-

Subscribe to Blog:

SEARCH THE BLOG

CATEGORIES

- Aerospace

- Asset Maintenance

- Automotive

- Blog

- Building Products

- Case Studies

- Chemical Processing

- Consulting

- Food & Beverage

- Forestry Products

- Hospitals & Healthcare

- Knowledge Transfer

- Lean Manufacturing

- Life Sciences

- Logistics

- Manufacturing

- Material Utilization

- Metals

- Mining

- News

- Office Politics

- Oil & Gas

- Plastics

- Private Equity

- Process Improvement

- Project Management

- Spend Management

- Supply Chain

- Uncategorized

- Utilities

- Whitepapers

BLOG ARCHIVES

- July 2025 (1)

- June 2025 (4)

- May 2025 (1)

- April 2025 (1)

- March 2025 (1)

- February 2025 (4)

- January 2025 (4)

- December 2024 (4)

- November 2024 (2)

- October 2024 (6)

- September 2024 (5)

- August 2024 (5)

- July 2024 (6)

- June 2024 (3)

- May 2024 (3)

- April 2024 (4)

- March 2024 (3)

- February 2024 (4)

- January 2024 (5)

- December 2023 (2)

- November 2023 (1)

- October 2023 (6)

- September 2023 (3)

- August 2023 (4)

- July 2023 (2)

- June 2023 (3)

- May 2023 (7)

- April 2023 (3)

- March 2023 (3)

- February 2023 (5)

- January 2023 (6)

- December 2022 (2)

- November 2022 (5)

- October 2022 (5)

- September 2022 (5)

- August 2022 (6)

- July 2022 (3)

- June 2022 (4)

- May 2022 (5)

- April 2022 (3)

- March 2022 (5)

- February 2022 (4)

- January 2022 (7)

- December 2021 (3)

- November 2021 (5)

- October 2021 (3)

- September 2021 (2)

- August 2021 (6)

- July 2021 (2)

- June 2021 (10)

- May 2021 (4)

- April 2021 (5)

- March 2021 (5)

- February 2021 (3)

- January 2021 (4)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (3)

- March 2020 (4)

- February 2020 (4)

- January 2020 (4)

- December 2019 (3)

- November 2019 (2)

- October 2019 (4)

- September 2019 (2)

- August 2019 (4)

- July 2019 (3)

- June 2019 (4)

- May 2019 (2)

- April 2019 (4)

- March 2019 (4)

- February 2019 (5)

- January 2019 (5)

- December 2018 (2)

- November 2018 (2)

- October 2018 (5)

- September 2018 (4)

- August 2018 (3)

- July 2018 (2)

- June 2018 (4)

- May 2018 (3)

- April 2018 (3)

- March 2018 (2)

- February 2018 (2)

- January 2018 (1)

- December 2017 (1)

- November 2017 (2)

- October 2017 (2)

- September 2017 (1)

- August 2017 (2)

- July 2017 (2)

- June 2017 (1)

- April 2017 (3)

- March 2017 (3)

- February 2017 (2)

- January 2017 (2)

- December 2016 (2)

- November 2016 (4)

- October 2016 (4)

- September 2016 (3)

- August 2016 (6)

- July 2016 (4)

- June 2016 (4)

- May 2016 (1)

- April 2016 (3)

- March 2016 (4)

- February 2016 (2)

- January 2016 (4)

- December 2015 (3)

- November 2015 (3)

- October 2015 (1)

- September 2015 (1)

- August 2015 (4)

- July 2015 (6)

- June 2015 (4)

- May 2015 (7)

- April 2015 (6)

- March 2015 (6)

- February 2015 (4)

- January 2015 (3)

CONNECT WITH US

Tag Archives: asset management

Poor asset management can result in significant financial losses beyond the cost of replacement, with reputational damage, compromised data, and operational disruption a few of many risks involved. Effective asset management, on the other hand, is essential for businesses across industries, with advantages that include increased productivity, elevated asset utilization, and minimal downtime, The Enterprise World highlights. For organizations that aim to enhance their asset management process, the perfect balance of key strategies is a must — especially when the goal is to better manage the return and disposal of physical assets.

Preventative maintenance as a front line defense

For companies that manage assets like physical tech equipment, a strategy that focuses on maintenance is essential in order to maintain assets that are in optimal working condition at all times. Further advantages include asset longevity, reduced maintenance costs over time, and greater operational efficiency. Due to the value that preventative maintenance can bring, businesses must consider the strategy as a valuable front line defense in an asset’s life cycle.

While manual, routine inspections are crucial to an effective asset maintenance strategy, technology now plays an indisputable role in predictive maintenance and asset management as a whole. Artificial intelligence (AI) is just one technology that is gaining traction in asset management. For example, AI algorithms can process large amounts of data in order to predict maintenance issues and generate optimal schedules for maintenance — all the while factoring in an asset’s previous maintenance data. This can prove to be particularly beneficial for organizations that possess a significant number of assets (such as many laptop computers). When combined with efforts like manual asset tracking, businesses can rest easy in knowing that everything is accounted for, in good condition, and up-to-date on routine maintenance.

