-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- September 2025 (1)

- August 2025 (2)

- July 2025 (2)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: On-Stream Time

No industrial business that hopes to turn a profit in the era of Industry 4.0 can do so without selecting the right key performance indicators (KPIs). These metrics afford operations managers and senior-level decision-makers critical snapshots of how their plants operate and, more importantly, how they ought to operate in order to compete.

When it comes to Oil and Gas, the KPIs that processing facilities choose and utilize depend on their unique objectives. Even businesses within the same industry may seek vastly different insights from their data. But given the state of O&G in America today, which KPIs often make the cut?

1. Capital project efficiency

Between 2006 and 2013, budgets for capital expenditures into exploration and upstream oil production grew at many E&P firms, but have since failed to deliver on the allocation, according to a report from PricewaterhouseCoopers. Capex concerns have been no doubt exacerbated by steep decreases in per-barrel oil prices then and now.

As the Oil and Gas industry as a whole moves into more challenging drilling and extraction environs, it should consider how to visibly articulate capex project efficiency, a multifaceted measurement that combines adherence to stricter budgetary allowance, maintenance spend, and project overrun as well as creep.

2. Attendance and completion of safety training

Safety is notoriously difficult to track. This particular KPI can give on-site safety managers a peek at potential dangers to come. Oil and Gas needs this now more than ever – according to E&E News analysis of data from the Occupational Safety and Health Administration, severe work-related injuries pertaining to “support activities for oil and gas operations” occurred at a rate of nearly 149 per every 100,000 workers. Severe injury includes amputation, in-patient hospitalization, or loss of an eye.

It stands to reason that those who undergo safety training courses will act safely and avoid injury. Safety managers must therefore address any barriers suppressing attendance or completion, and KPIs tracking both will alert them to such issues, especially if they monitor the rate at which completion occurs over time. Advocacy for training will ensure investment into these programs pays off as soon as possible, a crucial factor as many O&G companies face tight margins.

3. Leaks per X customers

Midstream oil and gas firms oversee an incredibly long and intricate distribution network, which requires an understanding of its environmental impact. U.S. Oil and Gas companies manage 2.4 million miles of energy-related pipe and 72,000 miles of crude-oil pipe, according to Pipeline101.org, a website maintained by the Association of Oil Pipe Lines and the American Petroleum Institute.

Aligning maintenance spend with environmental regulations requires a deeper look into how often leaks occur, in relation to customer revenue, and which assets incur the highest repair costs.

Although these KPIs have driven success for others, their real value lies in how facilities implement them through continuous improvement initiatives. To speak to organizational management consultants on how to turn KPI insights into actions, contact USC Consulting Group today.

Running a successful midstream oil and gas company can feel a lot like caring for a two-headed dog, one head for upstream operations and the other downstream. Midstream can’t address one head’s needs over the other, balancing the needs of both can prove complex and even redundant, leading to more work with less payoff. However, midstream can make peace by utilizing the right process optimization strategies that focus on increased transparency for both data and resource management.

Technological transparency for ethane recovery/rejection

Midstream oil and gas companies seeking to optimize their processes won’t succeed with a one-size-fits-all fix. Companies must develop multifaceted plans that cover different paths upstream operations might take according to market demand.

The choice between ethane rejection and recovery represents one such decision. Should upstream oil and gas companies divert its ethane into dry natural gas pipelines, or should they simply move it down the chain as is and send it to fractioners for midstream processing? In either case, how can either event receive an optimization boost so midstream businesses turn a good profit without adding complexity to an already complicated system?

“Data visibility allows midstream companies to discern which way upstream operations are leaning.”

Coordination with upstream and downstream partners through data transparency offers a window for midstream companies to interpret more about their partners’ schedules to effectively plan their own. Market and demand fluctuations scrutinized by either party should be shared via an easily accessible data management portal. Instead of waiting for commands from producers as to the course of action to be taken, data visibility allows midstream companies to discern which way upstream operations are leaning, so midstream can plan accordingly.

It isn’t just about market fluctuations either, as Level 2 Energy reported – the recovery-versus-rejection decision could also be contingent on the amount of ethane producers have recently sold as natural gas. Again, as the three segments in the oil and gas chain utilize an open network of freely moving, up-to-the-minute information in a centralized location with a consolidated data stream, midstream can better anticipate what’s coming down the pipe.

