-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2024 (4)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: Emissions

The material handling industry is the backbone of globalized supply chains. However, it encounters a range of challenges, both internal and external. One notable external challenge is the impact of labor shortages on transportation and logistics, which are vital components of material handling operations.

To overcome these challenges, companies are making significant investments in technology. According to the 2023 MHI Annual Industry Report, 74% of supply chain leaders are increasing technology spending.

While capitalizing on advanced supply chain technologies can offer some respite, leaders may need to take more profound measures to effectively address the emerging issues.

In light of the survey responses featured in the MHI report, this article aims to explore the three primary challenges faced by the material handling industry.

#1: Worker safety

According to the US Bureau of Labor Statistics, there were 5,190 fatal work injuries in 2021, with 798 attributed to exposure to harmful materials or the environment — the highest figure since the series began in 2011!

Material handling operations often involve risky conditions for workers. From handling hazardous chemicals in facilities to lifting heavy loads in warehouses, workers in this supply chain sector regularly risk their health and lives.

Common causes of worker injuries in material handling include:

- improperly stored materials falling

- damaged storage units

- heavy manual lifting, pushing, or carrying

- exceeding loading limits on lifting equipment

- collision with materials or equipment.

Ensuring workers’ safety and security is vital and requires a multi-pronged approach. Safety negligence or violation can quickly become a compliance issue, resulting in monetary and reputational damage.

Material handling and supply chain companies address workplace safety challenges by providing personal protective equipment (PPE), delivering safety training, conducting equipment training, and performing safety audits.

Conscious companies that rely on manual labor also address the ergonomics of material handling in their safety training. Identifying ergonomic risk factors in manual or machine-supported lifting, carrying, and pushing jobs is critical for preventing fatigue and injury.

To prioritize the health and safety of their employees, conscious companies cultivate a “safety-first” culture. A prime example of a logistics company that excels in worker safety is DHL, based in Germany.

Safety is a core value for DHL, and they have implemented a holistic approach to address safety concerns through continuous training, strict compliance with regulations, and active employee engagement.

#2: Material and equipment damages

Poorly maintained equipment, untrained workers, and natural disasters can lead to expensive damages. Among these challenges, equipment damage stands out as one of the primary concerns for material handling companies, often resulting in downtime. In fact, unplanned downtime costs manufacturers a staggering $50 billion annually.

To ensure reliability and resilience, timely maintenance is crucial for all aspects of material handling operations, ranging from trucks and forklifts to pallets and sliding racks.

Similarly, it is equally important to prevent damage to the materials being handled by the equipment or workers. Well-organized warehouse loading and unloading processes, supported by well-trained workers and advanced technology, can effectively minimize material handling damages.

Many supply chain companies are leaning towards predictive maintenance solutions for equipment to ensure they are well-maintained for operations. Predictive maintenance leverages technologies like artificial intelligence (AI) and machine learning (ML) to predict potential problems with equipment and fleet.

In addition, these companies are minimizing accidents that result in costly damages through increased visibility. Warehouse inventory management and organization technology, for example, helps maintain optimal inventory levels, prevents overstocking, and ensures efficient use of storage space.

Gradesens, a Swiss company specializing in predictive maintenance, is helping logistics companies with very-narrow aisle warehouses proactively maintain automated systems for loading and unloading. With accurate and timely maintenance, the warehouses prevent downtime because of equipment failure.

#3: Controlling emissions

Carbon emissions are a huge problem for major industries, and material handling is no exception. With environmental organizations ringing alarm bells on rising global temperatures, material handling and supply chain leaders are paying close attention to sustainability.

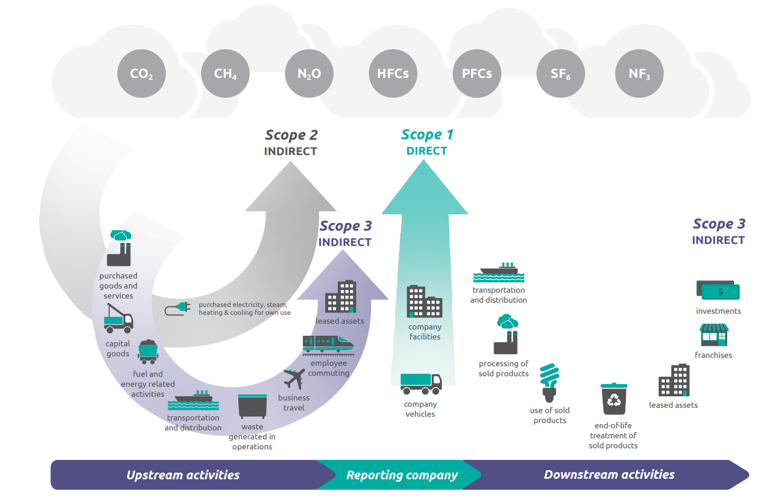

Material handling operations, including warehousing, contribute to greenhouse gas (GHG) emissions through electricity usage, particularly natural gas. Additionally, using fossil fuel-powered vehicles and equipment contributes significantly to carbon emissions. Many material handling companies make up Scope 3 emissions for other organizations.

Fortunately, the material handling industry is adopting energy-efficient practices, thanks to environmental advocacy and pressure from governments with ambitious sustainability goals.

The MHI report revealed that organizations in material handling are investing in electrification, natural resource management, sustainable water consumption, and the transition to renewable energy.

Similarly, the European Logistics Supply Chain Sustainability Report found that 80% of surveyed companies consider sustainability a key focus area.

Material handling companies are reducing carbon footprint by investing in electric lift trucks. Electric forklifts have zero emissions compared to their counterparts powered by internal combustion engines.

Renewable energy has also been a focus for the industry, with major companies setting goals to go 100% carbon-neutral or net zero emissions. For instance, Amazon, the largest corporate buyer of renewable energy, uses clean energy in many fulfillment centers. The company plans to reach its 100% renewable energy goal by 2025.

The takeaway

Material handling is linked with virtually every industry, which makes its challenges essentially every industry’s challenges.

Some of the issues aren’t unique to material handling. For instance, sustainability is a global issue. The good news is that many companies are taking promising measures to combat these challenges: and technology is at the heart of these solutions.

It’s imperative for organizations in material handling to provide training and maintain equipment for better worker safety. Similarly, investing in clean energy solutions can go a long way in reducing emissions, which is good for the environment and business.

Matilda Odell

*This article is written by Matilda Odell. Matilda works as the Content Creation Specialist at the brand TAWI, a brand by Piab Group, which enables smart lifting optimized for people and businesses. Piab helps its customers to grow by transforming their businesses with increased automation. If you have any questions about lifting equipment such as vacuum lifters or other lifting devices, Matilda is the person to talk to.