-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: SKU Rationalization

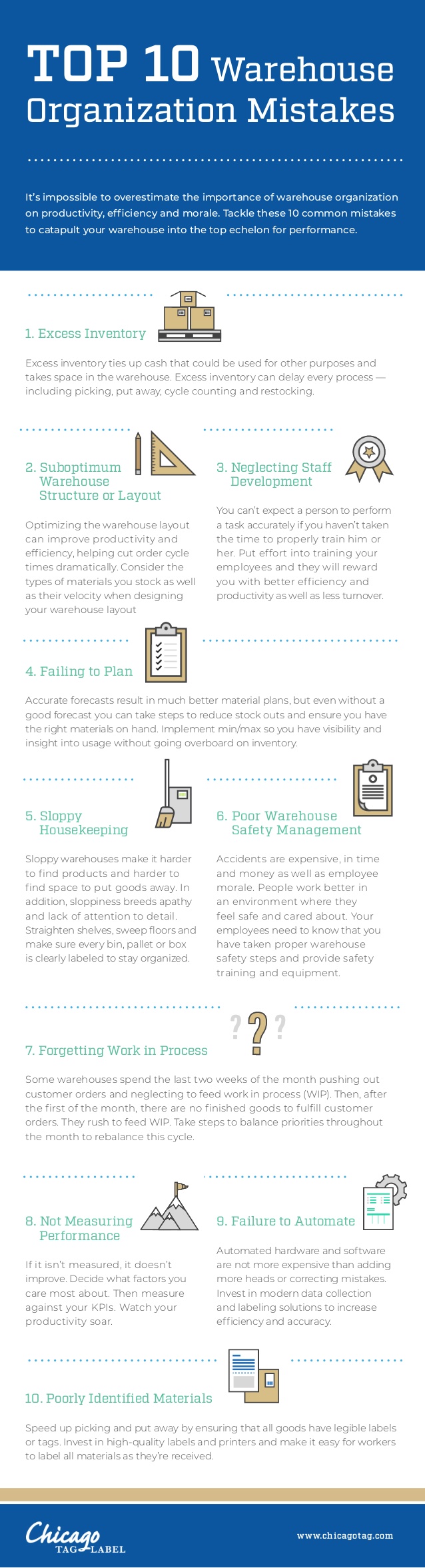

The supply chain is a business’s lifeblood. Unfortunately, much like our own bodies, it’s possible for this system to become sluggish and lethargic through neglect. Just as a lack of exercise and a poor diet can cause our blood to become clogged with cholesterol and fat, inefficient warehouse management can lead to serious issues for your operation. This is why it’s so important to understand how to avoid bad habits that can lead to problems in your warehouse operation.

For example, one of the most common mistakes made in these environments is having too much inventory. A glut of products means the money spent producing them is just sitting on the shelf providing no return on investment. A strict SKU rationalization plan can ensure that nothing goes to waste, and that only those items that are sure to sell enter the supply chain.

Another frequent misstep is made when inventory management doesn’t include metrics. Without a clear idea of how well a facility is performing, it can become nearly impossible to make improvements. Measuring all the factors that matter to your operations is essential if you want to streamline them. Too many warehouse managers also forget about work in process as they rush to push end-of-month orders out the door. When there are no finished goods to fill orders at the start of the month, they’re always playing catch-up.

Taking care of your body is crucial if you want to live a longer, healthier life — and the same principle applies to your warehouse management. For more tips on how to avoid poor habits that can hurt your business, see the accompanying infographic.

Author bio: Don Amato is Vice President of Sales for Chicago Tag & Label, which manufactures form labels, labels and tags that deliver solutions to a broad range of industries including retail, industrial, manufacturing, distribution and medical environments.

Modern retail organizations stock many different items to attract the widest audience of customers. But did you know that, according to the National Association of Convenience Stores and Inbound Logistics, the average corner convenience store may have as many as 2,500 SKUs, while the big-box grocer down the street might store more than 40,000?

Keeping this many products on hand might seem like the ideal strategy for facing ever-changing consumer demands. But this stock-heavy approach often does more damage than good. Simply storing in-demand products is expensive, and keeping items that fail to move costs even more. For this reason, many sellers are embracing SKU rationalization, which involves evaluating available products and stocking only the most sought-after items.

Intent on reducing its annual gross margin by 125 basis points, Hershey recently embraced this methodology, Food Business News reported. Retailers that believe they’re spending too much on warehousing undesirable items would be wise to follow in the footsteps of the confectionery giant. Here are three strategies for jump-starting SKU rationalization:

1. Establish workable sales benchmarks

Businesses pursuing SKU rationalization must establish sales benchmarks to determine which SKUs to cut. These thresholds will vary depending on the financial state of the organization and its fiscal goals. Scale is another critical differentiating factor. Larger retailers might use established benchmarks involving cases sold. Smaller sellers might use just units, according to Retail Wire.