Hydrocarbon transfer asset management and maintenance

Hydrocarbon transfer systems present midstream companies with another valuable opportunity to hone processes, not exclusively in their day-to-day operation and use, but also their upkeep over time. Lease automatic custody transfer units move resources from buyers to sellers and give all parties involved visibility into previously transported volumes.

So, why has such important equipment appear to have fallen by the wayside as the rest of the oil and gas industry at large appears so open to other forms of modernization? A study by Rockwell Automation found a predominant number of LACT units rely on “snail mail” to report supply information between seller and buyer, leading to an epidemic of accounting errors. Additionally, maintenance plans for these hydrocarbon transfer assets are usually just as outdated. Manually managing these sites with little to no technological integration and data reporting means midstream businesses charged with their oversight waste valuable resources visiting remote LACT units with no problems while neglecting those that do.

“Operators can coordinate LACT unit visitation data to create criticality rankings.”

Midstream companies ought to invest in remote monitoring capabilities to prioritize maintenance work orders and bolster resource accounting in one fell swoop. Operators can coordinate LACT unit visitation data to create criticality rankings for each site in terms of which receives immediate attention and why. Digital resource reporting capabilities will also prevent miscommunication between buyers and sellers, decreasing or eliminating altogether the resources expended to amend breakdowns in accounting.

Midstream oil and gas operations can serve of two masters, so long as companies pay particular attention to how innovation can streamline data flow and simplify their responsibilities in intelligent ways.

Industries from biopharm to oil and gas are abuzz with praise for continuous processing technology and the advantages the model brings to their businesses. Traditionally, these advancements take less time, consume less energy and usually have a smaller operational footprint to batch production, depending on the industry and assets utilized. From there, many businesses have seen significant Opex cost reductions, productivity gains, and alternative value-add opportunities.

Hype surrounding continuous processing can be particularly difficult to examine objectively, especially for decision-makers lacking the technical expertise while trying to determine if certain batch processes under their purview are worthy or in need of an upgrade to continuous status.

Do your operations fit the criteria below? Then it may be time to switch. Or, perhaps given what you learn, you must develop other areas first before taking the dive into continuous processing to gain and sustain its benefits.

Continuous processes ‘heating up’ in biopharm and chemical processing

If the science matches up, your company could be a prime candidate for continuous processing. Researchers from the Agency for Science, Technology and Research in Singapore published a study demonstrating how exothermic and endothermic liquid-phase reactions occurring in pharmaceutical or chemical processes could prosper greatly from continuous production methods over batch.

A*STAR scientists noted biopharm companies and chemical producers utilizing the Reformatsky reaction, a “organozinc-catalyzed reaction that frequently overheats with batch processing,” could find value in continuous processing. Using continuous methods in this way, companies could save on labor and resource costs, retain high uptime rates, uphold product quality, and perhaps even leverage efficiency as a means of lowering prices for consumers.

Will continuous processing give you IT nightmares?

A recent Automation World survey conducted for its advertisers inadvertently revealed several crucial differences between business leaders operating continuous processes versus batch processes. In sharing the results, the publication has provided on-the-fence decision-makers with powerful insights into what process changes could mean for their business at large.

The survey found more readers working with continuous processing worried about “technology upgrades” and “cybersecurity” than those working with batch processes. While correlation does not imply causation, Automation World Director of Content and Editor-in-Chief David Greenfield who wrote the accompanying article for the survey raised important points on-the-fencers should not take lightly. With an increase in technological innovation, connectivity, and interoperability gained through the incorporation of cutting-edge continuous processing equipment, the companies capitalizing on it are more than likely to possess a naturally increased awareness for the possibility of system breaches. That said, if your organization already struggles with cybersecurity issues under a batch regime, perhaps it may be best to devote attention to those gaps first before pursuing continuous processing and the tech that makes it possible.

Continuous processing removes many inefficiencies batch producers have struggled with since the dawn of modern industry. However, implementing continuous processes without proper foresight could backfire. Be sure to research how continuous processing has made an impact in your specific industry before integration, if you wish to glean a competitive advantage.

Natural gas production has remained stagnant even as the nation creeps toward cooler weather. Instead, processing plants have begun to increase the variety of products in their portfolios, investing in asset infrastructure for purifying natural gas liquids.

