-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Material Utilization

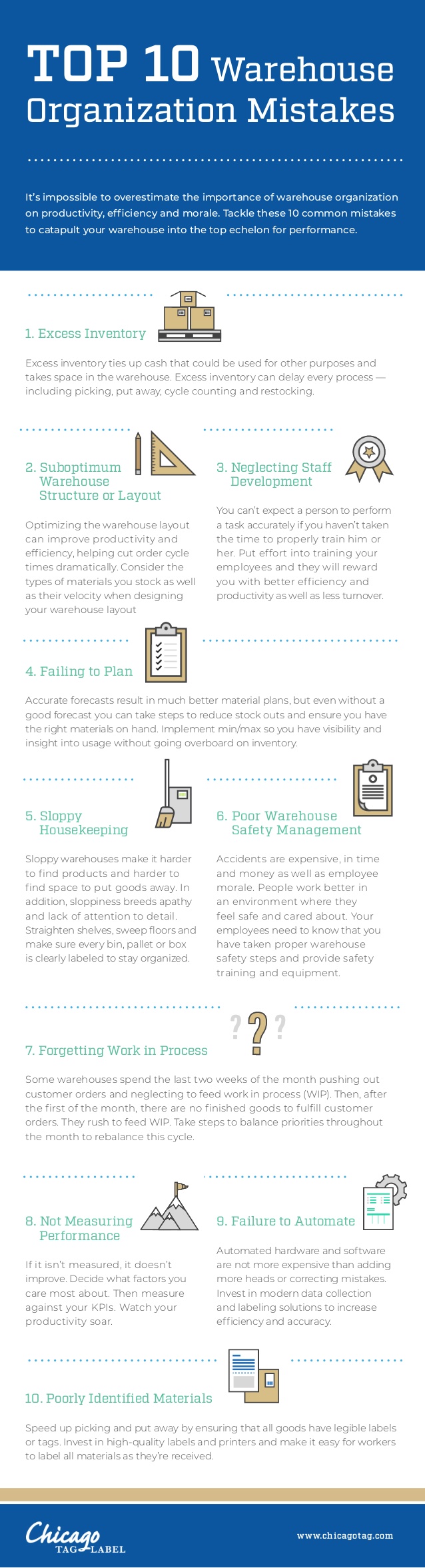

The supply chain is a business’s lifeblood. Unfortunately, much like our own bodies, it’s possible for this system to become sluggish and lethargic through neglect. Just as a lack of exercise and a poor diet can cause our blood to become clogged with cholesterol and fat, inefficient warehouse management can lead to serious issues for your operation. This is why it’s so important to understand how to avoid bad habits that can lead to problems in your warehouse operation.

For example, one of the most common mistakes made in these environments is having too much inventory. A glut of products means the money spent producing them is just sitting on the shelf providing no return on investment. A strict SKU rationalization plan can ensure that nothing goes to waste, and that only those items that are sure to sell enter the supply chain.

Another frequent misstep is made when inventory management doesn’t include metrics. Without a clear idea of how well a facility is performing, it can become nearly impossible to make improvements. Measuring all the factors that matter to your operations is essential if you want to streamline them. Too many warehouse managers also forget about work in process as they rush to push end-of-month orders out the door. When there are no finished goods to fill orders at the start of the month, they’re always playing catch-up.

Taking care of your body is crucial if you want to live a longer, healthier life — and the same principle applies to your warehouse management. For more tips on how to avoid poor habits that can hurt your business, see the accompanying infographic.

Author bio: Don Amato is Vice President of Sales for Chicago Tag & Label, which manufactures form labels, labels and tags that deliver solutions to a broad range of industries including retail, industrial, manufacturing, distribution and medical environments.

Fresh, frozen, canned, or packaged, food supply chain deliverables comes in many forms, distributed to grocery chains, convenience stores, and straight to Americans’ front doors. The U.S. is also one of the world’s largest mass exporters of pantry and fridge staples, such as wheat, soybeans, corn, and rice.

At the same time, though, many of these same foods wind up in the garbage heap due to spoilage, poor planning, or improper labeling. In fact, of all the food grown, harvested or raised, a whopping 40% goes uneaten, according to the Natural Resources Defense Council. That’s the equivalent of $165 billion a year that goes down the drain or out with the trash. The waste issue is even worse with certain types of foods, as 50% of North America’s, New Zealand’s, and Australia’s seafood and 52% of their fruits and vegetables goes unused in the typical year.

Preserving and better utilizing the nation’s food supply is a shared responsibility and something that must be taken seriously, given that it’s a finite resource and an estimated 1 in 6 Americans experience food insecurity, meaning they lack easy access to the sustenance they need for nourishment.

Food manufacturers have an important role to play. Here are a few of the ways to optimize the supply chain to reduce food waste, and the costs that come with it.

1. Use higher quality packaging material and practices

Although shelf life varies depending on what the food is and how it’s stored, perishability is inevitable, with fresh fruits and vegetables the most prone to spoilage. However, this can be mitigated by better coordinating with growers to assess which are the best types of packages to use to preserve freshness. With technology in a constant state of flux, developers have a variety of packaging materials that more effectively lock out the gases that may otherwise hasten spoilage. Some of these technologies and methodologies include supervisory control and data acquisition, otherwise known as SCADA, and using smaller amounts of air in packaged goods, like corn or potato chips.

