. As the Steel Market Development Institute points out, steel may prove more cost-effective than wood framing because it won’t warp, split, crack or rot like wood does.

From strategic sourcing to efficiency improvements or cycle time reduction, USC Consulting Group has the solutions that can help your business find it’s footing in the building products landscape — in more ways than one. Contact us today to learn how we can help you be more efficient in your operations.

In the blog Every Part Has a Purpose: Building Materials Manufacturing, we learned about a few of the challenges that the American housing market and its producers will be facing here in 2019. The number of wildfires occurring annually is increasing at alarming rates and the building materials manufacturers are feeling the repercussions from these natural disasters. The softwood and hardwood resources being burned down are causing the lumber suppliers to struggle to meet the demands of the home construction market. Furthermore, the housing market being on fire lately (pun intended) has led to intense bidding wars among buyers while developers work hard to increase inventories. To top it all off, material costs have increased significantly due to the global trade showdown linked to the recently introduced tariffs.

Backbone of the American housing market

Building materials manufacturers are poised to overcome the various obstacles thrown their way and accelerate operations in this demanding economy. Thus, continuing to power the U.S. housing market. But, just how pivotal are these building materials producers to the consumers who are scouring Zillow and Realtor.com in search of their dream home?

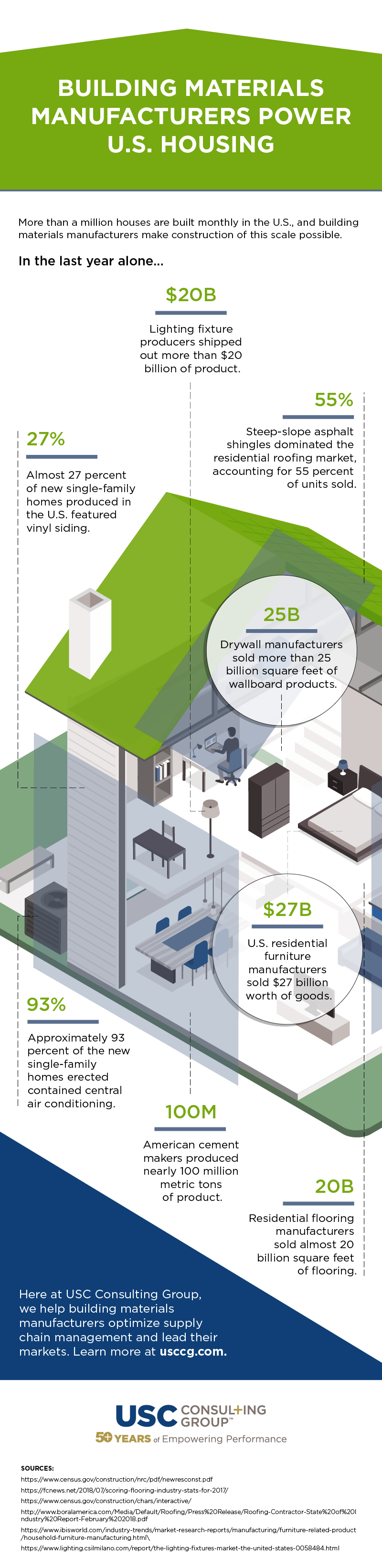

Here at USC, we love to analyze data and processes as much as Joey Tribbiani loves to eat sandwiches. So, we took a deeper dive into just how important these building materials manufacturers truly are to the industry. We put our results into a cool infographic for easy digestion. You will see that every part, or every manufacturer, has a significant purpose in powering the whole.

“More than a million houses are built monthly in the U.S.” That stat in itself is incredible. What’s even more mind-blowing is when you start considering “how” this is all made possible and realize how crucial building materials manufacturers really are to the industry.

Providing more power

It is essential that these behind-the-scenes producers improve their processes to keep pace with the housing market demands. However, with such a strain to keep up, building materials manufacturers may not have time to analyze and optimize their operations and could use some extra horsepower. USC Consulting Group is here to help. By working with your shop-floor personnel and leadership teams, we not only help to achieve greater throughput and yield, but can also enhance your supply chain management to improve in areas such as strategic sourcing, maintenance practices, and logistics.

Contact us today to discuss how together we can help you sustain as well as thrive in the current opportunistic landscape.

From foundation concrete to tile adhesive, the average house contains many different components. Building materials manufacturers are, of course, responsible for producing these essential supplies. Collectively, they are the backbone of the American housing market. These businesses are poised to continue their successes into the new year, a comforting sign for U.S. home builders, especially those who intend to accelerate operations in 2019 to bridge the inventory gap, according to research from the National Association of Realtors.

That said, building materials manufacturers will also face significant obstacles throughout the coming year. Here are a few of those challenges and how they might affect the organizations that form the foundation of the domestic housing market:

Wildfires

More than 52,300 separate wildfires burned through approximately 8.5 million acres in 2018, according to analysts for the National Interagency Fire Center. While neither of these figures surpassed historic highs, together they still paint a disturbing picture. Between 2008 and 2017, roughly 60,300 wildfires occurred annually, each one burning around 105 acres of land, but in 2018 the average wildfire claimed 163 acres. Suffice it to say, wildfires are getting worse, so their repercussions on related industries, such as building materials manufacturers, will continue to escalate.

