-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: food processing

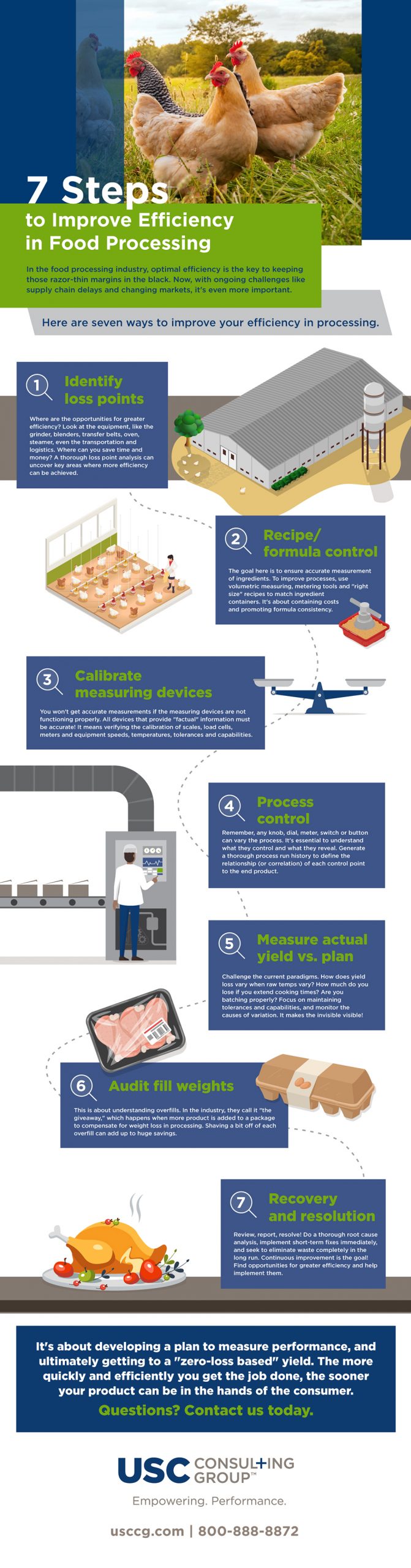

In the food processing industry, optimal efficiency is the key to keeping those razor-thin margins in the black. Now, with ongoing challenges like supply chain delays and changing markets, it’s even more important.

Efficient processes lead to reduced operating costs, improved yield and throughput, and more control over your management systems.

The following graphic provides seven ways to improve your efficiency in food processing:

1. Identify loss points

Where are the opportunities for greater efficiency? Look at the equipment, like the grinder, blenders, transfer belts, oven, steamer, even the transportation and logistics. Where can you save time and money? A thorough loss point analysis can uncover key areas where more efficiency can be achieved.

2. Recipe/formula control

The goal here is to ensure accurate measurement of ingredients. To improve processes, use volumetric measuring, metering tools and “right size” recipes to match ingredient containers. It’s about containing costs and promoting formula consistency.

3. Calibrate measuring devices

You won’t get accurate measurements if the measuring devices are not functioning properly. All devices that provide “factual” information must be accurate! It means verifying the calibration of scales, load cells, meters and equipment speeds, temperatures, tolerances and capabilities.

4. Process control

Remember, any knob, dial, meter, switch or button can vary the process. It’s essential to understand what they control and what they reveal. Generate a thorough process run history to define the relationship (or correlation) of each control point to the end product.

5. Measure actual yield vs. plan

Challenge the current paradigms. How does yield loss vary when raw temps vary? How much do you lose if you extend cooking times? Are you batching properly? Focus on maintaining tolerances and capabilities, and monitor the causes of variation. It makes the invisible visible!

6. Audit fill weights

This is about understanding overfills. In the industry, they call it “the giveaway,” which happens when more product is added to a package to compensate for weight loss in processing. Shaving a bit off of each overfill can add up to huge savings.

7. Recovery and resolution

Review, report, resolve! Do a thorough root cause analysis, implement short-term fixes immediately, and seek to eliminate waste completely in the long run. Continuous improvement is the goal! Find opportunities for greater efficiency and help implement them.

It’s about developing a plan to measure performance, and ultimately getting to a “zero-loss based” yield. The more quickly and efficiently you get the job done, the sooner your product can be in the hands of the consumer. Questions? Contact us today.