But what does diversification like this mean, especially to an industry focused on cutting Opex costs and optimizing production? What concerns should stay at the forefront of midstream investors’ minds when installing, expanding, or reconfiguring NGL fractionation and distillation equipment?

Plan for market agility through asset utilization

Although the low cost of natural gas may be of benefit to gas-fired energy generators across the country – especially as air conditioning demand trends upward, according to Reuters – companies entrenched in the oil and gas industry must find new methods for capitalizing on goods without saturating the market. Extracting pentanes and other worthy hydrocarbons from NGLs prevents natural gas organizations from tapping extra wells and using the most of the production already available to them.

However, as midstream operations spin ethane, butane, etc. from NGLs, asset expansion necessary to control these varied resources only stands to complicate processing and open up room for mechanical failures, product mishandling, and perhaps even regulatory noncompliance. Additionally, a diversified stock so reliant on domestic and export market performance requires responsiveness to remain a boon to business. When one outperforms others, decision-makers must be at the ready to tilt production accordingly without compromising quality or service.

Maintain cost-effective energy consumption

Industry leaders know distillation columns used in NGL fractionation burn a lot of thermal energy, with as much as 40 percent used on site for “refining and continuous chemical processes,” according to the U.S. Department of Energy.

Labor reductions to extraction upstream trim production to avoid market saturation, but these austerity measures also aim to deflate costs throughout all oil and gas operations while prices remain low. Adding energy-intensive assets without taking energy expenses into consideration may undermine cost-cutting initiatives elsewhere. Apart from balancing the books and ensuring the difference in operational growth doesn’t derail Opex cost reduction, what else can NGL producers and processors do to mitigate how much distillation may grow their energy footprint?

One method, according to the American Institute of Chemical Engineers, involves targeting energy variability through the establishment of pressure controls, particularly for light-hydrocarbon columns. Researchers found even a 7 percent reduction in pressure could yield the typical distillation process a savings of $240,000 in annual energy costs. Moreover, advanced condenser mediums capable of balancing distilled resources at the perfect temperature could more than double those gains.

Oil and gas companies ought to concentrate more on how they run their distillation towers.

Avoid distillation column misuse

How fractionation towers function in a more general sense also matters, especially if on-site NGL distillation has undergone maturation because of process mapping and other physical changes to the layout of a facility.

For instance, Chemical Processing reported how many refiners focus too heavily on condensers and reboilers when they should give equal consideration to column feeds and how they perform around entrant trays. A misplaced feed could force fractionation towers to work overtime and increase their energy demand unnecessarily. This mistake may also cause asset failure due to imbalance, compromising safety and the quality of the product therein, as well as every other NGL that would have been harvested down the chain.

When altering process organization for greater operational efficiency gains, don’t alter feed locations unless data confirms the move won’t jeopardize asset availability and uptime. Remember: Distillation towers are almost the perfect embodiment of the domino effect. If one column becomes compromised, you will almost assuredly lose all others until the problem is remedied.

Fractionation presents natural gas with horizons to conquer and opportunities to turn market troughs into progressive growth as companies expand the scope of their operations. Before integrating new distillation assets or changing how you use the ones already on site, discuss your plans with a knowledgeable consultancy, preferably one with a specialization in continuous processes and utilization, as well as one with a proven track record in the field of oil and gas.

Process industries, perhaps more so than any other, need a strong risk management approach since they experience and interact with risk on a daily basis. Due to the continual nature of a process-focused enterprise, these companies ostensibly subject themselves to the highest level of risk because they’re continually operating without stop.

As such, the most production-minded companies who pride themselves on efficient, timely output require a stellar and comprehensive risk management strategy. But risk is multifaceted, and in many ways, proper risk management deployment can positively impact and maximize lean processes.

“Everyone working at a processing plant assesses and manages risk.”

How does risk management apply to lean processes?

Lean processes boil down to the elimination of waste. While some experts may argue honing operations has more to it than, the mission of an average company seeking to increase value potential is to “trim the fat” and reduce areas of excess. According to Lean Manufacturing Tools, some of these areas include overproduction, overprocessing and extraneous movement.

However, promoting a true lean mindset shouldn’t hinge myopically on the problem, but the factor or process that yields the problem. This is where risk management comes in. In one way or another, everyone working at a processing plant assesses and manages risk. For example, when an employee applies his occupational knowledge by safely operating heavy machinery, he’s leveraging the risk of injury with his expertise. That said, risk management doesn’t exclusively pertain to preventing injuries in the workplace. That same employee prevents value loss by processing material properly.