2. Provide ongoing training

Because science and technology are always advancing, what’s standard procedure today may be out of vogue or obsolete tomorrow. That’s why personnel should be in the know about the latest in packaging and handling best practices. Manufacturers may want to consider partnering with a third party or running their own training programs so the very latest understandings in food preservation are leveraged.

3. Standardize labeling practices

“Sell by,” “use by” “best before,” labeling methods run the gamut and each set of terminology means slightly different things. For example, as noted by the Institute of Food Technologists, “use by” advisories do not necessarily mean food should be thrown out once the date arrives. They simply mean that the quality may not be quite as good by that time. Similarly, a product not being sold by a certain date does not mean it’s no longer safe to consume. It just means that it may need to be re-labeled by retailers whose guarantee is freshness.

Whatever method you use, ensure that everyone is on the same page as to what they mean so food doesn’t unnecessarily get thrown away.

4. Implement more regularly occurring quality control processes

No manufacturer is perfect — signs get missed and signals crossed when dealing with an unyielding supply chain that never takes a break. That’s why it pays to have more eyes on the development process so fewer missteps go unnoticed. This may include more coordination between departments and communication as to what’s been checked and what hasn’t.

5. Be more forthcoming with shoppers

Along similar lines, it’s important to educate shoppers about what food labels mean and for them to understand that dates are more guidelines — as opposed to deadlines — for when food ought to be consumed. They should also know that blemishes and soft spots on fresh fruits and vegetables are usually only cosmetic in nature, not necessarily indicative of poor quality or taste. Manufacturers may want to coordinate with resellers so slightly older produce still gets used. This can be done by reducing the price for these goods or setting them apart from the fresher selections.

6. Run the numbers

For the most part, people tend to be creatures of habit, typically buying the same type and amount of groceries on a week in, week out basis. Look into your production data to see if you can spot any similarities as to how much you’re selling of a certain ingredient or packaged good. Better coordinating the precise amount helps reduce waste and save money. Food and beverage companies, on average, create 50 pounds of waste for every $1,000 of revenue. Opaque yield management can solve this issue by examining losses in real-time.

7. Consider composting

Methane emissions, largely derived from food scraps according to the NRDC, contribute to the adverse effects of climate change. This can be modified by participating in composting, as over time, food and other natural substances break down and can be reused as fertile soil. Roughly 12% of food waste among medium-sized food manufacturers goes to compost, according to a joint report led by the Food Marketing Institute. Check into any local composting locations or consider starting one of your own.

8. Use better tracking methods

The food cycle is just that — an ever-evolving cycle, as there are typically several stops before snacks, breakfast, lunch, or dinner items eventually wind up in refrigerators and pantries. Enterprise resource planning software is a reliable way to keep tabs on when items are harvested, shipped, packaged, stored, and sold. By keeping track of the timeline, you can make the appropriate adjustments to modify production schedules so food spoilage is curbed.

9. Contribute to supportive causes

NRDC, the U.S. Department of Agriculture and the Food Waste Alliance are some of the main organizations laying the groundwork to better use the foods and water that ultimately derive from the ground. But they need help. Consider donating to some of these organizations and keep track of their latest campaigns by visiting their websites from time to time. According to the joint report referenced above, large manufacturers are leading the way, investing in food waste recycling solutions and disposal.

The beauty of streamlining the food supply chain is it not only ensures more fare gets used, but it also reduces costs. USC Consulting Group has the experience, knowledge, and understanding to help your company reach its full potential, whether in the waste reduction realm or another goal. Please contact us to learn more.

Raw material costs continue to increase as a result of recent economic developments – most notably, the new tariffs on aluminum, steel and Canadian lumber. Firms in the building materials manufacturing space are, of course, among the numerous industrial businesses dealing with the repercussions of these duties. Lumber companies looking to tap suppliers in the Canadian market must grapple with historically high prices, according to The New York Times. Sawmills in the Great White North are now charging $655 per thousand feet of product to offset tariffs as high as 21 percent. For comparison, the average price per thousand feet of Canadian fir, pine or spruce wood hovered near the $500 mark for most of 2017.

This situation has put building materials manufacturers in a tough position. Few of these firms are capable of absorbing higher costs and must make operational changes to keep their bottom lines intact. What exactly can companies in building material manufacturing do to mitigate the impact of increasing raw material expenses?

1. Operational optimization

Like most modern businesses, building materials manufacturers rely upon complex supply chains that contain numerous components and third-party stakeholders. Forward-thinking enterprises in this sector are scouring these intricate workflows in the hopes of uncovering hidden cost savings.

Transportation is often at the center of these supply chain optimization efforts, as it normally eats up the largest part of the logistics budget. Freight expenses went up significantly last year, according to the U.S. Bureau of Transportation Statistics. In 2017 alone, American businesses devoted more than $1.1 billion to transportation initiatives, an increase of 6.6 percent over figures recorded in 2016. This number is not likely to decrease any time soon, making transportation a good area of focus for building material providers looking to cut costs in light of rising raw material expenditures.

But what exactly can they do? Contracting steady lane volume and shipping on off-peak days are strong strategies, according to Mark Johnson, senior vice president of transportation and solutions for Kane Is Able, a third-party warehousing and transportation services provider. Investing in relationships is another good methodology. Building material manufacturers that make the effort to form sustainable connections with third-party shippers are more likely to see savings than those that continually chase discounted services.

