-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Risk Management

The nature of supply chains has evolved over the years, with new technologies and many players in the middle making logistics highly complicated and expensive. A report by PwC indicates that logistics and supply chain costs account for approximately 10% of the organization’s total expenses. This is the most costly issue businesses struggle to minimize in their supply chain operations.

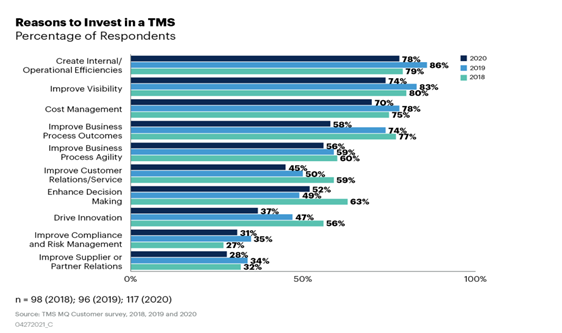

Managed transportation systems (MTS) address this problem, providing an organized way of consolidating logistics and eliminating waste. According to Gartner, the transportation management systems (TMS) market is expected to grow by 60%. This boom exemplifies the role of MTS in adapting to the prevailing dynamics of supply chain management.

This article will define MTS within the supply chain, reveal its operational and financial advantages, and explain how companies can embed them within their current structures and processes without disruption.

Benefits of Using Managed Transportation Systems

Managed transportation systems (MTS) go beyond optimizing shipping routing and data analysis management. They help manage logistics, allowing companies to concentrate on their primary business operations. Outsourcing the transportation management systems promotes professional development within the organization. It also enhances efficiency by eliminating wastefulness and saves costs in the long run.

The following are key benefits of using MTS in your supply chain processes:

Risk Management

Risk management has become more crucial now than ever because disruptions are bound to impact a company’s performance in its logistics industry. A managed transportation system can reduce risk by controlling carrier relationships and fine-tuning supply chain networks while using data-driven predictive tools to prevent delays or inefficiencies.

Cost Savings

Managed transportation systems assist organizations in selecting appropriate carriers and routes. This helps marketers cut transportation costs. In fact, companies that use data-driven insights can make well-organized decisions geared toward saving and managing costs effectively in the long run.

Simplified Day-to-Day Operations

If your company outsources logistics management, it can concentrate on its core business activities, such as developing new products and servicing customers. MTS providers manage logistics complexities, from booking shipments to addressing issues that may arise, so internal resources can be focused on core operations, increasing operational efficiency.

Enhanced Data and Insights

MTS analytics helps businesses monitor where logistics failed in real time. These insights allow businesses to make timely decisions, reduce delivery time, and optimize supply chain operations. Research indicates that data analytics helps cut costs and improve service levels.

Achieving Cost Efficiency with Managed Transportation Solutions

To stay competitive in the logistics market, your business must focus on reducing the cost of operations. But how do we achieve this? It’s pretty simple: Integrate managed transportation systems into your business.

Here are some vital hands-on ways to guarantee cost-effectiveness with MTS.

Carrier Optimization

Cost efficiency starts with choosing the appropriate carrier. MTS providers are not always out to settle on the cheapest rates but instead aim to optimize carrier selection by balancing cost and service performance. This guarantees timely deliveries and reduces transport costs.

Route and Mode Optimization

MTS helps companies find an optimum route and transport mode, resulting in huge cost savings. Increased route planning and mode selection for faster transit times help save on fuel consumption.

Data-Driven Decision Making

Data analytics are essential tools in minimizing a company’s costs. MTS vendors gather information from multiple systems and provide organizations with intelligence regarding logistics activities. Predictive and prescriptive analytics help forecast demand, anticipate disruptions, and make informed decisions that drive long-term cost savings.

Harnessing Data-Driven Insights for Superior Supply Chain Management

As supply chains grow more complex, data and analytics have become more than an optional add-on; they have become enablers of efficiency and resiliency. With the situation becoming even more complicated due to global disruptions, regulatory demands, and changing market conditions, data-driven approaches can bring a paradigm shift in supply chain management.

Here’s how businesses can capitalize on data-driven capabilities to improve the efficiency of their supply chain.