A streamlined return process

Effective equipment tracking is essential for any business with physical assets. Today, equipment management endeavors go well beyond a simple spreadsheet, and will typically involve the combined use of both physical tracking options (like barcodes or equipment tags). Software is another essential element, as asset management software provides a deeper look into the valuable details associated with physical assets. This technology will not only provide an overview of the assets that a business has, but details in regard to maintenance history and location (to highlight a couple of insights).

Businesses that have a well-defined asset tracking approach can easily overlook the complex nature of certain parts of the asset management process. For example, the return process can often involve several kinks along the way, such as employees that fail to send back company equipment, or inefficient shipping which can result in untimely delays. As such, effective equipment tracking does extend to a successful equipment return process. This is especially crucial for companies that routinely ‘loan out’ technology to their employees — a lost laptop is just one asset that can create a ripple effect for a business. In addition to lost productivity and the cost of replacement, the company may also have to shoulder the cost associated with a data breach, a factor that further underlines the importance of an effective return process. In addition to clear instructions, it’s essential that a business has a strategy in place to streamline the return. In addition to a trustworthy equipment management system and staying on top of paperwork (such as custom fees, etc.), aspects like consistent tracking updates throughout the shipping process can make a major difference.

Asset disposal can be a sustainable process

The integration of technology can elevate an asset management strategy by enabling businesses to continuously optimize maintenance schedules and elevate the return process. In turn, companies can minimize the downtime of assets, and benefit from equipment that will go the mile. When assets are truly no longer useful, however, businesses must abide by an effective disposal strategy. In many cases, there are sustainable approaches that can underline further advantages, such as environmental benefits or supporting the local community.

In some cases, a business may wish to donate old equipment (like computers, printers, etc.) to schools in order to support the local community. Businesses may wish to explore other options as well, such as the ability to refurbish and sell their equipment. Recycling old tech is another solution, and can be a sustainable option for equipment that is truly at the end of its life cycle. Before old tech leaves the hands of a business, however, it’s crucial to gain a full understanding of the laws, regulations, and the additional considerations that are involved. For example, businesses that wish to recycle their tech will need to comply with e-waste disposal laws. Other tasks are equally as necessary, such as a thorough asset inventory, the proper and secure destruction of any sensitive information (including GDPR compliance where applicable). Enlisting the help of a certified and professional Information Technology Asset Disposition (ITAD) provider can be a great option that can help guide a business through the process.

Poor management of physical assets brings to light a number of stark consequences for a business, from unnecessary financial losses to lessened efficiency overall. A balance between technology driven solutions and smart considerations, however, can make for an elevated management process even where asset return and disposal are concerned.

*This article is written by Lottie Westfield. Lottie spent more than a decade working in quality management in the automotive sector before taking a step back to start a family. She has since reconnected with her first love of writing and enjoys contributing to a range of publications, both print and online.

Achieving efficiency in manufacturing requires meticulous attention to pre-production processes, especially when managing temperature-sensitive operations. Pre-manufacturing thermal management is essential for maintaining product quality, ensuring equipment longevity, and improving overall operational efficiency.

The Role of Thermal Management in Manufacturing

Thermal management involves regulating temperature levels within machinery, materials, and environments to create ideal conditions for production. Excessive heat or improper cooling can compromise machinery performance and lead to defects in temperature-sensitive products. A robust thermal management strategy minimizes these risks, ensuring consistent outcomes and reducing downtime caused by equipment failure.

Industries such as electronics, pharmaceuticals, and aerospace often handle materials that demand precise thermal control. For instance, electronic components require steady temperatures during assembly to avoid warping or damage. Without adequate thermal management, manufacturers risk product recalls and damaged reputations.

Pre-Manufacturing Strategies for Temperature Control

Implementing a pre-manufacturing thermal management plan involves understanding your facility’s specific needs and employing the right tools to monitor and maintain conditions. Thermal analysis equipment is a key investment for businesses aiming to achieve optimal production outcomes. These tools provide detailed insights into how heat is distributed and managed throughout the production process, helping identify areas of inefficiency or potential failure.

Effective thermal management strategies also include proper ventilation systems, insulation, and advanced cooling technologies. Additionally, scheduling routine maintenance ensures that thermal management tools operate correctly, preventing unexpected disruptions during production.

The Long-Term Benefits of Optimal Thermal Management

Businesses that prioritize pre-manufacturing thermal control enjoy several advantages, including reduced operational costs, improved product quality, and extended equipment lifespans. By addressing thermal issues early, companies can avoid costly repairs, minimize energy consumption, and enhance workplace safety.

Furthermore, implementing thermal management measures aligns with sustainability goals, as efficient temperature regulation often reduces waste and energy usage, positively impacting the environment.

Pre-manufacturing thermal management is more than just a technical requirement—it’s a cornerstone of efficient and sustainable production. Investing in tools and prioritizing proactive strategies ensures businesses can meet high-quality standards while staying competitive in a fast-paced market.

Check out the accompanying resource below to learn more.