2. Smarter staffing management

U.S. manufacturers have embraced outsourcing over the last dozen or so years, researchers for the Bureau of Labor Statistics found. For instance, in 2015, the last year for which BLS data was available, temporary workers accounted for almost 10 percent of the American manufacturing workforce. Companies in the building materials manufacturing industry have most certainly embraced this model in an effort to reduce staffing costs and facilitate operational scalability.

Even so, such arrangements can weigh on the bottom line, as businesses with hastily managed outsourcing programs find out. Building material manufacturers cannot afford to suffer such inefficiencies, especially as raw material expenses rise. With this in mind, organizations in this space should maintain relationships with multiple outsourcing partners to drive competition and bolster service quality.

Additionally, human resources personnel and operational leaders must deploy temporary workers wisely – right-sizing contingent staff orders, for example – to generate a return on investment and reduce waste.

3. Passing on the cost

With the average cost of building a home in 2022 rising to $1,393.55 per sqm, here is one cost-cutting method a significant number of building materials manufacturers have implemented for absorbing higher material prices: passing the costs to customers. This is, of course, not ideal for many reasons. Few building materials manufacturers want to charge higher fees, as such increases may not only trickle down to individual consumers but also put them at risk for getting priced out of the market. However, some businesses in the industry find themselves with no other choice.

Building materials manufacturing companies that embrace these methodologies can sustain their bottom lines, even as various external forces push material prices higher and higher. Businesses that require additional assistance in the face of rising costs should consider connecting with USC Consulting Group. With 50 years of experience, we can help building materials manufacturers of all sizes retrofit their operations in response to recent economic pressures.

Contact USC Consulting Group today to learn more about our services.

Six Sigma hates waste. If a manufacturing plant plans on getting any leaner, its executives, managers, and supervisors should be on the prowl for areas to streamline workflow and cut out unnecessary steps.

Depending on the industry in question, inventory may play a vital role in on-site operations. Whether inventory is used for holding spare parts for the company’s most important assets, managing SKUs awaiting completion or transportation, or storing raw materials integral to the manufacturing process, inventory management can be pivotal to efficiency.

Inventory can also, however, become a breeding ground for waste, and the stresses of an unkempt inventory can permeate throughout disparate operations, creating backlog, downtime, and unmet expectations. Let’s take a look at a few examples of how an inventory without proper curation can lead to all different kinds of waste.

Before we go any further

Though it may seem rather obvious, inventory management really only impacts industries that actually maintain a comprehensive inventory. With the rise of just-in-time supply services and kitting, many inventories across a number of different industries have been thoroughly rationalized to the point where harping on them any further would be, in a word, pointless. Sure, organization throughout a company is an ideal worth promoting, but further investing time, money, and energy into an inventory after taking certain measures will not provide an ample return.

According to a study on the link between operational performance and inventory management published in the Journal of Operations Management, only two-thirds of industries investigated experienced substantial gains with a leaner inventory. As the authors of the study suggest, understanding the role inventory plays in an individual business and measuring how deeply ingrained it is in ancillary processes. Otherwise, companies attempting to adopt a leaner mindset will expend resources unnecessarily, resources better spent on making actionable changes in other areas where they’re needed. Managing inventory waste for some will merely be a surface adjustment, but for others, it can clue them into subcutaneous operational deficiencies that can return serious value if unearthed.

Waste in waiting

In an interview with IndustryWeek, Frank Hill, director of manufacturing business development for Stratus Technologies, said 3 out of 10 manufacturers run into unplanned downtime, the number of large downtime events are on the rise, and each one costs roughly $17,000 to navigate. With so much at stake, it’s no wonder why manufacturers push to keep their assets continuously operational.

That said, downtime for many in the manufacturing sector only pertains to failed assets or big-time disruptions. That isn’t always the case. Downtime can also include any time spent not performing the value-added tasks at hand. Machinery can be fully operational, employees can be at the ready, but downtime can still occur. Rooting out the culprit might lead lean teams right to inventory.

Builds or repairs might require components held in inventory, which means employees tasked with these duties will need to locate them as fast as possible to complete their respective jobs. Without a regimented, intuitive system for hunting down these things, workers waste time between tasks. While it may only be a matter of minutes, these gaps in performance add up incrementally. To prevent these undercurrents of waste from siphoning successes, ask: What systems or procedures would a manufacturer have to enact to ensure its employees find what they need exactly when they need it?

Moreover, in the event of a large-scale downtime event, what sorts of low-tech, high-value activities can employees perform until they can return to their work? Manufacturers should develop fail-safe measures against wasted opportunities. In fact, so long as it integrates well with a company’s downtime objectives, inventory management – like cleaning, organizing, and shelving – can be something employees attend to during the wait to return value to the company during a downtime deficit.

Waste in damaged materials

Shrinkage is like a monster with many heads – a single swipe of a sword might not be enough to take the beast down. However, everything has a weakness, and for shrinkage, it may reside in catalysts entrenched in peripheral operations and processes.