2. Embrace the ABC inventory rule

With workable benchmarks in place, organizations can move on to cutting down stock. The ABC inventory reduction strategy is perhaps the best option for retailers embarking on such efforts, Inbound Logistics reported. This involves separating items into three categories: Products in the A category are bestsellers. Those in the B category generally perform well. Items in the C-category rarely sell and drive up costs simply by sitting in the warehouse. These are offerings removed as part of SKU rationalization.

3. Address disposal

After identifying products ripe for removal, organizations must figure out methods for disposal. This is often easier said than done, but many businesses find success through write-offs or low-priced distribution networks perfect for off-loading superfluous product.

Retailers that implement these three strategies can effectively manage SKU rationalization efforts and generate savings. Those still unsure of how to pursue this methodology should consider working with USC Consulting Group. For more than five decades, our experts have been helping sellers streamline their operations through cutting-edge optimization efforts.

Contact us today or subscribe to our blog to continue receiving insight from our subject matter experts.

Behind every great retailer, there is a warehouse receiving, stocking, sorting, and distributing its products. These operations serve an invaluable service to these enterprises, but if one had to put a number on it, Supply Chain Digest estimated the total cost of logistics in the U.S. just under $1.5 trillion in 2014. Businesses spend significantly on their warehouses and logistics teams, trying to hone processes and accrue efficiency wherever possible, like building a better scheduling system so pickers can coordinate better with transportation or designing a more organized floor plan that limits excessive travel.

However, one lean processing enhancement retailers often balk at the opportunity to adopt is stockkeeping unit (SKU) rationalization, the act of reducing the number of different products they sell to streamline business all along the supply chain. According to research from the Association for Convenience and Fuel Retailing – formerly the National Association of Convenience Stores – the average retailer stocks between 2,500 and 3,000 SKUs. Paul A. Myerson, professor of Supply Chain Management at Lehigh University and contributor for Inbound Logistics, wrote grocery stores can easily hold up to 40,000 SKUs. Even removing a handful of these SKUs put less of a logistical strain on warehouses and creates space for newer, more profitable products.

How can retailers get the most out of SKU rationalization initiatives?

As far-reaching as these benefits of removing a few underachieving products could stretch, some retailers may still find it difficult to decide which items should be removed from shelves for the sake of optimization. What sorts of tools could retailers adopt to create the most cost-effective cuts?

Distinguish between successes and failures using one time-tested method: the Pareto Principle.

Apply the Pareto Principle

Merchandise can only be profitable to retailers if it indeed turns a profit, if customers buy it, and a demand is evident. Otherwise, retailers waste money, time, and valuable shelf space stocking products no one wants. Worse still, they’ll need to pay for removal of these failing products as well. If retailers could collaborate with their warehouse logistics teams, be they in-house or third-party, to create a reliable metric by which to separate products on the grounds of success, these enterprises could intelligently discern which products actually move through the supply chain and which ones simply crowd the aisles of their stores.

In doing so, retailers should keep the Pareto Principle – also known as the “80/20 Rule” – in the back of their minds. As this economics cornerstone dictates, 80 percent of effects come from only 20 percent of causes. In this case, 80 percent of sales only come from 20 percent of the items on warehouse shelves. Identifying and quarantining the highest fifth of SKUs within a given inventory can help inform retailers as they make their decisions as to what needs cutting. For example, if a brand with five overall SKUs has four in the top percentile, perhaps retailers would benefit from holding onto all five. Alternatively, if another brand only has one of its five SKUs in the most profitable echelon, perhaps this would make a good area for SKU rationalization.

“Tracking end-user purchasing activity can simplify SKU rationalization.”

Count on customer-focused cutbacks

All this aside, the most trying reason why retailers find SKU rationalization so difficult is the inherent element of customer retention. Should a retailer discontinue a product popular to a small, but loyal customer base, they risk losing its business permanently. So, when developing a plan for implementing SKU rationalization, forgetting to consider what the customer thinks would be foolish, for a number of reasons. Most importantly, tracking end-user purchasing activity can simplify the process even more.

For instance, a Marketelligent study found the success rate of SKUs segmented by color and style stayed relatively constant year after year, and any designs reactivated after being discontinued because of underperformance experienced no great gains or losses either way. In fact, on a list of SKU popularity rank from highest to lowest, the farther one descends, the steeper the climb to “long tail” logistics. This means mid to low-selling items suffer more from a greater number of options. By studying customer buying habits and their cumulative effect on sales, retailers and their warehouse teams can plot a course for effective SKU rationalization that reduces costs, complexity, and waste.