Over the next five years, mining and metals companies are expected to spend between $25 billion to $30 billion annually to maintain their assets.

Largely driven by efforts to improve operational efficiency, reduce downtime, immediately reduce costs, meet sustainability goals, and manage operational risks in an increasingly volatile market, mining and metals executives are motivated to start their asset management transformation now. Delaying this transformation could result in lost competitive advantages, higher operational costs, and increased regulatory or market pressures.

Over the next five years, the mining and metals industry is projected to invest heavily in the maintenance of fixed and mobile assets. Various reports indicate that the industry is expected to allocate a significant portion of its CAPEX to maintaining and upgrading its assets. A substantial part of this investment will be directed toward maintaining critical assets required to meet global demand for minerals essential for the energy transition. In a recent survey conducted by Global Data, 48% of the companies surveyed indicated they plan to increase investments in technologies like AI and IoT sensors for equipment upkeep over the next two years.

Investment in predictive maintenance is becoming a top priority for many mining operations. Companies are leveraging their EAM’s with advancing technologies like Digital Twins, AI and IoT, along with other reliability and planning applications, and significantly transforming asset management and the asset lifecycle. These advancements in technology are expected to reduce maintenance costs by 20-30%.

Mining and metals companies integrating Enterprise Asset Management (EAM), Computerized Maintenance Management Systems (CMMS), AI, and IoT are experiencing several quantifiable benefits, including:

- Improved Asset Reliability and Uptime: Utilizing a combination of AI, IoT sensors and Digital Twins provides continuous real-time monitoring of equipment health allowing companies to predict potential failures before they occur while reducing the reliance on reactive and scheduled maintenance – reducing unplanned downtime and fewer equipment breakdowns, increasing equipment availability and extending asset lifecycles.

- Cost Reduction: A predictive maintenance capability helps avoid costly emergency repairs and reduces unnecessary scheduled maintenance, saving on labor and spare parts. It also ensures that the right parts are available when needed, minimizing overstock and understock issues, which helps reduce capital expenditure tied to inventory. It optimizes the energy usage of equipment by adjusting operational parameters in real-time, leading to lower energy consumption.

- Scalability and Flexibility: Leveraging these technologies together, allows companies to scale their asset management strategies as they grow, adapting to changes in operational needs without significant disruptions. Maintenance scheduling based on asset condition rather than time-based intervals, ensures that resources are used effectively, reducing downtime and improving workflow efficiency. They provide a holistic view of all assets, enabling better coordination between teams while improving “wrench-time” productivity and the execution of maintenance and operational tasks. It delivers a single platform to access real-time data across the entire asset portfolio, improving visibility and control over operations for optimizing performance and recommendations for future operations.

USC partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence

USC brings a tailored, structured, and disciplined methodology, along with a range of tools and techniques we apply collaboratively with client’s personnel. Whatever your challenge, we are the people who work with our clients to find full potential and unlock the hidden value.

USC help to identify waste, redundancies, and ineffective processes, and then rapidly recover the prioritized opportunities, and convert them to improvements in performance and operating profit. Further, our people embed with client teams to develop, enhance, prototype, validate and implement asset management strategies to drive, sustain and perpetuate improvements in asset lifecycles and equipment reliability, while changing how plans, schedules, and work is executed. In short, USC implements measurable, sustainable changes that drive asset performance and financial improvements.

- Increased Wrench Time (up to 25% improvement) – Reducing non-productive time through improved work-order generation and prioritization, maintenance teams spend less time searching for work-orders, tracking down parts or waiting for approvals.

- Reduction in Travel & Downtime (up to 20% time savings) – Optimizing the routing and scheduling of maintenance tasks and reducing travel time between jobs to maximize “time on tools”.

- Faster Work-order Completion (up to 30% efficiency gains) – Reducing delays in task assignment, approval and completion tracking, technicians can move quickly from one job to the next by ensuring all the necessary tools and parts are available at the work site, eliminating delays caused by missing resources.

- Optimized Spare Parts Management (up to 15% time reduction) – Faster access to parts and accurate spare part forecasting reduce time on sourcing, stocking and searching while ensuring tools & parts are available for tasks.

- Better Data-Driven Decision Making (up to 20% longer asset life spans) – Collecting and analyzing needed information provides actionable insights that support planning and allow for more informed and pro-active decision making, often delaying the need for capital-intensive replacements.

USC clients experience measurable operational and financial results that significantly improve both the efficiency and profitability of their operations. Benefits delivered may include a 10-20% increase in overall equipment availability due to reduced unplanned downtime and optimized maintenance schedules and a 10-15% improvement in equipment utilization as predictive maintenance reduces the time equipment is out of service.

USC Helps You Tackle Key Challenges

- Optimize maintenance strategies and increase equipment availability operational output

- Predict asset integrity and reliability needs and improve time on tools

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcoming cultural and communication issues with contractors, while ensuring quality expectations

Do you want to understand how prepared your company is to drive needed asset management performance and reliability improvements and what the key focus areas that will contribute to lower operating costs? Contact us today.