Supply Chain Data Management

Effective data management is the backbone of survival in the modern supply chain. There is an increasing reliance on advanced analytic tools for managing large volumes of data, which warrants quick insights and quicker actions.

According to KPMG’s Future of Supply Chain report, 39% of global supply chain professionals say they will invest in digital technologies to strengthen their data analysis capabilities. The readily available data enables an organization to anticipate interruptions, enhance visibility, and support efficient actions that maximize costs and service.

AI-Enabled Supply Chain Planning

Traditionally, demand planning is frequently carried out across departments using antiquated methods. This always leads to slow and less accurate forecasts. Fortunately, using AI-powered supply chain planning, the gaps between internal and external data can now be eliminated by leveraging unique machine learning models that link disparate types of information into a much more accurate forecast.

Generative AI in Supply Chain

Generative AI (GenAI) can transform supply chain management by making automation and decision-making easy. Examples of Gen AI use cases are translating complex data, summarizing legal documents, and analyzing customer feedback in real time.

Gen AI helps supply chain leaders more easily spot early warning signs, such as disruptions in supplier countries. It also supports faster response due to its capacity for handling huge amounts of information.

Best Practices for Leveraging Managed Transportation Systems in Your Business

A managed transportation system is a significant step and must be planned accordingly. Some best practices can help guide the process and ensure business gain from these systems.

1. Evaluate the Specific Needs of Your Business

Each company has different logistics requirements, and there may not always be a one-size-fits-all answer. When choosing a managed transportation provider or system, map your specific needs and see if they align with what they have—this is key. Shipment volume, frequency, and where you operate your business are some things to reflect on.

2. Monitor Key Performance Indicators (KPIs)

Measuring success for managed transportation system metrics begins with setting KPIs as they provide the capability to formulate results and track ongoing progress. Some metrics to monitor in your LSP are on-time delivery rates, transportation cost per shipment, and how fuel-efficient they run. Frequent monitoring of these KPIs will help determine the probable areas where the system could be improved to deliver desired outcomes.

3. Focus on Continuous Improvement

The logistics industry is ever-changing, and what works today may not work tomorrow. Businesses should be proactive agents, constantly assessing their managed transportation system and making informed course corrections based on data intelligence and performance metrics.

While this explanation can be more in-depth, businesses that embrace these best practices will have a smoother deployment of their managed transportation system and the operational as well as cost-saving results they expect.

Conclusion

There are many benefits of using managed transportation systems for businesses trying to improve supply chain efficiency and cost savings. MTS gives companies the tools needed to modernize logistics by delivering real-time visibility, route optimization, and data-driven decision support so that carriers can gain a competitive advantage in an increasingly complex supply chain. By deploying these systems, businesses can reduce costs and improve compliance and overall customer satisfaction.

*This article is written by Sheer Logistics. Sheer Logistics provides technology-driven supply chain solutions that empower businesses with visibility, efficiency, and agility across their logistics operations. With a focus on transparency and strategic partnership, Sheer Logistics helps clients optimize their supply chains and drive sustainable growth.

Effective risk management, strategic planning, and operational excellence are crucial for minimizing NPV losses and maximizing project value.

Recent studies and industry reports suggest that a significant portion of mining projects may face challenges that impact net present value (NPV) negatively. Estimates range from 20% to 60% or more, highlighting the inherent risks and complexities involved in the mining industry. These challenges may include cost overruns, schedule delays, geological uncertainties, regulatory changes, and market fluctuations, among others.

In fact, in other reports, McKinsey says as many as 4 out of 5 mining projects come in late and over budget by an average of 43%. EY found that 64% ran over budget or schedule with the average cost overrun sitting at 39%, after studying 192 global mining and metals projects worth more than $1 billion.

How can mining projects improve project execution when it comes to budgets and timelines? Mining companies must grapple with many pain points – cost overruns, schedule delays, operational risks, supply chain disruptions, and geopolitical uncertainty.

One of the most critical areas involves owner-contractor relationships and creating a “culture by design” right from the beginning. Many owners outsource their projects to EPCMs that have historically operated in mining and are typically very engineering focused on getting the design as accurate as possible to maximize outcomes and benefits. While important, it only represents 35% or 40% of the total cost of a typical project and that’s not where we tend to see issues. The other 60%-65% of the scope is construction.