Root cause analysis might confirm shrinkage directly correlates with administrative shortcomings or underutilized metrics during the procurement stage. For instance, if a manufacturer’s inventory is lousy with a specific type of fastener, it could be because orders for that component don’t legitimately reflect updated supply/demand data. As such, administration has been placing orders for parts employees don’t need and already have too many of. Additionally, supplier-manufacturer relations could also play a role in waste. If a particular component is rare or difficult to produce, suppliers may pigeonhole manufacturers into procuring more than they need. Without an effective system in place auditing and monitoring said inventory, manufacturers could be overspending upfront.

So how can manufacturers determine if their shrinkage is bad enough to devote serious resources toward? According to a study conducted by Supply Chain Visions and the Warehouse Education and Research Council, it’s all a matter of finding what percentage of an inventory is lost to shrinkage. The average inventory sheds between 0.046 percent and 0.07 percent of its contents to shrinkage, while a score of less than 0.005 percent would be optimal and industry-leading. If, however, a manufacturer’s shrinkage hovers above 1.46 percent, they stand to reap the most out of reining in its inventory.

Waste in avoiding the real problem

Similarly to the aforementioned section, inventories overburdened with spare parts could signal manufacturers aren’t addressing major issues with their on-site assets. If inventories must maintain an above-average stock of replacement components for subassemblies constantly wearing out, supervisors have essentially made a habit out of treating the symptoms and not the disease.

Instead of worrying about additional spare parts, manufacturers should instead focus on the reasons why their valuable assets aren’t performing as they should. Tracking down the primary cause of even the most minor malfunctions will not only save on costs related to managing spare parts, but also completely eliminate the downtime required to replace the worn out component, returning considerable efficiency back to the manufacturer who takes the time to truly investigate.

Forestry has been one of the most profitable industries in recent years, even with modifications made to integrate environmentally sustainable practices into the mix. The Southeastern Lumber Manufacturers Association stated U.S. forestry products, from wood to paper, generate as much as $200 billion every year. Moreover, replanting strategies have made U.S. forests today 25 percent denser than in the 20th century.

As lucrative as some business opportunities within this industry can be, the potential for inefficiency detracting from any potential prosperity is also quite high. Work in the U.S. lumber manufacturing in particular is extremely competitive. According to an estimate by the U.S. Lumber Coalition, $0.60 to $0.70 out of every dollar spent on timber remunerate manufacturers for the cost of production, not toward profit. As such, competition in lumber manufacturing can sometime work against all parties involved. However, finding ways to reduce materials costs or inefficiencies in internal processes may provide lumber companies a cushion with which to benefit from marginal decreases in final product pricing.

One such area ripe for optimization is asset utilization. How manufacturers use their tools and equipment ultimately decides the outcome of their enterprise. By scrutinizing the ways operators complete a given task and whether their actions align with the industry’s best practices, lumber yard managers can potentially eliminate waste, save resources, cut lead times, and increase the quality of the lumber they produce.

Optimizing asset utilization in mill machinery means cutting lumber smarter, to retain more of it.

Comprehensive automation throughout the entire lumber mill

From a general standpoint, automating as much of millwork as possible feasibly increases the likelihood of greater asset utilization. Research from North Carolina State University found that while reducing manual processes at the onset – like gang rip – could boost yield and curtail operational errors resulting in wasted wood, many procedures on-site still rely too heavily on employees who could be better utilized elsewhere.

For instance, if rough mills could integrate technology capable of assessing least-cost grade-mix – which directly correlates to the accuracy of a yield prediction – then communicate that data effectively to industrial sawing equipment without operator intervention, lumber manufacturers could erase a time- and labor-intensive step from the milling process. When lumber yard employees are expected to eyeball raw materials to determine their grade, this affords too much room for mistakes to occur. Faulty judgments produce waste and increase labor costs to make up for lost time. Automating as many aspects of lumber mill operations as possible increases asset utilization, and leaves nothing to chance.

Rethinking how debarking assets affect resources

It stands to reason that the more fiber retained after raw material has been debarked, the greater the possibility of creating ideal lumber products. Manufacturers of forestry goods that own conventional drum or closed cylinder debarking equipment, however, might find a number of efficiency upgrades by switching to cradle debarkers, according to the U.S. Department of Energy.

To start, open-top debarking systems provide operators with the freedom to debark different types and grades of wood to account for bark thickness. Closed systems shear back bark without taking these variations into consideration. In the end, this cuts back on how much tree fiber is lost during the debarking process, retaining more resources for the mill to turn into lumber.

“Cradle debarkers use 33% less energy than closed models.”

Additionally, as the DOE states, cradle debarkers use 33 percent less energy than closed models. They are also compact enough to integrate into lumber mill operations instead of setting up a separate debark facility elsewhere, effectively phasing out costly transportation costs between the two sites. In making one simple equipment change, saw mills could permanently optimize the milling process without reshaping much else.

Limiting lumber variation through modern data-driven initiatives

Determining the dimensions by which fiber is cut into lumber ultimately impacts both yield and how manufacturers operate saws and other equipment. That said, companies in the industry must remember to account for differential shrinkage during lumber drying, which could lead to resource hemorrhaging and could cost anywhere between $50,00 to as much as $250,000 annually depending on the mill in question, according to a study conducted by members of the Forest Products Society.

By abandoning traditional formulas for ascertaining optimal board thickness in favor of real-time statistical process control. Up-to-the-second data increases a lumber mill’s recovery rate for the fiber they cut into lumber, as it limits the time between resource assessment and the sawing process. In doing so, mills can increase asset utilization by paring down waste created when inaccurate drying predictions result in defective lumber products.

