-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2024 (4)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: APM

From supply chain disruptions to fluctuating demand, the past few years have caused a ripple-like wave of challenges throughout businesses across the globe, including the oil and gas industry.

Fortunately, with oil prices bouncing back, the oil and gas industry has nearly recovered from the issues to pre-COVID operations. That being said, there are a considerable number of concerns on the forefront of the industry that will shape the course of operations for years to come.

So, what’s the state of the oil and gas industry today? Let’s look at some of the issues and opportunities they’re facing.

Production capacity concerns

For months, we’ve been seeing news reports about the Russia and Ukraine conflict. Many of us have been seeking updates on the conflict itself, but those in the oil and gas industry have no doubt kept a keen eye on how it is affecting the global oil and gas market.

The sanctions placed on Russian oil have caused strain on a U.S. refinery system that, like so many manufacturing industries, was already overwhelmed and under-staffed following the COVID pandemic and the Great Resignation that followed. Demand for gas plummeted during a time when the majority of the country stayed in their homes for months on end, which left a large number of refineries with no other choice but to close their doors.

Refinery numbers still have not yet rebounded, which has resulted in a refining shortage of roughly one million barrels of oil a day compared to pre-COVID numbers. Add in sanctioning one of the world’s biggest oil producers, and the increased demand coupled with reduced refining capabilities combines into the perfect storm for shortages and increased prices.

Mergers & acquisitions opportunities

Despite the recently tabled climate bill, this country (and the world at large) is moving toward a renewable energy future. Even if it’s at a snail’s pace.

This has caused leaders in the oil and gas industry to evaluate operations and find ways to meet renewable and decarbonization efforts in the next few decades. One option is partnering with or purchasing renewable energy companies.

Companies like BP, Equinor, Respol, and PKN Orlen are leading the charge in renewable energy investment opportunities, and are reaping the financial and ecological rewards of doing so. Expect many major players in the oil and gas industry to continue to expand their portfolios and increase their outreach with strategic mergers and acquisitions into renewable energy.

Appeasement of investors

Despite incredible year-over-year growth, the oil and gas industry as a whole has been plagued with cash flow issues that have caused investors to reconsider their financial plans.

There are a host of reasons why investors have turned their focus toward other industries in recent years: Some have been leaving due to increased concerns over carbon-mitigation and ecological issues, some have left due to oil and gas’s tendency to overspend cash flows in the name of company growth and continued investment, while others have been scared away due to plain uncertainty.

Whatever the case may be, oil and gas companies are seeking to attract investors again, while investors want to see predictability and consistent returns to shareholders. The aforementioned increase in renewable mergers and acquisitions opportunities is a step in the right direction for the oil and gas industry, and that coupled with an inevitable stabilization will no doubt cause investors to flock back to the industry.

Outdated infrastructure & opportunity for innovation

Across the board, oil and gas infrastructure is aging.

In the off-shore sector, oil platforms are becoming old, deteriorated and increasingly at-risk for operational failures and natural disasters. This, of course, poses a problem not only for oil and gas companies meeting the ever-growing demand of the marketplace, but also risks ecological disaster in the form of oil spills and other malfunctions. Equipment and structural deterioration is no doubt due to saltwater and other environmental factors that come with operating in the ocean, and improvements to such facilities come at great expense, leaving some executives to employ a “we’ll-fix-it-when-it’s-broken” approach.

On land, plants and refineries across the country are aging, too, with many having outdated control loops, absences of updating engineering controls, and lack of complete computerization. This, of course, doesn’t even touch on the efficiency potential that technological aspects like robotic automation, artificial intelligence and IoT advances could bring to these facilities.

We can help

No matter the challenges, issues or opportunities facing the oil and gas industry, one solution is getting the job done more efficiently. That means looking at supply issues in new ways, casting an eye toward structural improvements and ensuring your day-to-day efficiency in the refineries and out in the field. We can help with that. At USC Consulting, we’ve been working with companies in a wide range of industries to up their efficiency game for more than 50 years.

Contact us today if you’d like to talk about how we can help your business.

Are you performing preventive maintenance on a regular basis? If you’re not, you may want to consider adding it to your schedule. Why? In a word, it’s about efficiency. In a few words (as its name suggests), it prevents problems before they start. Preventive maintenance is becoming the manufacturing industry standard. Roughly 80% of asset and facilities stakeholders are embracing the process as a way to cut costs, increase efficiency, and keep assets running like clockwork.