Organizational culture can significantly impact projects in several ways:

- Risk Management: prioritizing safety, compliance, and responsible resource management can lead to better risk identification and mitigation strategies, reducing the likelihood of costly incidents and delays.

- Employee Engagement: creating a positive and supportive culture to foster employee engagement, morale, and retention, leading to higher productivity, better teamwork, and lower turnover rates, which are critical for project success.

- Decision-Making Processes: promoting transparency, collaboration, and innovation can lead to more efficient decision-making processes, enabling quicker responses to project challenges and opportunities – maintaining “single source of the truth”.

- Adaptability: encouraging flexibility, learning, and continuous improvement enables organizations to navigate changing market conditions, regulatory requirements, and technological advancements more effectively.

- Stakeholder Relations: valuing relationships with stakeholders, including local communities, governments, and investors, can enhance trust, collaboration, and support for mining projects, reducing the risk of opposition or regulatory challenges.

In summary, positive mining capital project performance, characterized by effective organizational culture, cost management, revenue generation, risk mitigation, and optimal capital expenditure allocation, can enhance NPV by increasing cash flows and reducing project risk.

USC partners with your organization and coaches your people to significantly impact performance outcomes and get your capital projects over the line on-time and within budget.

USC works with Owner Teams to execute capital projects and prepare for operational readiness during the early stages of the capital project development process, typically prior to the start of the construction phase. Operational readiness activities should be integrated into project planning and execution to ensure early adoption of the desired project culture while building buy-in from the various project stakeholders. There are three key elements to successful projects and capturing NPV.

Culture: Corporate culture is the shared values, attitudes, and practices that define the owner’s project, operation and interactions with its employees and various stakeholders. Culture clashes often occur when people from different backgrounds are assembled.

In capital projects, this often occurs when stakeholders are not aligned around a common set of goals and priorities, potentially resulting in the creation of an unsafe environment and/or low productivity and poor-quality execution. The imperative in this situation is to align stakeholders and define a “culture by design” at the top and instill the culture from the bottom up – deliberately starting at the work activity level.

USC works with successful owner teams to begin this journey from the outset of the project, and usually with a high sense of urgency.

Governance: While most recognize the need for establishing a robust governance framework, with a measurable set of metrics, many fail to execute. Typically, governance frameworks include everything from policies, regulations, functions, processes, procedures, and responsibilities, as well as how project progress and execution performance are tracked and reported.

It is not uncommon for EPCs and sub-contractors to use their own processes and systems to track performance – leading to various versions of the truth on the project. Inconsistent and inaccurate information results in inaccurate project execution planning, ineffective execution, and inaccurate status reporting which in turn results in schedule slippage and costly overruns.

USC works with project stakeholders to ensure governance goes beyond the decision-making of a single project, by developing a “Truth Center” where priorities are set, planning is done, performance is integrated, measured and communicated. By creating a single source of the truth and defining detailed work activities, including who is responsible for what and when, stakeholders can avoid the typical project execution pitfalls. By providing consistency, certainty and coordination, owner teams add to the stability of the project.

Readiness: How many projects are delayed due to poorly defined feasibility studies, engineering delays, late recruitment of key personnel and/or procurement delays? These early delays are difficult to overcome during the project and have a severe impact on NPV.

Many organizations are unclear when to start working on operational readiness – long ramp up times and slow operational start-ups are NPV killers, even for well executed capital projects. Key operations personnel should join the project early in the engineering phase to ensure the operability and maintainability of engineering designs. Additionally, they should play a role in defining and designing the culture for the project. Initiating the design of the operational processes and defining operational system requirements no later than the beginning of the construction phase and completed before starting the commissioning phase.

USC brings 55+ years of experience in shaping organizations and designing and implementing management operating systems and processes to assist owner teams in mitigating start-up risks and unlocking hidden-value to accelerate ramp-up success.

USC Helps You Tackle Key Challenges

- Aligning key stakeholders to a common goal and set of project priorities while defining a common culture

- Ingrain a safety-first approach into a planning and execution excellence culture

- Improving your NPV by developing management process and systems that enable in-shift execution optimization

- Ensuring project execution readiness prior to project startup and operational readiness prior to operational ramp-up

Do you want to understand how prepared your company is to manage project risks while accelerating work execution and operational ramp-up and what the key focus areas that will contribute to improved net present value?