As the saying goes, “It is a poor craftsman who blames his tools.” The weight of this argument still rings true, but intelligently optimizing asset utilization supports mill equipment operators so they get the most out of the tools they use daily and, in turn, process lumber efficiently without generating unnecessary waste.

Plastic has left an indelible mark on the manufacturing industry. This ubiquitous material helps companies produce high-quality products at an inexpensive cost for both the consumers and themselves. Moreover, the chemical makeup of plastics and other polymers opens up new frontiers in manufacturing as the industry finds new and exciting ways to deploy these materials to suit its needs and those of future generations. Reducing plastic manufacturing costs can have a huge impact on society and the industry.

The Plastics Industry Trade Association places plastics manufacture as the third largest sector in the field, one capable of generating more than $380 billion in annual shipments and employing more than 885,000 employees spread across every single U.S. state. However, even titans of industry can find methods of improving operational efficiency to simplify their supply chain relationships, streamline internal processes, and manage their resources more intelligently to secure the bottom line. As big as plastics is, it fits the mold for such improvement opportunities. Where can manufacturers focus their attention if they want to see their performance prosper and plastic manufacturing costs reduced?

Energy efficiency through reverse logistics

Like many process industries relying predominantly on raw materials, plastics manufacturing expends a great deal of energy in production. Most plastics are derived from either hydrocarbon gas liquids or natural gas. According to the U.S. Energy Information Administration, electricity makes up a significant portion of this industry’s energy consumption, used primarily in heating, cooling, and processes like compression and injection molding, as well as thermoforming. That said, ancillary processes also take their fair share – a study published in Manufacturing Engineering found the energy costs related to additive manufacturing techniques can be anywhere between 53 to 104 times more expensive than traditional injection molding.

However, energy conservation may not necessarily be in the cards for plastics manufacturers, as usage directly correlates to the desired chemical reaction necessary for production. Instead of devoting company resources toward finding solutions for reducing energy costs on-site, plastics manufacturers should give reverse logistics prospects equal consideration. While establishing or enhancing such a program may add a level of complexity to business functionality, the rewards outweigh those concerns by a wide margin. A recent study by the U.S. Department of Energy uncovered that the industry has the potential to dramatically decrease its energy and plastic manufacturing costs by instituting robust recycling measures, especially for companies working with polyethylene. A “modest” campaign could yield as much a 17 percent energy cost reduction, but an “aggressive” one could cut energy spend by nearly a third.

Implementing dynamic reverse logistics recycling programs for reclaimed or returned goods isn’t merely a fly-by-night trend for trimming costs, but a whole new way of envisioning manufacturing. Plastics manufacturers should consider instituting or expanding these areas to push their enterprises toward peak operational efficiency, powered by an innovative approach to waste management.

Where can plastics manufacturers focus their attention if they want to see their performance prosper and operational costs reduced?

Automated, end-to-end enterprise resource planning to cover administrative duties

Apart from optimizing on the manufacturing floor, plastics also requires well-oiled administrative processes behind the scenes to ensure plant operations run smoothly and cost-effectively. Automating a number of services on the back end can eliminate deficiencies caused by clerical errors related to data entry, as well as other pertinent processes specific to plastics like tracking fluctuating resource markets to scaling and managing plastics recipes. Moreover, programming these machinations to run automatically organizes low-level tasks in a way that complements the business intelligence gleaned from them by employees, managers, and supervisors.

“Comprehensive enterprise resource planning can provide the answers plastics manufacturers are looking for.”

Comprehensive enterprise resource planning can provide the answers plastics manufacturers are looking for. For instance, a 2015 DuPont survey regarding the top concerns facing the plastics industry placed “unstable oil prices” in the third seat, a single percentage point behind “environment and sustainability” and “competitive global environment.” By adequately forecasting demand and operational costs with real-time data tracking from volatile oil markets and others, plastics manufacturers can apportion resource spend intelligently, reducing waste by way of over- and underproduction, over- and understocking inventories, meeting budgetary requirements on daily resource investments, and more.

Plastics manufacturers without ERP or with only single-tier systems should seriously consider upgrading to a two-tier deployment as they scale. As a Constellation Research survey found, nearly half of all businesses with Tier-1 ERP already in place were considering making the switch to two-tier. Respondents thinking about onboarding two-tier ERP were motivated predominantly by its low cost in comparison to their overburdened, single-tier operations and as insurance securing their competitiveness in an ever-changing global market.

Well-executed ERP management doesn’t handle small, meaningless tasks, but decidedly important ones that plastics manufacturers might not have the human capital to oversee with the intensity the 21st-century business mandates. This resource puts automation to work for the plant, providing everyone from plant managers to executives with the information necessary to consolidate operations into a simplified, data-driven workflow and make industry-leading decisions about the direction of their organization.

Below is the second half of my interview with our CEOs, George Coffey and Jim Ostrosky. In this section they discuss who we are as a company and how we make a real difference for our clients. Read Part 1 of our interview.

How do you feel USCCG is different from other firms? How are we unique in the market?