For more information about how Food & Beverage consultants can significantly reduce your operating costs and improve productivity, read this eBook:

A little goes a long way. It’s an old adage, but one we’ve seen play out, day after day, during our 55-plus years in the consulting business. It’s the notion that what may seem like small changes actually produce big results. At USC Consulting Group, one of our specialties is the “detective work” we do to find hidden opportunities for greater efficiency. Acting on those opportunities can create great change.

Here are some ways a “little” can go a long way for our clients.

Outage management

Most industries that have 24/7 operations — manufacturing, mining & metals, and others — need to do planned outages, or work stoppages, for regular maintenance. It’s a practice we enthusiastically recommend. Planned outages prevent unplanned crises when a machine breaks down unexpectedly. Managing planned outages correctly is vital, because any time the operation is shut down for maintenance, that time is money.

Intricate detail and planning go into planned outages. That was the case with one of our recent clients in the mining industry. They approached USC to assist in planning and executing an upcoming plant-wide outage. Because of cost and schedule overruns year in and year out, the plant was given an ultimatum from its parent company — make the upcoming outage successful or close the plant down.

Through careful planning and execution, we shaved one day off of their planned outage. You might be thinking, just one day? That “small” improvement saved the company upwards of $1 million. The outage was successful, and the plant stayed open.

Food processing

The commercial food industry has a tough nut to crack (pardon the pun) when it comes to processing and bagging their product to send to grocery stores or other end-clients that sell to consumers. Getting the most of their raw materials is all about improving yield, but it’s not easy to achieve the right balance. Let’s take the beef industry for an example. In processing beef into burger, there is a loss of moisture. That’s why when you start off with a pound of beef you don’t get a pound of burger. But, as a consumer, when you’re buying what is labeled a pound of burger, you can expect a pound — by law. To achieve that, the industry compensates for the loss of moisture and adds more ground beef into each unit. Better to pack a little too much than too little, right? It’s what the industry calls “the giveaway.” It’s essentially overpacking.

Just a little more? How big a problem is this, really? If a company is processing, say, 30,000 pounds of ground beef into burger every day, adding a smidge more into each package can be a very big problem indeed. One recent client of USC came to us when they realized they were giving away over 1.5 million pounds of beef yearly.

With process improvements, equipment fixes and increased speed and throughput, we were able to help our client strike the right balance, decreasing that overpack from 2% to 1%. Just a 1% savings? That’s a pretty small number on the face of it… until you see it resulted in a savings of $84,000 per month. That’s huge.

Change management

Not every “small” change can produce hard numbers like the examples above, but we see the benefits time and time again when we’re helping clients with change management.

We’ve learned that we can effect all the change we can muster — make the line more efficient, increase throughput, get the operation lean and mean, whatever else is needed — but none of it will stick without managing the change correctly. This part of the job isn’t about numbers, planning or complex methods. It’s about people.

Whatever the change you’re making, it’s going to involve people behaving and working in a different way. So at its core, effective change management requires helping people transform their behavior. As we all know, people don’t necessarily love that, especially if they’ve been getting the job done one way for the duration. Research shows 62% of people don’t like leaving their comfort zone.

We find that small changes really go a long way here. It’s about the CEO taking some time to walk the shop floor and talk with frontline workers about the changes that are coming down the pike. It’s about us involving those workers in the process of change from the get-go, asking for their ideas for improvements, their thoughts about what the problems are that need solving. That way, the change that we’re implementing won’t be happening to them. They will be a part of it, champion it, and make that change stick every day on the line.

One other bonus to this tactic? It creates employee engagement and loyalty. Just 36% of U.S. employees are engaged at work, and 74% are actively looking for new jobs, according to a Gallup survey. 94% of employees say they’d stay at a company longer if it invested in their career development, LinkedIn reports. With manufacturing looking at 1 million unfulfilled jobs and the cost of replacing an employee as much as twice their annual salary, those small changes can mean big numbers on your balance sheets.

This is one part of our process that doesn’t take advanced degrees, engineers or Lean Six Sigma black belts to achieve. It just takes a little time and some people skills.

Get in touch today if you’d like to talk about how USC can help your company become more efficient and effective. One small conversation can go a long way to improving your operations.

In the food processing industry, the name of the game isn’t necessarily doing more with less, although that’s a powerful goal. For many companies, it comes down to getting the most out of their raw materials. To do that, it’s all about yield.