By integrating their Management Operating Systems (MOS) with AI and IoT, mining and metals companies can significantly enhance their operational capabilities, leading to better asset management, increased productivity, and ultimately, improved financial performance.

Utilizing IoT devices, such as sensors and connected equipment, to continuously collect data on various aspects of their operations, including equipment performance, environmental conditions, and production metrics, this real-time data is fed into the MOS, providing a comprehensive and up-to-date view of operations. The collected data is then analyzed by AI algorithms within the MOS to generate insights, identify patterns, and predict outcomes, allowing for proactive management of assets and operations, such as predicting equipment failures or optimizing production schedules.

A key aspect of any MOS is to assist management in decision making. Integrating AI with MOS enables real-time decision support, where AI provides recommendations or automates decision-making processes based on the analysis of IoT data. This helps managers make more informed decisions quickly, improving responsiveness to changing conditions. Additionally, AI allows the MOS to simulate different operational scenarios and predict their outcomes. This capability helps managers evaluate the potential impact of different decisions before implementing them, reducing risks and optimizing outcomes.

By focusing on operational efficiency, AI models integrated into the MOS can optimize processes in real-time by adjusting operational parameters based on current conditions and historical data, leading to improvements in ore and metal recovery, energy efficiency, and overall productivity. AI can also be used to analyze data on resource usage and availability, helping the MOS to optimize the allocation of resources such as labor, equipment, and materials, leading to cost savings and improved operational efficiency.

When approaching enterprise asset management and predictive maintenance models, integrating AI and IoT with the MOS, companies can enhance their predictive maintenance capabilities. AI algorithms analyze sensor data from IoT devices to predict when maintenance is needed, helping to prevent unexpected equipment failures and reduce downtime. This assists the MOS to automatically schedule maintenance activities based on AI predictions, ensuring that maintenance is performed only when necessary and that it is coordinated with other operational activities.

The use IoT and AI integration helps the MOS to optimize inventory levels by predicting demand for spare parts and materials based on operational data, thus reducing inventory costs and ensuring that critical components are available when needed. By having AI analyze data across the supply chain, assisting the MOS to optimize logistics, reduce lead times, and minimize costs associated with the procurement and transportation of materials.

Integrating Management Operating Systems with AI and IoT in the mining and metals industry offers substantial benefits, but it also comes with several challenges and potential pitfalls.

USC partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Operational Excellence

For more than 55 years, USC has been working with clients to address the challenges and avoid the pitfalls when developing, enhancing and deploying their management operating systems.

As technology enablers, like AI and IoT, are deployed, we help clients to address the challenges through careful planning and a strong focus on change management, including employee involvement. By proactively identifying and mitigating the pitfalls, mining and metal companies can successfully integrate AI and IoT with their MOS, unlocking the full potential of these technologies for improved asset management and operational efficiency.

Integrating AI and IoT into MOS often requires close coordination across different departments, such as IT, operations, and maintenance. Misalignment or lack of communication between these departments can lead to project delays and failures. The complexity of integrating AI and IoT, projects can often experience timeline and budget overruns. Effective project management is critical to keep the implementation on track and within budget.

Mining and metal operations often have data scattered across different systems and departments. Integrating this data into a unified MOS that can effectively leverage AI and IoT is challenging, particularly if the data is stored in incompatible formats or is not standardized. AI systems require high-quality, accurate data to function effectively. Inconsistent, incomplete, or inaccurate data can lead to poor AI performance, resulting in unreliable predictions or insights. Ensuring that data from IoT devices is processed in real-time is crucial for effective AI-driven decision-making. However, high latency in data transmission or processing can lead to delays, reducing the effectiveness of AI in making timely decisions.

Many companies often face a skills gap when it comes to AI, IoT, and data analytics. There may be a shortage of in-house expertise required to manage and maintain these advanced technologies effectively, so having a partner can assist in compressing the time it normally takes cleanse data and align MOS processes. Employees accustomed to traditional methods may resist adopting new technologies, especially if they perceive AI and IoT as threatening their jobs or making their roles redundant. Effective change management and training programs are essential to address this issue.

Companies that have integrated their Management Operating Systems with AI and IoT are experiencing several quantifiable benefits across various aspects of their operations. These benefits are often measurable in terms of improved safety (30-50% reduction in safety incidents), cost savings (10-40% reduction in maintenance costs), and an increased productivity (5-15% increase in productivity and 10-20% improvement in operating efficiency), just to name a few. By leveraging these technologies effectively, mining and metal companies can achieve substantial improvements across their entire value chain.

USC helps you tackle key challenges

- Ensure the right resources are at the right place to minimize lost time – enabling safe and disciplined execution

- Optimize mine planning and scheduling across all planning horizons – delivering detailed and accurate plans

- Identify potential roadblocks proactively during mine planning and solve complexity during the planning process

- Control quality of work at the point of execution by identifying off specification and enabling in-shift correction

- Enhance your ability to cluster & centralize scarce human expertise, allowing all sites to benefit from their expertise

Do you want to understand how a MOS can integrate your mine and operational planning, while helping you to safely increase performance site wide? Contact us today.