Want to find out more about how USC can help you uncover the hidden-value lurking in your capital project?

For more information, let’s talk it through with a no obligation meeting with one of our executive team members. Email info@usccg.com to arrange a call.

In many industries, globalization has resulted in the consolidation of suppliers and increasingly interdependent Supply Chains. Globalization has increased efficiencies and economies of scale, but it has led to decreased diversity of sourcing and supply options.

Increasing geopolitical tensions, pandemic related lockdowns, and ideological polarizations have increased supply chain disruptions for many products and materials.

Supply Chain Risk Management System

An active Supply Chain Risk Management System cannot ensure continuity of supply, however, it can provide a playbook with options when sources of supply are threatened.

Download our free eBook “The Supply Chain Risk Management Playbook: Navigating Through an Uncertain Supply Chain Future” as we advise how to identify and respond to the unique risks that affect your business.

This Playbook details the various concepts that will secure your operations, including:

- Planning the Risk Management assessment

- Conducting the Risk Management assessment

- Checking your findings

- Acting on your findings

Planning the Risk Management Assessment

During the planning stage you will define the project charter and assess your organization’s Risk Tolerance.

Conducting the Risk Management Assessment

Once management has defined success and risk tolerances, it’s time to take action and conduct the assessment.

Check your findings

This step must be tailored to the risk being assessed. Here you will build the risk models and validate the assumptions with your stakeholders.

Act on your findings

Once all appropriate stakeholders have agreed to the change, put the risk mitigation strategy into action.

For full details on each of these critical stages, download the complete Playbook below:

Installing a well-functioning Supply Chain Risk Management Operating System is a journey, not an event.

Enhancing responsiveness to risk provides competitive advantages, especially in industries where competition for key vendors, access to resources, and logistics constraints are prevalent.

USC Consulting Group’s Supply Chain experts have over 50 years of industry experience with the latest risk management practices and can help you with your unique challenges. Contact us to remove the risks and start driving operational improvements in your business.

These past several weeks have been a whirlwind for pretty much the entire world. The novel coronavirus – which has led to more than 3,020,000 deaths globally and has infected nearly 142 million people, according to John Hopkins University – has turned virtually everything on its head. In less than a month’s time, the U.S. economy went from being healthy to being forecasted to enter a recession, as over 25 million Americans have filed for unemployment benefits and over 700,000 jobs were lost in March, according to government data. This has led many Americans to lose confidence in the economy’s vibrancy; just 25% of respondents in a recent LIMRA survey believe it to be in good shape, down from 56% as recently as January. Fully 50% of Americans indicate that their financial situation is becoming worse, according to newly released polling from Gallup. That represents the highest percentage of respondents who have felt as much in the more than 20 years that the polling agency has been asking such a question. This comes after numerous monthly economic reports from the Department of Labor indicated unemployment nationwide was at a 50-year low and consumer spending was trending higher.

The suddenness of the economic downturn has many people – especially business leaders – wondering: Was the writing on the wall as to the extent of the adverse effects COVID-19 would have on supply chains? In other words, could it have been forecasted? No, according to Eric Wilson, director of thought leadership at the Institute of Business Forecasting & Planning. What the pandemic did do, however, is re-emphasize why it’s so important to plan for worst-case scenarios.

“50% of Americans indicate that their financial situation is headed downhill.”

Many businesses at risk

Businesses in the private sector have felt the affects of reduced consumer spending, constrained operations and supply chain challenges. In a survey performed by the U.S. Chamber of Commerce, a majority of small businesses – 53% – said they were less than six months away from shuttering permanently due to the economic downturn resulting from the nationwide shutdown.

These findings align with the Institute of Business Forecasting & Planning’s findings, which found that a strong plurality of mid-to-large-sized companies in the U.S. did not have a plan in place for a sudden economic downturn, Supply Chain Dive reported. Evidence of this was the fact that over 60% of respondents said they experienced delays in receiving orders from China, an issue that may have been avoided by dual sourcing.

The fluidity of the coronavirus situation and the timeline of when the threat first came to light has many people questioning what red flags, if any, were missed. Of course, no one can see things coming in the future, certainly not a novel virus.