George: Many of our clients who have had extensive experience with other firms tell us that we develop a greater depth of understanding of their business and the issues they face which enables us to better design pragmatic solutions to improve performance. Many also feel that we have a more effective approach to engineering change in their organization that fosters ownership by their people. Prospective clients will ask us what we are good at and what makes us different. What we are good at is achieving results. We are able to generate substantial results in a relatively short time while enabling our clients to sustain and accelerate improvements .We strengthen their internal continuous improvement capability with enabling tools, skills, infrastructure, and culture. Generating near term results, while strengthening on-going organizational effectiveness, makes us different from many other approaches.

Jim: I believe a key differentiator between USCCG and our competitors is the depth of experience that our consultants possess in the various industries and domains we service. In this age of specialization, it has become more and more challenging to maintain a cadre of capable resources, but we have been able to do exceptionally well at that over the past 4 ½ decades. We continuously train our people utilizing internal methods as well as memberships in various professional organizations that offer certifications and continuing education credits. Perhaps, more importantly, we have been able to retain our people, which is also a key success factor. In addition, our deployment methodologies have proven to be very effective. We look at the processes by which a client operates, the technology they deploy, and the skills of their people. Real changes are realized when you link all three things together: their People, Processes, and Technology. We feel we do that better than most and that is what makes us different. Another key difference is that we involve ourselves in the implementation. Many consulting firms will analyze a company, and compare current performance to industry norms and benchmarks, create a road map, and leave behind an answer, but it often times that solution will never get implemented. When practical, we prefer to be involved in the implementation of our recommendations, so our clients can realize the value and we can change the processes, the systems and behaviors, so the results last. When we are engaged to work at the process level of a company, we believe that enables us to cause even more fundamental, lasting change. Much of what we are doing in regulated industries, such as Oil & Gas, Energy, and Healthcare, are at the process level. As the government regulatory agencies issue changes and directives, our clients need to verify they are in compliance and understand where they’re lacking. They must put auditable processes in place to keep them in compliance as well as doing so in a cost-effective manner. We have been doing a great deal of work in this area recently.

What makes a successful project, both from our end and the clients’ end?

George:The most critical aspect of a successful project and a successful client relationship is communication. We find when we’re talking to our clients routinely and objectively about how the project is going in a very open and forthright manner, we are able to understand and mitigate issues as they arise over the course of a project. We believe that we are putting the success of the project at risk if too much time passes without meaningful communication with all levels of our client’s organization to get a shared understanding of exactly where we are, what we can do to improve the process, and take corrective action. We typically organize a steering committee protocol to enable efficient communication and decision-making. The steering committee is kept absolutely abreast of where we are with respect to our projected improvement and also to the specific tasks associated with that.

Jim: Communication is a critical component, but to communicate effectively, we need to always do our job at the front end of a project to create a crystal clear shared vision. As we engage with a client, it is imperative that we fully understand what must change and create a clear vision of the end result that is co-owned by USCCG and our clients. It then becomes our job to create a change model to continually reinforce the vision adjusting as we go to make sure that we’re of one mind with all levels of the organization. We believe it to be very important that everybody feels like they’re doing what’s in the best interest of their company as most employees have pride in their company and they want to succeed. Our change model is one where we involve everyone in the organization from the process owner on up to the highest level that we can access on a regular basis. The difference between a good project and a great project: in my experience, it has been the amount of involvement we can gain from our clients especially at the Steering Team Level. We built our change model around a shared vision of employee involvement, combined with the appropriate changes to the processes, the technology, and the skill sets of the process owners and their managers all which serve to make our model very effective.

In what ways have you noticed technology’s impact on our project process and how has that changed what we offer to our clients?

George:One of the more important aspects and benefits of being able to deploy and utilize more technology is the sustainability of our efforts. Good management practice depends on accurate data and timely information. Earlier on, we had to depend on the manual collection of data and the manual preparation of reports. As a result of that, it was very difficult to sustain some of the procedures we would put into place because they were very demanding from a time standpoint. Now, that information comes with a lot less pain, very often automatically. It makes all of our efforts, processes, and procedures easier to sustain. Since we are getting the information more quickly, good management requires timely corrective action when issues are identified. We are able to do more effective problem solving with a greater sense of urgency as a result of having that information more quickly. The whole business intelligence aspect of performance improvement is absolutely critical today.

Jim: With current technology, data has become readily available in various forms and in some cases, in excess. Some of our clients feel as if they have too much data and not nearly enough information. Often our job isn’t to provide clients with more technology, our job is to help them leverage the technology investments they already have made by sorting out the data they currently have and making it actionable. To do this we filter it, slice it and dice it, create meaningful metrics and Key Performance Indicators out of that plethora of information. In many cases, there have been tremendous investments in technology, but sometimes these systems leave out a key part of the organization: the people at the execution level of the process. Management and accounting have better information than ever, but the people who actually execute the process often times don’t receive timely accurate feedback of actionable information. Our job is to make sure we link the data and information from the board room to the process owner, and every step in-between. By sorting out the data, making it relevant, and holding the people accountable at the points of execution we leverage technology to help provide the underpinnings to meaningful lasting change.

What hurdles or objections do we encounter most often with respect to beginning an initiative with a new client or even a new project with an existing client?