It can be a slightly confusing term to those outside the industry, but yield is generally defined as “the amount of usable product AFTER processing raw materials.” There’s a popular meme on the internet right now with the theme of: “How it started. How it ended.” Essentially, it’s “before and after” photos. When you’re talking about yield, the “before” photos might be a side of beef hanging in a cooler, while the “after” photos would be a pound of hamburger packaged and ready to ship to the grocery store. In that case, how it started isn’t necessarily going to be how it ended. In other words, a pound of beef isn’t always going to end up being a pound of burger. The difference is your yield.

Yield is affected by a wide range of variables, and low yield numbers can mean trouble for a company’s bottom line. It’s a common problem, one USC Consulting Group helps our clients with regularly. Let’s look a little deeper at yield, how and why it can bedevil companies, and what they can do about it.

The challenge with yield

Improving yield is the end goal. But let’s start at the beginning. Staying with the beef industry as an example, when companies start with a pound of beef and end up with .8 pounds of burger, that’s an 80% yield. The reasons for that gap become the problem.

Loss of moisture or weight. In processing beef, moisture is lost. It’s just the nature of the beast. That’s why, when you start out with one pound of raw materials you don’t always get one pound of finished product.

MAV. Government regulations give the food industry a little wiggle room between the expected quantity of any given item and the actual quantity. That’s the Maximum Allowance Variance (MAV). No product should weigh less than the MAV, nor should it weigh more than 100% of the MAV. That’s the gray area, or wiggle room. However…

Label weight. Due to government regulations (and good sense) the actual weight of a product — say, that pound of packaged ground beef in a grocery store — should not be lower than the label weight. End users, in this case, grocery store customers, can’t be told they’re buying a pound of burger when they’re really getting .8 pounds or less. Nor should grocery store owners be told by their suppliers they’re buying 100 pounds of ground beef when they’re getting 80. So to hit that MAV sweet spot and comply with label weights, food processing companies commonly…

Compensate. In the case of the beef industry, it means adding a little more ground beef into each unit. To not take the risk of going below the MAV, companies often prefer to run the process at a higher weight than the label. It’s what the industry calls “the giveaway.” They are essentially giving away beef to compensate for the loss of moisture.

Just a little more? How big a problem is this? If a company is processing, say, 30,000 pounds of ground beef into burger every day, adding a smidge into each package can be a very big problem. One recent client of USC came to us when they realized they were giving away over 1.5 million pounds of beef yearly.

Maximizing yield

This isn’t unique to the beef processing industry. Produce companies can overbag. Companies that process shelf-stable foods can use too much water. The list goes on. But no matter the type of food industry, maximizing yield is about achieving the right balance, hitting the right numbers. Not too little, not too much. Here are a few ways we help our clients do that. Hint: It’s all about efficiency and managing by the numbers.

Operations. Efficiency is the key in any operation, and at USC, we are always looking for opportunities for our clients to improve their processes. Scheduling, the sequence of how the job gets done, and even shift changes can play into efficiency. Creating a solid management operating system that allows you to “manage by the numbers” is vital in evaluating these processes for maximum efficiency.

Equipment. We don’t always recommend the latest and greatest technology. In many cases, it’s not necessary to upgrade. Maintenance? That’s another issue. Machines used to process raw materials into batches need to be at their optimal best. Regular maintenance and monitoring are key. Something as simple as build-up on a machine can lead to overfilling. A processing arm that slows down just a bit can hamper production.

Throughput. One reason for loss of moisture in beef processing is speed, so you need fast, efficient processing. But not too fast, or you can risk issues like bottlenecks in packaging, errors and ultimately waste. The Lean Six Sigma methodology helps companies maximize throughput and eliminate waste while preserving quality.

Yield is a key element to a company’s bottom line. The more efficient, streamlined and effective the operation, the more it allows companies to wrangle yield so it adds to, not drags down, profits.

It is a delicate balance to run a business in times of economic uncertainty. On one hand, you want to be optimistic, but on the other, you must also be realistic. Many organizations in a variety of industries did just that when the pandemic first struck. Whether in official press releases, mass emails, or executive meetings, business leaders acknowledged that tough times may indeed be ahead, but also expressed confidence and cautious optimism that supply chain disruptions would be minimal.