However, given that approximately three-quarters of supply chains have been adversely affected due to the pandemic, according to survey research from the Institute for Supply Chain Management, it’s clear that everyone could have done a better job at contingency planning.

This starts by ensuring there’s more transparency within the supply chain, advised Subodha Kumar, professor of marketing and supply chain management at Temple University’s Fox School of Business. Speaking to Supply Chain Dive, Kumar warned that the biggest lesson to take away from the pandemic is becoming more effective in supply chain management so disruptions can be curtailed. The coronavirus serves as “a wake up call for all the companies, that this is the time to change the whole supply chain, and create transparency in the system where any changes at the store level are transmitted to all the partners in the supply chain – and as quickly as possible.”

In other words, companies of all sizes must do more to create transparency so it allows for smarter and smoother proactive contingency planning techniques.

What’s the difference between forecasting and contingency planning?

Forecasting and planning are terms that are often used interchangeably. While they undoubtedly have similarities, the key distinction is in regard to expectations. In other words, whereas forecasting is predicting a specific event to transpire, contingency planning is rooted in what behaviors and strategies should be employed to overcome disruptions, even if you don’t predict all, or even one, may actually happen.

A classic example of successful contingency planning consists of restaurants that prioritized their delivery channels prior to COVID-19. Because of the highly contagious nature of the virus, virtually all restaurants have closed their dining rooms and offer only takeout and delivery. Whether by partnering with delivery apps like UberEats and DoorDash or hiring personnel who can drive orders to customers’ houses, eateries have been able to effectively pivot and maintain incoming revenue. The restaurant sector has undoubtedly been hard hit by the shutdown, with businesses forced to lay off or furlough much of their staff. But companies that had delivery already in place were in a better position to adapt to sudden changes to business as usual.

The same can be said for those who use dual sourcing strategies. Particularly popular among manufacturers, dual sourcing serves as a smart fallback because it ensures that if one supplier is unable to deliver a particular product, the alternative likely can. As noted by IndustryWeek, dual sourcing usually entails utilizing suppliers from that are geographically diverse, such as one that is overseas and another that’s local or national. This more effectively balances supply-side or demand-side impacts

Data is critically important

What’s the best way to plan? Those who have been in the trenches say data plays a key role. Dustin Deal, director of North America business operations for telecommunications firm Motorola, noted during a recent town hall hosted by IBFP that the company’s ability to track, catalog and obtain data has enabled it to better adapt to how COVID-19 has affected its operations in many different countries.

“There’s so many data points coming at you from all over: the health industry, the government, financial markets,” Deal said, according to Supply Chain Dive. “[We] constantly look at the variables and try to figure out how that’s going to shape our markets.”

While many aspects of the pandemic are unclear and confusing, one thing is certain: the effects of the virus will be long-lasting. You may not be able to change the course of events, but there’s a lot you can do to develop a planning playbook so you’re more capable of adjusting and modifying your operations should similar local or federal emergencies happen again. USC Consulting Group can be your partner in arms in this effort and provide you with the education and strategies that fuel efficiency and adaptability. Contact us today to learn more.

When negotiating payment terms with suppliers, manufacturers must pay special attention to avoiding risk. A balanced supply contract ensures a mutually beneficial agreement between both parties, but if the language concerning payment isn’t exact, it could result in one side losing out, possibly even irreparable damage to the working relationship.

How can manufacturers properly mitigate risk when discussing payment terms with their suppliers?

1. Put mechanisms in place for delinquent or unmet deliveries

Obviously, when mapping out payment terms, suppliers will have a few conditions in place to handle late payments. In the same respect, manufacturers should make sure their interests are equally represented by chiseling out their own conditions for deliverables.

Think of it like a typical supplier escalation clause. Should the cost of materials increase, a supplier may invoke an escalation clause to raise the price of services rendered. Fair enough, but what if the supplier, for whatever reason, cannot meet the needs of the manufacturer?

Insufficient procurement may end up costing manufacturers significantly as they scramble to complete deficient work orders and pay top dollar for last-minute service. Manufacturers should actively address “worst case scenarios” with their partners, like who they’ll turn to if suppliers can’t fulfill their supply requirements, and how much the original supplier can expect to supplement that emergency investment.

“Flexible payment terms may even be preferable to lower prices.”