Managers and supervisors seeking to flesh out their risk management simultaneously enhance their lean capabilities. BASF explained risk matrices as a very simple math problem: Risk equals probability times severity. This means equal weight is given to small issues that occur frequently and huge ones that only happen once in awhile. Lean process oversight follows similar guidelines: Waste production can be glaring or ingrained in the system, but either way, it’s unwanted at a business seeking efficiency.

Proper risk management avoids processes that could take down the whole operation.

Why risk management and lean operations complement each other without redundancy

In fact, many common areas typically attributed to managing risk are practically blood-related to lean opeations. For instance, since the advent of the digital age, data curation has wedged itself into every industry. Regardless as to what companies do, these days, they all do it with data. In process industries, apart from customer data, information gleaned from machinery and integral technologies can provide managers with valuable insight toward both eliminating inefficiencies and removing risk from the equation.

For example, if a piece of smart equipment reports to a company’s operational risk management system that it’s running too hot, this procedure blends liability control with lean best practices. Not only do these alerts reduce the chances of worker injury, but they also give supervisors an advanced opportunity to address the issue on their own terms, rather than having to deal with a crippled production line completely out of the blue. A Mälardalen University study found downtime can consume almost a quarter of a manufacturer’s total cost ratio. Thankfully, intelligent data deployment and management can resolve those risks and many more.

The biggest mistake a person looking to optimize their production can make is cutting corners. Lean processes aren’t made by throwing the baby out with the bathwater, but by utilizing the resources available with the most innovative and effective methods. operational risk management keeps workers safe, but it’s just as important as a deterrent for expensive downtime, compromise products and surprise repairs.

In process industries, investment in new technology does not always mean that operations will be more efficient. In most situations, technology needs to be paired with the right processes. Automation does not lead to operational improvement by itself. When it comes to improving facility operations, timing is essential. Whether it is to implement a maintenance schedule, adjust equipment settings or administer training, determining the right schedule and sticking to it is paramount.

“Efficient changeovers increase production flexibility.”

The key to successful changeovers is in the planning

Facilities that produce two or more product types know that time can often be lost when switching gears. It takes significant time and effort to alter equipment from one group of settings to another. Accordingly, when implementing changeovers, preventing accrual of downtime is a major consideration. This is accomplished by analyzing the production schedule and determining the best time to make a switch. It may be that a switch from product “A” to “C” is more efficient than a switch from product “A” to “B.” Figuring out these small differences, facility operators can create the right changeover schedule and stick to it. The improvements add up over time and the company is able to save time and money while producing more at the same time. A Lean Journey mentioned that efficient changeovers increase production flexibility, reduce inventory costs and lower defect rates.

Another area of scheduling that is important with regard to changeovers is the staging area. Not only is it important to know when to perform changeovers, but it is also essential that facility technicians take care of the job as quickly as possible. The best way to do this is to make sure that staff members are ready to do the work when the time comes. Having fully stocked staging areas, maintenance staff on standby and process documents in hand can help companies save even more time when performing changeovers.

Scheduling changeovers at the right time can improve operations

Maintenance is not meant to be reactionary

All plant assets require regular maintenance. Some facility operators only do maintenance work when something breaks, but the better strategy is to implement a reliability centered maintenance program. This involves checking and fixing equipment on a regular basis. Reliability Web advised companies to schedule inspections at regular intervals, to discard items before some specified time limit and pay attention to hidden-function items that can lead to functional failures.

The right scheduling can improve facility operations.

Maintenance work is not meant to be reactionary. Alternatively, having a proactive approach ensures that equipment will run longer and more efficiently without interruption. To implement a RCM program, facility operators must designate specific times when the work will be done. The best time may depend on each individual asset and should definitely not interfere with the production schedule. Facility operators can think of RCM as taking insurance out against having to do more significant repair work down the road.