George:Sometimes clients feel that they have so many other issues and programs underway, that it’s difficult to add yet another project to everyone’s to-do list, even if it clear that something should be done. There’s never a good time to start these initiatives and there’s never a bad time to start making the kind of dramatic near term and strategic improvement that we can make in business performance. To start, we really have to talk through how many resources we have to bring to bear and get a good solid understanding early on about what the time requirement are going to be for our client’s people. These requirements should be properly assessed, understood, and planned for. There aren’t any businesses or organizations out there that don’t have many different distractions, different initiatives, and different problems. We are very effective at being able to come in and integrate into our client’s organization and be a net increase in their resource capability, not a distraction or a dilution to the already existing initiatives underway.

Jim: One of the questions that comes up often in the early phases of a relationship with a client is, Do you think I have the right organization in place? Or, I don’t feel that I have the right organization in place, therefore now is not the time to begin a project. It can be difficult to see the organization through the client’s eyes, but if the client could see their organization through our eyes, they would understand that it likely is an appropriate time to start. We can optimize their processes, upgrade their skills, implement systems, and technology to help enable their people to become better at what they do. A manager who may not be quite as effective today as a client would like them to be, after having gone through a USCCG deployment will have tools, improved supervisory skills, and will be much more effective than they would have been prior to starting the project. From our perspective, there’s rarely a bad time to start a project as in today’s competitive world improved performance is an imperative to survival. Perceived organizational deficiencies aren’t always a reason not to get started; often they are THE reason to get started.

The APICS Dictionary, 14th edition, defines Supply Chain Management (SCM) as “the design, planning, execution, control, and monitoring of supply chain activities with the objective of creating net value, building a competitive infrastructure, leveraging worldwide logistics, synchronizing supply with demand, and measuring performance globally.” Where globally can mean “either worldwide or applying to the chain as a whole rather than to a particular entity within the chain.”

Other important aspects of SCM according to APICS Fundamentals of Supply Chain Management, Module 1, include three things that point to the importance of collaboration with suppliers and customers alike:

- SCM is about creating net value – not all about squeezing out costs from one activity or another.

- Value-creating activities in the supply chain should transcend the activities of particular entities in the chain – the supply chain has to produce value for more than one stakeholder (i.e. all partners need to realize value) in addition to generating value for the consumers or investors.

- Managing supply chains requires a balancing act among competing interests – just like balancing competing priorities of finance, marketing, and operations internally.

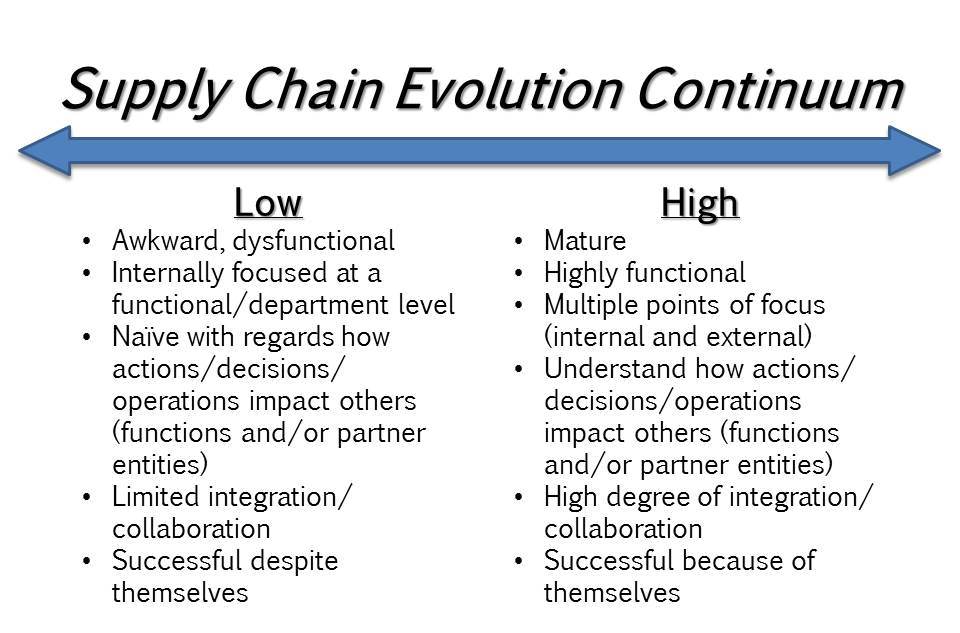

Like many things, an organization’s supply chain(s) and SCM practices evolve over time as they work toward customer focus and creation of net value. Regardless of where an organization begins its evolution or its current position on the continuum, the goal is to move as close to a highly evolved operation as possible.

Through the years, I have worked with organizations at varying points of evolution. Some even demonstrate variation within their own organization, having highly evolved supply chains for their core product offerings while operating at a much lower level on the continuum for extension offerings that follow a different supply chain. While all are looking to move to the right on the continuum, they have been successful regardless of their current level of evolution.

Based on this, I am curious:

- How evolved is your supply chain?

- Are your different supply chains operating at the same or different levels of evolution?

If you are not sure how to answer these questions, look for a short self-assessment in my next post.

Last month, USCCG celebrated its 46th anniversary. With a rich history of successful projects and satisfied clients, we know that we must be doing something right. As we begin another year in this business, I felt this was good time to get our CEOs, George Coffey and Jim Ostrosky, to share their thoughts on the company’s evolution and their vision for the future. Below is the first part of our interview:

When did you start with USCCG?