Downtime – the dreaded halt in production that can cripple a manufacturing operation. It’s more than just an inconvenience; it’s a hidden cost that can eat away at your profits. A recent study revealed that nearly 82% of businesses have experienced unexpected downtime in the past three years, with the average incident lasting four hours and costing a staggering $2 million. The impact goes beyond just financial losses – downtime can disrupt customer deliveries, delay critical projects, and erode trust with clients.

The Potential Culprits

One major factor is neglecting preventive maintenance. Regular servicing not only keeps equipment functioning smoothly but also allows technicians to identify potential problems before they snowball into major breakdowns.

Another hidden source is outdated equipment. Obsolete machinery can be a drag on your entire production line. Imagine a slow, malfunctioning piece of equipment holding up the entire process. This can put undue stress on other machines, leading to premature wear and tear, and ultimately, more downtime. Upgrading to newer, more efficient models can significantly improve production flow and reduce the risk of breakdowns. Outdated software can also be a culprit. Running outdated software can lead to compatibility issues with newer systems and leave your facility vulnerable to security breaches.

Beyond equipment and software, a lack of proper training for your workforce can also contribute to downtime. If operators don’t fully understand how a machine works, they might misuse it, leading to errors and breakdowns. Investing in comprehensive training empowers your employees with the knowledge and skills they need to operate machinery safely and efficiently, minimizing the risk of operator-induced downtime.

Finally, the importance of data tracking cannot be overstated. Keeping detailed logs of equipment issues and production hiccups allows you to identify recurring problems and implement preventative measures. Think of it as a historical record that helps you anticipate and address potential bottlenecks before they derail your production schedule.

Finding the Right Solution for You

The good news is that there are steps you can take to combat downtime and keep your production lines humming. Conducting risk audits to identify potential problems, installing sensors to monitor equipment health (like a torque transducer that detects excessive force on a rotating shaft), and implementing a comprehensive preventive maintenance program are all crucial steps in the battle against downtime.

Investing in employee training and partnering with reliable third-party service providers can further strengthen your defenses. By adopting a proactive approach to maintenance and addressing the root causes of downtime, you can significantly reduce disruptions and ensure your manufacturing operation runs smoothly and efficiently.

Want to learn more about the specific costs associated with different downtime causes? The following infographic breaks down the financial impact of various downtime triggers, helping you identify areas for improvement and optimize your production process for maximum uptime.

Mining and metals companies are implementing a range of strategies to enhance asset management and equipment reliability.

In today’s market, many senior executives leading natural resource companies hesitate in making additional capital investment and instead focus on what can be done to squeeze higher performance out of current assets. Consequently, companies are increasingly looking for ways to improve performance and returns with existing infrastructure.

The key approach to this challenge lies in upgrading and improving asset management capabilities. Many organizations have failed to deploy optimal asset management practices. This is surprising given that asset spend frequently represents 30% to 50% of the overall operating expenses. Shifting to a best-in-class asset management program will consistently deliver improved plant or equipment performance, lower operating costs, extend asset life, and generate a higher return on capital. Most recently, companies have sought to implement a range of strategies such as:

- Implementing Asset Management Systems: Utilizing robust asset management systems to track equipment performance, maintenance history, and lifecycle costs, allowing for better decision-making regarding repairs, replacements, and upgrades. Digital technologies like IoT sensors, AI-driven analytics, and automation further optimize asset management.

- Enhancing Maintenance Practices: Implementing proactive maintenance strategies like conditioned-based monitoring and reliability-centered maintenance to address issues before they cause failures. Utilizing data-driven insights, mining companies can optimize “time on tools” by identifying patterns and trends in equipment usage, maintenance needs, and performance. This allows for more precise scheduling of maintenance tasks, reducing downtime and maximizing the time equipment is operational.

- Investing in Training: Providing comprehensive training programs for front-line management, maintenance and operations personnel to ensure equipment is used and serviced properly, reducing the likelihood of breakdowns due to human error and that access to equipment is available. Training personnel to utilize data-driven insights enables management to make informed decisions impacting “time on tools” and leading to improved equipment utilization and overall operational performance.

- Improving Supply Chain Management: Ensuring timely access to quality spare parts and materials to minimize downtime caused by equipment breakdowns and repairs. Some are adopting blockchain for transparent supply chain management and better tracking of assets throughout their lifecycle.

The level of performance improvement companies can realize by implementing key strategies such as enhancing proactive maintenance practices, investing in training to improve skills and capabilities, improving supply chain management, and leveraging digital technologies and data-driven insights varies depending upon factors like current operational efficiency, the scale of implementation, and industry conditions. However, many can expect significant improvements in:

- Safety: Proper training programs and proactive maintenance strategies contribute to a safe work environment by reducing risk of accidents and equipment failures.

- Productivity: Proactive maintenance and digital technologies can reduce downtime, increase equipment availability, and optimize process execution, leading to higher productivity levels.