Training is not an option

Because process industries involve lots of equipment, software and technical issues, instituting an ongoing training program is a good idea. Training is one of the main tools employed in the Continuous Improvement methodology. There are many benefits that come with managing a culture of education. Staff will always be updated on best practices in the facility. Furthermore, ongoing training ensures that valuable tribal knowledge accumulated in a facility does not dissipate as aging experienced workers retire. IndustryWeek pointed out that in the manufacturing industry, filling skilled production jobs is already difficult. Regular training can help alleviate this problem because younger workers can learn to take the place of their managers and companies will not have to work so hard trying to hire from the outside

Having excellent On-Stream Time is the bread and butter of any processing plant or other facility that produces chemicals, power, pulp, etc. Effective maintenance practices minimize downtime by focusing and coordinating preventive and corrective maintenance activities. There is however another entire category of downtime; that is the downtime driven by Turnarounds. Paul Harker, Senior Operations Manager with USCCG, explains the best approach to Turnarounds below.

The objective of a Turnaround (TA) is to complete all essential maintenance work required to ensure that the area runs reliably for an entire production campaign. This must be done while keeping the TA duration as short as possible to minimize the loss of production.

Turnarounds exist for two reasons:

- There are some maintenance activities that can only take place completely and safely when the plant is down.

- A correctly scoped Turnaround, executed in the minimum time required, prevents unplanned down events that ultimately cause greater total downtime.

Without a comprehensive approach to turnarounds, an organization exposes itself to a number of issues:

- There may be no annual Turnaround Plan:

- The timing to conduct a TA is determined by an individual

- There are no future Turnarounds scheduled

- The work scope of any given TA may be focused on the problem asset(s), but is easily and artificially inflated by, ‘What can we get done while it is down?’ Rather than by, ‘What must be done to ensure reliability?’

- The ability to report & manage TA costs and duration is cumbersome and incomplete. In some situations, the final cost is only known weeks or months later when all the invoices are in.

- Costs and duration over-runs are frequent.

- There is often an intense scrambling to get everything done in the last few hours or days, whereas in a well-managed outage the final stages are typically calmer. This is because most of the work is already completed, with only a few critical activities left.

Due to the complex mix of parts, equipment, and contractors involved there is a great deal of scrambling required to execute the event. Some common stumbling blocks include:

- The TA planning process is not launched and stabilized early enough to be effective.

- The essential work scope is not formally defined and agreed, resulting in some important work being left out, in favor of less significant work that is clearly defined and ready to go.

- The critical path is determined and managed subjectively.

- An individual must manually coordinate the timeline of internal and outside resources.

- There is frequent interference or disconnects between crafts, and in some situations the crafts even have their own plans developed in isolation.

- Significant time is lost waiting for shared equipment to become available.

- The benefit of Key Activities being completed early is invariably lost due to the inability to reschedule with simplicity. As a result, all delays to critical activities translate directly to outage duration increases.

- Float is not readily visible in the schedule resulting in a less effective focus of attention and resources.

- Informal documents are used to pre-identify and track the status of the parts that need to be purchased for a TA.