By performing regular preventive maintenance (or its cousin, data-based predictive maintenance) you are heading off problems, snafus and breakdowns at the pass. It’s about identifying and handling any potential issues that may be lurking down the road. The point is to find potential problems before they become real problems that could lead to delays and costly headaches.

The irony of preventive maintenance is that it can sometimes seem like it causes more problems than it solves. It requires regular downtime, which in itself is a problem. There’s also the tricky matter of timing. Finding the optimal time to perform the maintenance can be a delicate balance between shutting down for maintenance too soon and waiting too long.

But, the challenges are worth the rewards. Ensuring you have the proverbial well-oiled machine will make your operation more efficient and productive now and in the future.

Let’s take a look at preventive maintenance benefits and challenges and how it can help boost your operations.

Preventive maintenance benefits

The idea behind doing regular maintenance on the lifeblood of your manufacturing operations — your machinery — is to keep it humming along at optimal efficiency and prevent any problems that might occur. Benefits to making it a regular part of your business process include:

You control the downtime schedule. It’s true that performing maintenance requires downtime. You’ll experience a work stoppage because of it. However, the good news is, when that downtime happens is up to you. You can schedule it for slow periods and avoid your high-volume times. Build maintenance into your schedule as a regular part of your routine.

Fewer surprises. A snafu happens, something breaks, and you have to stop production to figure out what it is and fix it. That can happen at any time, and trust us, it will happen when you least want it to. Performing preventive, not reactive, maintenance will lessen those unwelcomed surprises that erode your productivity and profitability. A general rule is that planned work will cost two-thirds less than unplanned work in time and other resources.

Increased efficiency. At USC Consulting Group, we’re all about efficiency, and one of the surest ways to find “hidden efficiencies” that you didn’t even know were possible is to perform regular preventive maintenance on your machines.

Increased longevity of your machinery and assets. This is key. Just like your car needs regular oil changes and tune-ups to keep it running at its best, so do your assets.

Preventive maintenance challenges

There are some challenges with doing regular preventive maintenance. However, in our view, these don’t outweigh the benefits.

Finding the optimal time to do it is tricky. A regular schedule is the key to finding the best time to shut down for maintenance. And the downtime is typically where we see the most pushback from executives and managers who aren’t thrilled with this process.

It will cause shutdowns. There’s no way around it. To perform maintenance on your equipment, the line must stop.

If it ain’t broke, don’t fix it. This is an old adage for a reason. You may be shutting down for your scheduled maintenance when no problems actually exist. The shutdown does come at a productivity cost, so… is it worth it? Some manufacturers solve this issue by performing predictive maintenance instead. It’s a more complex process that is data driven, and analyzes how your assets are performing in real time. All’s well? No shutdown. But if you find problems, that’s when you act. It reduces downtime, and you’re not replacing any parts while they’re still good to go. The downside of this approach is complexity and connectivity. If you don’t have state-of-the-art machinery, you won’t get the data analytics that this process requires. That’s why the majority of manufacturers today are using the preventive approach.

At USC Consulting, we’ve been helping manufacturing businesses increase their efficiency, production, throughput and profits for more than half a century. Get in touch today if you’d like to learn more about how preventive maintenance benefits can boost your bottom line.

A proper Asset Performance Management (APM) plan ensures that your critical revenue-producing assets operate smoothly, efficiently, and at or near their rated capacity.

Asset Performance Management is the broad, systematic planning and control of a physical resource throughout its operating life. It includes the specification, design, construction, operation, maintenance, modification, and ultimately, disposal. Its principles apply to any industry with mission-critical assets, and is best implemented with support from the top-down and bottom-up. The entire organization should be involved, and supportive to ensure that it is executed properly.

Methodologies used in APM

- Asset Reliability – The process of ensuring that assets continue to do what they are needed to do, when they are needed to do it.

- Reliability-centered Maintenance (RCM) – Used to determine the activities necessary for the asset to operate properly by focusing on maintenance tasks that mitigate against the consequences of failure.

- Maintenance Management – Adherence to a benchmark of world-class maintenance standards and practices.

Key Performance Indicators (KPIs) and Enabling Technology

A vital step in implementing an APM plan is establishing, tracking, and analyzing KPIs. This is what takes a maintenance plan from reactive to proactive. The close management of leading and lagging Key Performance Indicators helps increase the likelihood of driving measureable results without significant capital investment.