- Cost Reduction: Efficient equipment usage and maintenance practices can lower operational costs by minimizing unplanned downtime, reducing repair and replacement expenses, and optimizing resource utilization.

- Quality: Improving the essential management skills and work place practices result improve the quality of maintenance execution.

Overall, these strategies can result in substantial performance improvements, enhancing competitiveness and profitability for mining and metals companies.

USC Consulting Group partners with your organization and coaches your people to significantly impact performance outcomes and accelerate Asset Management and Reliability Excellence.

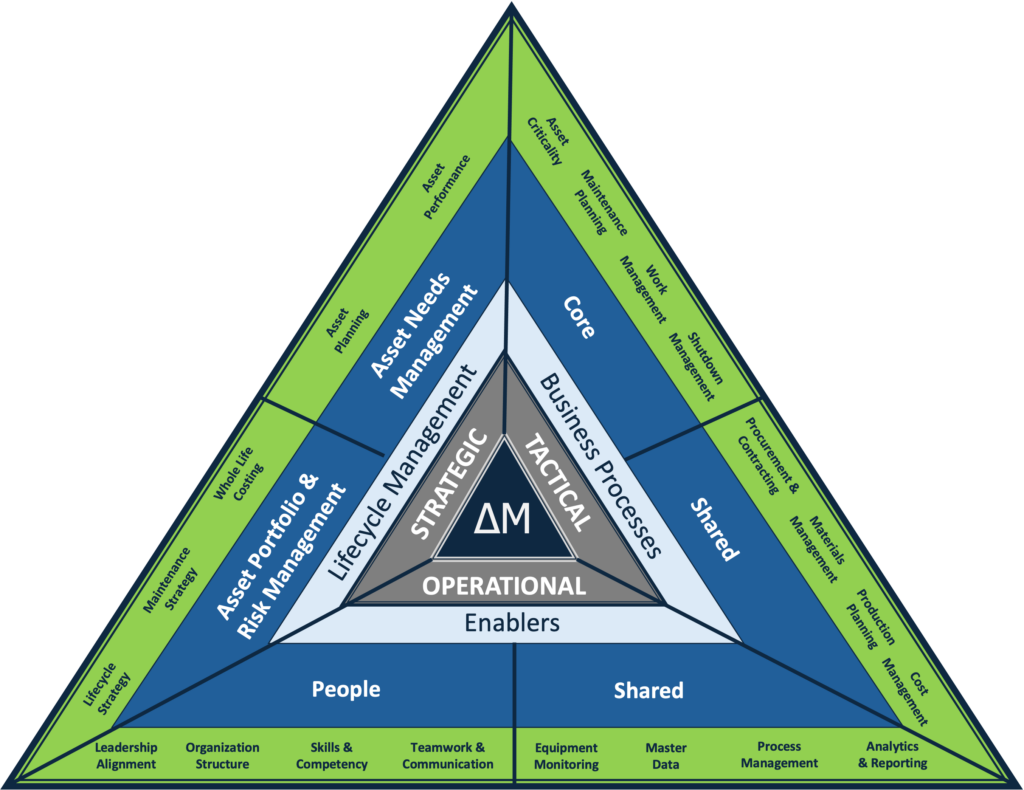

USC’s experience helping clients to shift asset performance by transforming and optimizing asset management capabilities and processes has repeatedly demonstrated the need to focus on the key levers and enablers to asset management and reliability excellence. Our asset management framework is designed to be pragmatic rather than conceptual, thereby leading to accurate, practical decisions about a client’s assets and aspirational outcomes.

The primary goal of USC’s asset management framework is to help our clients to implement and execute of a robust set of integrated processes and tools to manage and maintain their operational assets at the targeted service levels while optimizing life-cycle costs and asset life. This is accomplished by recognizing the needs to:

- Improve safe execution of work

- Increase asset life and reliability

- Improve productivity and cost performance

- Improve operational predictability

- Control material asset risks

- Develop competitive advantage

Our asset management and reliability framework helps clients identify an organization’s asset management maturity level and the areas and gaps that need to be addressed, by evaluating their strategic, tactical and operational levers and the enablers that comprise each.

Strategic (Lifecycle Management): A tailored maintenance program for each piece of equipment translates overall strategic objectives into executable plans for equipment upkeep. Our framework helps to structure and prioritize critical assets while defining a baseline operational ‘plan of action’ by determining strategies for maintaining equipment based on analysis of equipment capabilities, required performance levels, failure frequencies, and cost objectives. Optimal maintenance strategies are frequently a blend of preventative, predictive, operator-maintained, and run-to-fail options.

Tactical (Business Processes): Business processes bridge the gaps between the initial, ideal plan and the reality of ‘day-to-day’ operations, so the maintenance and reliability organization can make adjustments. Historically, many maintenance organizations have been poor utilizers of labor resources that result in low “time on tools” and excessive delays in repairing down or poor performing equipment.

Operational (Enablers): Enablers help to identify needed support to manage assets throughout their lifecycle in alignment with organizational aspirations. Leading asset management teams have also made changes in their organization structures and management practices to foster more action-oriented leadership that focuses on operational excellence, which usually requires a culture shift that must be relentlessly supported by the leadership team over the long-term. A heavy emphasis on management behaviors and company culture can help organizations make this difficult transition.