2. Don’t accept boilerplate payment windows

Suppliers may offer standard payment terms, or at least terms “standard” for their other contracted partners. Adjusting and extending the length of payment terms presents manufacturers with perhaps one of the greatest “parachutes” against risk: immediate cash flow increases.

According to Entrepreneur, flexible payment terms may even be preferable to lower prices, depending on the manufacturer’s situation.

Manufacturers might get less pushback from suppliers when they bring detailed reasons as to why certain payment windows adversely impact their operations. In fact, manufacturers could calculate cash flow estimates according to different payment windows as the groundwork for their arguments regarding extensions.

3. Discuss supplier pain points as well as your own

When two organizations partner, they effectively assume each other’s risks by way of mutual dependence. A degree of transparency between suppliers and manufacturers, therefore, could mitigate or eliminate problem areas for both parties. After all, with an extra set of eyes and hands – so to speak – both partners could find ways to restructure payment terms that attack these risks head on.

Beyond timing, there are two important factors worth highlighting concerning alternative frameworks for payment terms that partners could take advantage of. Pre-payment, for one, could be a show of good faith for suppliers unwilling to budge on lengthening invoice durations. Additionally, how manufacturers remunerate suppliers could be a bargaining chip as well. If suppliers have switched to an e-payment system but the manufacturer sticks with paying in check, manufacturers could agree to modernize if suppliers are willing to expand payment windows.

Process industries, perhaps more so than any other, need a strong risk management approach since they experience and interact with risk on a daily basis. Due to the continual nature of a process-focused enterprise, these companies ostensibly subject themselves to the highest level of risk because they’re continually operating without stop.

As such, the most production-minded companies who pride themselves on efficient, timely output require a stellar and comprehensive risk management strategy. But risk is multifaceted, and in many ways, proper risk management deployment can positively impact and maximize lean processes.

“Everyone working at a processing plant assesses and manages risk.”

How does risk management apply to lean processes?

Lean processes boil down to the elimination of waste. While some experts may argue honing operations has more to it than, the mission of an average company seeking to increase value potential is to “trim the fat” and reduce areas of excess. According to Lean Manufacturing Tools, some of these areas include overproduction, overprocessing and extraneous movement.

However, promoting a true lean mindset shouldn’t hinge myopically on the problem, but the factor or process that yields the problem. This is where risk management comes in. In one way or another, everyone working at a processing plant assesses and manages risk. For example, when an employee applies his occupational knowledge by safely operating heavy machinery, he’s leveraging the risk of injury with his expertise. That said, risk management doesn’t exclusively pertain to preventing injuries in the workplace. That same employee prevents value loss by processing material properly.

Managers and supervisors seeking to flesh out their risk management simultaneously enhance their lean capabilities. BASF explained risk matrices as a very simple math problem: Risk equals probability times severity. This means equal weight is given to small issues that occur frequently and huge ones that only happen once in awhile. Lean process oversight follows similar guidelines: Waste production can be glaring or ingrained in the system, but either way, it’s unwanted at a business seeking efficiency.

Proper risk management avoids processes that could take down the whole operation.

Why risk management and lean operations complement each other without redundancy

In fact, many common areas typically attributed to managing risk are practically blood-related to lean opeations. For instance, since the advent of the digital age, data curation has wedged itself into every industry. Regardless as to what companies do, these days, they all do it with data. In process industries, apart from customer data, information gleaned from machinery and integral technologies can provide managers with valuable insight toward both eliminating inefficiencies and removing risk from the equation.

For example, if a piece of smart equipment reports to a company’s operational risk management system that it’s running too hot, this procedure blends liability control with lean best practices. Not only do these alerts reduce the chances of worker injury, but they also give supervisors an advanced opportunity to address the issue on their own terms, rather than having to deal with a crippled production line completely out of the blue. A Mälardalen University study found downtime can consume almost a quarter of a manufacturer’s total cost ratio. Thankfully, intelligent data deployment and management can resolve those risks and many more.

The biggest mistake a person looking to optimize their production can make is cutting corners. Lean processes aren’t made by throwing the baby out with the bathwater, but by utilizing the resources available with the most innovative and effective methods. operational risk management keeps workers safe, but it’s just as important as a deterrent for expensive downtime, compromise products and surprise repairs.