While the economic fallout from the pandemic proved to be less harmful than anticipated for some – particularly those in the big box and e-commerce retail segment, such as Walmart and Amazon – it greatly impacted the vast majority of industries. This includes food and beverage suppliers, packers, and manufacturers. Indeed, the pandemic and resulting economic downturn have impacted several major organizations, and as a result, led to a domino effect resulting in back orders and food shortages.

“The food and beverage industry is ramping up efforts to adjust and adapt.”

Since a vaccine for COVID-19 likely won’t be available any time soon, the food and beverage industry is ramping up efforts to adjust and adapt so shelves, pantries, refrigerators, and freezers are as fully stocked as possible.

In one form or another, from restaurants to processors and grocers, no food-related organization has been unaffected. But the meat industry may have gotten the worst of it. As reported by The Wall Street Journal, this $213 billion segment has experienced significant declines in production and assembly line output, as thousands of workers have been sidelined after testing positive for COVID-19. According to the Department of Agriculture, beef and pork yield plummeted nearly 30% during the first full week of May when compared to the corresponding period in 2019.

With fewer individuals operating assembly lines, output naturally declines, but these adverse effects were exacerbated by meat plants shutting down almost entirely. Food service distributors are as a result notifying customers of what to anticipate in the days and months ahead.

“Expect little to no boxed beef,” a correspondence obtained by the Journal read. “Business as usual is nowhere in sight.”

Dairy industry plagued by problems

Meanwhile, dairy farmers and bottlers have encountered similar obstacles during this ordeal. Early on, grocers throughout the country experienced “panic buying,” in which consumers snatched up gallons upon gallons of milk in anticipation there would be a shortage. Others followed suit, fearing they too would be unable to purchase milk products. This forced the industry to ramp up production. However, with illnesses also impacting bottlers, the surge in demand could not be complemented with growth in supply, resulting in millions of gallons being dumped due to curdling.

Nearer to the start of the public health crisis, organizations like the American Dairy Products Institute turned to the federal government for guidance and support. In a statement, ADPI CEO and President Blake Anderson said at the time that the U.S. needed to draw lessons from what other countries had encountered.

“It is imperative that our federal government now begin to lay out a strategy for ensuring the continued operation of the critical infrastructure industries,” Anderson said at the time. “After speaking with the EU and Canada about impacts to their dairy industries, we must prioritize the safety and availability of our workforce, ensuring transportation routes remain open, and providing a viable market or market alternatives for our nation’s dairy products.”

Shortly thereafter, Coca-Cola reported some of its own supply chain issues, only related to the sugar alternatives used in its diet and zero-calorie products. As reported by CNN, the soft drink conglomerate noted in its annual report that it fully anticipated “critical raw materials” like sucralose, cyclamate, stevia and acesulfame potassium may become harder to find, having experienced fewer shipments from China.

While many point to the COVID-19 pandemic as the first of its kind, given the degree to which the virus has affected the economy, it’s possible that something similar may happen again. As such, the food and beverage industry may need to be more proactive about adapting their processes so interruptions can be mitigated.

Subsidiaries and franchises are at varying degrees of progress in the midst of these preparatory efforts. For example, MVP Dairy, located in the northwestern portion of Ohio, is more assiduously examining its supply chains to close gaps and ensure continuity. The co-owner of the plant told the Journal he’s stocking up on feed for his cows as well as vitamin and mineral substitutes should there be a run on such staples. MVP Dairy is also being more fastidious about cleanliness and sanitation by implementing regularly scheduled scrubbings of high-touch surfaces, handles, and equipment.

Inventory management more of a priority

It isn’t just the food and beverage industry that’s reevaluating its supply chains – it’s businesses, in general. For example, inventory management has always been something that consultants have promoted, but it appears that more organizations are taking this advice more seriously.

Griffith Lynch, executive director for the Georgia Ports Authority, noted in a recent group discussion that he’s witnessed the degree to which organizations have inquired and focused on smart storage strategies.

“We’ve moved from a just-in-time world to a just-in-case world,” Lynch said in a discussion hosted by the U.S. Chamber of Commerce, Supply Chain Dive reported. He further stated shippers have come to the authority requesting free storage.

Organizations inside and outside the food and beverage industry are also re-evaluating their suppliers and considering whether they should supplement them with a fallback provider. They’re further stressing the importance of buying local or at the very least transitioning processes that had been done overseas back to the States. In a Thomas survey conducted in April, nearly two-thirds of manufacturers indicated they planned to increase production and sourcing in North America, 28% of which said this move was “extremely likely,” Supply Chain Dive reported separately.