Important KPIs include:

- % of planned maintenance work, and completed.

- % of unplanned/emergency maintenance work.

- Proactive work as % of planned maintenance work.

- Actual maintenance hours vs. planning estimate.

- Overall equipment effectiveness.

Having the right technology tools are needed to measure and analyze this data. USC Consulting Group has helped clients optimize their existing tools or install computerized maintenance management systems (CMMS), ERP systems, and USC’s own proprietary Lean Information Control System (LINCS) to ensure that this data is used effectively.

Benefits of Asset Performance Management

In addition to increased uptime, shorter turnaround times, greater throughput and lower maintenance costs, organizations have seen improvements in their EBITDA by 15-25%.

Learn more about how APM can improve the performance of your revenue-producing assets by downloading our eBook Asset Management: The Rise of Reliability.

As a typical rule of thumb in maintenance, planned work will consume roughly one third of the resources (labor cost, materials cost, and costs associated with equipment down-time) as unplanned work will consume. Therefore, the first objective of any maintenance program can be simplified as maximizing the percentage of time and resources spent on planned maintenance, and reducing the amount of unplanned maintenance or repair work resulting from unexpected breakdowns.

Understanding the Types of Work

Planned work can be broken down into two main categories: preventative maintenance and planned repairs. Preventative maintenance includes all the work done not in response to a failure, but to prevent future failures from occurring. This work is typically outlined by the manufacturer in terms of frequency and work that must be performed (oil change, lube, and filter). If the fleet size remains constant, so will the level of preventative maintenance. Planned repairs are work that must be done as a result of wear and tear in which the equipment has not yet failed and can still run reliably until the maintenance department is set up with the required materials, labor, and shop space to adequately address these repairs. For exemplary purposes in this article, we will consider maintenance needed for an underground mine as a model. Due to the travel time in underground mining and the requirement in most cases to have repairs done in the shop after a wash, these two types of planned work are best done together to minimize the mechanic’s trips to and from the equipment.

Given that the level of preventative maintenance will remain considerably flat, as both the materials required and time required can be predicted and cyclical, the only way to effectively increase planned work as a proportion of total work is to increase the level of planned repairs. The first task is to shift the balance of planned maintenance and unplanned maintenance. That is, to convert as much of the resources spent on unplanned work as possible into resources spent on planned work.

Converting Unplanned Work into Planned Maintenance

The first step is to create a backlog, a master list of all known repairs that must be made to each piece of equipment. It consists of repairs necessary to components that are in a partial state of failure, but have not yet failed. The size of a backlog and how well it is managed will provide some valuable insight as to the over-all health of your assets. A complete detailed backlog will also provide other benefits to management when taking a closer look at each type of equipment and analyzing which components require more attention than others. If repairs to equipment must be done before the equipment actually fails, the ability to identify or predict failures before they actually occur will be crucial. Coordination can then be made for the replacement of these components before failure occurs. This can be a very difficult and daunting task when considering a large fleet with complex equipment.

The first element to be considered when creating and managing a backlog is where the backlog work will be sourced from. Where will the maintenance planners get the information to create backlog list? Each time the equipment is inspected, an opportunity is provided to gather backlog. In an underground mining environment, some of these touch points include the preventative maintenance services, planned repairs, and operator circle checks.

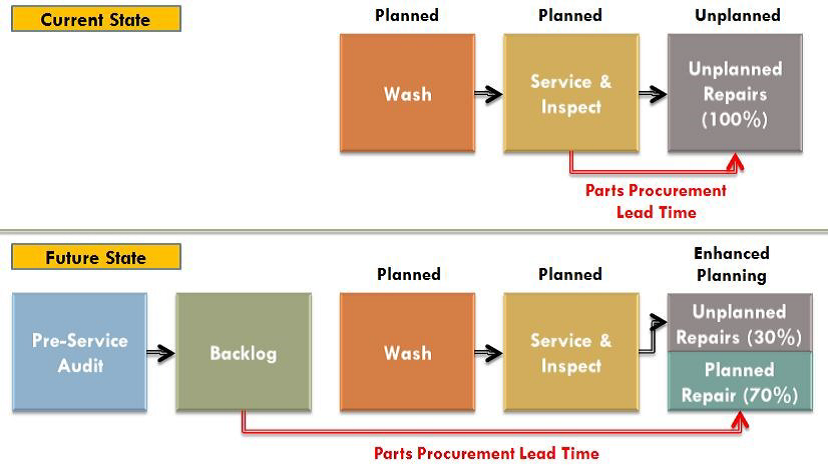

An additional inspection can be strategically added to generate a greater and more detailed amount of backlog. Figure 1 below depicts the impact on parts procurement time of an inspection conducted by a mechanic in a predetermined time frame before the equipment is scheduled to come into the shop for a preventative maintenance service.