USC Helps You Tackle Key Challenges

- Optimize maintenance strategies and increase equipment availability operational output

- Predict asset integrity and reliability needs and improve time on tools

- Mitigate risks through stronger stakeholder partnerships, while removing redundancies in the supply chain

- Overcoming cultural and communication issues with contractors, while ensuring quality expectations

Do you want to understand how prepared your company is to drive needed asset performance and reliability improvements and what the key focus areas that will contribute to lower operating costs?

Want to find out more about how USC can help you uncover the hidden value lurking in asset portfolio?

For more information, let’s talk it through with a no obligation video conference call or a meeting with one of our executive team. Email info@usccg.com to arrange a call.

In the dynamic realm of industrial operations, downtime is the arch-nemesis of productivity and profitability. Every minute lost to equipment breakdowns or maintenance activities translates into potential revenue losses, increased operating costs, and compromised competitiveness. Amidst this relentless pursuit of operational efficiency, the emergence of low or no maintenance industrial machinery heralds a transformative era for industries worldwide.

High maintenance equipment has long been a staple in industrial settings, requiring regular servicing, lubrication, and part replacements to ensure optimal performance. However, the inherent drawbacks of such machinery, including frequent downtime, escalating maintenance costs, and operational disruptions, have spurred a quest for alternative solutions.

Enter low or no maintenance industrial machinery—an innovation poised to revolutionize the industrial landscape. Engineered with durability, reliability, and longevity in mind, these advanced systems promise to mitigate the adverse effects of downtime and high maintenance requirements, ushering in a new era of seamless operations and cost savings.

The detrimental effects of downtime on industrial productivity cannot be overstated. Whether due to unexpected breakdowns or scheduled maintenance activities, every moment of idle machinery translates into lost production opportunities and diminished output. Moreover, the ripple effects of downtime extend beyond immediate financial implications, impacting supply chain dynamics, customer satisfaction, and overall business resilience.

In contrast, low or no maintenance components, equipment, and machinery offer a beacon of hope for industries grappling with the specter of downtime. By incorporating self-lubricating mechanisms, wear-resistant materials, and advanced monitoring technologies, these innovative solutions minimize the need for frequent maintenance interventions and extend operational uptime.

The benefits of adopting low or no maintenance industrial machinery are manifold. Beyond the immediate gains in productivity and cost savings, these systems promote a culture of efficiency, sustainability, and resilience within industrial ecosystems. By reducing reliance on traditional maintenance practices, industries can reallocate resources towards value-added endeavors, enhance worker safety, and contribute to environmental stewardship efforts.

In this infographic from FLEXIM, we delve into the profound impacts of downtime and high maintenance equipment on industrial operations, while illuminating the transformative potential of low or no maintenance machinery. Through compelling visuals and insightful analyses, we aim to empower industries with the knowledge and tools needed to navigate the evolving landscape of industrial maintenance and usher in a new era of efficiency and prosperity.

To learn more about best practices for asset management and reducing downtime, contact us to connect with our subject matter experts.

The 2024 forecasts for the oil and gas industry include some conflicting speculation about supply and demand. It’s leading to confusion for U.S. companies… not to mention dismay as people everywhere scowl at the gas pump when they’re filling up.

Reuters reported in August that OPEC+ expects to see supply cuts that impact oil inventories, which will drive prices potentially higher than the $88 per barrel of crude in August 2023, the highest price since January. OPEC+ is confident, however, that demand will rise markedly.

But… the International Energy Association (IEA) doesn’t quite agree with those numbers, noting that the fluctuating economy will impact manufacturing businesses, and coupled with the tsunami of electric vehicles, will shake out in the form of falling demand.

Those clear-as-mud speculations boil down to one thing: Uncertainty is ahead for an industry that has already had its fair share.

All industries have been weathering uncertainty for the past few years, starting with the pandemic and, once we thought we had that handled, continuing with a shaky economy, a cried-wolf recession and ever-rising interest rates, putting consumer confidence on shifting sands.

At USC Consulting Group, we specialize in helping companies through uncertain times by optimizing their processes, becoming as efficient as possible and positioning themselves on solid ground to handle whatever is coming down the pike.

Preparing the Oil & Gas industry for an uncertain 2024

Here are seven ways the oil and gas industry can shore up for an uncertain 2024. Though separate goals, all work together to make companies as efficient and productive as they can be.

1. Reducing costs

Is there ever a year when companies in any industry shouldn’t focus on reducing costs? That’s a given, 24/7/365. But, it’s especially important for oil and gas going into 2024, when the economy continues to be volatile and uncertain. Buttoning up costs is a good strategy for the industry to get through that storm. It’s about optimizing production processes in the field and reducing extraction costs in order to offset costs involved in finding new sites.