The coronavirus crisis has forced everyone to reevaluate business as usual. A new normal may be necessary moving forward. USC Consulting Group can help you make productivity improvements and learn from experience so challenging times can lead to opportunities for growth. Contact us today to learn more.

Food and beverage trends leave lasting marks on production best practices, but one recent development could very well transform operational standards across the food and beverage space.

In recent years, consumers worldwide have embraced free-from foods, which omit certain ingredients, additives, or contaminants, such as gluten, antibiotics, or pesticides, Bloomberg reported. Analysts at Euromonitor predict that free-from food sales in the U.S. will grow 15 percent between 2017 and 2022, creating $1.4 billion in revenue. Businesses in the food and beverage space certainly stand to benefit from this trend, but many have found that free-from food production requires significant changes to their shop floors. Even so, it appears this phenomenon is here to stay, meaning these companies must embrace free-from foods production or risk losing their footing in the marketplace.

Understanding the rise of free-from foods

The free-from food movement began in the late 2000s and early 2010s, as consumers embraced wholesome eating habits at the behest of public health officials and popular fitness and nutrition experts. Sales of packaged foods dropped significantly during this period, while interest in organic products soared. At the same time, food allergy awareness increased drastically, leading people of all ages to scour their diets for problematic ingredients.

By 2014, approximately 60 percent of Americans attested to eating larger quantities of fresh fruits and vegetables, while 46 percent said they were avoiding processed items containing artificial colors and flavors, according to researchers from Nielsen. By 2015, 51 percent of U.S. residents reported having an understanding of common food allergens, according to survey data from the American College of Allergy, Asthma and Immunology. Dairy, gluten, antibiotics, pesticides and other once-standard-issue additives became anathema to large numbers of consumers, forcing businesses in the food and beverage industry to rethink their processes and expand their product lines.

Grappling with ground-up change

Major companies in the food and beverage space have transformed their production workflows to meet the expectations of free-from advocates.

According to Bloomberg, General Mills recently put the finishing touches on an eight-story structure that sorts through oats destined to become Cheerios and remove any traces of gluten. It took five years to construct the facility, which can process 1 billion pounds of oats per year. Although Cheerios do not contain gluten, General Mills built the behemoth sorter anyway, ostensibly to ensure gluten particles from other farms near its oat-harvesting operations would not make their way into finished product. General Mills is likely to benefit from this move; almost one-quarter of U.S. consumers consider gluten-free alternatives necessary, Nielsen discovered. In 2018 alone, these individuals are expected to spend more than $4.4 billion on such products, according to MarketsandMarkets.

Poultry producer Butterball took similar steps back in 2017, rolling out an entire line of antibiotic-free turkey products, all of which are produced at a state-of-the-art facility in Mount Olive, North Carolina. Here, production teams carefully handle antibiotic-free poultry to ensure it does not come into contact with conventional items. While this has certainly complicated shop floor operations, the company’s embrace of antibiotic-free production and packaging methods has certainly paid off. Sales of Butterball antibiotic-free ground turkey saw a year-over-year increase of 71 percent in the third quarter of 2018, as free-from food devotees flocked to the new offerings, according to Bloomberg.

However, the steps these and other food and beverage producers have taken are not meant to meet the needs of consumers in a niche market. Free-from foods could become the norm. While not all eaters identify with this movement, a majority are embracing healthier eating habits and therefore becoming more discerning about their food choices, habits that might translate into an across-the-board embrace of items now associated with the free-from foods phenomenon.

Preparing for the free-from future

Food and beverage producers that have yet to develop products catering to the growing slice of free-from consumers would be wise to take action quickly or risk surrendering serious ground in the marketplace.

Process evaluation and improvement are, of course, critical to managing change of this kind, especially around raw material acquisition, an essential variable in the creation of shop floor processes capable of producing free-from food products at scale. But production changes constitute only half the equation. Not only do consumers want food and beverage makers to provide free-from products, they also demand that companies outfit such offerings with labels featuring complete ingredient lists for total transparency, according to Food Processing. In the end, firms that take these steps can effectively prepare for the future of food and beverage production and find success in the years to come.