When did you start with USCCG?

George: I started in 1978, as a project consultant in our operating group and progressed through management positions. Ultimately, I moved out to LA to run our projects on the west coast, and then I moved into business development. I became a Business Development Executive, a Regional Manager, Analyst, and ultimately headed up all of Business Development.

Jim: I started in 1979, and entered our operating group at the entry-level; Project Consultant. I spent the majority of my career in Operations, working at every level from a Project Consultant on up to VP-Senior Operations Manager. When the company decided it was time to put a technology practice together, I moved over from directly working in operations to help organize our CTS group. I co-ran Operations and lead the CTS efforts that we now know as LINCS, as well as some of the other client offerings we have.

How do you feel business has changed, back when you started to today?

George: One of the most significant changes is that we had shorter business acquisition cycles back then. Typically, we would meet with a prospective client, determine whether or not there was a compelling value thesis, develop scope, move into feasibility study to more fully develop the business case for moving forward, and get a very quick decision. Today, for a number of reasons, prospective clients are more cautious, the process has slowed, and there is an opportunity cost for these delays in decision-making. More importantly, when I first started, more of our focus was on manufacturing and labor productivity. Today our approach is to address overall EBITDA performance improvement by driving operational excellence across all aspects of our clients’ business, across the entire supply chain including SG&A, Spend Management, Asset Performance Management, Rationalization/Consolidation, Acquisition Integration, Quality, Service, as well as cost reduction. So today, we are much more focused on overall financial performance.

Jim: One thing that is similar is that it’s still a people business. In the 1980’s we would talk about the fact that 80% of our efforts were focused on helping people understand the change process, find out what they are dissatisfied about in their current operation, and help them make that transition; 20% of it was on the technical aspects of what actually had to be changed in order to realize the results. One might argue the ratio 80-20 or 60-40, but ours remains a people business. Other than the people aspect, everything else has changed, the whole world has changed, and we were forced to change our approach as well. Technology entered into the picture and our clients’ expectations certainly changed. Clients are looking for a group to come in make an impact, make it quickly, and drive the value, then move on. Another major difference today is who owns businesses. In the past we dealt with many entrepreneurs, while today, Private Equity has entered the market and has a lot to say about what goes on and that brings different pressures that we have had to adapt to as well. It’s still a people business, but the expectations have certainly changed from the timing of results, the depth of results, and clients who are less patient than ever and expecting more.

How would you describe the way we do business?

George: A cornerstone of our business has always been long-term relationships. In any given year, typically two-thirds of our business, or more, is the result of existing relationships and that’s underwritten by the fact that we’ve done what we’ve said we would do. We make time-bound, realistic projections of what can be accomplished, and then we meet or exceed those projections. Our business is performance improvement. We are not about products, we are about outcomes. We have an extensive array of tools including technology, methodology, and processes that we apply within the context of an intended result. Most importantly we bring to bear a powerful organization of talented subject matter experts (domain, industry methodology) that are highly experienced in designing and implementing performance improvement programs. We can drive improvement in many creative ways and we architect our client relationships based on circumstances and timing.

Jim: I would say, the two R’s: relevance and relationships. We’ve stayed relevant and found a way to deliver value in an ever-changing world. It’s definitely a relationship business in a networked world. We are proud to have worked almost continuously for a couple of clients over the past couple of decades. We recently did a project for a client that we worked for in 1970. The third generation is now running the company, but there was enough staying power to what we implemented and the credibility that we established that when they had a need we were called in to again help with their current challenges. Our goal is always delivering value, and at the end of the day, our clients love us as long as we do what we say. And we definitely do what we say. We feel we’ve always been market driven and client centric, and have had to adapt over the years to survive. Whatever the market or our clients demand, that is what we learn to do. The clients who were the most demanding over time caused us to change and adapt the most, and we are very grateful for those demanding clients. They caused us to really push the envelope for us and for them, but their confidence in us and our ability to do what we say, created great partnerships. By working with them we are able to establish many of the new offerings that we have.

Where do you see USCCG going forward into the future?

George: We’ve always gone to market and organized as a hybrid model, meaning that we have horizontal domain offerings with subject matter experts in areas such as Asset Performance Management, Business Intelligence, Spend Management, and others. We can drive that horizontal domain expertise across different industries. We also have a vertical approach in certain industries because they have significant issues that are specific to those industries such as Mining and Healthcare. We will continue to expand both approaches as we move forward with more offerings, more adjacencies, as well as further develop more industry focus as it relates to our vertical approach.

Jim: Looking ahead to the future, in addition to all the industries we currently serve, we will continue to expand in the areas of healthcare and energy. These are two growth areas with tremendous needs and opportunities for us. In addition, demand for Procurement and Logistics will also continue to grow. The logistics of buying things from the other side of the world and having them delivered to your doorstep creates both challenges and opportunities. As our clients globalize their supply chains, they have those same challenges. How do they get their products procured, inventoried, and delivered in a timely and cost efficient manner? Getting it manufactured cheaply in Indonesia is one thing, but getting it to your customer in an efficient manner is another. Globalization is driving much of our current volume, and is a trend that will likely increase. As we have done for the past 46 years, we will continue to be market and client driven and we will remain focused on our clients’ needs as we develop the value added offerings and solutions they are seeking.