Figure 1—Current State vs. Future State with Backlog

Once the backlog list has been developed, the repairs can then be strategically scheduled alongside the preventative maintenance services while the equipment is already in the shop with shop space and labor assigned to it. Additionally, once these repairs have been scheduled, parts and materials can be ordered, packaged, and delivered to the shop where the repairs will be completed.

The supply benefits of planning repairs before failure are amplified in underground mining as the remote locations can be difficult for suppliers to deliver to. Even once on site, the materials must go through a complex supply delivery system to make their way underground. Planning these repairs ahead of time allows the equipment to run for the duration of this prolonged lead time. If the equipment is run until failure, it will remain down for the entire duration of this lead time until the needed parts can be delivered.

In generating and completing the backlog list against each piece of equipment, failures and breakdowns that would normally occur can now be discovered before failure and repaired on average much quicker than if the equipment would have broken down. The backlog system is working towards converting unplanned maintenance work into planned maintenance work, and therefore consuming one third of the resources on each repair converted as would normally be expended.

Planned maintenance leads to significant cost savings with improved productivity. For 50 plus years USC Consulting Group has helped organizations develop planned maintenance programs to increase their uptime. Contact us today to start converting your maintenance practices and keep your operations running as much as possible.

The preventive maintenance methodology has become industry standard. An estimated 80% of asset and facilities stakeholders now leverage preventive workflows, while approximately half take advantage of predictive maintenance tools meant to further enhance such forward-thinking processes, per research from Advanced Technology Services and Plant Engineering. Why are so many businesses embracing this approach? The return on investment can be immense. Some see maintenance savings of between 12% and 18% percent, on top of the revenue-generating performance improvements that naturally unfold as a consequence of machine uptime increases, according to Transcendent. Companies on the outside looking in on the emergence and solidification of the PM model typically view these developments with considerable envy and race to keep up with the competition. However, firms attempting to play catch-up at hyperspeed often encounter roadblocks — most notably, the perceived cost of implementation.

Redesigning existing maintenance workflows is neither easy nor expense-free. These essential backend processes support production activities that directly affect the bottom line, and changing them, even incrementally, might seem risky, especially for organizations with thinner margins. However, the long-term costs that come with hanging on to reactive maintenance methodologies could very well outweigh the expenses incurred as a product of PM implementation and the shop floor disruption that could accompany such a move. Organizations looking to embark on this transition would be wise to unpack the entire cost equation and determine the potential ROI.

Understanding PM implementation costs

The Preventive Maintenance (PM) concept is easy to understand — focus on equipment upkeep and optimization, and address small mechanical deficiencies before they devolve into bigger problems bound to cause downtime. The idea is far more complicated in practice, however. To actually achieve PM implementation, maintenance stakeholders must navigate a multistage process that begins with program design. This initial phase normally involves establishing an overarching PM objective. Some organizations move forward with PM implementation with the sole purpose of saving money, while others want to ensure optimal shop floor performance. Choosing an end goal establishes the foundation for effective program development. Here, maintenance experts — ideally those intimately familiar with OEM requirements, Plant Engineering reported — design granular equipment management processes, including rotating and reciprocating mechanical component lubrication.

Once maintenance personnel have developed an effective PM plan, they can move forward with deployment. This normally entails scheduling mission-critical PM tasks through computerized maintenance management software and training the staff members who will execute these actions. To ensure long-term PM sustainability, stakeholders will create and release program management and communication workflows that facilitate adherence and continuous improvement. This process requires considerable effort and can come with an equally substantial price tag. According to Plant Engineering, the expense breakdown might include items like this:

- Mechanic reassignment: Businesses often find themselves reassigning top-notch mechanics to oversee PM program design. This move could disrupt maintenance operations and potentially have a material impact on production, should serious equipment issues arise.

- Ancillary component installation: PM implementation sometimes requires the purchase of smaller mechanical components or accessories — infrared scanning guns for equipment heat checks and automated lubrication for scheduled machine conditioning, for instance — that are key to PM success.