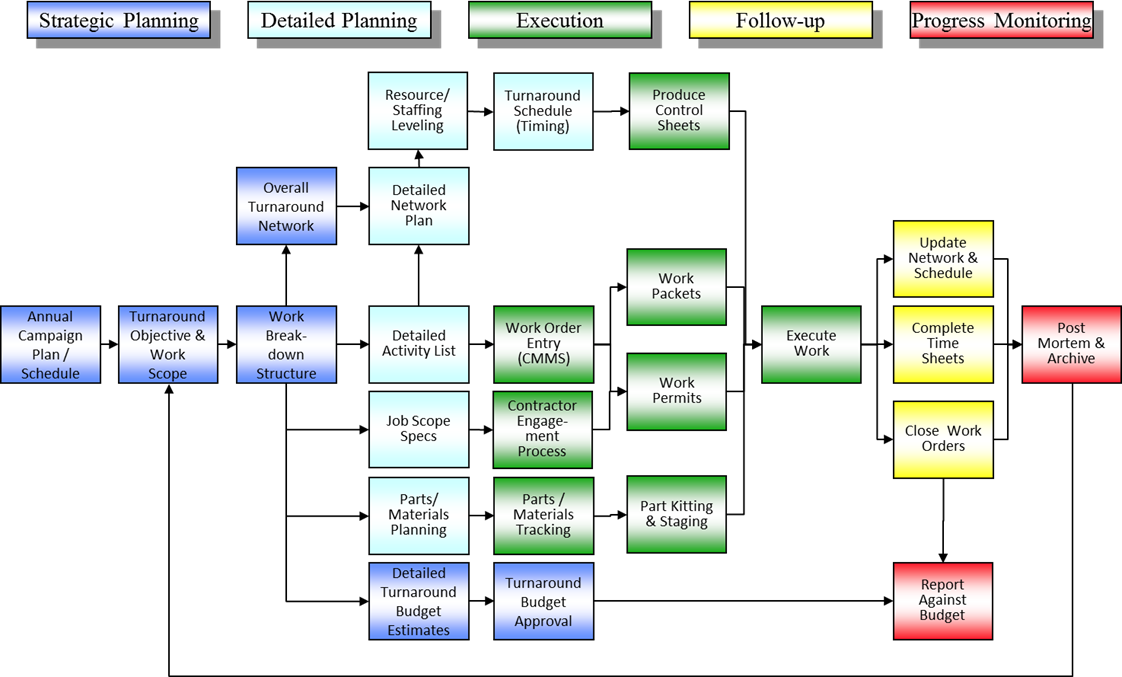

To avoid these issues and to actively manage the balance between speed and effectiveness, a comprehensive system must define a closed loop. The loop needs to contain tools & techniques that fit into the following categories: Strategic Planning, Detailed Planning, Follow-Up, Execution, and Progress Monitoring.

The illustration below depicts the Stages for managing Turnarounds. Each of the categories has been given a color code to make it easier to visualize which elements of the system fit into each category.

(Click image to enlarge)

1. Strategic Planning

The strategic elements of planning for Turnarounds exist to ensure that its activities will drive results. The results need to be consistent with the organization’s production and financial objectives. It is surprising how quickly complex activities like Turnarounds can develop a life of their own and stray from what the organization intended.

The Strategic Planning elements include:

- Annual Campaign Plan

- Define the Turnaround Objective and Essential Work Scope

- Work Breakdown Structure (WBS)

- Overall Turnaround Network

- Detailed Turnaround Budget Estimates & Budget Approval

2. Detailed Planning

This is where the bulk of the planning activities take place. In order to make effective use of the tools and techniques to implemented, there must be resources put in place that have the authority to draw together the needed information and to call the appropriate planning and updating sessions. If these resources and the processes they are pursuing are not given the full support of the management team, you will find that the Turnaround will miss one or more of its reliability, schedule, or cost objectives.

The Detailed Planning elements include:

- Detailed Activities List

- Detailed Network Plan

- Resource/Staffing Level

- Turnaround Schedule (Timing)

- Job Scope Specifications

- Parts/Materials Planning

3. Execution

Execution is where the rubber hits the road in any operating system. For Turnarounds, that includes: ramping down the operation, getting the maintenance work completed, and ramping back up. It also involves follow through on all of the detailed plans by getting work orders written, contractors aligned, work packets put together, materials acquired & staged, etc.

Managing the elements within the Execution category include:

- Produce Control Sheets

- Work Order Entry

- Contractor Engagement Process

- Work Packets

- Work Permits

- Parts/Material Tracking

- Part Kitting & Staging

- Execute Work (Operations, Maintenance, Engineering/HSE&S)

4. Follow-Up

Close Follow-Up is the key to the successful completion of the TA activities. It is also a basic management skill that cannot be over-emphasized. Follow-Up is the periodic review of the status of a work assignment to determine if we remain on-schedule or if some execution problem has arisen. It is essential to give good assignments with specific expectations for follow-up to be effective. This is as equally true for contractors as it is for our own people.

The Follow-Up elements include:

- Update Network & Schedule

- Complete Time Sheets

- Close Work Orders

5. Progress Monitoring

Progress Monitoring is the last of the system categories. It differs from Follow-Up in that we are monitoring the progress to improve our turnarounds, as opposed to executing the current TA. The elements here are designed to capture how successful we were against our cost, schedule, and reliability objectives. Are we getting better at these over time?

The Progress Monitoring elements include:

- Report Against Budget

- Post-Mortem & Archive

The tools and processes outlined above are designed to actively manage the balance between the speed and the effectiveness of Turnarounds.