This disturbing development is especially concerning to businesses in the forestry industry, which supplies the softwood and hardwood used in home construction. While reports from the Department of Agriculture show that forest inventories have steadily increased over the last seven decades, the recent intensification of wildfires threatens American woodlands and, by extension, the lumber suppliers that depend on them. Unfortunately, the NIFC believes that significant fire activity is likely to unfold over the course of 2019, meaning timber manufacturers will have to grapple with the threat of wildfire over the coming months and look for ways to mitigate the associated production risks.

America’s global trade showdown

When the Trump administration announced that it would increase duties on aluminum and steel imports back in March 2018, leaders in the home building space immediately criticized the decision. Randy Noel, chairman of the National Association of Home Builders, said the then-proposed tariffs would “translate into higher costs for U.S. consumers and businesses.” American Institute of Architects CEO Robert Ivy offered a similar sentiment, concluding that “inflating the cost of materials will limit the range of options [that architects] can use while adhering to budgetary constraints for a building.”

However, these voices failed to persuade the Department of Commerce, which enacted the tariffs in May. In the months since, material costs have indeed increased significantly, according to data analysis from the Associated General Contractors of America. Over the same span, the White House has issued additional import duty increases, further weighing down building materials manufacturers, their clients, and American homebuyers.

While America’s global trade conflicts have cooled as of late, President Trump has reiterated his desire to move forward with similar trade policies, NBC News reported. Enterprises in the building materials space could encounter new challenges linked to tariffs in 2019. Again, businesses in the industry will likely have to engage in some operational reorganization to reduce the bottom-line impact of any new duties.

A hot housing market

American home builders have struggled to meet demand in recent years, forcing buyers to participate in intense bidding wars, but developers are working hard to increase inventories, according to research from the U.S. Census Bureau. Residential permits, starts, and completions rose in 2018, signaling the arrival of a building construction boom. This activity is expected to continue into 2019, during which time single-family housing starts are forecasted to increase, analysts for the NAR found. Building materials manufacturers may find themselves fielding higher order volumes, even as sourcing gets more complicated and supplies dwindle.

Together, these developments pose serious challenges to organizations navigating the building materials manufacturing arena and may necessitate the implementation of new shop-floor techniques and tools. Here at USC Consulting Group, we have been helping businesses of all kinds adjust to new marketplace conditions, implementing on-the-ground strategies that lay the groundwork for success.

Connect with USCCG today to learn more about our work and how we can help your company prepare for the challenging year ahead.

Shelter is a basic human necessity, but in many parts of the world so is high-speed internet. Building materials manufacturers, as fundamental as their industry is to civilization, must open themselves up to adaptation in the face of global innovation. Cement, steel, glass, wood – these and other ubiquitous resources all have roles to play in the 21st century, so long as they carry the torch of technological process like other private sector manufacturers do. So what’s preventing some businesses in building materials from embracing innovation?

1. Too scared to invest

As the saying goes, “Once bitten, twice shy.”

As authors Robert Bono and Stephen Pillsbury chronicle in a PricewaterhouseCoopers industrial manufacturing report, many companies still remember the losses they sustained from the drive to invest in new technology in the early-to-mid 2000s that ended abruptly with the economic collapse in 2008 – at least, the companies that survived do.

When innovation was at its peak then, investors paid top dollar. When the market crashed, their worthwhile ventures became financial burdens they suddenly couldn’t justify, let alone liquidate at sticker price. Since then, many of these same businesses, ironically enough, have converted to models of risk management at all costs which stifle productivity. According to the U.S. Bureau of Labor Statistics, productivity change in the wake of the 2008 economic collapse is less than half what it was between 2000 and 2007, the worst it’s been since the late 80s.

2. Narrow vision moving forward

What can building materials manufacturers do with things like augmented reality and the Internet of Things? Their industries are far too old-school to truly benefit from these cutting-edge digital innovations, right?

Depends on who you ask. The plumbing sector, for instance, could see massive reductions in resourcing and operational costs, as well as enhanced quality, by prototyping fixtures and piping with 3-D printers. How else would one test a new low-flow shower head he or she hopes will earn a stamp of approval from the U.S. Green Building Council’s LEED program? For plumbing manufacturers and their distributors, both looking to sell entire plumbing systems rather than mere parts, AR could help them cost-effectively design custom specifications with their clientele and drive sales.

Plumbing aside, connected sensors and data management software serve all asset-intensive manufacturers by monitoring machine efficiency, forecasting failure and laying the groundwork for proactive and prescriptive scheduled maintenance programs that significantly increase equipment uptime. What manufacturer wouldn’t want that? A lack of imagination is no excuse.

Every manufacturing company deserves an operational boost from proactive maintenance technology.

3. Reluctance in the face of rapid progress

What prevents building materials manufacturers from adopting new technology may simply be a blindness to the risk of not innovating when others do. As the rate of innovation accelerates, the businesses that perform the best in the market will be the ones that choose the tech that helps their cause and onboard it cleanly only to replace with something better when it comes along. That said, it will always feel easier to maintain the status quo, even if “business as usual” will ultimately be your company’s downfall.

One caveat to that, however: No emerging technology, regardless of how hyped it may be, is a guarantee of success. So before throwing your whole company behind the latest, greatest solution, manufacturers should work with operational consultants to ensure they possess the efficiency to adopt, utilize, and adapt.