- CMMS implementation: For firms without CMMS technology, installing one of these platforms is almost essential. Pricing for CMMS software varies. Pared-down versions might cost as little as $40 per user per month, while more robust platforms featuring customized features could require larger investments, TechRadar reported.

- Vendor onboarding: PM tasks such as equipment lubrication management can become overwhelming for internal maintenance teams, which is why some organizations end up outsourcing these processes to external vendors. This improves efficiency and saves time but costs money.

These are a handful of the most common expenses organizations navigating PM implementation encounter. However, the costs sometimes do not stop here — under-the-radar expenses can materialize post launch, per researchers from Oniqua Enterprise Analytics. These extra amounts actually come from over-maintenance. This occurs when maintenance teams become overly focused on equipment optimization and establish work intervals that are far too short, meaning staff members execute upkeep activities so often that both time and resources go to waste. A surprisingly large number of firms make this mistake, according to analysts for Oniqua, who found that 80% of PM tasks unfold over a period of 30 days or fewer and that 30% to 40% of these duties are applied to equipment that has little to no impact on uptime.

Assessing PM implementation ROI

While the aforementioned costs can certainly make PM implementation seem overwhelming, the operational returns that come with embracing this approach typically make these initial expenses easier to swallow. For example, researchers for ReliaSoft estimated that organizations with reactive maintenance operations in place pay around $8 per replacement part, while those with PM strategies spend just $2 per new equipment component. Additionally, PM programs often catalyze shop floor improvements that could only be achieved through purchasing new machinery. An operation that implements such an initiative might pay $100,000 per year to maintain PM workflows that increase capacity by 25% — a gain that would require an upfront equipment investment of $500,000 and $200,000 in annual staffing and asset management work, Reliable Plant reported. Together, PM-related cost reductions and productivity boosts can generate big returns, according to Jones Lange LaSalle, which found that some adopters stood to 545% ROI.

This sort of improvement is simply too significant to pass up for most modern businesses, particularly small and medium manufacturers, many of whom are just getting by within today’s fluid marketplace. That said, pursuing PM implementation can be an immensely daunting task for all organizations, regardless of sector or size. Here at USC Consulting Group, we have been helping companies across a variety of industries navigate PM implementation for decades, leveraging proven techniques and tools that simplify change management and lay the foundation for sustainable organizational growth via continuous operational improvement.

Contact us today to learn more about our work and how we can help your business embrace the Preventive Maintenance methodology.

Heavy production assets are ubiquitous across numerous industries, from residential construction to mining. Keeping this mission-critical equipment up and running is among the top priorities for modern industrial organizations. It is why the average firm devotes almost 10 percent of its facilities budget to maintenance activities, according to researchers from Plant Engineering.

Virtually all of these entities leverage either predictive or preventive maintenance methodologies, both of which materialized in recent years due to widespread enterprise digitization. But how exactly are businesses deploying these strategies to ensure heavy production assets maintain peak performance? Here is an industry-agnostic look into the state of predictive and preventive maintenance best practices for heavy asset optimization:

Unpacking the preventive approach

An estimated 80 percent of maintenance teams employ preventive maintenance techniques, per survey data from Advanced Technology Services and Plan Engineering. The proactive approach centers on one operational goal: reducing production downtime. There are several associated best practices that guide preventive maintenance implementation and management.

Relinquishing the reactive approach to asset maintenance is the most impactful of these exercises. Unfortunately, it is also the hardest to adopt, Modern Materials Handling reported. Maintenance specialists that have traditionally listened for the cacophony of mechanical collapse and responded in turn must change their mindsets and instead focus on implementing piecemeal adjustments to mitigate the wear and tear that causes asset failure.

Making this cultural switch is no easy task – neither is reassessing all production and maintenance policies and procedures, and drafting new ones to comport with key performance indicators and company goals. However, four-fifths of maintenance teams have managed to execute these and the other preventive best practices on the way to transformation, including groups responsible for overseeing heavy assets.

Industrial organizations that excel at heavy machinery maintenance and effectively address small mechanical errors before they devolve into downtime-causing kinks focus on developing and sustaining routine asset optimization schedules, according to Reliable Plant. Through consistent check-ups and slight tweaks, maintenance teams responsible for bulky equipment can ensure these key production tools are always in good condition and ready to perform. Usage monitoring is also key, as heavy assets that are misused, either intentionally or unintentionally, typically break down the fastest.