Here at USCCG, we’ve been working with businesses across numerous industries for more than 50 years, including the food and beverage industry, helping them as they adapt to marketplace transformations of all kinds. Connect with us today to learn more about our work.

The food and beverage space continues to evolve in response to consumer demand, production innovation, and resource availability. Numerous sea changes are poised to unfold in 2018, nearly all of which will affect producers’ bottom lines. Here are some of the impactful trends taking hold within the food and beverage arena over the next several months:

Cellular agriculture

In recent years, food and beverage makers have embraced unorthodox production methods in an effort to engage increasingly conscious customers who not only demand healthy, all-natural food products but also prefer vendors that use sustainable processes.

In June 2017, the market intelligence firm Ipsos Research collaborated with Coast Packaging Company to conduct a nationwide study on consumer attitudes toward sustainability in the food and beverage sector. Approximately 42 percent of respondents attested to caring about “minimally processed” food items more than they did five years earlier, while more than one-quarter expressed interest in producers whose methods reduce food wastage.

These attitudes have forced producers to re-evaluate their workflows and have led to the creation of experimental food production methods, the most notable being cellular agriculture. This strategy involves engineering products in laboratories via cutting-edge bioengineering and tissue-engineering techniques that enable the creation and manipulation of cell cultures. Innovators in the space have been able to “harvest” virtually every food product using cellular agriculture, including animal products such as meat, dairy, and eggs, along with vegetables, according to Quartz. Early successes show the methodology holds transformative potential in an environment where available agricultural land continues to shrink, according to the Food and Agriculture Organization of the United Nations. Of course, cellular agriculture also opens the door to increased sustainability, allowing producers in the U.S. to take pressure off the more than 408,000 hectares of land they currently control and produce their products within controlled laboratories, according to the Organization for Economic Cooperation and Development.

However, brands have yet to convince consumers to embrace products created through cellular engineering. Messaging surrounding the topic will take shape throughout 2018, as advocates attempt to promote the natural roots of the process while opponents fight back by labeling the resulting food items “lab-grown.” Should the former group win the marketing battle, producers could find themselves making room in the budget for investments in cellular agriculture.

Food safety

Consumers weathered multiple food safety breakdowns last year and are currently under threat from an international E. coli outbreak linked to tainted romaine lettuce, according to the Centers for Disease Control and Prevention. The bacteria-ridden vegetable has sickened more than 180 people across Canada and the U.S., and caused two deaths. This is not uncharted territory. Last year, the CDC conducted eight large-scale investigations addressing bacterial outbreaks related to food production.

These very public food safety problems have put consumers on edge. Chipotle’s recent struggles evidence increased public awareness of such issues. The restaurant chain suffered a massive E. coli outbreak during the fourth quarter of 2015 and has yet to re-establish its footing in the marketplace, despite mitigating the immediate problem in February 2016, instituting new quality control methods and investing in an aggressive rebranding campaign, CNN reported. In short, consumers are not as willing to trust food and beverage brands with black marks on their safety records, no matter what post-outbreak changes are made.

Food and beverage firms must keep this in mind as they navigate the market in 2018. They must ensure their safety processes and fail-safes are in place and compliant with modern production standards. A single slip-up could wreak long-term budgetary havoc.

Changing regulatory tides

A number of federal authorities have signaled that various regulatory changes affecting the food and beverage space could unfold in 2018, the most prominent being the U.S. Department of Agriculture’s potential repeal of the Organic Livestock and Poultry Practices proposed final rule, according to Lexology. On Dec. 18, the agency published an external communication requesting public comment on new guidance that would withdraw the rule, which would require organic livestock companies to refine their handling and slaughter methods to make them more animal-friendly. The OLPP was scheduled to go into effect March 30, 2018, but the USDA has since pushed the implementation date back to May 14. However, the agency is unlikely to allow the rule to take effect.

Farmers are divided on the decision. While some appreciate the USDA’s push to reduce regulations, others are concerned that lowering standards for animal welfare will anger customers, an increasingly large number of whom consider ethical farming practices paramount.

In addition to grappling with the recent OLPP decision, food and beverage producers are still digesting the U.S. Food and Drug Administration’s decision to discontinue the Food Advisory Committee. The group, established in 1992, dissected national nutrition and food safety trends, until Dec. 12 when the FDA announced that it was not renewing its charter. The agency cited inactivity – the FAC had not held an official meeting since 2015 – as the impetus behind the move.