2. Managing supply chain risks

After the supply chain bottlenecks most every industry experienced during the pandemic, it’s vital to mitigate supply chain risks. It’s a burr under the saddle of the entire industry. Fluctuating costs and supply uncertainty can impact the entire operation. Oil and gas companies need a little breathing room, predictable lead times and a more secure footing going into next year. Securing your supply chain is one way to achieve that. It can help avoid the market roller coaster we’ve seen in the recent past and may help ease pressure from inflation as well. The bonus here is, it can save about 15% on costs.

Developing a solid risk assessment plan that takes into consideration what’s happening at the supplier level will secure your supply chain and prevent any surprise shortages.

3. Focusing on yield

Maximizing yield, like reducing costs and managing supply chain risks, brings solid benefits in any economy, but especially now. It means making sure extraction techniques are as efficient as possible, utilizing methods like Enhanced Oil Recovery to extract more oil from reservoirs that may have been underutilized, managing those reservoirs carefully and by the numbers, and making sure employees across all facilities are on the same page.

4. Closing the how-why gap

In an organization the front line often does not understand the “why,” and the executives don’t understand the “how.” It means, the top brass do not fully understand how the job gets done and the frontline workers don’t fully understand why the job needs to be done. Closing that “how-why gap” is critical for optimal performance all the way up and down the organizational food chain.

5. Standardizing daily and weekly instructions for front-line managers

Going hand in hand with closing that how-why gap is increased training for managers. Many industries like oil and gas rely on frontline training, but some people would say that supervisors need even more. Training trickles down, but efficiency does, too. And the key to that is making sure everyone, across all departments and facilities, is on the same page, doing the job the same way, with a standard set of operating procedures. It’s a vital component for optimal efficiency.

6. Consolidation and acquisition = increased need for communication

New talent, ideas and perspectives can breathe life into a company. Mergers and acquisitions in the oil and gas industry exploded in Q2 2023, according to Enverus Intelligence Research. After $8 billion M&A in Q1 2023 (nothing to sneeze at) we saw $24b in Q2. It’s in line with increased consolidations, as reported by Forbes, with the goal of lowering costs, raising inventory and in the end, boosting investor returns.

All of that M&A activity can put a strain on employees of affected companies. Especially during this flurry of M&A, it’s important to find solutions to help them with the complexities of combining two “legacy” groups, which have their unique set of standards. Finding ways to combine both schools of thought into one set of “best practices” after a merger is paramount to its success. To learn more about it, read our recent case study: “Creating Harmony When Merging Two Companies.”

7. Performing scheduled maintenance

The goal is zero unplanned downtime. Pros in the industry know that’s not so easy to achieve. It starts with asset monitoring, including wells but also pipelines, processing facilities and other equipment to maximize operational efficiency. Scheduling downtime for maintenance ensures a shutdown, but it also ensures you’ll know when it’s coming and can plan accordingly. Unplanned failures or glitches can be costly problems at best but dangerous threats to workers at worst.

At USC Consulting Group, we’ve been working with the oil and gas industry for decades. If you’re interested in optimizing your company’s efficiency in this uncertain economy, give us a call.

Are you always putting out fires? Not in the literal sense, of course. We’re talking about operational problems that pop up at the most inconvenient times. Once you take care of one issue, two more seem to appear in its place. Issues such as:

- Machines break down

- Workers calling in sick

- Human errors

- Backups and bottlenecks

- Inventory uncertainty

If you’re busy troubleshooting today, it’s hard to focus on improving tomorrow. Opportunities for growth can be missed.

Get ahead of problems before they catch fire by watching this video:

At USC Consulting Group, we’ve been helping clients for over 50 years to implement strong Management Operating Systems that assist them with breaking that firefighter mentality.

The best management operating systems center around four main components:

- Processes

- Systems

- Roles

- Structures

A well-designed MOS will have your company operating like a well-oiled machine, making your bottom line stronger and your operations more efficient.

So put down the fire extinguisher and enhance your management operating system today by contacting USC Consulting Group.

Phone: +1-800-888-8872

Email: info@usccg.com

Learn more about the benefits of an effective MOS in our article How Can A Management Operating System Help Your Organization?

After 50+ years in the operations management consulting business, USC has become skilled detectives at finding hidden opportunities in our clients’ operations. Here’s the evidence on how we uncover more throughput and production in your operations:

The key to doing more with your existing assets is uncovering opportunities for efficiency and increased productivity. Things you might not even see that are right under your nose.

- Excessive cycle time

- Excessive machine changeover time

- Operational bottlenecks

That’s where our expertise comes in. We often find them by looking at issues that are accepted in the workplace as “that’s the way we’ve always done it.”

We discover breakthroughs by asking questions.

- Where is the bottleneck?

- Is it technical?

- Is it tactical?

If it’s about technology, or your assets, maybe it’s time to bring in the engineers to improve on your machines’ functions.

If it’s tactical, we analyze your processes to find areas of improvement.

Follow the footsteps in the accompanying infographic as Detective Payne points out the areas of interests you want to focus your magnifying glass on.

If you’d like to catch the “thief” stealing efficiency in your operations, contact us today. We’ll put our expert detective work to use for you.