How does usage monitoring unfold within an actual production workflow? A construction company preparing to excavate a new worksite might assess the climate and the soil to determine which backhoe digging attachment is not only best suited for the task at hand, but also the least likely to cause mechanical stress. These and other techniques make preventive maintenance possible, even with heavy assets in play.

Unpacking the predictive approach

When investments in heavy machinery began climbing dramatically more than a half decade ago, equipment manufacturers advised industrial companies to adopt asset tracking solutions to ensure that the multimillion-dollar tools they were deploying were actually required, The Wall Street Journal reported. At the same time, an innovative approach to maintenance, which also happened to be based on data analytics, was emerging.

This methodology, called predictive maintenance, would allow organizations to harness the power of advanced information technology to monitor mission-critical machinery in real-time, calculate the potential for future downtime and make improvements to avoid shutdown. In the years since this strategy materialized, many businesses have embraced it. In fact, 47 percent of industrial firms attest to deploying predictive maintenance processes and tools, per Advanced Technology Services and Plan Engineering.

Perhaps the most well-publicized and successful predictive maintenance programs have unfolded within organizations leveraging larger production assets. For example, construction equipment giant Caterpillar was among the first asset producers to manufacture products meant for use in predictive maintenance workflows, Forbes Magazine reported. The company began building bulldozers, dump trucks, excavators and other common equipment with pre-installed wireless sensors designed to transmit usable performance insights to maintenance leaders. Caterpillar customers have seen significant efficiency gains and cost reductions as a consequence of this forward-thinking equipment and the accompanying software.

Harley-Davidson is another early adopter that propelled predictive maintenance to new heights. Starting back in 2010, the automotive giant began outfitting the decades-old equipment in its York, Pennsylvania plant with wireless sensors configured to monitor mechanical operations and measure physical variables such as component vibration to assess asset performance, The Journal reported. These tools and the predictive maintenance program they facilitated led to drastic shop floor improvement, as Harley-Davidson watched production throughput times and costs decrease.

While impressive, these outcomes merely represent the initial stages of the predictive maintenance approach, according to PricewaterhouseCoopers. The rise of deployable enterprise artificial intelligence technology is expected to have an immense impact on this strategy, lending industrial firms the ability to monitor more data points across larger pools of equipment, including heavy assets.

That said, there is ample ground to cover before AI-propelled predictive maintenance workflows become industry standard. Most organizations inhabit the second position on the predictive maturity scale, per PwC, and therefore still depend on instrument inspections and other manual means. However, a significant number have entered stage three and now leverage real-time condition monitoring tools. Far fewer are in stage four, where expansive data-driven workflows capable of handling massive amounts of asset information are the norm.

In any case, predictive maintenance holds immense potential for teams assigned to heavy assets and, as the survey data from Advanced Technology Services and Plan Engineering indicates, a good number of the teams overseeing large machinery today have at least embraced some processes and tools associated with the strategy.

Implementing preventive and predictive maintenance strategies centered on heavy equipment can seem like an overwhelming task, especially for smaller industrial firms or those with particularly intense production demands. For businesses in these positions, external assistance could be all but necessary. USC Consulting Group has been helping organizations optimize their maintenance operations for decades, leveraging proven techniques and tools that accelerate change and lay the foundation for sustainable growth.

Connect with us today to learn more about our work and how we can help your company reduce heavy asset-related downtime.

USC Consulting Group is a world-class operations management firm that for the past 50 years has helped mining companies around the globe improve their business performance by increasing throughput, reducing costs, eliminating waste, increasing productivity, improving quality and leveraging existing assets.

Discovery

Your process improvement experience starts with USC digging in to begin to learn what truly makes your mining operations tick. We conduct detailed diagnostics, at the point of execution, whether underground, in the pit, surface, processing plants and support services to gain an understanding of impediments to increased performance. We’ll handpick a team uniquely qualified to address your specific challenges. We’ll observe how you do things around the clock, shift to shift, engaging directly with the people on the front lines – production, maintenance, engineering, and all support departments. Then we’ll collaborate with you to turn our findings into a detailed, workable plan, complete with tools from our well-rounded toolkit.