“Trade Value for Value– If you are not putting in more than you’re taking out, you are either a thief or a mooch. I don’t want to be either.” –Paul Harker

Paul Harker is a Senior Operations Manager at USCCG and has been with the firm since 1988. He has been among the leaders within USCCG in developing our Inventory Management and Sales & Operations Planning processes. Paul has conducted approximately 160 implementations in projects for over 75 clients located in the US, Canada, Mexico, Denmark, Italy, Germany, Taiwan, and China. Despite his busy schedule, he was kind enough to let me ask a few questions about his recent work with clients in the chemical industry, and I’m excited to share Paul’s insights with all of you.

Chemicals is a broad industry, what types of clients do you work with most often?

In terms of process types, our work has been with Continuous and Batch Processing facilities. The Continuous Processing facilities conduct production campaigns, often lasting many months on a single product. The Batch Processing facilities manufacture discrete batches of various products in self-contained loops of vessels.

The product types range from pharmaceuticals, surfactants, and amines to petrochemicals. Their uses range from industrial applications to additives enhancing our medicines, our food, and even our beer.

How is this industry different from other business sectors?

Chemical manufacturing is extremely capital intensive and frequently requires high research and development costs. This industry is stringently regulated on product specifications, sanitation, environmental impact, and employee and public safety. The high cost of entry makes the competitive landscape relatively stable and the operating margins can be quite attractive.

What kinds of issues are your current clients facing?

Because of the capital invested and the margin opportunities, it is critically important that the On-Stream Time of their plants remains very high. Obviously, if they are not producing, they are not making any money. The percentage of On-Stream Time typically needs to be in the mid to high 90% range.

In addition to being On-Stream, the processes within the facilities need to be operating at or near their Rated Capacity. It does our clients little good if they have 98% On-Stream Time, but are only running at 10% of their Rated Capacity. Both indices need to be impacted in order to elevate the output of the plant.

For some clients, the largest erosion of On-Stream Time takes place during their planned Turnarounds (sometimes referred to as Shutdowns). These are periods when the plant is taken down in order to complete maintenance tasks or process improvements that cannot take place while the facility is running. These Turnarounds may occur annually and require two or more weeks to complete. Keeping these as effective and as short as possible are of huge value.

Other clients may have their Turnarounds well managed, but have smaller bites taken out of their On-Stream Time by thinly managed Down Days. A Down Day is a generic term for when a plant goes down due to an unplanned event, or for a planned maintenance or construction task. The duration may be a few hours or a day or two, but are still referred to as Down Days. Although smaller bites, these also need to be well managed in order to get the maximum value in the shortest amount of time

These facilities are tremendously complex and, even with state of the art Distributed Control Systems (DCS), there are typically thousands of steps required to start-up, run, and ramp-down the plant. Well defined and linked procedures are necessary to safely and effectively operate. This is particularly important as the industry expands and the experienced work force approaches retirement.

Virtually all of these clients face an ever-increasing number of regulations and regulatory bodies. The amount of data required concerning the process, equipment configuration and condition, and maintenance task definition and recording has been growing exponentially. This places more requirements on all levels of the organization as well as on the Information Technology infrastructure and support.

What kinds of solutions and benefits can you bring to your clients?

We can have an impact on On-Stream Time by managing Turnaround (TA) events and Down Days (DD) differently. To knock a few days off of an annual TA we have developed a Turnaround Management Operating System that is a comprehensive, closed-loop system that contains the tools, procedures, and practices to manage the balance between the speed and the effectiveness of TAs. We can get more out of DDs by enhancing the use of the Computerized Maintenance Management Operating System (CMMS), overlaying additional planning steps, and restructuring the responsibilities within the planning and materials groups.

We can also have an impact on the Rated Capacity through shifting the maintenance organizations from a Response Centric approach to a Reliability Centric approach. A plant that runs reliably spends more time at or near the rated capacity. This often means building a Reliability Function with dedicated planners and crafts persons. Within that function, we place inspections, lubrication routes, and Preventive Maintenance tasks as well as Down Day and Turnaround events. Additionally, this often requires conducting Failure Mode and Effect Analysis (FMEA) in order to define the correct work plan and frequency for each piece of equipment. Through the years, we have developed a number of templates that dramatically speed up this otherwise daunting task.

Are there any other industries that could benefit from some of the solutions implemented at your clients’ sites?

Any continuous flow manufacturing facility could benefit from these approach elements. Food processing, pharmaceuticals, pulp and paper, petrochemical production and transmission, waste water treatment, and power plants all come to mind.