Eight days after the FDA publicized its decision, a group of more than 10 public interest groups and seven former FAC members sent a letter to the agency asking it to reactivate the panel, Lexology reported. The FDA has yet to respond.

These developments signal a loosening of federal food and beverage production regulations, possibly laying the groundwork for higher revenues. That said, this approach could also increase operational risk, as producers working without strong guidelines in mind may end up rolling out substandard product that disappoints or, even worse, sickens food-savvy consumers.

With these developments in play, businesses in the food and beverage industry must re-evaluate their back-end and front-end operations to assess their respective levels of preparedness. Firms that need external assistance to effectively undertake these activities should consider connecting with USC Consulting Group. Our management experts can help food and beverage producers of all sizes adjust to the current marketplace and future-proof their operations for tomorrow.

What challenges do food and beverage companies face when integrating high-pressure processing equipment?

At first glance, high-pressure processing – or HPP – appears to be the answer to a question the food and beverage industry has long sought: What is the best way to process goods based on consumer interest?

HPP technology replicates extremely pressurized environments, thereby eliminating viral or bacterial growth as well as other such biota without introducing goods to high heat or infusing them with additives. This innovation marks a turning point in the industry at a time when an increasingly discerning consumer base has its eyes on how brands process their foods and drinks safely and sustainably.

However, integrating high-pressure processing technology into plant operations can’t be done overnight. In some instances, many internal factors must be accounted for before installing the equipment. Otherwise, businesses run the risk of hurting process efficiency, compromising quality, and creating a wasteful production system.

Process validation always difficult for new technologies

When engineers and food scientists develop breakthroughs in processing goods, validation teams must intervene and ensure these methods or machines act how they were designed to – not just once, but at every unique application. These days, many regulators have their sights on HPP, and for good reason.

According to Food Safety Magazine, HPP processes represent one of several non-thermal approaches to quality control, including cold plasma and high-intensity pulsed light technology, still heavily scrutinized by validating regulators. Not because the process itself is flawed, but rather because it is so new validation specialists still need to compile knowledge before easing up on validation measures across all applications.

To accomplish this, regulators require a lot of operational data to validate HPP processes, perhaps more so than would be necessary if a business simply installed familiar equipment with a more easily verifiable history. For businesses hoping to integrate HPP quickly, advanced data management strategies could provide regulators with the necessary information as completely as possible and at a faster clip. Before high-pressure processing integration, they must be sure the operational data management processes in place are capable of demonstrating the equipment’s potential so lag does not occur.

Possible changes to packaging materials may be necessary

One of the beauties of HPP technology is its ability to process goods after they’ve been packaged. This both enhances the quality of the foods and beverages right up to distribution and has the potential to accelerate cycle times along the way thanks to its instantaneous application of pressure.

That said, certain food and beverage packaging cannot withstand HPP treatment, according to a study by the National Food Lab. Metal and glass, for instance, would break under the intense conditions. Additionally, the National Food Lab specifies any flexible packaging like vacuum seals or plastics must “be compressed by about 15 percent without suffering structural damage and […] return to its original shape upon pressure release” to be considered safe in the long term.

Businesses should therefore research in advance of high-pressure processing technology investment as to whether their current packaging strategy will hold up or need a complete overhaul. Knowing one way or the other could factor into asset purchase and future training courses on new HPP equipment, as well as any new operational requirements for packaging necessary to supplement changes to product processing.

Consider how to maintain product uniformity throughout HPP equipment life cycle

Over time all equipment malfunctions, and HPP assets are no different. For instance, pistons creating the pressurized environment may do so unevenly when not calibrated properly, causing ruptured packages and destroyed goods when too high or potentially passing contaminated products when too low. Food and beverage businesses can look for these effects as signs their HPP machinery might be on the fritz, but by then it may be too late to continue production on time and at volume. Due to the high costs of HPP equipment and their importance to quality control, businesses may only rely on a few machines for their entire operation.

So, what should happen when HPP equipment is found to be technically deficient? Like all other capital-intensive assets on a production line, it needs to be serviced. However, reactive maintenance strategies will only exacerbate issues by bottlenecking production when machinery breaks down. Instead, businesses should establish predictive and proactive maintenance standards, as well as a system for ranking internal assets. That way, maintenance specialists can prioritize HPP repairs over less vital work orders.