Implementation

This is the point when most consultants leave you with a binder and walk out the door. Instead, we’re developing a project plan, organizing work breakdown structure, developing performance goals, determining measurement metrics and making sure our jointly developed strategies get the desired results. Managing data and information in the mining environment is vital for continuous improvement efforts. As part of our implementation process, we will help you enhance how your organization makes use of key data and information. Knowing where the right data and information lives and putting it to value added purposes is essential to managing a successful business. Leveraging enabling technology such as Microsoft Power BI helps to achieve, and then sustain the desired outcomes. Our LINCS® Lean Information Control System will enhance your existing Management Operating System (MOS) by smoothing the change process, providing timely feedback on KPI’s to process owners and actionable business intelligence to key decision makers. We openly share the results of our collaboration to increase and maintain operating excellence, and provide the extra horsepower needed to put ideas (both yours and ours) into action. We help deliver on your goals by empowering your performance. In fact, we’ll help you audit, verify, and sustain results for years to come.

USCCG’s Mining team uses the best of tried-and-proven, and emerging, methodologies to bring about enterprise-wide Lean Transformation, resulting in significant operating and financial gains, all at a very attractive ROI.

Discover more about our work in the Mining industry and contact us today to start your process improvement experience.

The U.S. chemicals manufacturing space is poised for growth following years of middling performance. Worldwide economic development, improvements in the domestic manufacturing and oil and gas industries, and the completion of improved chemical production infrastructure are likely to drive historic gains over the next two years, researchers from the American Chemistry Council found. Production volumes are expected to increase 3.7 percent in 2018 and 3.9 percent in 2019, laying the groundwork for an industrial valuation of more than $1 trillion by 2022. How has the sector managed to regain ground in the marketplace? Increased production capacity linked to digitization.

Advanced hardware and software are transforming chemicals producers of all sizes, facilitating efficiency gains across virtually all operational areas, from the back office to the shop floor, according to the World Economic Forum. By 2025, digital technology will have generated a cumulative economic value of between $310 billion and $550 billion within the worldwide chemicals space. There are, of course, countless solutions and deployment methods specially designed for use within the chemicals manufacturing arena. However, innovations centered on asset management stand above the rest in terms of demonstrable operational impact.

Unpacking the asset management equation

Chemical companies live and die by the mission-critical machinery they use to craft their product. In the event of unexpected downtime, the entire operation grinds to a halt, customers orders go unfilled, and revenue drops. Losses can increase at an accelerated rate when this occurs. For example, the average automotive manufacturer loses an estimated $22,000 per minute of unplanned production stoppage, according to research from Advanced Technology Services and Nielsen. Only the largest companies can weather such losses. Small or midsize organizations might falter entirely under the weight of such astronomical downtime costs.

Chemicals manufacturers are at great risk for suffering such events due to the very nature of their work. These firms supply the market with more than 100,000 different chemical compounds, according to the WEF. The vast majority of these substances are extremely caustic and therefore wreak havoc on production assets, requiring major investments in maintenance. In the U.S., chemicals producers are expected to spend more than $1.26 billion on planned maintenance activities in 2018, constituting a year-over-year rise of more than 38 percent, analysts for the ACC found. Of course, this figure does not take into account unplanned work, which usually costs 2 to 5 times more than scheduled activities, according to the Marshall Institute.

Implementing an innovative solution

Rising costs and the continual existence of massive maintenance-related risk has forced businesses in the chemicals manufacturing arena to embrace bleeding-edge technology in hopes of streamlining asset management workflows and ultimately improving reliability. Many are turning toward predictive maintenance processes powered by connected equipment sensors and robust backend platforms, Schneider Electric reported. These all-encompassing solutions allow chemical companies of all sizes to closely monitor their production assets and catch small mechanical issues before they devolve into full-on catastrophes with the potential to cause downtime. Such products also give producers the power to continually fine-tune their machinery, embrace continuous improvement, and boost productivity.

Early adopters have seen serious results, promoting wider investment in the technologies that underpin such proactive asset management approaches. For instance, businesses across all sectors are expected to spend more than $239 billion on industrial sensor technology alone in 2018, researchers for the International Data Corporation have predicted. Firms in the chemicals manufacturing space are likely to contribute to this spend as they retrofit their production workflows to more effectively compete in an expanding marketplace. However, such technology is unlikely to remain optional for long. Almost 90 percent of chemical company executives believe businesses in the industry that fail to embrace digitization will end up falling behind, the WEF found.

Chemicals manufacturing firms standing on the outside looking in on this trend must act quickly to implement next-generation asset management processes and technology. USC Consulting Group can help. Here at USCCG, we’ve been working with businesses across numerous industries for 50 years, helping them adjust to marketplace transformations of all kinds. Connect with us today to learn more about our work and how our chemicals manufacturing consultants can help your enterprise embrace and benefit from digitization.

Let’s keep in touch – subscribe to our blog in the top right of this page or follow us on LinkedIn and Facebook.

Energy companies across the globe have been forced to change their operational approaches in response to an evolving energy marketplace. Crude oversaturation, along with the emergence of cost-effective alternative sources such as natural gas, has pushed per-gallon prices for gasoline and oil down considerably, according to research from the Energy Information Administration. Consequently, firms have found themselves engineering massive restructuring initiatives over the past two years, transforming their business verticals and on-the-ground workflows via mergers and acquisitions, all in an effort to remain prosperous in the low-price era, CNBC reported.

With this work completed, analysts expect more transactions to occur within the global energy space. However, this M&A activity will constitute the heart of portfolio consolidation programs aimed at catalyzing growth and bolstering production. How might this unfold?

Understanding the M&A environment

Many large oil and gas producers with balanced budgets are looking to increase efficiency at scale through tactical moves that allow them to net more acreage in high-yielding territory. At the same time, smaller organizations with considerable experience and drilling inventory seek to scale up through acquisition. This environment gives oil and gas giants such as Exxon Mobil the opportunity to acquire valuable assets located in prime drilling territory that requires little to no investment. RSP Permian, an independent driller based in Dallas, Texas, is an exemplary target for bigger producers hoping to consolidate through targeted M&A activity, according to Forbes contributor and energy journalist Claire Poole. The firm controls more than 500,000 acres of territory in the oil-rich Permian Basin, making the small yet well-established company an ideal acquisition for large organizations focused on solidifying their core operations.

Of course, RSP Permian is not the only viable asset on the market. A handful of other hardy entities are available for purchase. As a result, a significant number of transactions are likely to occur over the next seven months. By year end, the upstream transaction total may eclipse the $64 billion recorded in 2017, according to analysts at the oil and gas research firm 1Derrick.

Grasping the production impact

How will increased M&A activity affect production? Last year’s figures suggest improvement. Even as oil and gas companies swapped assets in 2017, crude production moved upward, especially in the U.S. market where companies exported record amounts of crude oil and petroleum products, the EIA reported. In short, a repeat performance is to be expected during this year of consolidation through M&A.

Oil and gas enterprises navigating this transaction-heavy territory should consider connecting with the industry experts at USC Consulting Group. With 50 years of experience, our consultants can help energy producers on both sides of the M&A equation achieve ideal outcomes. Not only will USC help streamline the M&A process, but they can help improve overall production and process efficiency focusing on areas such as asset performance management, predictive and preventative maintenance, throughput, reliability and sustainability, and inventory control. Contact us today to learn more.

Truly innovative asset management covers all aspects of monitoring, analyzing, and maintaining capital equipment. Does your business have all its bases covered?

Now recovering from economic instability over the last decade, companies in asset-intensive industries have begun to invest in new and recommissioned equipment. In turn, these decisions ignite a fervent interest in improving uptime quality through optimized workflows, reliability-centered maintenance, and proactive decision-making.

Download our latest e-book “Asset Management: The Rise of Reliability” to discover asset management best practices from our team of experienced operational experts. Here are the seven points examined and discussed therein.

1. Work management

A work order is more than just a slip of paper. Its life cycle extends further than most businesses realize and should include information valuable to future successes in asset management.

2. Downtime tracking

If you fail to understand the nuance of downtime tracking, you will fail to sustainably decrease it.

3. Preventive and predictive maintenance

Reward awaits those facilities that understand what these two cutting-edge maintenance methodologies entail and how to execute on them properly to achieve new heights.

4. Asset criticality review

Are you allocating your resources to the machinery that matters most to your business? Align your goals with your actual asset management processes with a comprehensive ACR.

5. Equipment history capture and analysis

Those who ignore history are doomed to repeat it. Do you know what sorts of data you should capture about your assets today in order to make informed decisions tomorrow?

6. Root cause failure analysis

Assets fail for any number of reasons, but they boil down to three basic types of failure. Learn these as well as tips for digging below the surface when failures strike.

7. Operator equipment care

Line operators can work wonders for an innovative asset management program – if only their leaders know how best to utilize them.